Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.04% lower at at 19,869.5, signalling that Dalal Street was headed for a muted start on Friday.

Asian shares were trading mixed. Japan’s Nikkei 225 index rose 0.79% and the Topix jumped 0.62%. In China, the Hang Seng slumped 1.52% and the CSI 300 index fell 0.50%.

The Indian rupee fell 1 paise to 83.34 against the US dollar on Thursday.

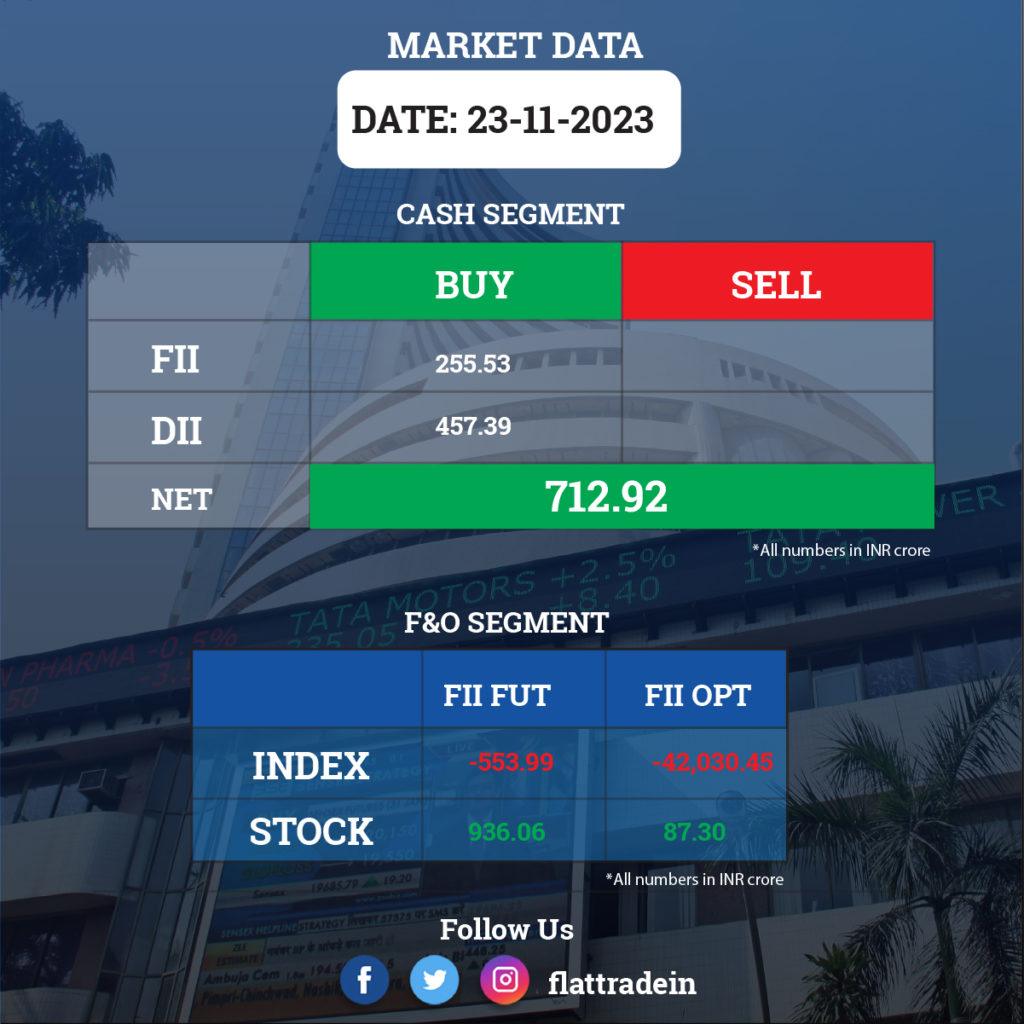

FII/DII Trading Data

Stocks in News Today

LTIMindtree: The company has launched Quantum-Safe virtual private network (VPN) link in London that will bolster security and integrity of encrypted data. LTIMindtree’s Quantum-Safe VPN platform was realized in close collaboration with its partners Quantum Xchange, a leader in quantum-safe communication solutions, and Fortinet, the global cybersecurity leader driving the convergence of networking and security.

