Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.16% higher at 18,153, signalling that Dalal Street was headed for positive start on Monday.

Japanese shares were trading lower as Nikkei 225 index fell 0.75% and the Topix was down 0.32%. Chinese shares were trading higher, helped by gains in financial shares. The Hang Seng rose 0.61% and the CSI 300 index gained 0.68%.

Indian rupee closed at 81.80 against the US dollar on Friday [May 5, 2023].

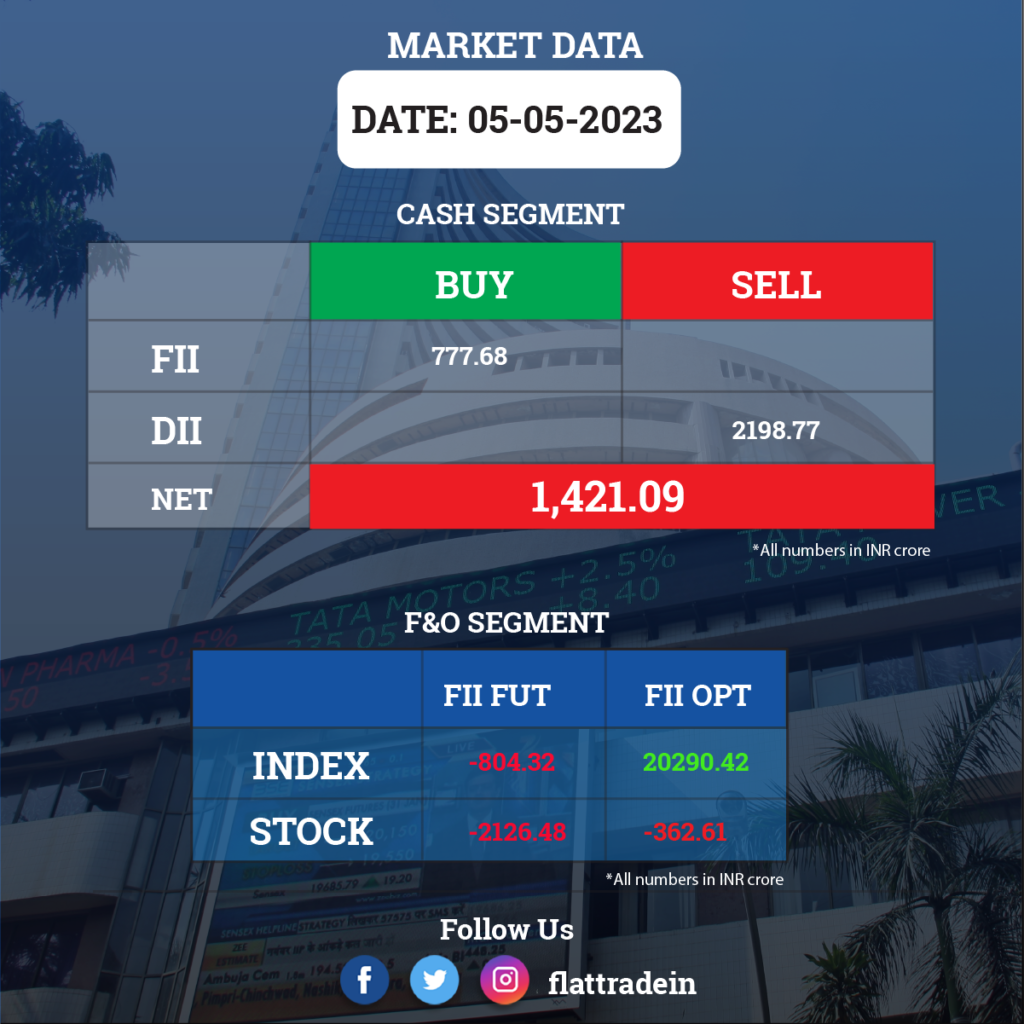

FII/DII Trading Data

Upcoming Earnings

UPL, Pidilite Industries, Canara Bank, Kalpataru Power Transmission, Apar Industries, CG Power and Industrial Solutions, Kansai Nerolac Paints, Aarti Industries, Mahanagar Gas, Birlasoft, Carborundum Universal, Craftsman Automation, VIP Industries, Happiest Minds Technologies, Indian Bank, Apollo Pipes, Andhra Paper, Avadh Sugar & Energy, Exide Industries, HFCL, IndInfravit Trust, and IRB InvIT Fund.

