Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.18% per cent higher at 17,262.50, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares were mixed as investors were cautiously optimistic and keenly eyed the upcoming corporate earnings. Japan’s Nikkei 225 index rose 0.47% and the Topix gained 0.59%. China’s Hang Seng fell 0.99% and the CSI 300 index slipped 0.06%

The Indian rupee rose by 50 paise to 79.25 against the US dollar on Friday.

Foreign investors have turned net buyers and invested nearly Rs 5,000 crore in Indian equities in July after nine straight months of massive net outflows, which started in October 2021. Between October 2021 and June 2022, they sold for Rs 2.46 lakh crore in the Indian equity markets.

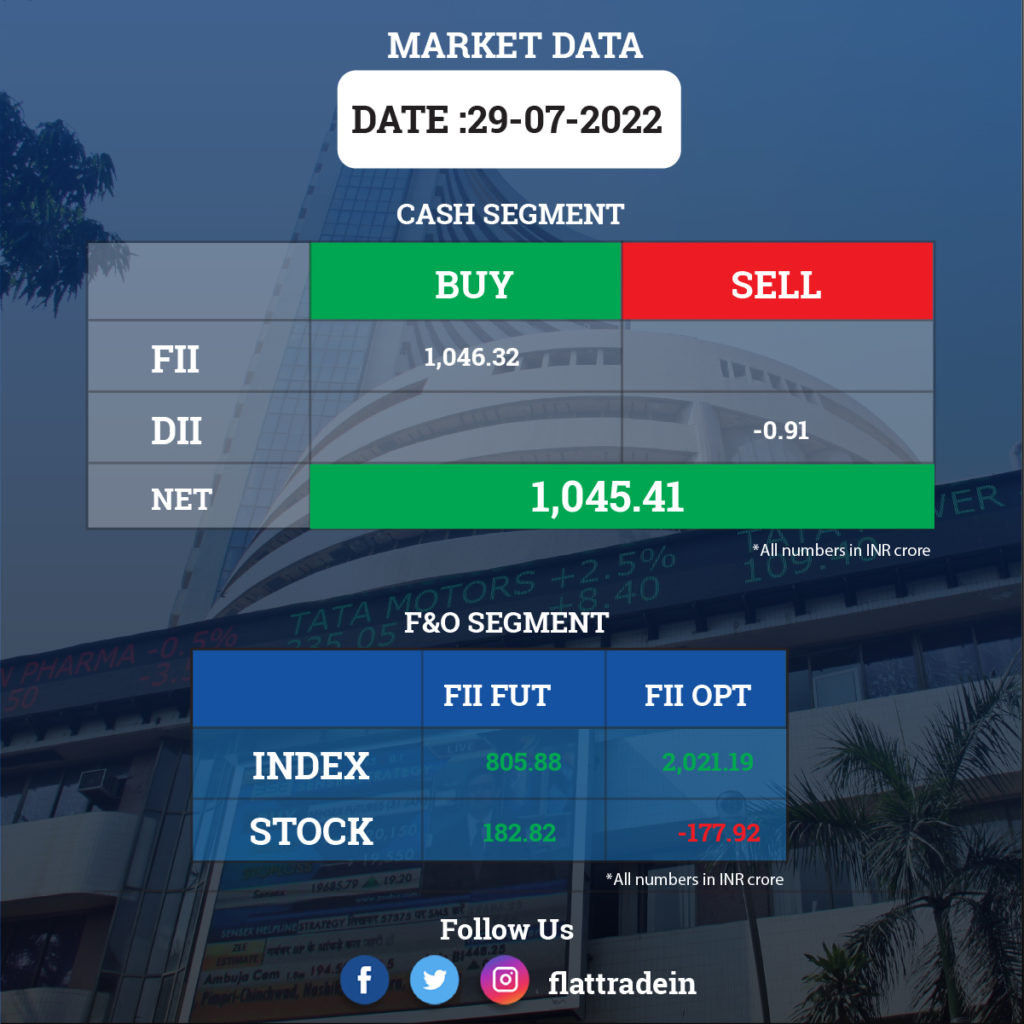

FII/DII Trading Data

Upcoming Results

ITC, Zomato, Arvind, UPL, Bajaj Consumer Care, Barbeque-Nation Hospitality, Carborundum Universal, Castrol India, Escorts Kubota, Eveready Industries India, Indo Count Industries, Kansai Nerolac Paints, Max Financial Services, Prudent Corporate Advisory Services, Punjab & Sind Bank, The Ramco Cements, RateGain Travel Technologies, Thyrocare Technologies, Triveni Turbine, and Varun Beverages will report their quarterly earnings on August 1.

