Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.23% higher at 19,605.50, signalling that Dalal Street was headed for positive start on Wednesday.

Asian shares were trading lower due to weak economic numbers related to consumer price and producer price from China. The Nikkei 225 index fell 0.25% and the Topix was down 0.26%. The Hang Seng fell 0.46% and the CSI 300 index dropped 0.25%.

The Indian rupee fell 7 paise to 82.83 against the US dollar on Tuesday.

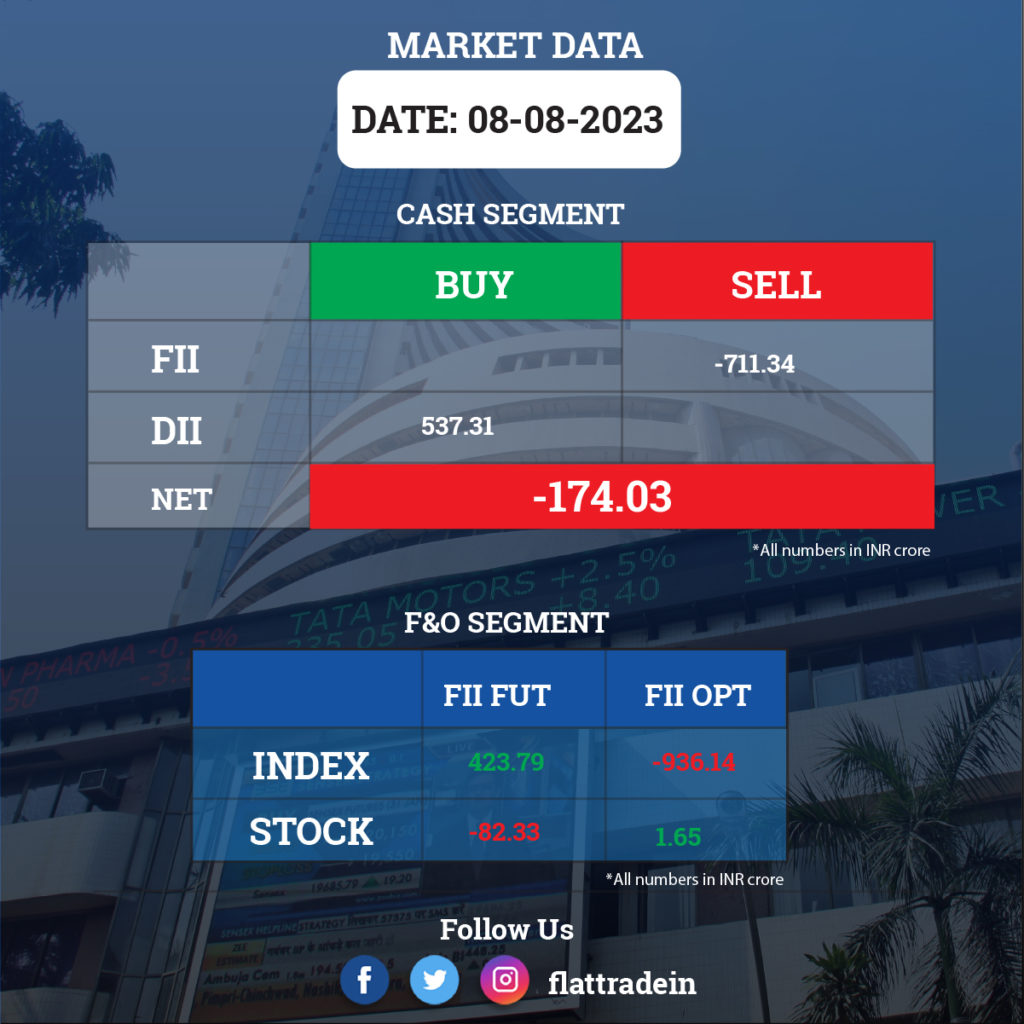

FII/DII Trading Data

Stocks in News Today

Coal India: The state-owned coal mining major said its consolidated net profit fell 10.1% YoY to Rs 7,941.4 crore in Q1FY24 as against Rs 8834.22 crore iin the year-ago period. Revenue from operations grew by 2.5% year-on-year to Rs 35,983 crore in the quarter ended June FY24 from Rs 35,092 crore in the year-ago period. Ebitda was down 14% to Rs 10,513.85 crore in Q1FY24 as against Rs 12,250.84 crore in Q1FY23.

