Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.02% higher at 17,668.50, signalling that Dalal Street was headed for a flat opening on Friday.

Asian shares were trading lower, after Wall Street declined weighed by a fall in technology stocks. US manufacturing and earnings data showed signs of weakness. The Nikkei 225 index was down 0.07% and the Topix slipped 0.06%. The Hang Seng slipped 0.49% and the CSI 300 index dropped 0.29%.

Indian rupee rose 8 paise to 82.15 against the US dollar on Thursday.

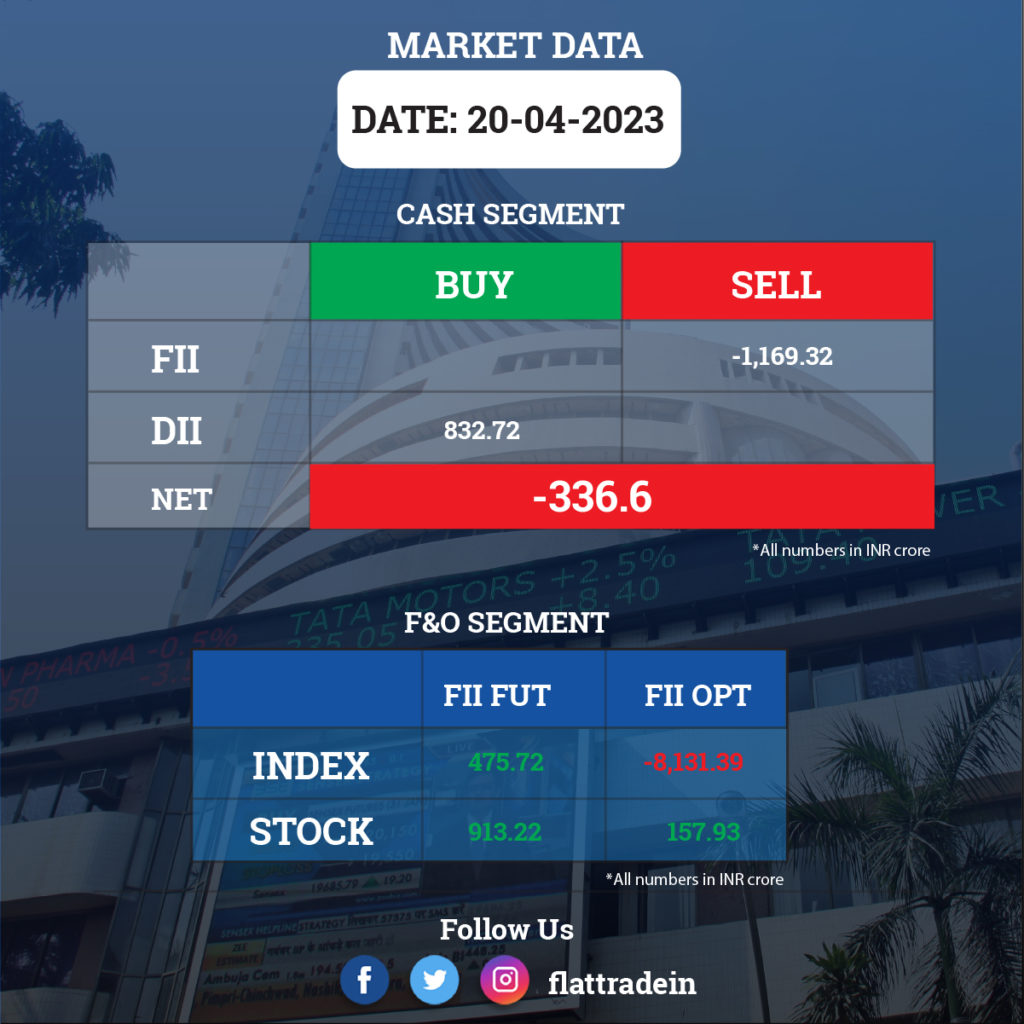

FII/DII Trading Data

Upcoming Results

Reliance Industries, Hindustan Zinc, Tejas Networks, Aditya Birla Money, Bheema Cements, Metalyst Forgings, Rajratan Global Wire, and Wendt India will report their results today.

Stocks in News Today

HCLTech: The IT services company reported lower-than-expected earnings for Q4FY23 with profit falling 2.8% QoQ to Rs 3,983 crore and revenue declining 0.4% to Rs 26,606 crore. On the operating front, EBIT fell 7.5% sequentially to Rs 4,836 crore with its margin down by 140 bps to 18.2% for the quarter. Revenue in dollar terms declined 0.3% and topline in constant currency terms was down 1.2% QoQ, but its attrition rate dropped sequentially to 19.5% from 21.7% .

The company’s board has declared an interim dividend of Rs. 18/- per equity share of Rs.2/- each of Company for FY 2023-24. The record date of April 28, 2023 fixed for payment of aforesaid interim dividend has been confirmed by the board. The payment date of said interim dividend shall be May 9, 2023.