JSW Steel: The company has completed the last tranche of the entire investment of Rs 750 crore in JSW Paints and JSW Paints has completed the allotment of shares. With this transaction, the company holds 2.94 crore equity shares in JSW Paints, representing 12.84 percent of the paid-up equity capital.

Indian Hotels: The company has made an investment of Rs 55 crore in Genness Hospitality Private Ltd. and 35 crore in Qurio Hospitality Private Ltd. by way of subscription to rights issues.

Prestige Estates Projects: The real estate firm has launched Prestige Glenbrook, a high-rise residential project in the Bangalore’s IT Hub. The development comprises of 285 apartments across two high-rise towers with a developable area of 0.7 million square feet and has a revenue potential of Rs 550 crore. Spanning 4.5 acres, the residential property offers a diverse range of dwelling options, from efficient 2-bedroom apartments to spacious 3 and 4-bedroom residences.

Clean Science and Technology: The company made an investment of Rs 60 crore in Clean Fino-Chem Ltd., a wholly owned subsidiary of the company, by way of the right issue. The company subscribed to the 10,03,346 equity shares of face value of Rs 10 each at a premium of Rs 588 apiece.

NMDC: The state-owned iron ore company has fixed prices of lump ore (65.5%, 6-40mm) at Rs 5,400 per tonne and fines (64%, -10mm) at Rs 4,660 per tonne. The revised prices will be effective from November 23.

Lupin: The pharma major has received tentative approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application for Canagliflozin tablets, and Bromfenac Ophthalmic Solution, to market in the US.

Radico Khaitan: The company announced the launch of Magic Moments Remix Pink Vodka to cater to the growing demand for the coloured and flavoured beverage alcohol category. Positioned in the premium segment a cut above Magic Moments Remix flavours, it will be initially launched in UP, Rajasthan and Assam, and expanded to PAN India over the next 2-3 quarters.

Granules: The company received a communication from the GST authorities directing the payment of a tax liability of Rs 43.43 lakh for the tax period July 2017 to March 2021.

Bharat Electronics: The company said that NSE and BSE have imposed a penalty of Rs 1,82,900 each on the company for noncompliance of norms with respect to the composition of the board of directors due to the insufficient number of independent directors.

Karnataka Bank: The bank tied up with Bajaj Allianz Life Insurance Company Limited to distribute life insurance products. The partnership will leverage the strength of BALIC’ s product capabilities and Karnataka Bank’s large customer base with wide distribution of over 900+ branches across India.

Siemens: The company received a GST demand and penalty notice worth Rs 23.7 crore from Belapur’s CGST and Central Excise Commissionerate. The company said it is perusing the order and will seek appropriate legal remedy in order to contest the demand. The Company does not foresee any material financial impact on account of this order

Apar Industries: The company opens QIP for raising up to Rs 1,000 crore at a floor price of Rs 5,540.33 per share. The company said it may offer a discount of not more than 5% on the floor price so calculated for the Issue. The issue price will be determined by the company in consultation with the lead managers appointed for the Issue.

Samvardhana Motherson International: The National Company Law Tribunal approved the scheme of amalgamation between Motherson Consultancies Service Ltd., Motherson Invenzen Xlab Pvt., Samvardhana Motherson Polymers Ltd., and MS Global India Automotive Pvt. with Samvardhana Motherson International Ltd.

Bharat Heavy Electricals (BHEL): NSE and BSE imposed a fine of Rs 5,42,800 each for non-compliance with the SEBI regulation pertaining to composition of board of directors as the number of independent directors are less than 50% of the actual strength of the BHEL’s Board.

Vishnu Chemicals: The company incorporated Vishnu International Trading FZE, a wholly owned subsidiary in Dubai, UAE. The main objective of the new subsidiary is to distribute, transmit and sell chemicals.

JM Financial: The company said it has received an administrative warning letter from the market regulator SEBI in its capacity as a Merchant Banker in relation to the buy-back of securities in respect to one of its clients. The company further said that there is no impact on financial, operations or other activities.