Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.10% higher at 18,891, signalling that Dalal Street was headed for positive start on Monday.

Asian markets were mixed as the Japanese equities were trading marginally higher, while Chinese markets were trading lower. Japan’s Nikkei 225 index was 0.05% higher and the Topix was 0.16% higher. The Hang Seng dropped 1.04% and the CSI 300 index fell 0.8%.

Indian rupee appreciated by 25 paise to close 81.94 against the US dollar on Friday.

The Union government has collected Rs 3.8 lakh crore in the form of direct taxes in the first two-and-a-half months of 2023-24, the finance ministry said on June 18. As per the ministry, as on June 17, the direct tax collected was 11.2% higher compared to the same period last financial year. This comprised of corporate tax mop-up of Rs 1.57 lakh crore and personal income tax – including Securities Transaction Tax – of Rs 2.22 lakh crore.

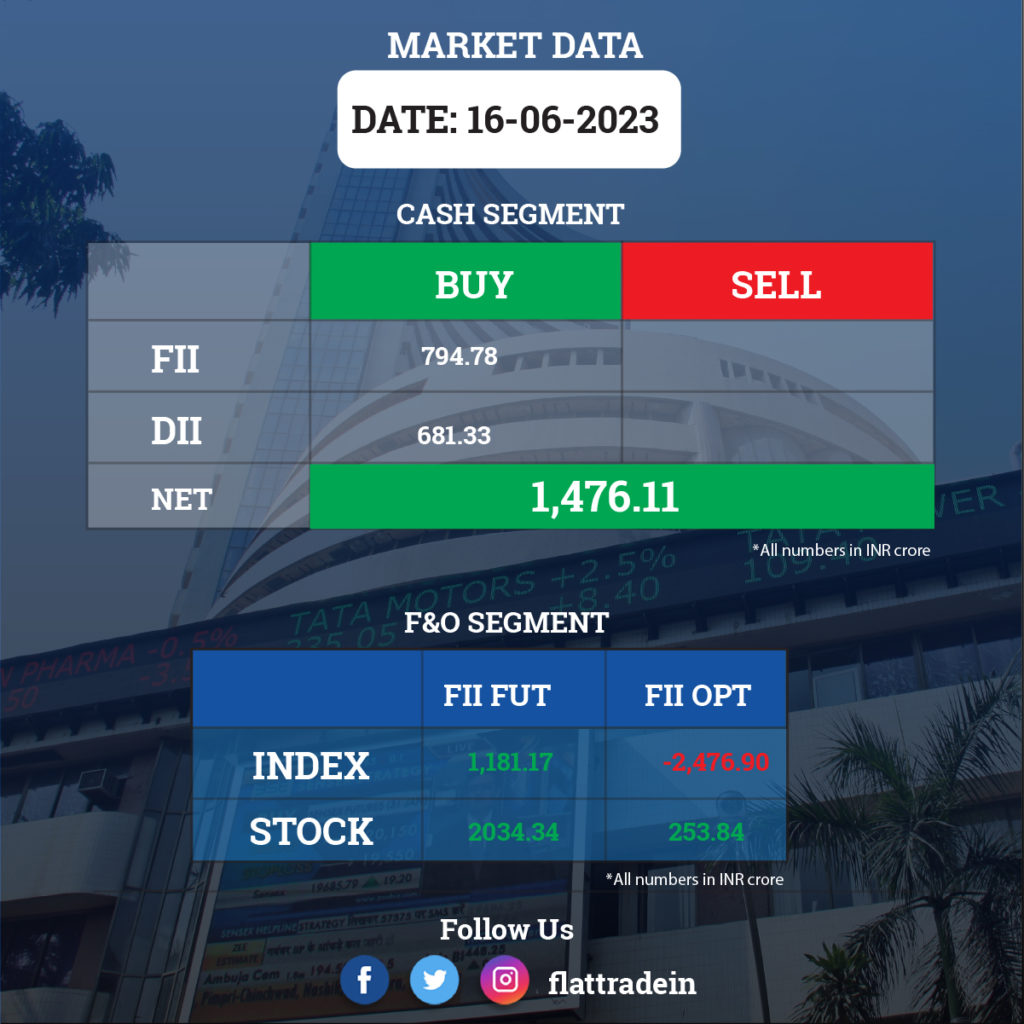

FII/DII Trading Data

Stocks in News Today

HDFC Bank: The Reserve Bank of India (RBI) has advised HDFC Bank that it may hold the commercial papers that were issued till date by HDFC, till their maturity. The bank should not roll over or reissue any commercial paper after the effective date of the proposed amalgamation. The bank will also approach the RBI with the crystalized amounts of all the liabilities of HDFC as of the effective date.

ZEE: Capital markets regulator Securities and Exchange Board of India (SEBI) in its reply in the matter of ZEE to Securities and Appellate Tribunal (SAT) has pointed out that Chairman Emeritus Subhash Chandra and Managing Director and CEO Punit Goenka have diverted public money to private entities, according to a report by news agency IANS.

ABB India: The Kanpur Metro has deployed ABB India’s electrification solutions for power distribution. ABB India has been contributing to Indian Metro systems by proving electrification solutions to 13 metro rail projects across India.

Tata Steel: The company said it is planning a consolidated capital expenditure (capex) of Rs 16,000 crore for its domestic and global operations during the current financial year.

Dr Reddy’s Laboratories: The United States Food & Drug Administration (USFDA) completed a good manufacturing practice (GMP) inspection at company’s API manufacturing facility in Bollaram, Hyderabad. The inspection was conducted during June 12 and June 16, and closed with zero observations.

Axis Bank: The lender has appointed former RBI Deputy Governor N.S. Vishwanathan as Non-Executive Part-Time Chairman with effect from October 27, 2023.

