Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.05% lower at 17,713, signalling that Dalal Street was headed for negative start on Wednesday.

Most Asian shares were trading lower after comments from Federal Reserve officials hinted at continued rate hikes. The Nikkei 225 index fell 0.24% and the Topix was down 0.23%. The Hang Seng was down 0.69% and the CSI 300 dropped 0.37%.

Indian rupee fell 7 paise to 82.04 against the US dollar on Tuesday.

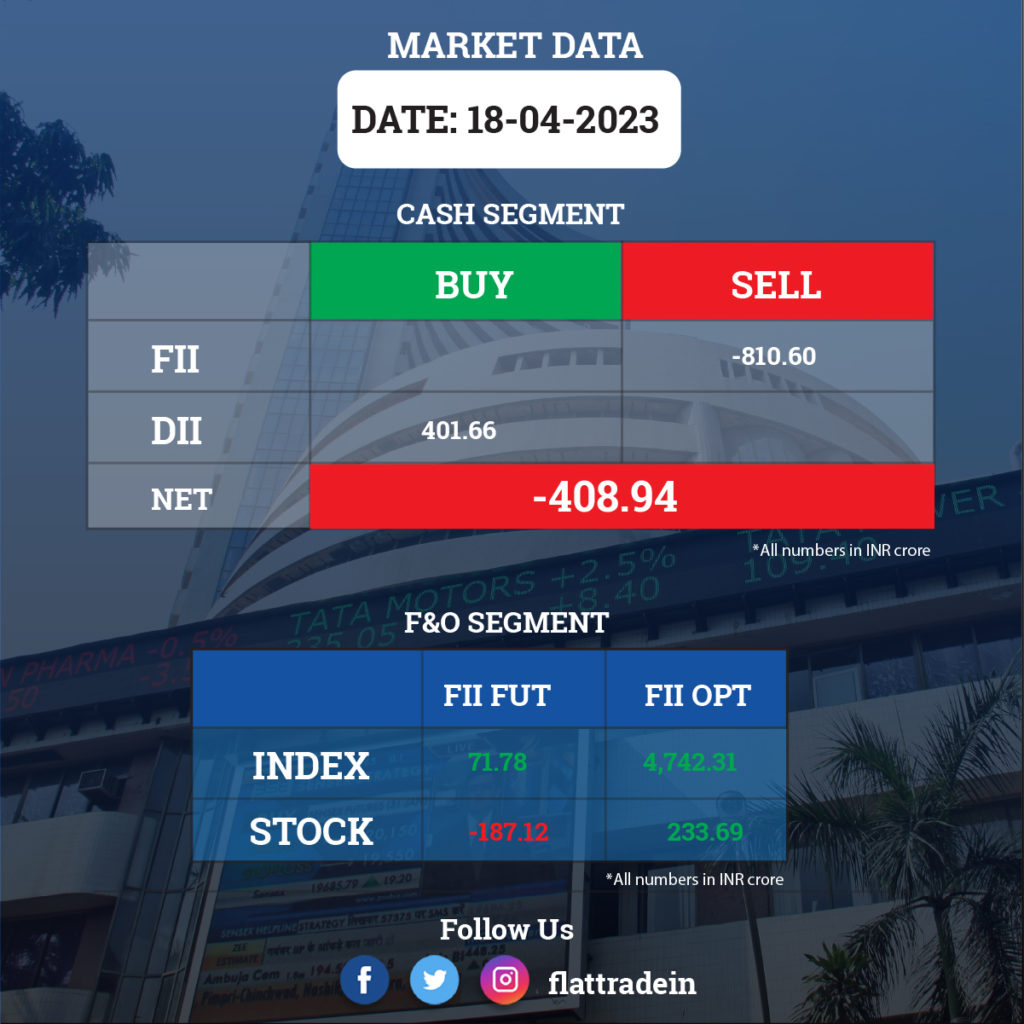

FII/DII Trading Data

Upcoming Results

ICICI Securities, Mastek, Tata Communications, Alok Industries, Artson Engineering, Citadel Realty and Developers, G G Engineering, Gujarat Hotels, Reliance Naval and Engineering, Benares Hotels, and Stampede Capital will report their quarterly earnings on April 19.

