Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.19% higher at 18,393, signalling that Dalal Street was headed for positive start on Thursday.

Most Asian shares were trading lower. The benchmark Nikkei 225 index opened higher but dropped 0.21%, and the broader Topix index was down 0.30%. The Hang Seng fell 0.11%, while the CSI 300 index rose 0.27%.

Indian rupee appreciated by 5 paise to 81.99 against the US dollar on Wednesday.

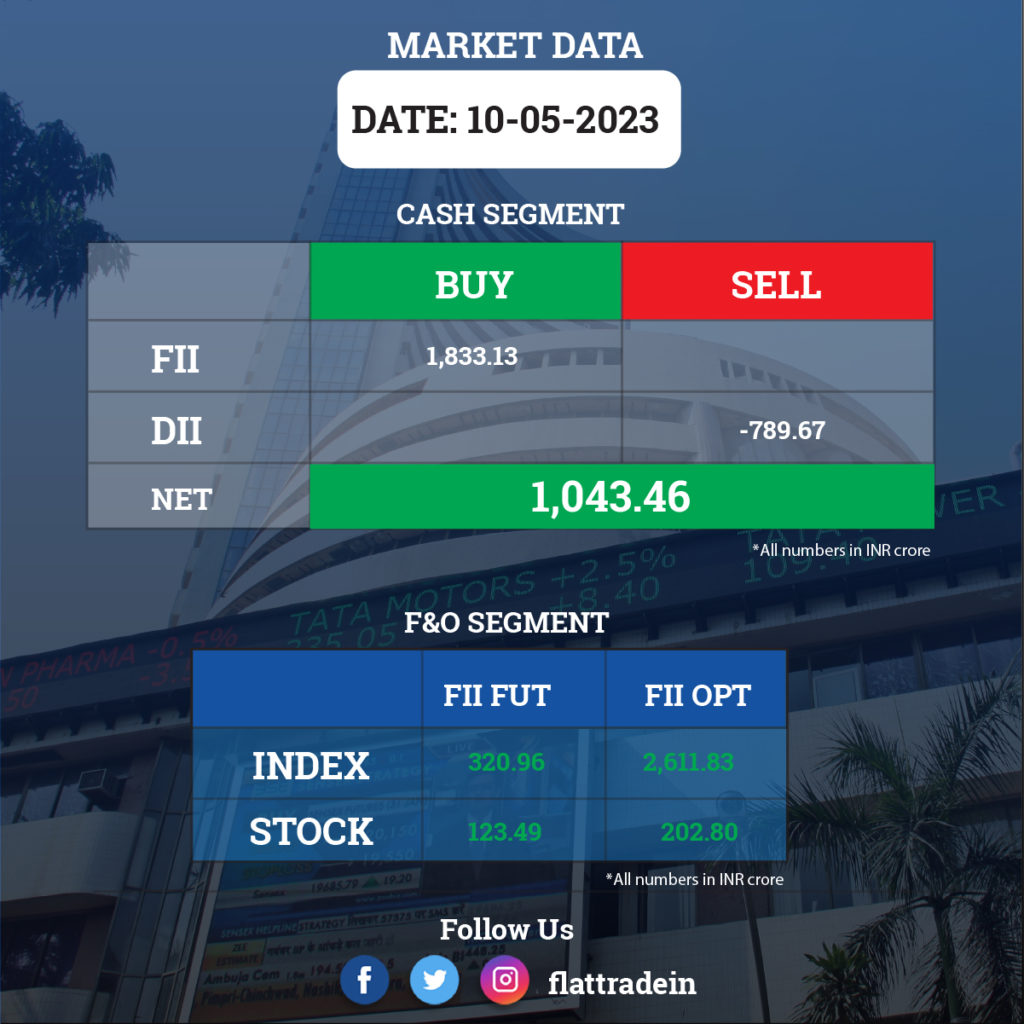

FII/DII Trading Data

Upcoming Results

Asian Paints, Eicher Motors, Aditya Birla Capital, PDS, Deepak Nitrite, Balrampur Chini Mills, Intellect Design Arena, Dr Lal Pathlabs, Care Ratings, Siemens, Zensar Technologies, Ujjivan Small Finance Bank, Ajmera Realty & Infra India, Alkyl Amines Chemicals, BLS International Services, DCW, Everest Industries, Gillette India, Gujarat State Petronet, GTL Infrastructure, Kirloskar Brothers, Mangalore Chemicals & Fertilizers, Neuland Laboratories, Paisalo Digital, PTC India Financial Services, Religare Enterprises, SG Finserve, Shankara Building Products, South Indian Bank will report their quarterly earnings.

