Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.14% higher at 18,138, signalling that Dalal Street was headed for a positive to flat start on Friday.

Most Asian shares were trading higher on Friday. The Nikkei 225 index was up by 0.08%, the Topix index up by 0.26%. The Hang Seng index was 0.67% higher, while the CSI 300 index up 0.29%.

Indian rupee was down 11 paise to 81.35 against the US dollar on Thursday.

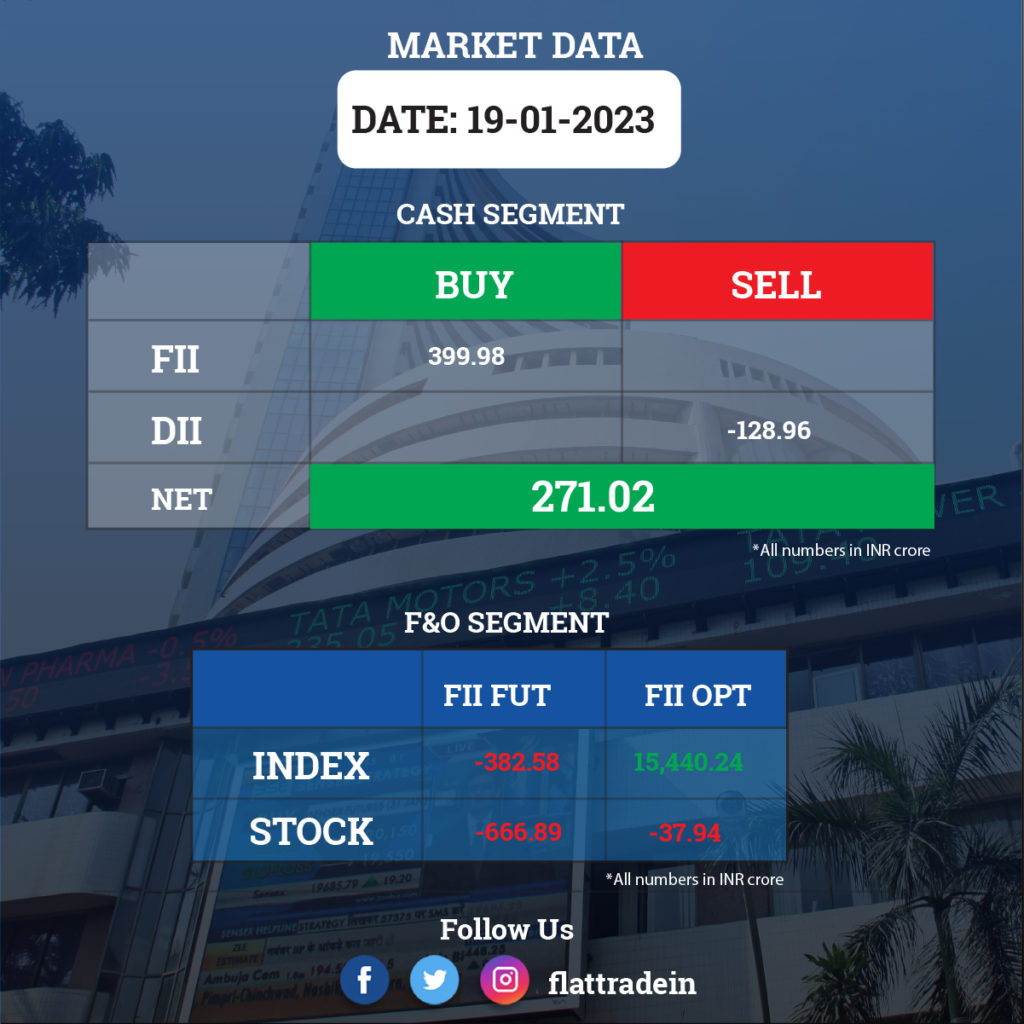

FII/DII Trading Data

Upcoming Results

Reliance Industries, HDFC Life Insurance Company, JSW Steel, LTIMindtree, Union Bank of India, Bandhan Bank, RBL Bank, Aether Industries, Atul, Coforge, DCM Shriram, Heritage Foods, Indian Energy Exchange, JSW Energy, NELCO, Petronet LNG, Ramkrishna Forgings, Shakti Pumps,Tanla Platforms,ICICI Bank, Kotak Mahindra Bank, SBI Life Insurance Company, UltraTech Cement, Yes Bank, IDFC First Bank, Dodla Dairy, Meghmani Organics, and Punjab & Sind Bank

