Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.78% higher at 17,761.5, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares rose, tracking Wall Street gains overnight, as investors braced for an expected bigger interest rate hike by the US central bank. Japan’s Nikkei 225 index rose 0.42% and Topix gained 0.43%. China’s Hang Seng advanced 1.12% and CSI 300 index was 0.57% higher.

The Indian rupee fell 3 paise to 79.77 against the US dollar on Monday.

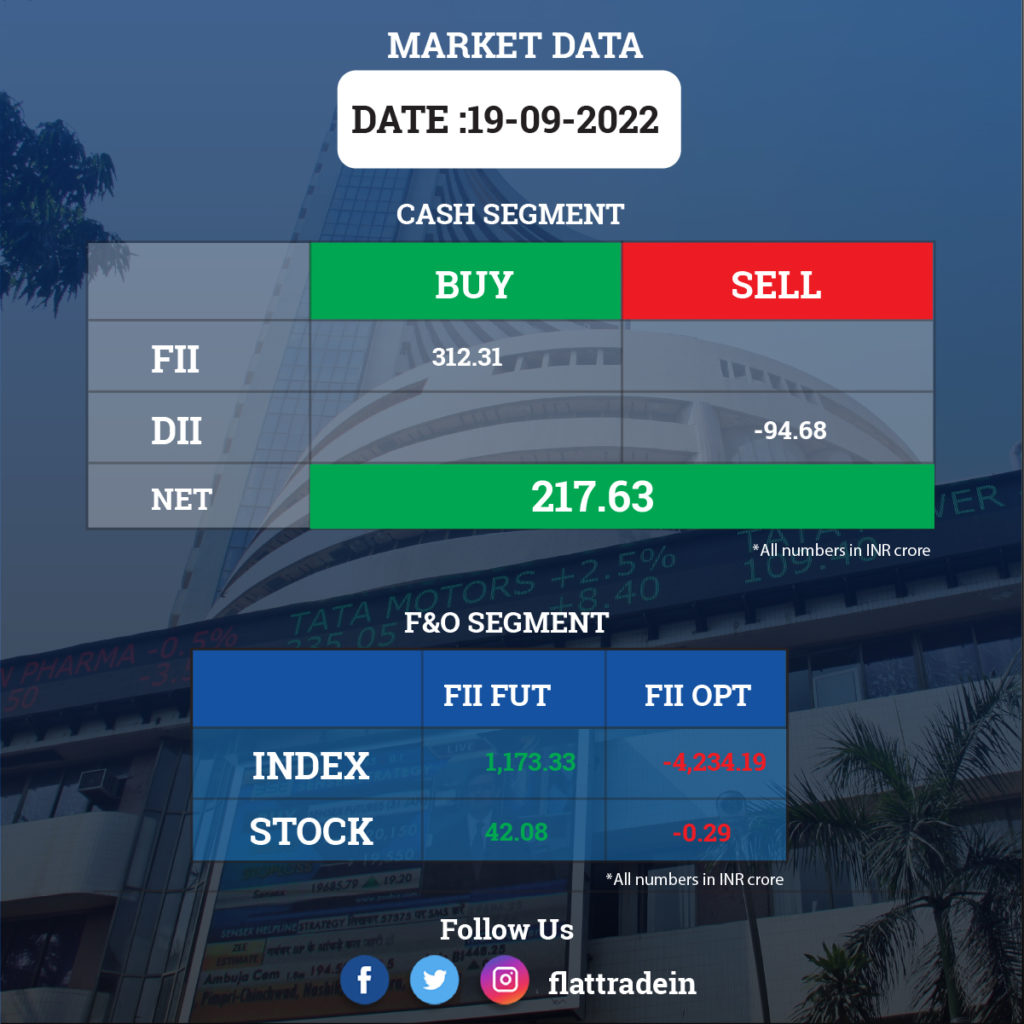

FII/DII Trading Data

Stocks in News Today

Reliance Jio and Network 18: The Competition Commission of India (CCI) approved the proposed merger of Jio Cinema OTT with Viacom18, a subsidiary of Network 18. Under the partnership, Reliance’s popular Jio Cinema OTT app will be transferred to Viacom18.

Adani Enterprises: The company has raised Rs 100 crore by allotment of 1,000 non-convertible debentures of face value of Rs 10 lakh each on a private placement basis. The market-linked debenture will be listed on the Wholesale Debt Market segment of BSE.

Adani Ports and Special Economic Zone: The West Bengal government approved issuance of letter of intent (LoI) to Adani Ports for the proposed greenfield port in the state. The company had emerged as the H1 bidder earlier this year, but the state government had not declared it.

Indian Railway Catering and Tourism Corporation (IRCTC): The company is set to enter the payment aggregator space and it has planned to approach RBI for an aggregator license, according to a report by BusinessLine. The report said IRCTC has received an approval from the Registrar of Companies, NCT, Delhi and Haryana to change the Main Objects Clause of the Memorandum of Association and insert a new clause to act as a Payment Aggregator.

Crompton Greaves Consumer Electricals and Butterfly Gandhimathi Appliances: Crompton Greaves Consumer Electricals will sell 10.72 lakh equity shares or a 6 percent stake in its subsidiary, Butterfly Gandhimathi Appliances, via offer for sale on September 20 and September 21. The floor price for the sale will be Rs 1,370 per share.

GAIL India: The state-owned company has bought several LNG cargoes for delivery between October and November at more than double the price it paid around this time last year, after vital Russian deliveries were cancelled. The New is finding it difficult to replace supply from the former trading arm of Gazprom PJSC, which was nationalized by Germany earlier this year and is paying contractual fines rather than delivering fuel.

Can Fin Homes: The mortgage lender’s managing director and chief executive officer (MD&CEO) Girish Kousgi resigned stating personal reasons, according to its exchange filing. However, Kousgi will continue to function as the MD & CEO of the company and discharge his duties till the date of his relieving, the company said.

Natco Pharma: The drugmaker will launch Chlorantraniliprole (CTPR) and its formulations, through its non-infringing process as the company has received an order from the High Court of Delhi to launch the same. CTPR technical is formulated into broadspectrum insecticides used across a wide range of crops for pest management.

CEAT: The company’s board has allotted non-convertible debentures (NCDs) on a private placement basis aggregating to Rs 150 crore.

Ircon International: The company has won a work order of engineering and project management consultancy services for the development of rail infrastructure for Ananta OCP of Jagannath Area at Talcher, from Mahanadi Coalfields. The total value of the order is Rs 256 crore.

Future Supply Chain Solutions: The company has called off a proposal to sell or dispose of warehouse assets, and has decided to explore other opportunities for rehabilitation of business operations.