Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.13% higher at 20,010.5, signaling that Dalal Street was headed for positive opening on Thursday.

Asian markets were trading higher after the Federal Reserve increased interest rates as expected and delivered no major surprises. The Nikkei 225 index rose 0.19% and the Topix was flat. The Hang Seng jumped 1.54% and the CSI 300 index gained 0.58%.

Indian rupee fell by 11 paise to 81.99 against the US dollar on Wednesday.

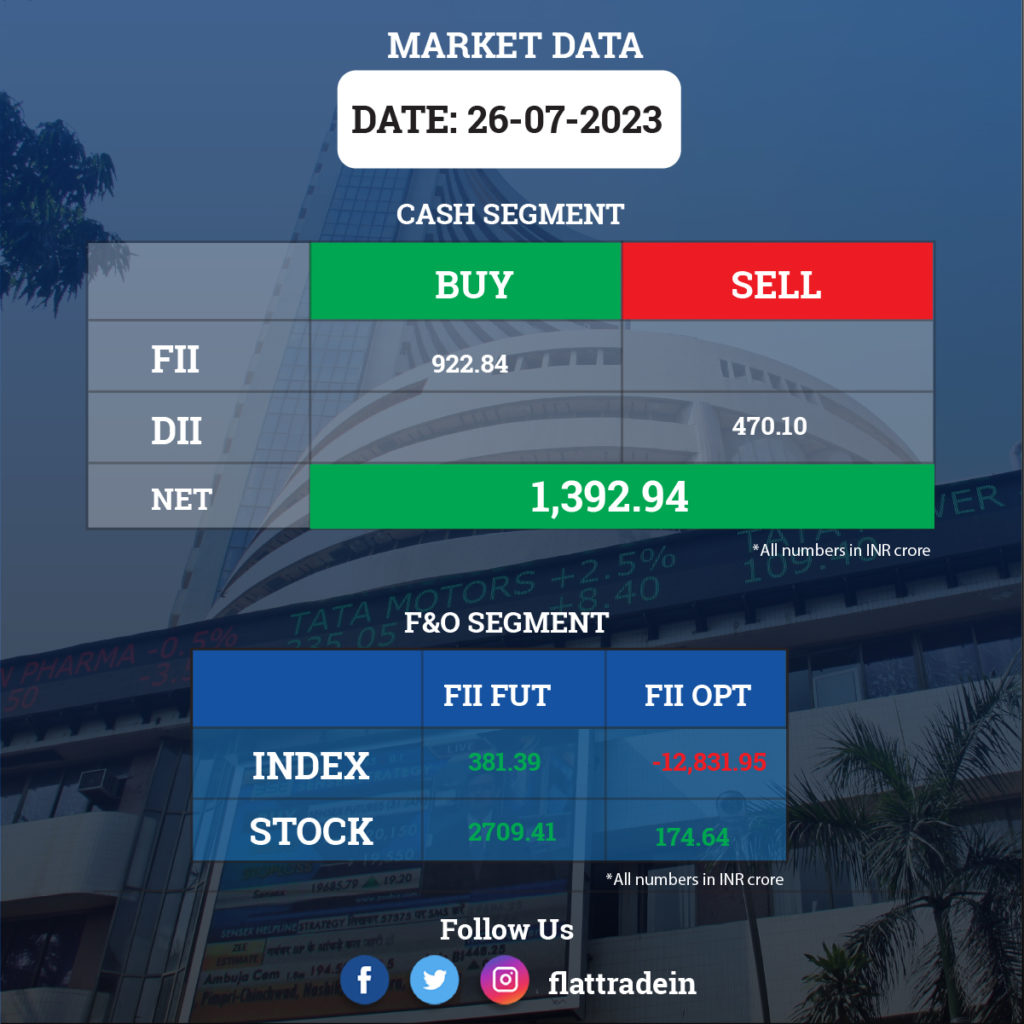

FII/DII Trading Data

Upcoming Results

Bajaj Finserv, Nestle India, Bajaj Holdings & Investment, Bharat Electronics, Blue Dart Express, Birlasoft, Sona BLW Precision Forgings, Shriram Finance, RailTel Corporation of India, Laurus Labs, Latent View Analytics, Dr. Lal Pathlabs, Jyoti Resins & Adhesives, JK Lakshmi Cement, Coromandel International, PSP Projects, Powergrid Infrastructure Investment Trust, NDTV, Nippon Life India Asset Management, NACL Industries, L.G.Balakrishnan & Bros, Intellect Design Arena, Indus Towers, Indian Bank, Indian Hotels, IIFL Finance, Indian Energy Exchange, Home First Finance Company India, ZF Commercial Vehicle Control Systems, Westlife Foodworld, Welspun Specialty Solutions, Ujjivan Small Finance Bank, Tata Teleservices (Maharashtra), Trident, Symphony, Sundram Fasteners, Sterlite Technologies, Supreme Petrochem, Shyam Metalics And Energy, Saregama India, Arvind, and Greenlam Industries will reoport their results today.

