Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.06% lower at 19,342, signalling that Dalal Street was headed for muted start on Tuesday.

Asian markets were trading higher as investors awaited a slew of economic data, which is scheduled during the week. The Nikkei 225 index rose 0.17% and the Topix edged up 0.05%. The Hang Seng jumped 1.5%, the CSI 300 index advanced 0.69%, and the Shanghai Composite index gained 0.67%.

The Indian rupee rose 3 paise to 82.63 against the US dollar on Monday.

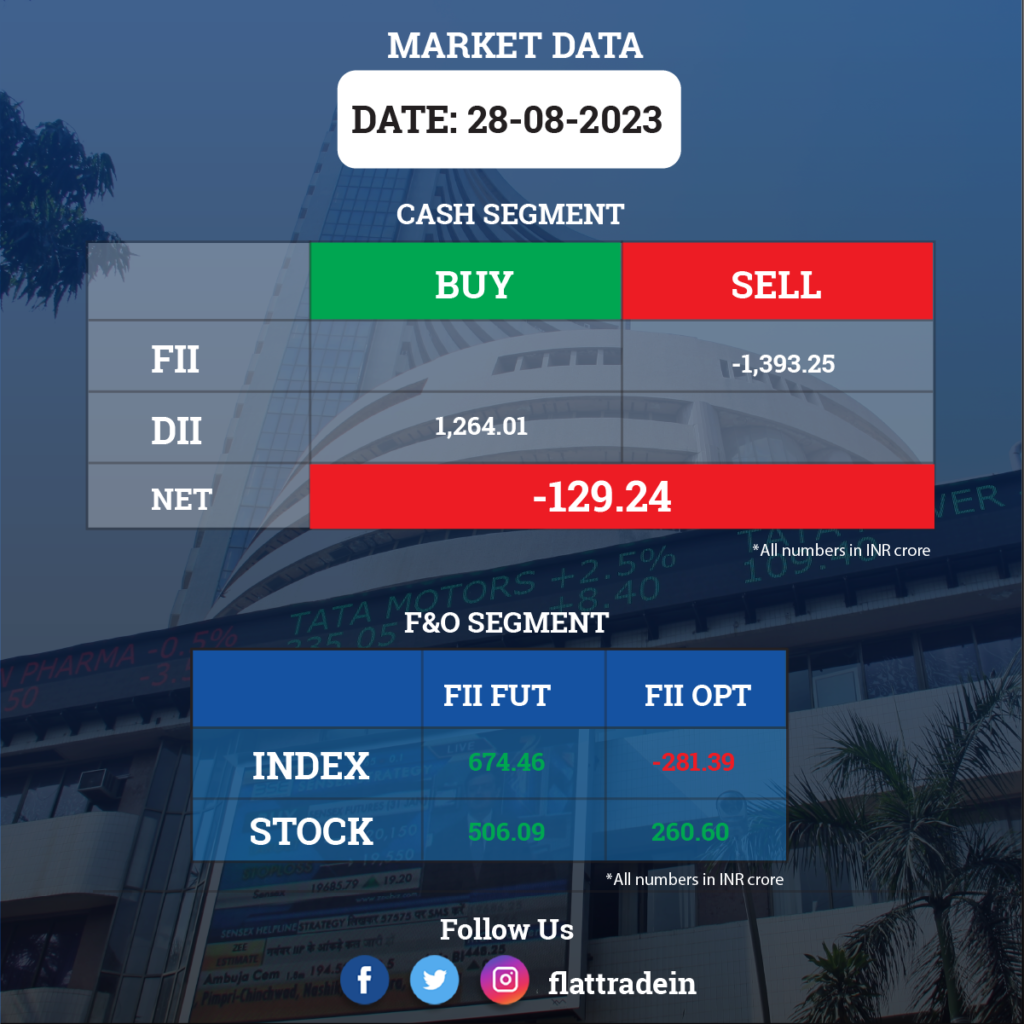

FII/DII Trading Data

Stocks in News Today

Zomato: Internet Fund III Pte Ltd, the venture capital fund managed by US-based investment management company Tiger Global Management, has exited Zomato by selling its entire shareholding in the food delivery giant for Rs 1,123.85 crore, via open market transactions on August 28. The internet fund sold 12.34 crore shares or 1.44 percent stake in Zomato at an average price of Rs 91.01 per share, as per bulk deals data available on exchanges.

