Market Opening - An Overview

GIFT Nifty on the NSE IX was trading 0.13% higher at 19,783.5, indicating that Dalal Street was headed for positive start on Friday.

Asian shares were trading lower as investors’ optimism was dented by Sino-US tensions and interest rates continuing to be higher for a longer period. The Nikkei 225 index slumped 0.94% and the Topix dropped by 0.61%. The CSI 300 index fell by 0.62% and the Hang Seng tanked by 1.34%.

The Indian rupee fell 6 paise to 83.21 against the US dollar on Thursday.

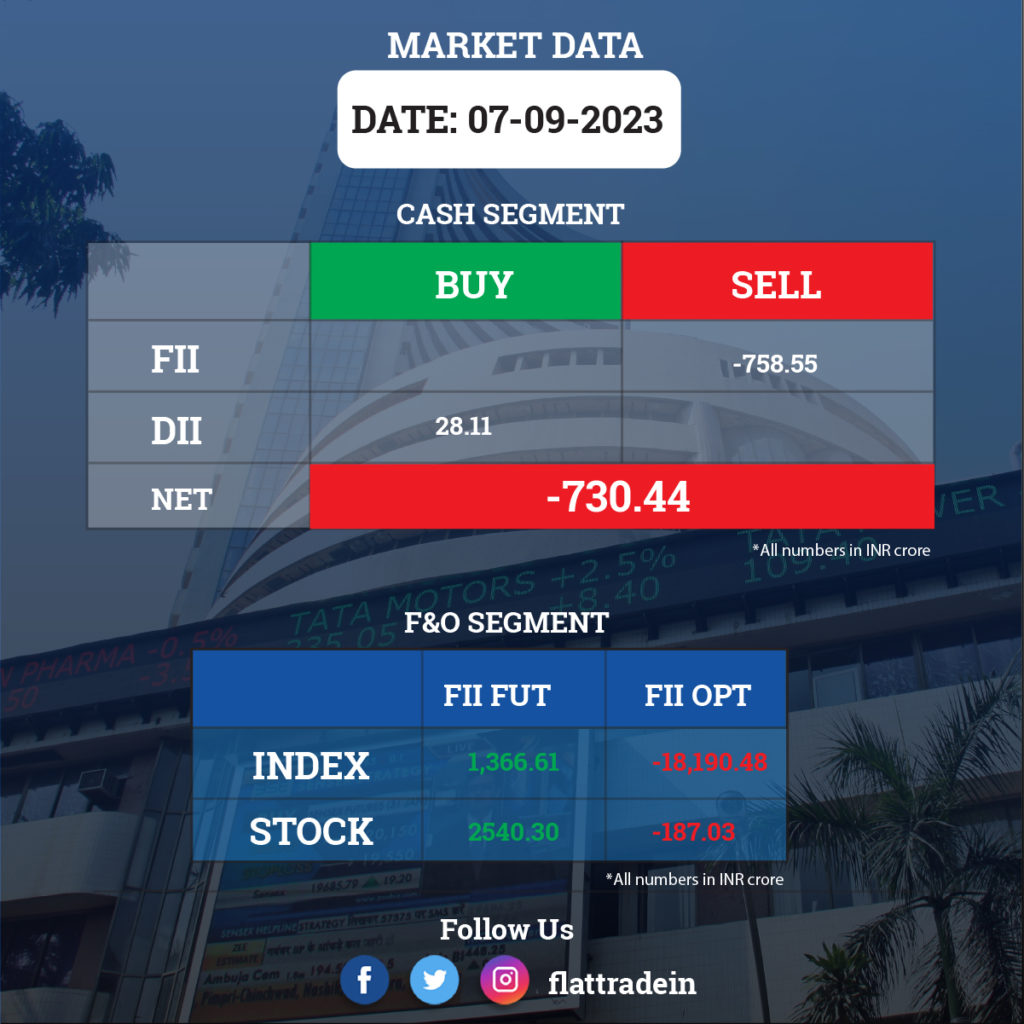

FII/DII Trading Data

Stocks in News Today

Larsen & Toubro (L&T): The infrastructure conglomerate has bagged an order from Saudi Aramco’s Jafurah unconventional gas development project worth $2.9 billion, according to a Business Standard report.

Bajaj Finserv: The company said its subsidiary Bajaj Allianz General Insurance Company’s gross direct premium underwritten for August stood at Rs 1,677.87 crore, and the premium in the current financial year up to August was at Rs 9,228.81 crore. Further, its subsidiary Bajaj Allianz Life Insurance Company’s total premium for August stood at Rs 926.41 crore and premium in the current financial year (FY24) till end of August 2023 stood at Rs 3,828.06 crore.

Tata Steel: The steelmaker’s unit Tata Steel Special Economic Zone has tied up with AVAADA Group to set up a green hydrogen and ammonia manufacturing unit in Odisha.

Exide Industries: The company plans to invest Rs 100 crore in subsidiary Exide Energy Solutions via rights issue. The unit is involved in manufacturing of advanced chemistry battery cells.

LTIMindtree: The IT company has launched two industry solutions — AdSpark and Smart Service Operations — to accelerate the time-to-market for businesses on the Salesforce platform.

Mazagon Dock Shipbuilders: The state-owned shipbuilding company has signed Master Ship Repair Agreement (MSRA) with the US Government represented by NAVSUP Fleet Logistics Center (FLC) Yokosuka. The agreement is expected to open-up voyage repairs of US Navy Ships at Mazagon Dock.

Tejas Networks: The company said it has received the mobilization advance of Rs 750 crore from Tata Consultancy Services, towards the supply of Radio Access Network equipment for BSNL’s Pan-India 4G and 5G network.

Sterlite Technologies: The company has partnered with TruVista, a broadband services and applications provider, to drive the growth and enhancement of South Carolina’s rural connectivity infrastructure. TruVista, which is headquartered in South Carolina, plans to expand fiber optic connectivity across rural South Carolina.

Landmark Cars: The premium automotive retailer has signed letter of intent (LoI) with Mahindra & Mahindra for opening dealership in Howrah, West Bengal. This dealership will be established in one of the wholly-owned subsidiary of Landmark Cars, namely Landmark Mobility. This business will include sales and after sales of Mahindra’s Personal, Pickup and Supro range of vehicles.

JB Chemicals & Pharmaceuticals: The company said its chief financial officer Lakshay Kataria will resign from the post with effect from November 30.

Shemaroo Entertainment: The company’s MD, CEO and CFO have been granted bail on Thursday after tax authorities detaining them earlier this week and carried out search operation. The company said it is contesting allegations in accordance with law. The company further said that the estimated impact on the company and the amount involved is not identifiable currently.

Samvardhana Motherson International: The company has inaugurated its new wiring harness facility located in Ras Al Khaimah Economic Zone (RAKEZ).

Oricon Enterprises: The company has signed an agreement for sale of assets of its Petrochemical unit situated at village Niphan and Anandwadi, Raigarh, Maharashtra with Narendra Plastochem for a consideration of Rs 19 crore

Campus Activewear: The company said Piyush Singh will resign as Chief Operating Officer of the footwear company with effect from December 2, 2023, due to personal reasons.