Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.03% lower at 19,775, signalling that Dalal Street was headed for muted start on Tuesday.

Asian markets were mixed. Tokyo shares were trading higher as the Nikke i 225 index was up 0.08% and the Topix index gained 0.31%. Chinese markets fell on worries over sluggish economic recovery. The CSI 300 index fell 0.52% and the Hang Seng tanked 1.69%.

Indian rupee appreciated by 12 paise to close at 82.05 against the US dollar on Monday.

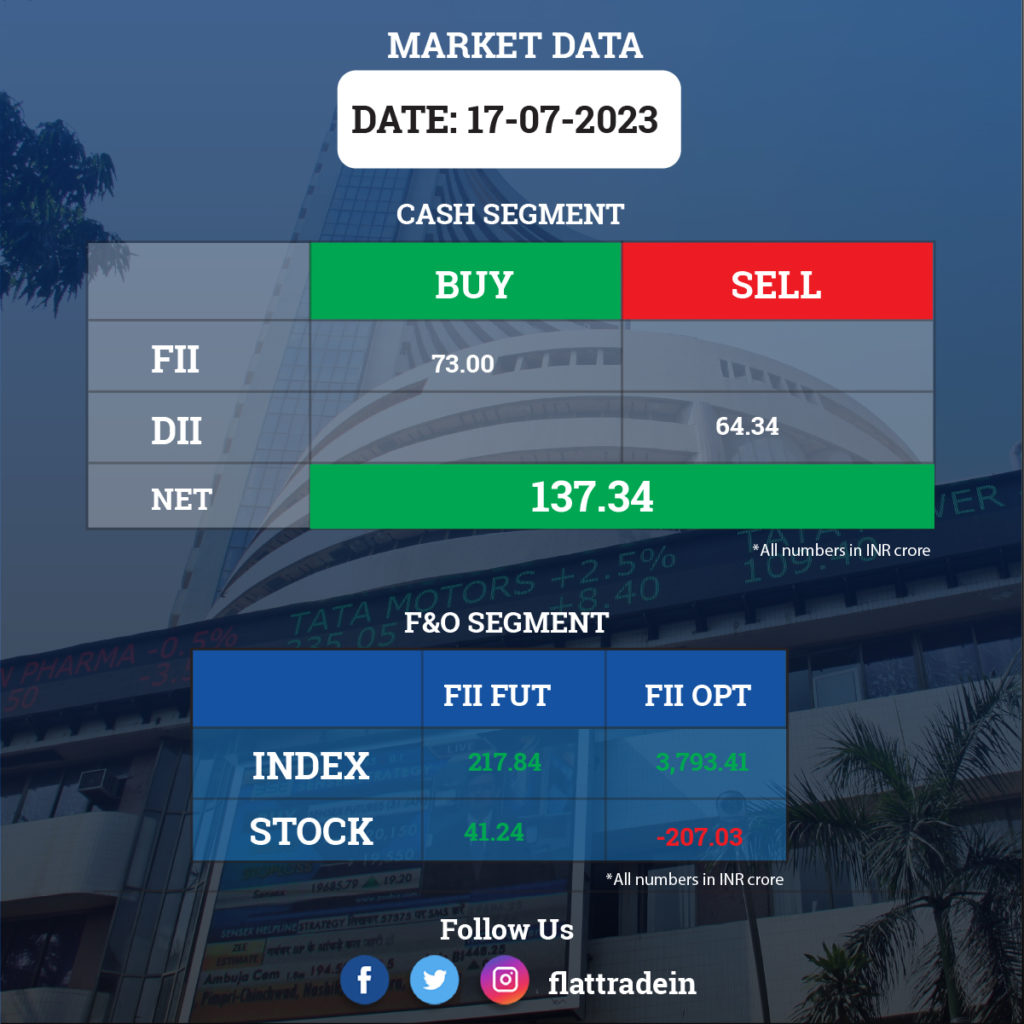

FII/DII Trading Data

Upcoming Results

ICICI Lombard General Insurance Company, ICICI Prudential Life Insurance Company, IndusInd Bank, L&T Technology Services, HeidelbergCement India, JSW Ispat Special Products, Network18 Media & Investments, TV18 Broadcast, Bharat Bijlee, Polycab India, CIE Automotive India, Himadri Speciality Chemical, Lotus Chocolate, and Mudra Financial Services will post their quarterly earnings today.

