Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.31% higher at 17,066, signalling that Dalal Street was headed for positive start on Tuesday.

Most Asian shares were trading higher as concerns over the contagion from the US banking sector trouble eased after First Citizens Bank acquired the failed Silicon Valley Bank. The Nikkei 225 index rose 0.07% and the Topix gained 0.30%. The Hang Seng climbed 0.49%, while CSI 300 index slipped 0.10%.

Indian rupee strengthened by 11 paise to 82.37 against the US dollar on Monday.

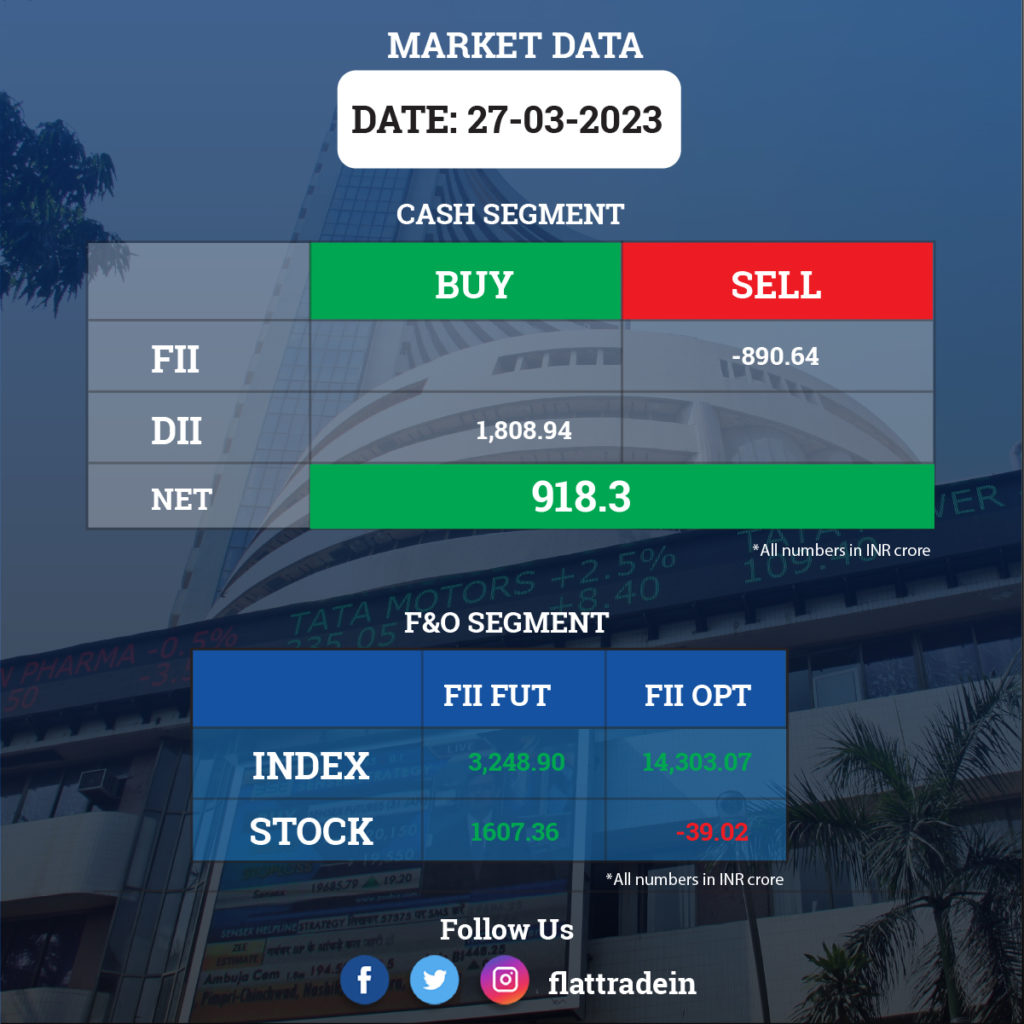

FII/DII Trading Data

Stocks in News Today

One 97 Communications (Paytm): The company announced that its full KYC wallet customers will be able to make payments on every UPI QR codes and online merchant where UPI payments are accepted. The NPCI announced Wallet interoperability guidelines on March 24, 2023. Hence, from now on, Paytm Payments Bank will earn 1.1% interchange revenue when Paytm Wallet customers make payments on merchants acquired by other payment aggregators or banks. The Bank will pay 15 bps of charges for adding more than Rs 2,000 using UPI, and in turn will also earn 15 bps when any other wallets use the bank to add more than Rs 2,000 using UPI.

PNC Infratech: The company has been declared as L1 (lowest) bidder in a Ministry of Road Transport & Highways’ (MORT&H) highway project in Uttar Pradesh on Hybrid Annuity Mode (Package-III), for a bid project cost of Rs 819 crore.

Adani Enterprises: The company has informed the exchanges that its media arm — AMG Media Networks Ltd — has completed the acquisition of 49% equity stake in Quintillion Business Media.

Allcargo Logistics: The logistics company has signed a Share Purchase Agreement with KWE Singapore, KWE Kintetsu Express (India), Gati and Gati-Kintetsu Express (GKEPL) for the acquisition of 1.5 lakh equity shares, representing 30% stake, in GKEPL, for Rs 406.7 crore. The deal includes purchasing 1.3 lakh shares (26%) from KWE-Kintetsu World Express (S) and 20,000 shares (4%) from KWE Kintetsu Express.

Dilip Buildcon: The company has been declared as the L-1 bidder for the new Hybrid Annuity Mode (HAM) project ‘Bengaluru-Vijayawada’ under Bharatmala Pariyojana Phase-I (Package -7) in Andhra Pradesh. The project is worth Rs 780.12 crore, and the tender is floated by the National Highways Authority of India.

SJVN: The hydroelectric power generation company has secured GREEN Financing of JPY 15 billion (around Rs 915 crore) from Japan Bank for International Cooperation (JBIC). The loan is co-financed with Japanese private financial institutions.

Phoenix Mills: CPP Investment, which is owned by Canada Pension Plan Investment Board, has completed its second tranche of investment of Rs 160 crore in Plutocrat Commercial Real Estate (PCREPL), a subsidiary of Phoenix Mills, on a private placement basis.

Vedanta: The company’s board will meet Tuesday (March 28) to consider and approve the fifth interim dividend on equity shares. The company has fixed April 7 as the record date for the same.

Nestle India: The FMCG behemoth said its board will consider an interim dividend for the year 2023 on April 12 along with the first quarter results.

Lemon Tree Hotels: The company has opened its fifth hotel in Kerala under the brand ‘Keys Prima by Lemon Tree Hotels’. The 42-room property will be managed by the company’s subsidiary Carnation Hotels.

CreditAccess Grameen: The company has allotted 26.75 lakh shares to eligible shareholders under the merger deal with Madura Micro Finance.

NDTV: The media company has appointed former SEBI Chairman Upendra Kumar Sinha and Welspun CEO Dipali Goenka as additional directors till March 26, 2025.