Stocks in News Today

Coal India: The state-owned company reported a consolidated net profit of Rs 5,527.62 crore in the March quarter, down 17.7% from a year ago, due to increased provisions towards wages. Consolidated revenue for the quarter stood at Rs 35,161.44 crore, up 17.3 percent year on year. The company recommended a final dividend of Rs 4 per share. Earlier in two tranches a total dividend of Rs 20.25 per share was already paid out. Total expenses in the fourth quarter increased to Rs 32,791 crore from Rs 25,140.01 crore in the corresponding quarter of the previous fiscal.

Britannia Industries: The biscuit manufacturer bakery and dairy products maker recorded 47.5% year-on-year growth in consolidated profit at Rs 557.6 crore for quarter ended March FY23, driven by healthy operating performance and topline. Consolidated revenue from operations at Rs 4,023.2 crore grew by 13.3% on significant distribution gains.

Adani Power: The company’s consolidated revenue was up 40% YoY at Rs 38,773.30 crore in Q4FY23 as against Rs 27.,711.20 crore in the year-ago period. Ebitda rose 2.3% to Rs 10,044.7 crore in Q4FY23 from Rs 9,814.16 crore in the same period last fiscal. Net profit jumped 118.4% YoY to Rs 10,726.6 crore in the reported quarter from Rs 4,911.58 crore in the eyar-ago period.

One 97 Communications (Paytm): The fintech company narrowed its losses to Rs 168.4 crore in March FY23 quarter, against loss of Rs 761.4 crore in same period last year. Consolidated revenue for the quarter grew by 51.5% to Rs 2,334.5 crore compared to the corresponding period last fiscal. For the entire fiscal 2023, the loss dropped to Rs 1,776 crore against a loss of Rs 2,393 crore in FY22, and revenue jumped 60.6% to Rs 7,990.3 crore in the same period.

Union Bank of India: The public sector lender recorded a 93.3% year-on-year growth in standalone profit at Rs 2,782 crore for the quarter ended March FY23, backed by lower provisions, with improvement in asset quality. Higher other income and net interest income also boosted profitability. Net interest income grew 22% YoY to Rs 8,251 crore, with margin expansion of 23 bps at 2.98% for the quarter.

Bank of India: The state-owned lender said its consolidated profit after tax for the quarter ended March 2023 quarter jumped 115% to Rs 1,388.19 crore, helped by higher other income. The lender’s profit for FY23 increased to Rs 3,882 crore, up from Rs 3,406 crore in FY22. The bank’s core net interest income was up over 37% to Rs 5,493 crore on a 13% growth in advances. It posted a widening of net interest margin increased to 3.15% from 2.56% in the year-ago period. Its non interest income almost doubled to Rs 3,099 crore for the reported quarter from Rs 1,587 crore in the same quarter a year ago. The bank is planning for a capital raise of Rs 4,500 crore in equity capital in FY24, which will help bring down the government’s stake in the lender to the Sebi-mandated 75%.

Equitas Small Finance Bank: The company has reported a net profit of Rs 190 crore for the quarter ended March 2023. It had registered net profit at Rs 119.50 crore during the corresponding quarter of the previous year. Total income during the quarter under review stood at Rs 1,394.41 crore as against Rs 1,043.97 crore registered in the same period of last year. The Board of Directors at its meeting held on May 5 has recommended a dividend of Re 1 per equity share, subject to approval of members at the ensuing annual general meeting of the bank.

