Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.22% higher at 20,073.50, indicating that Dalal Street was headed for positive start on Wednesday.

Asian shares were trading lower as investors were on the sidelines and awaited for the US inflation data on Wednesday amid rising oil prices. The Nikkei 225 index fell 0.31% and the Topix 0.2%. In China, the Hang Seng dropped 0.20% and the CSI 300 index lost 0.67%.

The Indian rupee closed 11 paise higher at 82.92 against the US dollar on Tuesday.

The Consumer Price Index-based inflation in India stood at 6.83% in August, as compared with 7.44% in July, according to government data. Further, India’s industrial output surged 5.7% in July, compared with 2.2% rise in July 2022 and 3.7% growth in June 2023.

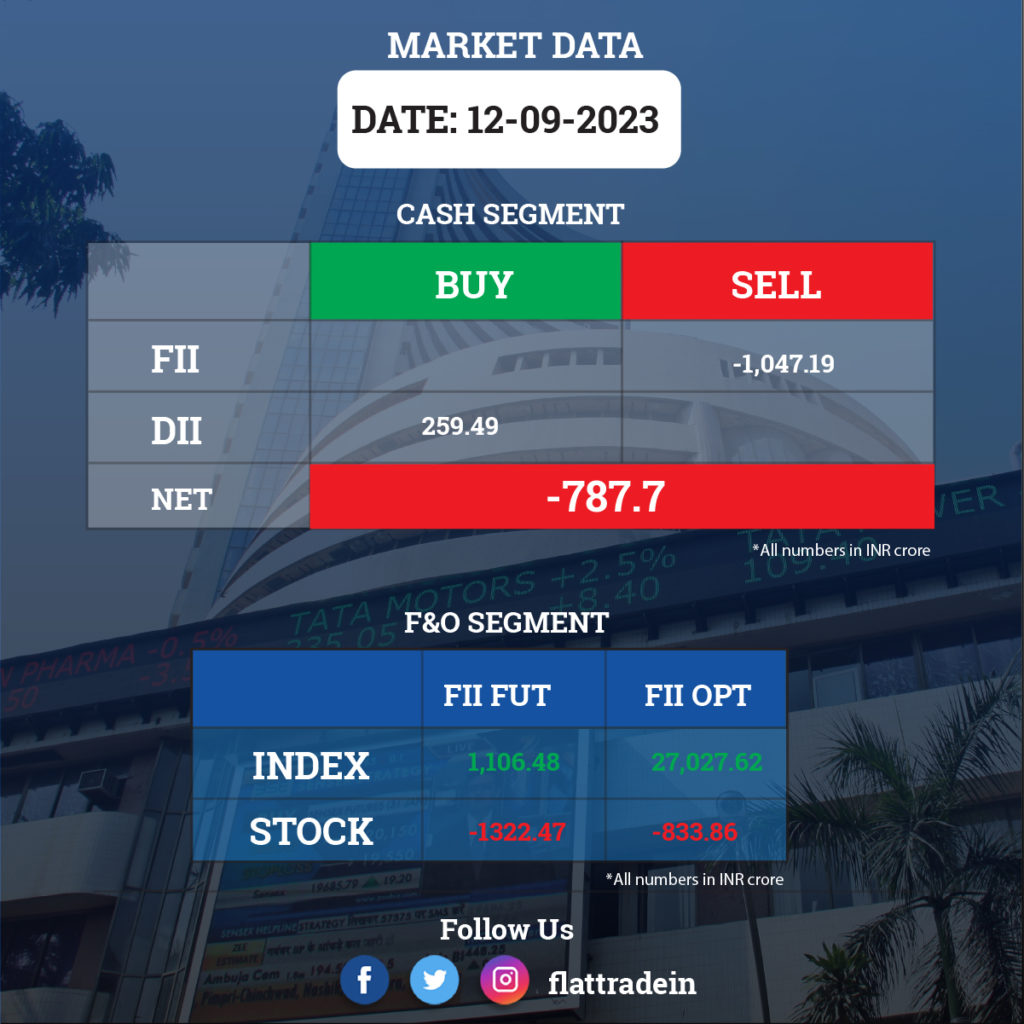

FII/DII Trading Data

Stocks in News Today

Infosys: The IT major has tied up with Europe-based STARK Group, to establish a state-of-the-art data centre in Denmark, which will serve as the foundation to drive technological advancements with an ‘AI first’ approach powered by Infosys Topaz.

