Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% higher at 18,010 signalling that Dalal Street was headed for a positive start on Wednesday.

Asian equities edged higher on Wednesday as investors awaited the US retail inflation data. Japan’s Nikkei 225 index rose 1.02% and th Topix jumped 1%. The Hang Seng gained 1.345 anf the CSI 300 index advanced 0.59%.

Indian rupee appreciated by 57 paise to 81.78 against the US dollar on Tuesday.

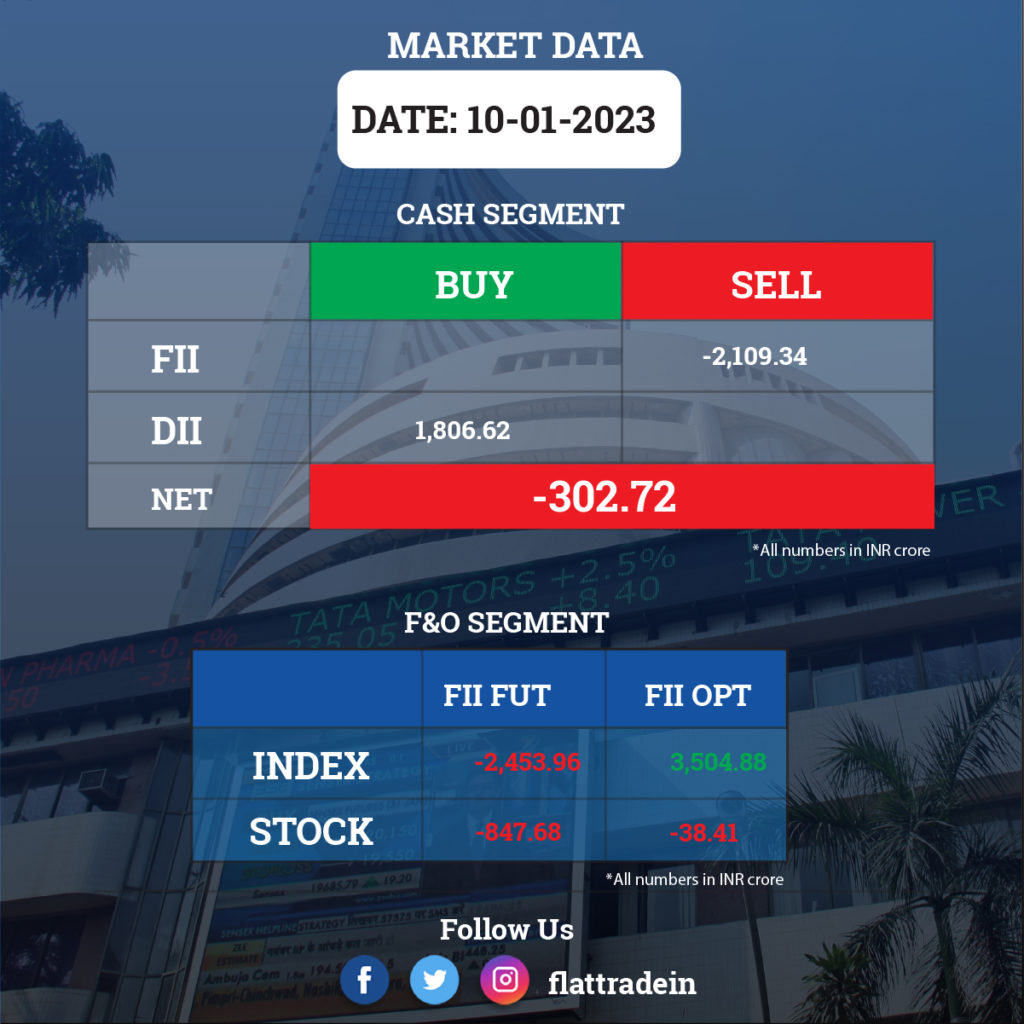

FII/DII Trading Data

Stocks in News Today

Adani Ports and Special Economic Zone: The company and Gadot Group of Israel have completed the acquisition of Haifa Port Company (HPC) from the Government of Israel. The consortium had won the bid for HPC, at an offer price of $1.18 billion during July 2022. The concession period of the port is up to 2054.

Tata Motors: The company’s subsidiary, Tata Passenger Electric Mobility, has completed the acquisition of Sanand property as well as the VM plant and machinery of Ford India. Both companies signed an agreement in August 2022 for the acquisition of Ford India’s manufacturing plant at Sanand, Gujarat, for Rs 725.7 crore.

Reliance Jio: The telecom arm of Reliance Industries will invest additional Rs 2,500 crore to deploy 5G network services in Assam. Currently, the company has invested Rs 9,500 crore in the state.

Adani Wilmar: The company expects sales in the December 2022 quarter to grow in high single digits, helped by strong demand during the festive season and stronger out-of-home consumption. Standalone sales volume is expected to have grown in high teens, the company said. Price volatility in edible oil was lower in the third quarter compared with the second quarter and the segmental volume growth was at high-single digits.

PC Jeweller: During the quarter ended December 2022, the company recorded a domestic turnover of Rs 829.10 crore as compared to the turnover of Rs 600.18 crore in the corresponding quarter of the previous year, registering 38% growth. It has also opened a new franchisee showroom at Katihar in Bihar during the quarter.

Bank of Baroda: The public sector lender has hiked the marginal cost of funds-based lending rate (MCLR) by up to 35 bps across tenors. The rate hike will be effective from January 12.

Cupid: The company has received an order from United Nations Population Fund for the supply of male condoms and water-based lubricant worth Rs 5.21 crore. The said order will be executed by June 2023.

Uttam Sugar Mills: The company will invest Rs 56 crore to increase distillery capacity to 250 kl per day from 150 kl per day at its unit in Barkatpur, Uttar Pradesh. The company expects to complete the proposed capacity expansion by December. The capacity expansion will be funded through internal accruals and loans under the interest subvention scheme. It has also increased the cane crushing capacity from 23,750 TCD to 26,200 TCD.

PC Jeweller: The company’s domestic sales in the quarter ended December rose 38% on year to Rs 829 crore. The jewellery maker opened a new franchisee showroom in Bihar during the quarter.

Sigachi Industries: The company’s board approved an increase in authorsied share capital from Rs 32 crore to Rs 42 crore by way of issue of up to 1.10 crore convertible warrants to the promoters at Rs 285.30 per share.

Jet Freight Logistics: The company’s shares will trade ex-rights with respect to its rights issue in the ratio of 1:1 offered at a price of Rs 16.25 apiece.