Stocks in News Today

Reliance Industries (RIL): The company’s financial arm, Jio Financial Services, will be included in 19 NSE indices with effect from July 20, after the demerger of Reliance Industries’ financial services business into Reliance Strategic Investments. Reliance Strategic Investments will be renamed as Jio Financial Services. NSE indices included Nifty50, Nifty 100, Nifty 200, Nifty 500, Nifty Oil & Gas, Nifty Energy, Nifty Commodities, and Nifty Infrastructure. This is on account of Reliance Industries being a part of the Special Pre-Open Session.

Infosys: The software giant has signed an agreement with one of its existing clients to provide artificial intelligence and automation-led development, modernization, and maintenance services. The deal is valued at $2 billion (Rs 16,411 crore) over the next five years.

LTIMindtree: The technology consulting and digital solutions company has recorded 3.4% sequential growth in consolidated profit at Rs 1,151.5 crore for the quarter ended June FY24, supported largely by other income and operating margin. Revenue from operations grew by 0.13% QoQ to Rs 8,702.1 crore, while revenue growth in constant currency and dollar terms stood at 0.1% each QoQ. EBIT was up 2% QoQ at Rs 1,450.8 crore in the reported quarter.

Sheela Foam: The polyurethane foam manufacturer has received approval from the board for the acquisition of foam and coir-based home comfort products maker Kurlon Enterprise, and furniture company House of Kieraya (Furlenco). Sheela Foam will acquire a 94.66% stake in Kurlon Enterprise for Rs 2,150 crore and the said acquisition is expected to be completed by or before November 30, 2023. The company will also buy a 35% stake in Furlenco for Rs 300 crore.

Tata Elxsi: The technology services company posted a 2.2% year-on-year growth in profit at Rs 188.85 crore for quarter ended June FY24. Revenue from operations grew by 17.1% to Rs 850.3 crore compared to the year-ago period. At the operating level, EBIT increased by 4.1% year-on-year to Rs 230.1 crore, but the margin fell 340 bps to 27.1% for the quarter.

Maruti Suzuki India: The automaker has added an Acoustic Vehicle Alerting System for the intelligent hybrid variants of its premium sports utility vehicle, the Grand Vitara. With this addition, the automaker has increased the price of these variants up to Rs 4,000 with effect from July 17.

RPP Infra Projects: The RPP-HSEA joint venture owned by RPP Infra Projects and Hs Engineers Associates, has received a letter of acceptance for a new project in Himachal Pradesh at the cost of Rs 138.24 crore. RPP Infra with 51% holding along with its JV partner (49% holding) will invest in the project as per their capacity of holding and complete the said project within the decided timeline.

Hindware Home Innovation: The building products maker has received board approval for the appointment of Salil Kappoor as Chief Executive Officer with effect from July 18. Earlier he was leading the appliances division at Orient Electric as the business unit head.

Amara Raja Batteries: Foreign investor Clarios ARBL Holding LP is likely to exit the automotive battery manufacturer via stake sale in a block deal on July 18, according to media reports. The floor price has been set at Rs 651 per share. Clarios ARBL Holding LP holds a 14% stake or 2.39 crore shares in Amara Raja.

Tanfac Industries: The company said its revenue was up 27% YoY at Rs 106 crore in Q1FY24 and net profit jumped by two times to Rs 18.39 crore on a yearly basis. Ebitda was up 75% YoY at Rs 26.20 crore.

Texmaco Rail and Engineering: The company has approved fundraising of up to Rs 500 crore by issuing one or more instruments, including equity shares, preference shares, convertible securities, non-convertible securities, and warrants, by either preferential issue, rights issue, qualified institutional placement, follow-on public offer, or any combination of these.

Endurance Technologies: The company acquired an additional 5% equity share capital of Maxwell Energy Systems for a cash consideration of Rs 69.4 million, taking its total shareholding to 56%. The company will buy the remaining equity stake in annual tranches.

ITI: The company has received accolades from ISRO and the Department of Telecommunications for its significant role in the launch of Chandrayaan-3. The flight vehicle had 55 packages on board manufactured by the company.

Axis Bank: The National Stock Exchange and the Bombay Stock Exchange have approved the promoter reclassification request of the Specified Undertaking of the Unit Trust of India from the Promoter category to the Public Category. The Specified Undertaking of the Unit Trust of India has ceased to be a promoter of Axis Bank.

IDFC: The lender reappointed Mahendra N. Shah as the managing director with effect from October 1, 2023, till September 30, 2024. It named Bipin Gemani as the chief financial officer with effect from July 17, 2023, till Sept 20, 2024.