Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.32% lower at 18,815, signalling that Dalal Street was headed for negative start on Tuesday.

Asian shares were trading lower as investors were worried over the pace of China’s economic recovery. Japan’s Nikkei 225 index fell 0.62% and the Topix was down 0.81%. The Hang Seng tanked 1.53% and the CSI 300 dropped 0.23%.

India rupee was nearly flat at 81.94 against the US dollar on Monday.

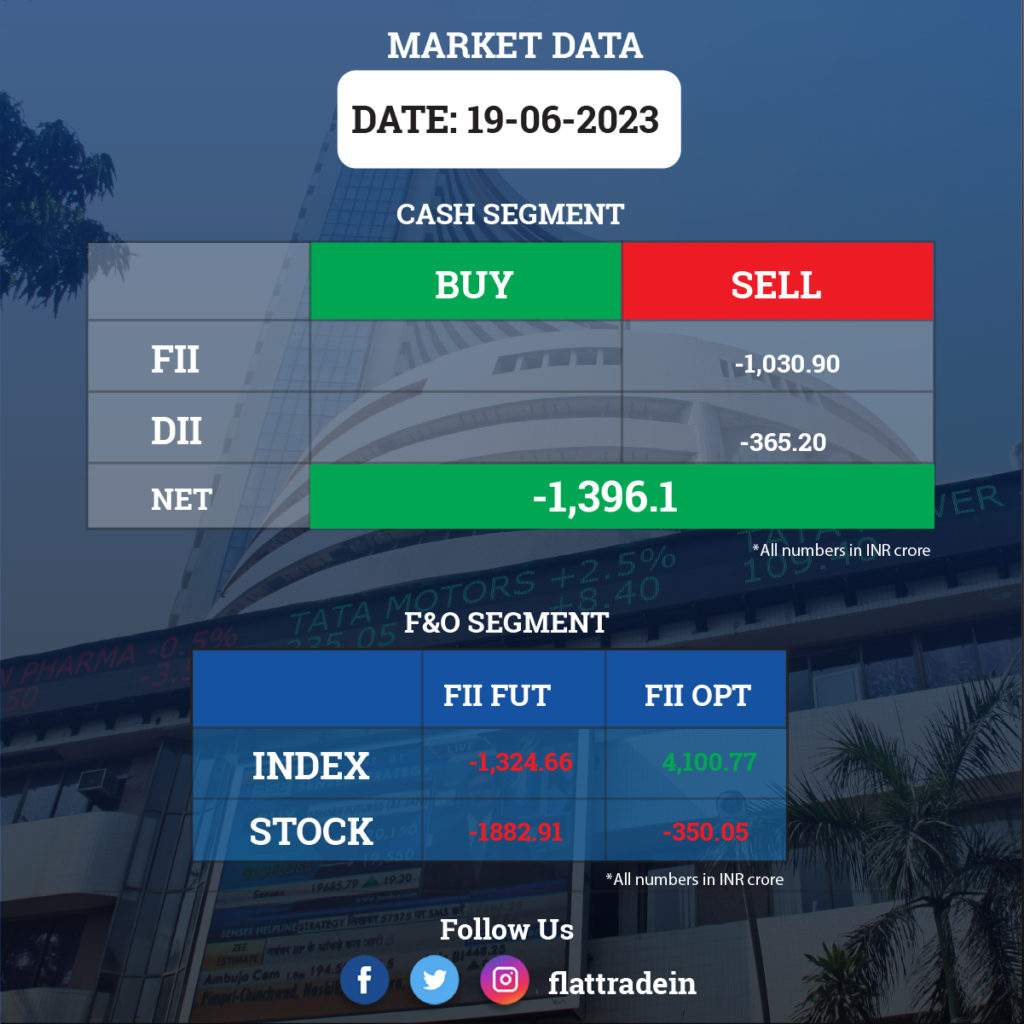

FII/DII Trading Data (19-06-2023)

Stocks in News Today

HDFC: The NBFC has sold a 90% stake in HDFC Credila to a consortium of Baring Private Equity Asia and ChrysCapital for Rs 9,060.4 crore. HDFC Credila will receive additional fresh capital of Rs 2003.61 crore as a part of the proposed transaction. The company will hold less than 10% of Credila after the stake sale.

HDFC Asset Management Company: Abrdn Investment Management is likely to exit HDFC AMC by selling its entire 2.18 crore equity shares or 10.2% stake via block deals on June 20. The selling price is likely in the range of Rs 1,800-1,892.45 per share, a 0.0-4.9% discount to the closing price of June 19.

IIFL Securities: Market regulator, Sebi, has banned brokerage IIFL Securities from onboarding new clients in the stock broking operations for two years. As per Sebi’s order, IIFL has mixed clients’ funds with proprietary funds, used credit-balance client accounts to settle obligations of debit-balance client accounts, and used credit-balance client accounts to settle proprietary-trade obligations. However, the company plans to appeal before Securities Appellate Tribunal (SAT) against the Sebi order.

Sun Pharmaceutical Industries: The pharma company’s subsidiary — Sun Pharma Canada Inc — has received an approval from Health Canada for WINLEVI (clascoterone cream 1%). WINLEVI is the first and only androgen receptor inhibitor indicated for the topical treatment of acne vulgaris (acne) in patients 12 years of age and older.

Timken India: Promoter Timken Singapore Pte Ltd is expected to offload 63 lakh equity shares or 8.4% stake in the ball and roller bearing manufacturing company via block deals on June 20. The floor price for the transaction is at around Rs 3,000 per share, a 14 percent discount to the closing price of June 19. The offer size could be Rs 1,890 crore or $231 million.

Aether Industries: The specialty chemical manufacturing company has launched its qualified institutional placement (QIP) issue on June 19 and the floor price for the offer is fixed at Rs 984.90 per share by the fundraising committee. According to media reports, the fundraising is expected to be about Rs 750 crore.

Can Fin Homes: The housing finance company has received the board approval for raising funds up to Rs 4,000 crore via debt instruments, and up to Rs 1,000 crore via qualified institutional placement (QIP), preferential allotment, or Rights issue. The board also sought approval for fund raising from shareholders.

ITC: The FMCG company will acquire additional stake in Mother Sparsh through 857 compulsory convertible preference shares of Rs 10 each. With this, the company’s stake will increase to 26.5% from 22% on a fully diluted basis.

ITI: The telecom equipment company has signed a Tripartite MoU with Centre for Development of Telematics (CDOT), and Telecommunications Consultants India (TCIL), to synergize R&D efforts in telecommunications. Each project will be governed by a separate Project Agreement, in which TCIL will be the lead partner, C-DOT will be the technology partner and ITI will be the manufacturing partner.

Royal Orchid Hotels: The hospitality company has appointed Philip Logan as its Chief Operating Officer (COO) and Logan will report directly to Chairman & MD Chander K Baljee.

Bharat Agri Fert & Realty: The company has received Commencement Certificate from Thane Municipal Corporation for construction of residential project. The management expects additional net revenue of approximately Rs 700-800 crore over 5 years.

Zydus Lifesciences: The company has received final approval from the United States Food and Drug Administration for Minocycline Hydrochloride Extended-Release Tablets USP, 55 mg, 65 mg, and 115 mg.

ISGEC Heavy Industry: The company’s wholly owned subsidiary, Saraswati Sugar Mills, has enhanced the production capacity of its ethanol plant from 100 kiloliters per day to 160 kiloliters per day, and the enhanced capacity will come into commercial production on June 18, 2023.