Sun Pharmaceutical: The company plans to spend 7-8% of its sales in FY24 on research and development activities to strengthen its product portfolio across therapeutic segments. It also expects high single-digit consolidated revenue growth for FY24.

SJVN: The company’s subsidiary — SJVN Green Energy — has received a Letter of Award from Assam Power Development Corporation (APDCL) for three solar power projects with a cumulative capacity of 320 MW. The cost of the project is Rs 1,900 crore. These three solar power projects will be developed on a build-own-and-operate (BOO) basis and are expected to generate a cumulative 628 MUs in the first year and the cumulative energy generation over a period of 25 years would be about 14,591 MUs.

LTIMindtree: The technology consulting and digital solutions company has announced a strategic collaboration with SaaS company CAST AI which specialises in automated cost optimisation for customers who run their cloud-native applications on Google Cloud, AWS, and Microsoft Azure. The partnership will help companies save over 60% on cloud costs as they modernise legacy applications for cloud migration.

KRBL: The company submitted the Letter of Offer for the buyback of up to 65 lakh fully paid-up equity shares of Rs 1 each at a price of Rs 500 apiece for a maximum amount of Rs 325 crores through the tender offer process.

Gokaldas Exports: The company, through its wholly owned subsidiaries, will acquire UAE-based Atraco Group (Atraco), a leading manufacturer of apparel, for $55 million. The acquisition will be funded by a mix of debt and internal accruals and the transaction is expected to be closed by third quarter of FY24.

Rane Madras: The board has approved divestment of its entire holdings in Rane Light Metal Casting Inc., USA (LMCA), held through its wholly owned subsidiary Rane (Madras) International Holdings BV, The Netherlands (RMIH).

Schaeffler India: The company has entered into a share purchase agreement for the acquisition of 100% of the shareholding of KRSV Innovative Auto Solutions (“Koovers”) following the board’s approval.

Divis Laboratories: Madhusudana Rao Divi has retired as Director as well as Whole-time Director of the Company in view of his age and health situation with immediate effect, according to its exchange filing.

Indiabulls Real Estate: The company has appointed its current senior vice president, Atul Chandra, as Chief Operating Officer with immediate effect. Chandra is the senior vice president of the company.

V-Mart Retail: Promoter Lalit Agarwal has executed a gift deed in favour of promoter Madan Gopal Agarwal to transfer 10.4 lakh shares, representing 5.27% of the paid-up share capital.

NBCC India: The state-owned construction company has bagged a work order worth Rs 66.32 crore from the Indian Medical Association. The said work order included planning, designing and executing of IMA House at Indraprastha, New Delhi. The order is expected to be executed within 30 months.

Bayer CropScience: Duraiswami Narain has resigned as the Vice Chairman & Managing Director and Chief Executive Officer of the company with effect from October 31, 2023 due to his planned repatriation to Bayer US. The company appointed Simon Weibusch as the Vice Chairman, Managing Director and CEO with effect from November 1, 2023. Weibusch resigned as the Executive Director as the Whole-time Director of the company with effect from October 31, 2023.

HFCL: The company has launched its fund raising programme via qualified institutional placement (QIP). The Fund Raising Committee has fixed the floor price for the QIP at Rs 68.61 per equity share. The board will meet on August 31, 2023, to fix the issue price of the offer.

APL Apollo Tubes: The promoter will reportedly sell stake up to 2.63 million shares, or 0.85% equity, via block deals. The floor price is set at Rs 1,595 per share, a 4.3% discount to the current market price.

Jet Airways: The National Company Law Appellate Tribunal (NCLAT) has extended the time till September 30 for Jalan-Kalrock Consortium to pay Rs 350 crore to the lenders of the bankrupt carrier.