Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.04 % higher at 17,875, signalling that Dalal Street was headed for a muted start on Tuesday.

Asian shares were mixed as investor optimism was dampened due to central banks hawkish monetary policy stance. Japan’s Nikkei 225 index slipped 0.05%, while Topix was up 0.07%. China’s CSI 300 index rose 0.37% and the Hang Seng fell 0.22%.

Indian rupee rose 11 paise to 82.72 against the US dollar on Monday.

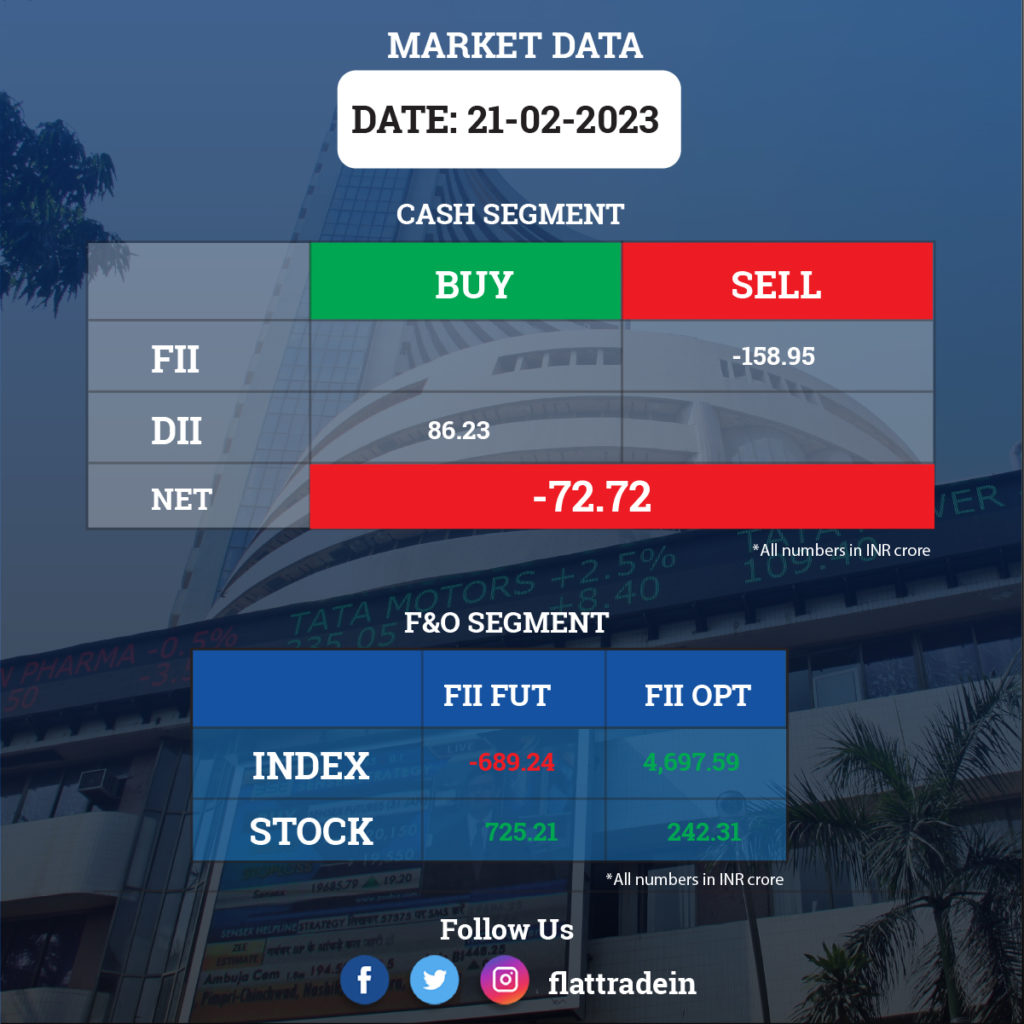

FII/DII Trading Data

Stocks in News Today

Vedanta: A joint venture between Vedanta and electronics manufacturing giant Foxconn has finalised the Dholera Special Investment Region near Ahmedabad city of Gujarat for setting up their semiconductor and display manufacturing facility, PTI reported citing a senior state government official.

Both the companies would invest Rs 1,54,000 crore to set up the facility in Gujarat, which would create one lakh job opportunities. This project is likely to get huge subsidies and incentives, like zero stamp duty on land purchase and subsidised water and electricity, under the ‘Gujarat Semiconductor Policy 2022-27’ announced by the state government in July last year.

NHPC: The state-owned hydro power giant raised Rs 996 crore through the issuance of non-convertible bonds on private placement basis. NHPC raised Rs 996 crore through unsecured, redeemable, non-convertible, non-cumulative and taxable 7.59% AD series bonds on private placement basis, according to its exchange filing. The bonds are proposed for listing at Wholesale Debt Market (WDM) segment of BSE and National Stock Exchange (NSE).