Stocks in News Today

Hindustan Unilever: The FMCG major has clocked an 11.7% year-on-year growth in standalone profit at Rs 2,505 crore for the quarter ended December FY23, backed by revenue from operations that grew by 16.3% to Rs 15,228 crore for the quarter with domestic volume growth at 5 percent, and higher other income. Profitability was impacted by the exceptional loss of Rs 102 crore for the quarter against Rs 66 crore in the year-ago period. At the operating level, EBITDA increased 7.9% to Rs 3,537 crore but the margin fell 180 bps YoY to 23.2 percent in Q3FY23 impacted by higher raw material costs.

AU Small Finance Bank: The small finance bank has recorded a 30% year-on-year growth in profit at Rs 392.8 crore for the quarter ended December FY23, led by net interest income and lower provisions. Net interest income grew by 41% to Rs 1,153 crore for the quarter with a 10 bps YoY fall in net interest margin at 6.2%. Asset quality improved with the gross non-performing assets (NPA) as a percentage of gross advances falling 9 bps QoQ to 1.81% and net NPA declining 5 bps QoQ to 0.51% for the quarter.

PVR: The multiplex chain operator has reported a consolidated profit of Rs 16.1 crore for quarter that ended December FY23, against a loss of Rs 10.2 crore in the same period last year. Consolidated revenue for the quarter at Rs 941 crore increased by 53%, with the movie exhibition business growing 37% and others (including movie production & distribution) 23.5% YoY. EBITDA in Q3FY23 grew by 75% to Rs 288.8 crore and the margin expanded by nearly 4 percentage points to 30.7 percent for the quarter YoY.

Sun Pharmaceutical Industries: The pharma company is going to acquire Concert Pharmaceuticals for $576 million or $8 per share. Concert stockholders will also receive a non-tradeable contingent value right (CVR) entitling holders to receive up to an additional $3.50 per share on deuruxolitinib achieving certain net sales milestones within specified periods. The concert is a late-stage biotechnology company, developing deuruxolitinib, an oral inhibitor of Janus kinases JAK1 and JAK2 for the treatment of alopecia areata, an autoimmune dermatological disease.

Can Fin Homes: The company has reported a 31% year-on-year growth in profit at Rs 151.5 crore for quarter ended December FY23, supported by lower provisions. Net interest income for the quarter at Rs 251.71 crore grew by 22.23% YoY. Asset quality improved with gross non-performing assets (NPA) improving by 2 bps QoQ to 0.60% and net NPA falling 5 bps to 0.30% in Q3FY23

Hindustan Zinc: The company has reported a 20.2% year-on-year decline in consolidated profit at Rs 2,156 crore for quarter ended December FY23, impacted by lower revenue, operating income and higher power & fuel cost. Revenue fell 1.6% YoY to Rs 7,866 crore for the quarter. EBITDA fell 15.2% to Rs 3,707 crore and margin dropped 760 bps to 47.1% compared to year-ago period. The company will pay an interim dividend of Rs 13 per share for FY23 and will buy international zinc assets from Vedanta by subscribing to the shares of THL Zinc for $2,981 million.

L&T Technology Services: The engineering services company has reported a 7.5% sequential growth in profit at Rs 303.6 crore for December FY23 quarter, with revenue rising 2.7% to Rs 2,048.6 crore and revenue in dollar terms increasing 0.4% to $248 million for the quarter. At the operating level, EBIT climbed 6.3% sequentially to Rs 382.9 crore and margin expanded 60 bps to 18.7% for the quarter. Also the company received a multi-year contract from Airbus for providing advanced engineering capabilities and digital manufacturing services.

Tata Consultancy Services: Canadian business jet manufacturer, Bombardier selected TCS as its strategic IT partner, to accelerate its digital transformation & drive innovation.

Bharat Heavy Electricals: BHEL has bagged Rs 300 crore worth order for renovation & modernisation (R&M) of steam turbines at Ukai thermal power station in Gujarat.

Bata India: Anil Somani has been appointed as the new Chief Financial Officer of the company. He has over 25 years of experience in finance, strategy, compliance, information management and business development functions.