Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading lower by 0.21% at 19573, signalling that Dalal Street was headed for negative start on Tuesday.

Asian shares were trading lower as investors were worried over the Federal Reserve’s hawkish stance on interest rates. The Nikkei 225 index fell 1.24%, the Topix was down 0.97% and the Hang Seng tanked 3.16%.

The Indian rupee rose 15 paise to close at Rs 83.04 against the US dollar on Friday.

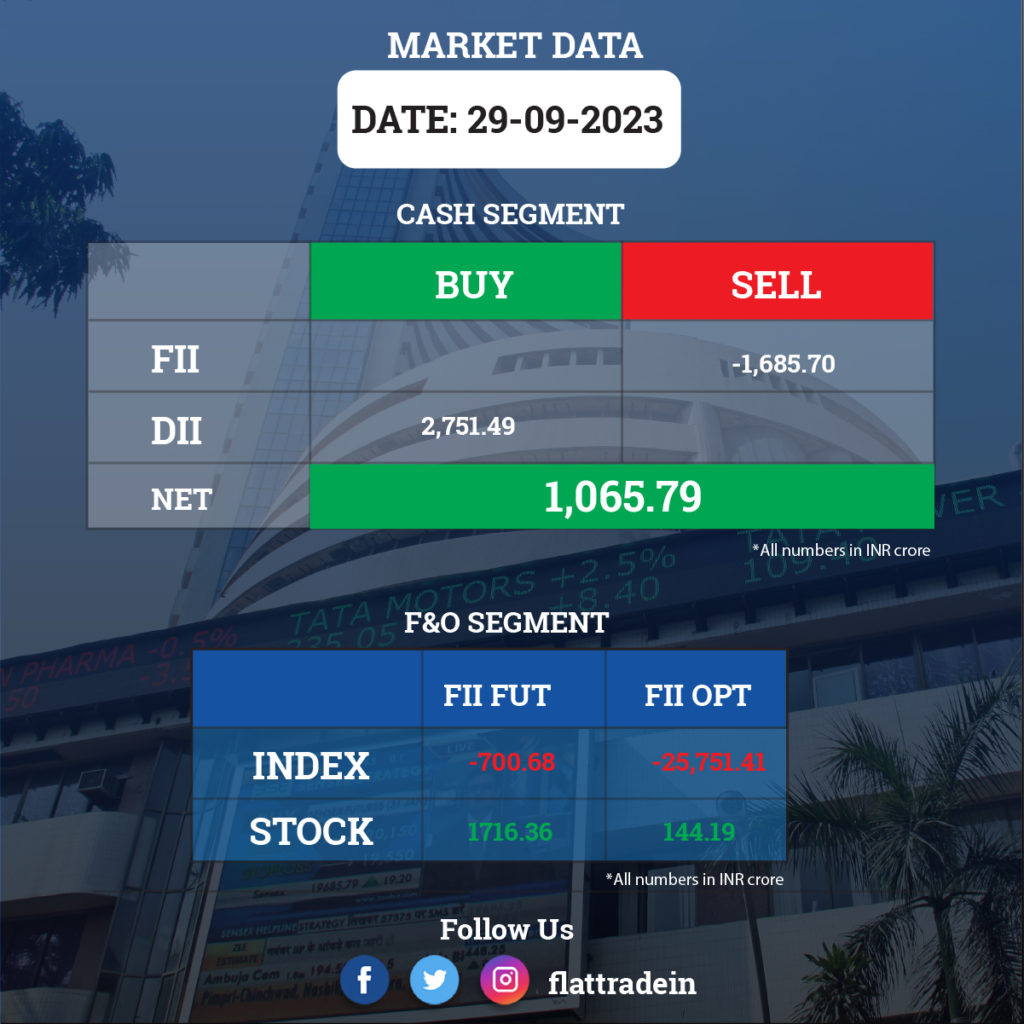

FII/DII Trading Data

Stocks in News Today

Maruti Suzuki: The car manufacturer said in an exchange filing that it has sold a total of 181,343 units in September 2023. Total sales in the month include domestic sales of 153,106 units, sales to other OEM of 5,726 units and exports of 22,511 units. Meanwhile, the company received a GST demand notice for Rs 139.3 crore.

Hero MotoCorp: The two-wheeler manufacturer said that it will marginally revise the ex-showroom prices of select motorcycles and scooters, effective from October 3, 2023. The price increase will be about 1% and the exact amount of price rise will vary by specific models and markets.

Vedanta: The conglomerate announced the demerger of business units into independent companies to unlock value. For every share held in a company, shareholders get one share of each of the five newly listed companies. The six separate listed companies will be Vedanta, Vedanta Aluminium, Vedanta Base Metals, Vedanta Oil & Gas, Vedanta Power, and Vedanta Steel and Ferrous Materials.

HDFC Bank: The lender’ board has approved the appointment of Rakesh Kumar Rajput as Chief Compliance Officer for three 3 years effective October 1, 2023.