Cyient: The company has recorded a 4.6% sequential growth in consolidated profit at Rs 163.2 crore for the quarter ended March FY23 on strong topline and operating numbers. Revenue for the quarter at Rs 1,751.4 crore grew by 8.2% and dollar revenue at $213 million increased by 8.1%, with constant currency revenue growth at 6.6% QoQ. The company appointed Prabhakar Atla as chief financial officer, with effect from April 21, 2023.

Sterling & Wilson Renewable Energy: The company posted a net loss of Rs 417.45 crore for the quarter ended March FY23, widening from a loss of Rs 126.3 crore in the same period last year, as consolidated revenue plunged 91.7% YoY to Rs 88.4 crore and EBITDA loss increased to Rs 352.12 crore from Rs 124.24 crore in the same period.

ICICI Prudential Life Insurance Company: The company said its Consolidated revenue fell 17% YoY to Rs 11500 crore. Net profit rose 26% YoY to Rs 235 crore. Value of New Business (VNB) was up 27.8% YoY at Rs 2,765 crore for the full fiscal. VNB margin stodd at 32% for FY23 as against 28% in the previous fiscal. The insurer recommended a final dividend of Rs 0.60 per share, subject to approval at the upcoming AGM.

Infosys: The company’ subsidiary, EdgeVerve Systems, and XacBank, a leading universal bank in Mongolia, announced the successful transformation of the bank’s technology landscape with Finacle Digital Banking Solution Suite. The Finacle suite now powers both the retail and corporate banking operations at XacBank, enabling a robust digital foundation for the bank to achieve its growth strategy.

Rail Vikas Nigam/Siemens: The company as part of a consortium along with Rail Vikas Nigam, has received two separate orders from Gujarat Metro Rail Corporation (GMRCL). Siemens’s share in orders is Rs 678 crore. The orders are for Surat Metro Phase 1 and Ahmedabad Metro Phase 2.

Suven Pharmaceuticals: The Competition Commission of India (CCI) has approved the acquisition of up to 76.10% of the voting share capital of Suven Pharmaceuticals by Berhyanda. Berhyanda is ultimately managed by Advent International Corporation.

Finolex Cables: The electrical and telecommunication cables manufacturer would set up a plant at the Urse facility in Pune to produce optical fibre preforms as well as expand on its fibre draw capacity. The plant with an initial capacity of 100 tons of preforms, is being set up at a cost of Rs 290 crore and would be funded entirely out of internal accruals.

Life Insurance Corporation of India: The premium of the life insurance company in March FY23 dropped 32% compared to the year-ago month, but the premium for FY23 grew by 17% over the previous year. The retail annual premium equivalent growth stood at 10% YoY in March, reports CNBC-TV18.

Vodafone Idea: The company appointed Kumar Mangalam Birla as additional director with effect from April 20, 2023.

India Grid Trust: International Finance Corporation subscribed to a listed NCD issuance of the company, worth Rs 1,140 crore.

Laxmi Organic Industries: The board approved the proposal to raise funds through equity and/or debt, as well as borrow Rs 2,000 crore.

Greenpanel Industries: The company resumed manufacturing operations at MDF plant in Rudrapur, Uttarakhand on the April 19. The plant was closed on April 1 for routine maintenance.

PVR: The company said its name has been changed to PVR-Inox with effect from April 20. Shares of PVR was last trading in NSE at Rs 1508.7 apiece.

Reliance Industrial Infrastructure: The company which is part of the Reliance Industries Ltd said its total income stood at Rs.20.80 crore during the period ended March 31, 2023 as compared to Rs.19.65crore during the period ended March 31, 2022. The company posted a net profit of Rs.11.5429 crores in the reported period as against a net profit of Rs.1.0655 crores in the year-ago period. The company’s EPS for the quarter under review was Rs.7.64 as compared to Rs.0.71 in the eyar-ago period.

Cholamandalam Investment and Finance Company Limited (CIFCL): The company plans to raise up to Rs 1,000 crore via public issue of secured, rated, listed redeemable non-convertible debentures (NCDs). The base issue size is ₹500 crore with an option to retain any oversubscription up to ₹500 crore. The NCD issue opens on April 25, 2023 and closes on May 9, 2023 with an option of early closure. The NCDs will carry a face value of ₹1,000 each and they are being offered with tenor options of 22 months, 37 months and 60 months with annual and cumulative payments options across six series. The minimum application size is Rs 10,000 (i.e., 10 NCDs) and thereafter in multiples of Rs 1,000 (i.e. 1 NCD) thereof. Effective yield (per annum) for the NCD holders in all categories of investors ranges from 8.25% to 8.40% per annum, according to the Chennai-headquartered non-banking finance company’s statement.