Stocks in News Today

ICICI Lombard General Insurance Company: The firm has recorded a 40% year-on-year growth in net profit at Rs 437 crore for the quarter ended March FY23. Net premium earned for the quarter grew by 12.3% to Rs 3,726 crore and total income increased by 13.3% to Rs 5,256 crore compared to the year-ago period. The combined ratio was at 104.2% in Q4FY23, against 103.2% in Q4FY22. The insurance company announced a final dividend of Rs 5.5 per share.

State Bank of India (SBI): The state-owned lender said its Executive Committee of the Central Board has approved the long-term fund raising in single and multiple tranches up to $2 billion, through a public offer or private placement of senior unsecured notes in US dollar or any other convertible currency during FY24.

Tata Coffee: The company reported nearly 20% year-on-year increase in consolidated profit at Rs 48.8 crore for the March FY23 quarter supported by higher other income and lower tax cost. Consolidated revenue for the quarter grew by 10.2% to Rs 723 crore compared to the same period last year. However, EBITDA fell 4.8% YoY to Rs 105.72 crore with the margin falling 230 bps for the quarter.

Pidilite Industries: The company has entered into an agreement with US-based Basic Adhesives LLC for the purchase of its certain assets comprising technology, design, trademark, copyright, domain name and trade dress. The company will pay the consideration in tranches over a period.

Crisil: The company reported results for the quarter ended March 2023. Its revenue was up 20.16% YoY at Rs Rs 714.89 crore and net profit rose 19.84% YoY to Rs 145.75 crore. EBITDA increased 15.43% YoY to Rs 203.47 crore in the reported quarter. EBITDA margin stood at 28.46% in the quarter under review as against 29.63% in the year-ago period. The board has approved an interim dividend of Rs 7 per share for the fiscal ended Dec. 31, 2023, to be paid on May 16, 2023. Crisil follows a January-December financial year.

Bank of India: The public sector lender said the board of directors has approved the raising of capital up to Rs 6,500 crore for FY24, comprising Rs 4,500 crore via the issue of fresh equity capital in the form of FPO/QIP/Rights issue/preferential issue and/or Basel III compliant additional Tier-1 (AT-1) bonds, and Rs 2,000 crore via Basel III compliant Tier-2 bonds.

Zydus Lifesciences: The pharma company has received final approval from the United States Food and Drug Administration (USFDA) to manufacture and market Estradiol Transdermal system in the US. Estradiol transdermal system is used for the prevention of postmenopausal osteoporosis. The drug will be manufactured at the group’s formulation manufacturing facility at Moraiya near Ahmedabad.

Prestige Estates Projects: The company’s wholly subsidiary Prestige Exora Business Parks Limited acquired 51% stake in commercial office space developer Dashanya Tech Parkz for a cash consideration of Rs 66.07 crore.

South Indian Bank: The Kerala-based lender hiked lending rates across tenors in the range of 5-10 basis points, with effect from April 20, 2023.

Som Distilleries and Breweries: The company commenced commercial production at its expanded capacity at the facility in Hassan, Karnataka.

Piramal Pharma: The USFDA has issued an establishment inspection report for the company’s manufacturing unit in Sellersville, U.S. and closed the inspection of the same facility.

RattanIndia Enterprises: The company has launched direct-to-consumer fashion brands business with Neobrands Limited.

PDS: The company’s arm Norwest Industries has proposed to acquire an equity stake of 10% in Norlanka Manufacturing Limited, a company incorporated under the laws of Hong Kong.

Sprayking Agro Equipment : The company has fixed May 3 as the revised record date for the purpose of ascertaining the eligibility of shareholders for issuance of bonus shares in the proportion of 2:3.

Kanchi Karpooram: The company has entered into a joint venture agreement with Prince Housing Chennai for the construction of residential and commercial apartments at its property situated at Purasaiwalkam, Chennai on a profit-sharing basis.

Calcom Vision: The board has approved the issue and allotment of equity shares of face value of Rs. 10/- each to person(s) belonging to the non-promoter category on a preferential basis, aggregating up to Rs 9.21 crore.