Stocks in News Today

Indian Oil Corporation (IOC): The state-owned oil refiner reported a consolidated net profit of Rs 882.96 crore for the quarter ended June 2022, a 85.62 per cent lower than Rs 6,140.63 crore profit reported in the same quarter last year. Consolidated Revenue from operations stood at Rs 2,55,381.62 crore, up 63.16 percent from Rs 1,56,519.19 crore in the year-ago quarter.

Housing Development Finance Corporation (HDFC): The NBFC said it will acquire its venture capital subsidiary HVCL by buying State Bank of India’s 19.5 per cent stake in the company. HDFC holds 80.50 per cent equity share capital of HVCL. The acquisition is expected to be completed within 14 days from the date of execution of the share purchase agreement or by August 12.

The lender has hiked its benchmark lending rate by 25 basis points, with effect from August 1, the company said in an exchange filing.

HDFC Life Insurance: The company said its board has approved the issuance of over 3.5 crore equity shares to promoter company HDFC for Rs 2,000 crore on a preferential basis. The company’s board approved the issuance of 3,57,94,824 equity shares of the company at Rs 558.74 per equity share, not exceeding Rs 2,000 crore in aggregate on a preferential basis.

Yes Bank: The private lender said it will sell up to 10% stake to U.S. private equity firms Carlyle Group Inc and Advent International for $1.1 billion, Reuters reported. It will raise the funds through a combination of about $640 million in shares and about $475 million in share warrants. Yes Bank will offer 3.69 billion shares to affiliates of Carlyle Group and Advent for 13.78 Indian rupees ($0.1737) apiece. The company will also issue 2.56 billion share warrants at a price of 14.82 Indian rupees ($0.1868) per warrant to both the investors.

Dr Reddy’s Laboratories: The company said that it has entered into a pact with US-based Slayback Pharma to acquire rights of a medication to relieve redness of the eyes. The company has inked a licensing pact with the NewJersey-based drug firm to acquire rights in Brimonidine Tartrate Ophthalmic Solution 0.025 per cent. The company’s product is equivalent to Lumify, an over-the-counter (OTC) eyedrop, that can be used to relieve redness of the eye due to minor eye irritations.

NTPC: The state-owned posted a more than 15 per cent increase in consolidated net profit to Rs 3,977.77 crore in the Q1FY23 on the back of higher income. It had posted a consolidated net profit of at Rs 3,443.72 crore in Q1FY22. Its total income rose to Rs 43,560.72 crore in the first quarter of the current fiscal from Rs 30,390.60 crore in the same period of the last year.

Bank of Baroda: The public sector lender reported a 79.3 per cent YoY growth in its net profit at Rs 2,168 crore in Q1FY23 on the back of dip in provisions for bad loans. It had posted a net profit of Rs 1,209 crore during in Q1FY22. Its net interest income (NII) was up 12 per cent in Q1FY23 to Rs 8,838 crore from Rs 7,982 crore in Q1FY22. Its net interest margin (NIM) moderated to 3.02 per cent in Q1FY23 from 3.04 per cent a year ago.

Mangalore Refinery and Petrochemicals Ltd (MRPL): The company’s net profit zoomed to Rs 2,707 crore in the first quarter of the current fiscal on the back of record refining margins. It has posted a loss of Rs 230 crore in the same period a year back. The company earned $24.45 on turning every barrel of crude oil into fuel in the quarter compared to a gross refining margin of $4.94 per barrel in the year-ago period.

Cipla: The pharma company posted a marginal decline in consolidated net profit to Rs 706 crore in Q1FY23 as against a net profit of Rs 710 crore in the year-ago period. The company’s consolidated revenue shrunk 2 per cent YoY to Rs 5,375 crore. Domestic revenue dipped 8.4 per cent YoY to Rs 2,483 crore during the quarter under review and revenues from its North American business rose 10 per cent YoY to $155 million.

Emami Ltd: The FMCG firm reported 6.55 per cent decline in profit after tax (PAT) at Rs 72.69 crore during Q1FY23. It had posted a PAT of Rs 77.79 crore in the same period last year. Its revenue from operations was up 17.75 per cent to Rs 778.29 crore during the quarter under review as against Rs 660.95 crore in the year-ago period.

Zee Entertainment Enterprises (ZEEL): The proposed merger of ZEEL and Culver Max Entertainment (formerly Sony Pictures Networks India) has been approved by the Bombay Stock Exchange and National Stock Exchange. The development hints at a positive step in the overall merger process and it would allow both the companies to complete the merger transaction.

Future Group: The US-based e-commerce giant Amazon has moved Supreme Court against an order of the NCLAT, which upheld fair trade regulator CCI’s decision to suspend its approval for investment in a Future Group company, reported PTI news agency. It has said the NCLAT order has several glaring defects and suffers from a total non-application of mind by the appellate tribunal.