Tata Power: The company said its subsidiary Tata Power Solar Systems (TPSS) has signed an MoU with the Small Industries Development Bank of India to finance MSMEs which are willing to opt for Rooftop Solar PV Plant. Under this partnership, TPSS and SIDBI will encourage solar energy adoption among Micro, Small & Medium Enterprises by offering customised & innovative financing solutions through SIDBI’s 4E (End to End Energy Efficiency) Scheme.

NTPC: The state-owned company has completed the trail operation of Unit 1 of the 800 MW capacity of Stage I of the Telangana Super Thermal Power Project. With this development, the installed capacity of NTPC and the NTPC Group has become 57,838 MW and 73,824 MW, respectively.

Wipro: The company said Wipro Holdings (UK) has transferred 100% of its shareholding in Wipro 4C NV to Wipro IT Services UK Societas, effective September 12. Wipro Holdings (UK) and Wipro IT Services UK Societas are wholly-owned subsidiaries of the company, while Wipro 4C NV is the step-down subsidiary. The purpose behind this transaction is the rationalisation and simplification of the overall group structure.

IRCTC: The company has signed an MoU with NBCC Services for the planning, designing, and execution of interior works for its upcoming office space in Delhi. The cost of the project is Rs 31.4 crore.

Mahindra and Mahindra: The company in an exchange filing said that it has received an order from the Assistant Commissioner, Commercial Taxes Department, Begumpet Division, Hyderabad imposing a penalty of Rs. 1,69,949 for not reversing VAT Input Tax Credit related to certain exempt transaction. It also said that it is hopeful for a favourable outcome at the appellate level and does not expect the said order to have any material financial

impact on the Company

Avenue Supermarts: The retailer which operates D-Mart stores across India has opened a new store in Perungudi, Chennai, Tamil Nadu, taking the total number of stores to 334.

Trent: The company said its subsidiary, Booker India, has acquired approximately 4.95% of the equity share capital of its subsidiary, Fiora Online, from a shareholder. The cost of acquisition is Rs 4.1 crore.

KEC International: The RPG Group company has secured new orders worth Rs 1,012 crore across its various businesses including orders for transmission & distribution projects in India and Americas, and orders from new clients in the data centre & FMCG segments in India

The Phoenix Mills: The company has incorporated a wholly owned subsidiary, Orcus Logistics and Industrial Parks.

RITES: The state-run transport infrastructure consultancy and engineering firm signed a Memorandum of Understanding (MoU) with Caminho De Ferro De Moçâmedes (CFM) Angola for cooperation in the development of railways and related infrastructure including the supply of rolling stock.

CRISIL: The company has entered into a definitive agreement to acquire renewable energy consulting and knowledge services provider Bridge To India Energy for a consideration of Rs 6 crore. The acquisition is expected to close within three months. Further, the company’s board of directors has given the green signal for incorporation of a step down subsidiary, CRISIL ESG Ratings & Analytics Ltd, which will primarily focus on the business of Environmental, Social, and Governance (ESG) ratings.

GMR Power and Urban Infra: The company increased its stake from 82% to 100% in GMR Smart Electricity Distribution from its subsidiary, GMR Generation Asset, for Rs 5 lakh.

GE Power: The company received a purchase order from Vedanta for the combustion modification of a boiler. The base value of the order is Rs 25 crore, and the time period for execution is 14 months.

Waaree Renewable Technologies: The company received a letter of intent for engineering, procurement, and construction services for setting up a solar power project of 52.6 MWp capacity. The project is expected to be completed in FY24.

Vakrangee: The technology company has entered into an agreement with private equity investor International Finance Corporation to acquire an 8.8% equity stake in Vortex Engineering. With this acquisition, Vakrangee will have a cumulative shareholding of 57.3% in Vortex, one of the leading suppliers of automated teller machines (ATMs).

Container Corporation of India: The Indian Government has extended the tenure of Manoj Kumar Dubey, Director (Finance) of the company, for five years with effect from November 1, 2023 till October 31, 2028.