Stocks in News Today

Axis Bank: The private sector lender has recorded a profit lower than analysts’ estimates at Rs 5,797.1 crore for the quarter ended June FY24, up 40.5% YoY as against Rs 4125 crore in the year-ago period. The bank registered a sharp spike in provisions, driven by a surge in other income and pre-provision operating profit. Net interest income grew by 27.4% YoY to Rs 11,959 crore from Rs 9384 crore. Its net interest margin expanded 50 bps YoY to 4.1% and net NPA stood at 0.41% in the reported quarter compared with 0.39% in the preceding quarter. The lender’s net advances was up 22% year-on-year to Rs 8.58 lakh crore.

Reliance Industries (RIL): The company’s financial arm, Jio Financial Services, and BlackRock have signed joint venture pacts to foray into the asset management sector. The 50:50 joint venture, Jio BlackRock, will deliver tech-enabled access to affordable investment solutions. Both parties will initially invest $150 million (Rs 1230.19 crore) each in the joint venture.

Dr Reddy’s Laboratories: The pharma major has registered an 18% YoY increase in consolidated profit to Rs 1,402.5 crore for June FY24 quarter despite a drop in operating margin. Revenue from operations grew by 29% YoY to Rs 6,738.4 crore with double-digit healthy growth in North America (up 79% YoY), Europe (up 22%) and Emerging Markets (up 28%).

Tech Mahindra: The IT services provider posted disappointing numbers as the profit tanked 38% sequentially to Rs 703.6 crore in Q1FY24 from Rs 1,125 crore in Q4FY23. Revenue fell 4.07% QoQ to Rs 13,159 crore in Q1FY24 from Rs 13,718.2 crore in Q4FY23. EBIT was down 32.4% at Rs 891.4 crore in the reported quarter from Rs 1,317.8 crore in the previous quarter.

Tata Consumer Products: The FMCG company has clocked 22% YoY growth in consolidated profit at Rs 338 crore for the quarter ended June 2023, with strong growth in the India branded business and improved performance in international and non-branded business. Consolidated revenue from operations grew by 12.5% year-on-year to Rs 3,741.2 crore. Ebitda was up 19% at Rs 545.03 crore in Q1FY24 from Rs 457.3 crore in Q1FY23.

RBL Bank: Mahindra & Mahindra said it has acquired a 3.53% stake in the lender Bank for Rs 417 crore, and may consider raising the stake in the bank further, but won’t exceed 9.99%. The acquisition price was Rs 197 per share.

Jindal Stainless: The company’s Consolidated revenue was up 25.44% YoY at Rs 10,183.96 crore in Q1FY24 as against Rs 8,118.59 crore in Q1FY23. Consolidated net profit rose 45.22% to Rs 737.58 crore in Q1FY24 from Rs 507.89 crore in Q1FY23. Ebitda was up 34.1% at Rs 1,192.37 crore in Q1FY24 as against Rs 889.15 crore in Q1FY23.

Aditya Birla Sun Life: The company’s consolidated revenue was up 2% at Rs 311.16 crore in Q1FY24 as against 304.50 crore in Q1FY23. Ebitda fell 6.25% to Rs 169.95 crore in Q1FY24 as against Rs 181.29 crore in Q1FY23. Consolidated net profit jumped 79.47% to Rs 184.57 crore in Q1FY24 from 102.84 crore in Q1FY23.

Poonawalla Fincorp: The NBFC announced the consummation of its controlling stake sale in its housing finance subsidiary Poonawalla Housing Finance (PHFL) to Perseus SG Pte Ltd, an entity affiliated to TPG Global LLC. With this stake sale, PHFL has ceased to be a subsidiary of PFL and Perseus SG Pte Ltd now holds a controlling equity stake in PHFL. PFL received a post-tax consideration of Rs 3,004 crore for its stake sale.

Rail Vikas Nigam (RVNL): The Government of India is going to sell up to 7.09 crore equity shares or a 3.4% stake in Rail Vikas Nigam, with an option to additionally sell 4.08 crore shares or 1.96% via an offer for sale (OFS). The OFS will take place on July 27 for non-retail investors and July 28 for retail investors. The floor price has been fixed at Rs 119 per share.

Aurobindo Pharma: The company has set up a step-down subsidiary, Auro Pharma LLC, in Russia to pursue pharma business operations there. The drugmaker has proposed making an initial investment of around $10 million. As many as 100% of the shares of Auro Pharma LLC are held by Auro Active Pharma Private Limited.

Marico: The company has acquired a 32.75% stake in Satiya Nutraceuticals on a fully diluted basis and has majority control overboard. It will buy the remaining 25.25% stake in tranches by May 2025.

IDFC First Bank: The lender will discuss and consider a proposal to raise funds in the next one year by issuing equity shares or other equity-linked securities.

Colgate Palmolive: The toothpaste maker said its revenue was up 11% to Rs 1,323.67 crore in Q1FY24 from Rs 1,196.81 crore in Q1FY23. Net profit jumped 31% YoY to Rs 273.68 crore in Q1FY24 from Rs 209.67 crore in Q1FY23. Ebitda gained 28% to Rs 418.12 crore in Q!FY24 from Rs 325.67 crore in Q1FY23.

Fine Organics: The company’s consolidated revenue fell 26.82% YoY to Rs 547.17 crore in Q1FY24 from Rs 747.73 crore in Q1FY23. Ebitda dropped 34.19% YoY at to Rs 141.23 crore in Q1FY24 from 214.61 crore Q1FY23. Net profit tanked 37% to Rs 99.76 crore in Q1FY24 from Rs 159.79 crore in Q1FY23.