PNB Housing Finance: The housing finance company said its board will consider issuance of non-convertible debentures worth Rs 5,000 crore on a private placement basis on June 22.

Axiscades Technologies: The company’s board approved the 100% acquisition, in a phased manner, of add solution GmbH in Germany. add solution GmbH is specialized in automotive solutions to global OEMs. The acquisition will be carried out through subsidiary AXISCADES GmbH. The cost of acquisition is 5.50 million euro.

Adani Enterprises: The company’s subsidiary, Adani Digital Labs (ADL), has signed a Share Purchase Agreement for proposed acquisition of 100% stake in Stark Enterprises. Stark is also known as Trainman, an online train booking and information platform. The company has not disclosed the cost of acquisition.

Castrol India: Castrol and Mahindra Insurance Brokers have signed an agreement to distribute insurance policies. The deal will allow Castrol Auto Service workshops to distribute eligible insurance policies, and these workshops will be able to register as cashless claim sites with insurance companies.

Gufic Biosciences: The company has received approval from National Medical Products Administration (NMPA), China for its product Prilocaine (API). This approval will help the company commercialise the said product in China and explore Chinese market. Prilocaine has a clinical profile similar to lidocaine and is used for infiltration, peripheral nerve blocks and spinal and epidural anaesthesia.

Skipper: The company has received orders worth Rs 1,135 crore for design, supply and construction of new transmission line projects for Power Grid Corporation as well as tower and pole export supplies to Latin America, Middle East and North Africa regions. The company is involved in power transmission & distribution as well as telecom and railway structures manufacturing.

Kalyan Jewellers: Highdell Investment, owned by private equity firm Warburg Pincus, has sold partial stake in Kalyan Jewellers through open market transactions on Friday.

Trident: The company’s unit, Trident Home Textiles, incorporated a wholly-owned subsidiary, Trident Global B.V., in the Netherlands. Trident Global will carry out the wholesale business of textiles, paper, non-food consumer goods, and clothing accessories.

Kalpataru Projects: The board meeting of the company is scheduled to be held on June 21 to consider and approve the proposal for the raising of funds by way of issuance of non-convertible debentures on private placement basis.