Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.16% higher at 18,733, signalling that Dalal Street was headed for positive start on Tuesday.

Asian markets were mixed. Tokyo stocks were trading lower, tracking the US and European markets. The Nikkei 225 index was down 0.77%, while the broader Topix index was down 0.57%. Meanwhile, Chinese shares were trading higher. The Hang Seng jumped 1.08% and the CSI 300 index rose 0.2%.

Indian rupee was unchanged at 80.04 against the US dollar on Monday.

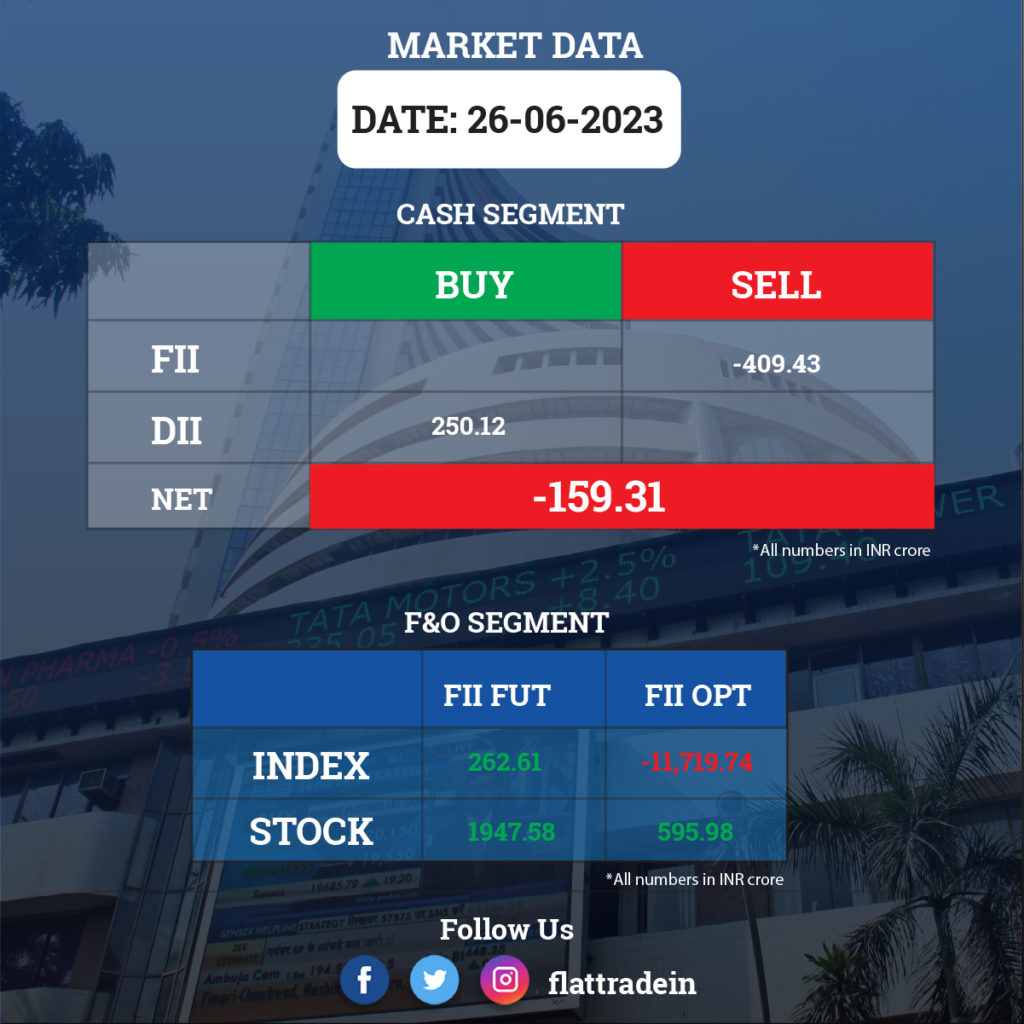

FII/DII Trading Data

Stocks in News Today

Bharti Airtel: The telecom operator has announced changes to its leadership team in Airtel Business. Ajay Chitkara has resigned as CEO of Airtel Business and will continue with the company until the third week of August 2023. Consequently, Airtel Business will operate as three business and channel segments. Global business will be led by Vani Venkatesh, Domestic business by Ganesh Lakshminarayanan, and Nxtra Data Centers by Ashish Arora.

ICICI Prudential Life Insurance: The company has received a GST show cause cum demand notice for Rs 492 crore. The matter “relates to an industry-wide issue of input tax credit,” and the company believes it has availed of eligible input GST credit in compliance. It has deposited Rs 190 crore without accepting any liability.

Tech Mahindra: The company’s unit LCC France has approved a proposal to divest its 49% holding in SARL Djazatech and its subsidiary EURL LCCUK Algerie. The stake sale transaction is expected to be completed by July 10, 2023. Tech Mahindra said there was no contribution in terms of turnover or net worth to the consolidated turnover of the company for the year ended March 31, 2023.

Aditya Birla Capital: The financial services company has launched qualified institutional placement, offering its shares in the price range of Rs 170-176 apiece. The company is seeking Rs 1,750 crore from the QIP.

JSW Steel: After the approval for the scheme of amalgamation by NCLT, JSW Vallabh Tinplate, Vardhman Industries, and JSW Steel Coated Products filed the said order with the Registrar of Companies. The said scheme has become effective from June 26. Accordingly, JSW Vallabh Tinplate and Vardhman Industries have merged with JSW Steel Coated Products, and ceased to exist from the effective date, according to its regulatory filing.

BLS International Services: The outsourcing service provider said the board members of its subsidiary BLS E-Services have approved fundraising via initial public offering (IPO). The size of the offer, price and other details of the proposed IPO will be determined in due course. Post the proposed IPO, BLS E-Services would continue to be a subsidiary of the company.

City Union Bank: The company has received approval from the board of directors for raising further capital to the tune of Rs 500 crore via qualified institutional placement (QIP) route.

SBI Life Insurance Company: Swaminathan Janakiraman has resigned as a director of the life insurance company with effect from June 26 after the Reserve Bank of India appointed Swaminathan as Deputy Governor. He was the nominee director representing State Bank of India.

Federal Bank: The lender has appointed Independent Director A. P. Hota as the part-time chairman with effect from June 29, 2023, till Jan. 14, 2026.

Axiscades Technologies: The company has completed the re-financing of its existing debt of Rs 210 crore, which it borrowed for the acquisition of Mistral Solutions. The refinancing will bring down the company’s interest costs by over 400 basis points per year.

Sapphire Foods India: The company’s promoter is likely to sell 30 lakh shares through a block deal, Bloomberg reported and the floor price is set at Rs 1345-1391 per share.

Godrej Properties: The real estate developer has received its board approval for the issuance of unsecured redeemable non-convertible debentures (NCDs) worth Rs 750 crore, consisting of base issue of Rs 500 crore with an oversubscription option of Rs 250 crore.

Navin Fluorine International: The specialty chemicals manufacturer said the board members will meet on June 30 to consider a proposal for raising funds via issuance of equity shares.