Piramal Enterprises: The company reported an 8.95 per cent decline in consolidated net profit to Rs 485.98 crore in Q1FY23. It had posted a consolidated net profit of Rs 533.79 crore in the same period last fiscal. Its revenue from operations in the first quarter stood at Rs 3,548.37 crore compared to Rs 2,908.68 crore in the year-ago period, it added.

DLF Ltd: The real estate company reported a 39 per cent increase in consolidated net profit to Rs 469.56 crore in the quarter ended in June on higher topline growth. Its net profit stood at Rs 337.16 crore in the year-ago period. Total income rose to Rs 1,516.28 crore in the first quarter of this fiscal from Rs 1,242.27 crore in the corresponding period of the previous year.

The realty major is targeting a 10 per cent growth in its sales bookings to about Rs 8,000 crore this fiscal on higher demand for its housing properties. Its sales bookings rose to Rs 7,273 crore in FY22 from Rs 3,084 crore in the previous year. In the first quarter of this fiscal, DLF’s sales bookings doubled to Rs 2,040 crore from Rs 1,014 crore in the year-ago period.

Exide Industries: The battery manufacturer reported an over five-fold rise in consolidated net profit after tax to Rs 202.44 crore in Q1FY23, driven by higher revenue. It had posted a consolidated net profit after tax of Rs 31.81 crore in the same quarter last fiscal. Its consolidated revenue from operations during the first quarter jumped to Rs 4,021.77 crore, from Rs 2,565.54 crore in the year-ago period.

Metro Brands: The multi-brand footwear retailer reported a consolidated net profit after tax of Rs 105.78 crore for the quarter ended June 2022. It had posted a net loss after tax of Rs 12.13 crore in the year-ago period. Its total revenue from operations was up over two-fold to Rs 507.95 crore during the quarter under review as against Rs 131.39 crore in the year-ago period.

Godfrey Phillips India: The cigarette maker reported a 16.6 per cent rise in its consolidated net profit to Rs 131.05 crore in Q1FY23 as against a net profit of Rs 112.40 crore in the year-ago period. Revenue from operations was up 33.49 per cent to Rs 981.83 crore during the quarter under review as against Rs 735.49 crore in the corresponding period of the previous fiscal.

Indian Bank: The public sector lender posted a net profit of Rs 1,213.44 crore in Q1FY23, as against a net profit of Rs 1,213.44 crore for the period ended June 2022, up from Rs 1,181.66 crore earned during the corresponding period of the previous year. The lender’s advances grew by nine per cent to Rs 425,203 crore over Rs 389,626 crore a year ago. Its total deposits grew by eight per cent to Rs 584,251 crore as compared to Rs 540,082 crore during the corresponding period a year ago.

IDFC First Bank: The private sector lender has recorded highest-ever standalone profit of Rs 474.33 crore in Q1FY23, against a loss of Rs 630 crore in corresponding period of the previous fiscal. The rise was attributed to higher income and fall in provisions for bad loans. Net interest income grew by 26 per cent YoY to Rs 2,751.1 crore during the reported quarter and net interest margin stood at 5.89 per cent for the quarter ended June 2022.

Rain Industries: The company recorded a 184 per cent YoY increase in consolidated profit at Rs 668.50 crore for the quarter ended June 2022, driven by healthy top line and operating performance. Revenue grew by 52 per cent to Rs 5,540.6 crore helped by strong growth in average blended realisation for carbon and advanced material sales.

Sundram Fasteners (SFL): The auto component major posted a consolidated net profit of Rs 138.03 crore in Q1FY23, up 14.5 per cent from Rs 120.51 crore in the same period last year. The company’s revenue from operations for the quarter ended June 2022 stood at Rs 1,410.12 crore as against Rs 1,129.56 crore during the during the corresponding period of FY22, an increase of 24.8 per cent.

Mahindra Holidays & Resorts: The leisure company reported a consolidated profit after tax of Rs 29.8 crore for the first quarter ended June 30, boosted by higher revenue. The company had posted a consolidated loss after tax of Rs 21.4 crore in the same quarter last fiscal. The consolidated revenue from operations during the quarter under review stood at Rs 604. 85 crore as against Rs 370.87 crore in the year-ago period.

Strides Pharma Science: The company posted a consolidated net loss of Rs 163.4 crore in Q1FY23, compared with a consolidated net loss at Rs 244.1 crore in the same quarter previous fiscal. Revenue from operations during the quarter under review grew 36.6 per cent to Rs 940.07 crore compared with Rs 688.37 crore in the year-ago period.