Adani Total Gas: Ahlem Friga-Noy has resigned as nominee director of TotalEnergies on the board of the company with effect from September 30, 2023. The development comes due to restructuring of directorship/nominees of TotalEnergies Group in India.

Mahindra & Mahindra: The automaker sold 75,604 vehicles in September 2023 including exports, a growth of 17% over the year-ago period. Its passenger vehicle sales in the domestic market stood at 41,267 vehicles, up 20% YoY, while tractors sales dropped 11% YoY to 43,210 units. Domestic sales down 11% to 42,034 and exports declined 27% to 1,176 units during the same period.

Tata Motors: The vehicle manufacturer its total domestic sales stood at 82,023 units, up 2% over the year-ago period. Total commercial vehicle sales increased by 12% YoY to 39,064 units.

Eicher Motors: Royal Enfield sales in September fell by 4% YoY to 78,580 units, with exports declining 49% YoY to 4,319 units. The company’s commercial vehicle sales increased 8.6% to 7,198 units during the same period.

Coal India: The coal supply increased by 12.6% YoY to 55 million tonnes in September 2023, and output during the same period jumped by 12.6% to 51.4 million tonnes. It produced about 333 million tonnes of coal during the first half of this fiscal, up 11.3% YoY growth.

KPIT Technologies: The company completed the acquisition of Future Mobility Solutions GmbH with a payment of €8.199 million for the final tranche. The company acquired a 25% shareholding in 2021 and the remaining 75% over a six-month period beginning April 1, 2023, for a total consideration of €15.9 million.

ZEE: The company said that it has incorporated a wholly owned step-down subsidiary Zee UK Max in the U.K. with an initial share capital of 25,000 sterling pounds.

Cipla: The drugmaker has divested 51% stake in Saba Investment, UAE, for $6 million. With this transaction, Saba and its subsidiaries, viz., Cipla Middle East Pharmaceuticals FZ LLC, UAE, and Cipla Medica Pharmaceutical and Chemical Industries, Yemen, have ceased to be subsidiaries of the company.

Indus Towers: The company has signed an agreement with IOC Phinergy (IOP) for deployment of 300 zero-emission energy systems based on aluminium-air technology, to optimize diesel consumption at Indus’ telecom tower sites. This development accelerates Indus Towers’ progress towards its sustainability priorities. IOC Phinergy will supply 300 energy systems which will be deployed in the next few quarters as a pilot project.

Rail Vikas Nigam (RVNL): The company has emerged as the lowest bidder for the development of distribution infrastructure at South Zone of Himachal Pradesh under the Revamped Reforms based and Results-linked, Distribution Sector Scheme (loss reduction works). The said project worth Rs 1,098 crore will be executed within 24 months.

Kirloskar Industries: The company announced that it has acquired a 100% shareholding in Oliver Engineering for a consideration of Rs 9 crore.

Kalpataru Projects International: The EPC company and its international subsidiaries have secured new orders amounting to Rs 1,016 crore including orders in the transmission & distribution business of Rs 552 crore.

AstraZeneca Pharma: The company has appointed Bhavana Agrawal as Chief Financial Officer with effect from October 1. Rajesh Marwaha will retire as the Chief Financial Officer and Wholetime Director of the company with effect from September 30.

Lemon Tree Hotels: The company has signed a franchise agreement for a new hotel property – Lemon Tree Resort Somnath in Gujarat that is expected to open in FY25.

RBL Bank: The lender approved the appointment of Buvanesh Tharashankar as Chief Financial Officer, effective September 29.

KFinTech: The company has entered into an angreement with Bank of Ayudhya Public Co. to offer fund administration and investment management solutions.

Ramkrishna Forgings: The company’s board has approved fundraising of up to Rs 1,000 crore via issuance of equity shares through qualified institutional placement (QIP).

Karur Vysya Bank: The lender said advances for the quarter ended September 2023 stood at Rs 70,446 crore, up 15.3% over a year-ago period and deposits during the same period increased by 13.2% to Rs 83,068 crore. CASA grew by 3.4% YoY to Rs 26,795 crore in Q2FY24.

VST Tillers Tractors: The company announced total sales at 2,627 units in September 2023, a decline of 1% compared to the 2,656 units sold in same month last year. Power tillers sales was at 2,092 units, an increase by 1.06%, while tractors sales fell 8.7% percent YoY to 535 units.

Atul Auto: The company sold 2,662 units in September 2023, up 18.1% over 2,254 units sold in September 2022. During the April-September period, sales stood at 10,465 units, a fall of 7.46% from the year-ago period.

Eris Lifesciences: The company has entered into term loan agreement to avail term loan facility totalling to Rs 212 crore from HDFC Bank. Moreover, an equivalent amount is expected to be paid by Eris Oaknet Healthcare to the bank towards repayments of outstanding loans over the next fortnight.