Oil India: The state-run oil & gas exploration company said its consolidated revenue fell 20.9% to Rs 6,208.22 crore in Q1FY24 from Rs 7,851.78 crore in the preceding quarter. Ebitda fell 35% to Rs 2,276.52 crore in Q1FY24 from Rs 3,503.95 crore in the fourth quarter of FY23. Consolidated net profit dropped 18.14% to Rs 1426.6 crore in Q1FY24 from Rs 1742.83 crore in Q4FY23.

Birla Corporation: The company recoreded a consolidated revenue of Rs 2,408.46 crore in Q1FY24, up 9.3% from Rs 2,203.76 crore in Q1FY23. Ebitda rose 14.9% to Rs 297.84 crore in Q1FY24 from Rs 259.31 crore in Q1FY23. Consolidated net profit down 3.6% at Rs 59.71 crore vs Rs 61.92 crore.

Prestige Estates: The company’s consolidated revenue was down 13% at Rs 1,681 crore in Q1FY24 as against Rs 1,938.5 crore in Q1FY23. Ebitda was up 14% at Rs 526.5 crore in the reported quarter as against Rs 462.5 crore in the year-ago period. Consolidated net profit was up 30% at Rs 267 crore in Q1FY24 as against Rs 205 crore in Q1FY23.

NTPC: The company’s subsidiary, NTPC Renewable Energy Limited (NTPC REL), said that it has secured the bid for an 80 MW floating solar project at the Omkareshwar reservoir in Khandwa, Madhya Pradesh (MP). The discovered tariff is Rs 3.80/kWh and the energy generated from the project shall be used by MP state DISCOMs, the company said.

Siemens: The company has posted a consolidated revenue of Rs 4873.2 crore in Q3FY23, up 14.4% Rs 4,258.30 crore in the year-ago period. Ebitdta jumped 37.5% YoY to Rs 566.60 crore in the quarter under review as against Rs 412.20 crore in th eyear-ago period. Consolidated net profit surged 51.6% to Rs 455.80 crore in the reported quarter as against Rs 300.70 crore in the same period last year.

Aarti Industries: The company’s consolidated revenues was down 12.17% at Rs 1,414 crore in Q1FY24 from Rs 1,610 crore in Q1FY23. Ebitda fell 28.72% to Rs 201 crore in Q1FY24 from Rs 282 crore in Q1FY23. Consoliadted net profit dropped 48.52% to Rs 70 crore in Q1FY24 as against Rs 136 crore in Q1FY23.

Dhampur Sugar Mills: The company’s consolidated net profit rose 15.5% to Rs 45.41 crore in Q1FY24 from Rs 39.30 crore in Q1FY23. Consolidated revenue was up 10.4% at Rs 915.14 crore in Q1FY24 from Rs 828.86 crore in Q1FY23. Ebitda grew 15.5% to Rs 94.48 crore in the quarter under review from Rs 81.81 crore in Q1FY23.

EPL: The company has registered a consolidated net profit of Rs 55.6 crore in Q1FY24, up 58.9% from Rs 35 crore in the year-ago period. Consolidated revenue was up 9.4% YoY to Rs 910.20 crore in Q1FY24 from Rs 831.80 crore in Q1FY23. Ebitda jumped 26.6% to Rs 159 crore in Q1FY24 from Rs 125.60 crore in Q1FY23.

Lupin: The pharma company said that its US-based subsidiary, Novel Laboratories, has received approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application for Fluocinolone acetonide oil, a generic equivalent of DermaSmoothe/FS, of Hill Dermaceuticals Inc.

SBI Life Insurance Company: The company said that Insurance Regulatory and Development Authority of India has given its approval for the appointment of Amit Jhingran as Managing Director & CEO of the insurance company.

Data Patterns India: The defence and aerospace electronics solutions provider has recorded a consolidated profit of Rs 25.83 crore for the quarter ended June FY24, rising 81.4% over a year-ago period, driven by higher other income and topline numbers. Revenue during the quarter grew by 31.2% year-on-year to Rs 89.7 crore.

Jay Bharat Maruti: The company said its board has approved a stock split of existing shares in 5:2 ratio. The existing equity shares with face value of Rs 5 will be split into equity shares having face value of Rs 2. The company said that the purpose of the stock split is to enhance liquidity of the company’s equity shares and to give opportunity to small investors for investment.

Inox Wind Energy: The promoter and promoter group entities of the company has raised Rs 500 crore through sale of equity shares of the company through block deals. The funds raised are proposed to be infused into Inox Wind and use for repaying existing debt.