Adani Ports & SEZ: The company has paid SBI Mutual Funds’ due amount of Rs 1,500 crore on Monday and will also pay another Rs 1,000 crore of commercial papers due in March (as per the payment scheme), a company spokesperson said. “This part prepayment is from the existing cash balance and funds generated from the business operations,” the spokesperson added.

In other news, Gautam Adani has decided not to bid for a stake in state-backed electricity trader PTC India Ltd., Bloomberg reported citing people familiar with the matter, as his business empire looks to preserve cash amid criticism from a US short-seller.

Hindustan Zinc Ltd (HZL): The Indian government has opposed Vedanta Ltd’s proposal to sell its international zinc business to Hindustan Zinc Ltd for $2.98 billion over concerns of valuation. The government has threatened to take legal action to stop the sale of the Africa-based assets to HZL, in which it holds a 29.54% stake. In a letter to HZL, posted by the company to stock exchanges, the Ministry of Mines said the deal is a “related party transaction” and the government would “like to reiterate” its dissent.

InterGlobe Aviation: Promoter Shobha Gangwal intimated exchanges that her shareholding in the low-cost airline operator reduced to 2.99 percent from 7.04 percent earlier after selling a 4.05 percent stake or 1.56 crore shares via block sale on February 16.

JK Tyre & Industries: The tyre manufacturer plans to raise Rs 240 crore by executing a subscription and policy rights agreement with International Finance Corporation for the issuance of 24,000 compulsorily convertible debentures (CCDs), which will carry an interest rate of 6 percent per annum, compounded cumulatively on a quarterly basis and it will have a face value of Rs 1 lakh each of the company to IFC by way of a preferential issue on a private placement basis. These CCDs will be convertible into equity shares at a conversion price of Rs 180.50 per share. The company will get approval from shareholders for the fundraising at its Extra-ordinary General Meeting on March 6.

G R Infraprojects: The company has emerged as L1 (lowest) bidder for two projects, for which tenders were invited by the National Highways Logistics Management. The projects include the development, operation, and maintenance of Ropeways from Gaurikund to Kedarnath and from Govind Ghat – Ghangaria – Hemkund Sahib in Uttarakhand on Hybrid Annuity Mode, with a cost of Rs 1,875 crore and 1,738 crore, respectively.

Bharat Petroleum Corporation (BPCL): The company is planning to raise up to Rs 1,500 crore in FY23 through private placement of unsecured non-convertible debentures subject to market conditions. The NCDs are proposed to be listed on the debt market segment of BSE and the National Stock Exchange of India.

BEML: The state-owned company has signed a Memorandum of Understanding (MoU) with Delhi Metro Rail Corporation (DMRC) led SPV. The SPV is shortlisted for constructing the Bahrain Metro Rail Project Phase-1. The company will be responsible for manufacturing and supply of metro rolling stock and DMRC will provide expertise in project development, budgeting and facilitating of contractual obligations.

Asian Paints: The company’s subsidiary, Asian Paints (Polymers), has entered into a Memorandum of Understanding (MoU) with the Gujarat government to set up a manufacturing facility for vinyl acetate-ethylene emulsion (VAE) and vinyl acetate monomer (VAM) at Dahej. The company will make necessary disclosures on any material developments in this regard from time to time.

Sapphire Foods India: Mirae Asset Mutual Fund has picked an additional 0.56 percent stake in Sapphire Foods India via open market transactions on February 17, raising total shareholding to 7.9 percent from 7.35 percent earlier.

BEL: Delhi Metro has launched India’s first ever indigenously developed Signalling System (I-Ats), which was jointly developed with BEL for operations on its first corridor, Red Line.

Blue Star: The company has incorporated a subsidiary named “Blue Star Innovation Japan LLC”, in Japan for research and development of refrigeration cycles, control algorithms, and control boards for residential and commercial air conditioners and cold/hot water chillers. The total investment made by the company is about Rs 2.46 crore.

IFL Enterprises: Its board will meet on March 9, 2023, to consider the proposal for sub-division of the shares of the company and issuance of fully paid-up bonus shares to the members of the company.

Duke Offshore: The company said it has received a contract for it’s vessel Duke Express and the contract is awarded by a multinational corporation. It will be executed in The Republic of Maldives where the vessel will provide support for dredging operations. The vessel will be relocated abroad and the contract will commence in March 2023 for a period of one year plus optional extensions.

Ritco Logistics: Dhananjay Prasad has resigned after completing 5-year tenure with Ritco Logistics as Chief Executive Officer (CEO). Sanjeev Kumar Elwadhi, Promoter and MD of the company is going to be the new CEO for a tenure of 5 years.