Muthoot Microfin: The company said that its net profit nearly doubled year-on-year to Rs 102 crore for the Q4FY23, backed by robust business growth. Total income was at Rs 448 crore during the reported quarter compared with Rs 249 crore in the year-ago period. Profit for the full year FY23 was Rs 203 crore against Rs 80 crore in the preceding year. The asset under management for the lender jumped 37% year-on-year to Rs 9200 crore at the end of March. Its gross non-performing assets ratio fell to 2.9% at the end of the fiscal from 6.3% the preceding fiscal.

Marico: The consumer goods company posted an 18.7% year-on-year growth in consolidated profit at Rs 305 crore for March FY23 quarter, as operating performance remained strong on lower input cost. Consolidated revenue increased by 3.7% YoY to Rs 2,240 crore.

Lupin: The pharma major entered into a definitive agreement to acquire the entire share capital of the French pharmaceutical company Medisol, subject to approval from the French Ministry of Economy and Finance.

DCB Bank: The private sector lender reported a 25% on-year growth in profit at Rs 142 crore for quarter ended March FY23, following decline in provisions. Net interest income grew 28% YoY to Rs 486 crore with over 18% growth each in deposits and advances.

Alembic Pharmaceuticals: The drugmaker registered nearly seven-fold rise in consolidated profit at Rs 152.6 crore for quarter ended March FY23, supported by strong operating performance and lower other expenses. Revenue dropped 0.65% to Rs 1,406.5 crore compared to year-ago period, impacted by the US business that fell 36% to Rs 354 crore.

Piramal Enterprises: The company’s net interest income declined 4% YoY to Rs 1,128 crore Q4FY23. Its consolidated net loss widened to Rs 195.87 crore compared with a consolidated net profit of Rs 150.53 crore in the year-ago period. Net NPA ratio stood at 1.9% in the reported quarter as against 1.7% in the preceding quarter. The board recommended a final dividend of Rs 31 per share.

Blue Dart Express: The logistics company’s consolidated revenue was up 4.34% YoY at Rs 1,216.55 crore in Q4FY23. Ebitda was down 31.72% YoY to Rs 199.23 crore in Q4FY23. Consolidated net profit fell 49.3% YoY at Rs 69.44 crore. The board recommended a dividend of Rs 30 per share, subject to shareholders and regulatory approval.

Aditya Birla Fashion and Retail: The company has signed a definitive agreement to acquire 51% stake in TCNS Clothing for Rs 1,650 crore. The company will buy between 22% to 30.81% stake from TCNS promoters and up to 29% stake through open offer at Rs 503 per share. Under the agreement, public shareholders of TCNS will receive 11 shares of ABFRL for every 6 shares that they hold in TCNS.

Tatva Chintan Pharma: The company’s consolidated revenue was up 26.37% YoY at Rs 124.51 crore in Q4FY23. Ebitda fell 26.01% YoY to Rs 16.27 crore in Q4FY23. Consolidated net profit was down 3.2% YoY at Rs 16.95 crore in Q4FY23. The board recommended a final dividend of Rs 2 for the fiscal.

Artemis Medicare Services: The company’s consolidated revenue was up 30.68% YoY at Rs 195.28 crore in Q4FY23. Ebitda gained 50.44% YoY to Rs 25.65 crore in Q4FY23. Consolidated net profit fell 20% YoY at Rs 10.60 crore in Q4FY23. The company announced a dividend of Rs 0.45 per share for fiscal 2023.

Ajanta Pharma: The drugmaker’s consolidated revenue was up 1.33% YoY at Rs 881.84 crore in Q4FY23. Ebitda fell 27.73% YoY to Rs 149.37 crore in Q4FY23. Net profit was down 19.15% YoY to Rs 122.25 crore in Q4FY23.

Olectra Greentech: The company said its consolidated revenue rose 38.56% YoY at Rs 375.91 crore in Q4FY23. Ebitda jumped 31.89% YoY to Rs 132.11 crore in the reported quarter. Net profit rose 52% YoY to Rs 27.01 crore in the quarter under review.