Stocks in News Today

Larsen & Toubro (L&T): The engineering and infrastructure major has recorded a 10% year-on-year growth in consolidated profit at Rs 3,987 crore in the quarter ended March FY23 despite a drop in operating margin. Revenue from operations grew by 10% to Rs 58,335 crore compared to the year-ago period. The board approved a final dividend of Rs 24 per share for FY23. Meanwhile, AM Naik will step down as non-executive chairman of the company from Sept. 30, and will be conferred the status of chairman emeritus. SN Subrahmanyan, the chief executive officer & managing director, has been re-designated as the chairman and managing director of the company, with effect from Oct. 1, 2023.

Dr Reddy’s Laboratories: The pharma major has registered an 11-fold year-on-year increase in profit at Rs 959 crore for the March FY23 quarter. Revenue for the quarter increased by 16% to Rs 6,297 crore compared to the year-ago period, with North America business growing 27 percent, Europe 12 percent, and India business showing a 32 percent growth YoY. The company approved a final dividend of Rs 40 per share for the fiscal 2023.

HDFC: The company has received final approval from the Securities and Exchange Board of India (SEBI) for a change in control of HDFC Asset Management Company, investment manager of HDFC AMC AIF II on account of the proposed composite scheme of amalgamation for the amalgamation of HDFC Investments and HDFC Holdings with HDFC, and HDFC with HDFC Bank.

Godrej Consumer Products: The FMCG company has reported a 24.5% year-on-year growth in consolidated profit at Rs 452.1 crore for quarter ended March FY23, backed by better-than-expected operating numbers. Consolidated revenue grew by 10% YoY to Rs 3,200.2 crore in Q4FY23 with volume growth of 6%.

Gujarat Gas: The company said its consolidated revenue was down 15.87% YoY at Rs 3928.57 crore in Q4FY23. Ebitda fell 19.66% YoY at Rs 560.32 crore in Q4FY23. Consolidated net profit was down 16.63% YoY at Rs 370.5 crore. The board recommended a dividend of Rs 6.65 per share for the fiscal ended March 2023.

Procter & Gamble Hygiene & Health Care: The company’s consolidated revenue fell 9.26% YoY to Rs 883.09 crore in Q4FY23. Ebitda was down 9.54% YoY at Rs 149.27 crore in Q4FY23. Consolidated net profit was up 60.45% YoY at Rs 165.02 crore in Q4FY23.

Rail Vikas Nigam, Siemens: The consortium of the two companies received an order worth Rs 300.11 crore from Mumbai Metropolitan Region Development Authority for design, manufacture, supply, installation, testing and commissioning of two 110KV receiving substations for main line and depot of Mumbai Metro line 2B. Siemens is the lead consortium partner with 60% share, and RVNL holds 40% share.

Oil India: Stimul-T, the owner of Project License-61 oil block in Tomsk, Russia, has filed for bankruptcy. Oil India owns 50% stake in WorldAce tnvestment, the parent company of Stimul-T, through its subsidiary Oil India International BV. Meanwhile, the Numaligarh refinery allotted 20.03 crore partly paid-up shares to the company on May 10 at Rs 110 per share, taking its stake in the refinery to 73.27%.

Zydus Lifesciences: The pharma company received establishment inspection report from the U.S. FDA for the inspection conducted at its facility in Moraiya, Ahmedabad without any observations. The pre-approval inspection, conducted from Jan. 23 to 27, covered transdermal patch products.

CSB Bank: The private sector lender has appointed Satish Gundewar as Chief Financial Officer with effect from June 5, 2023. BK Divakara will step down as CFO on June 4.

KPI Green Energy: The Gujarat-based renewable energy company has received a new order for a 35 MW capacity solar power plant under the captive power producer (CPP) segment. The project is scheduled to be completed in FY24 and the said order is in lieu of the previous order of a 33 MW capacity solar power plant under the CPP segment received in December 2022.

HG Infra Engineering: The company has recorded a 64.4% year-on-year growth in profit at Rs 170.9 crore for the March FY23 quarter. Revenue from operations in jumped by 44.2% YoY to Rs 1,535.4 crore in Q4FY23.

Novartis India: The healthcare company has registered a profit of Rs 25 crore for the quarter ended March 2023, against a loss of Rs 23.4 crore in the same period last year. Revenue from operations fell 22.6% YoY to Rs 76.1 crore during the quarter. The company has announced a final dividend of Rs 10 per share and a one-time special dividend of Rs 37.50 per share.

Pricol: The automotive components and precision engineered products manufacturer has reported a 127% year-on-year increase in profit at Rs 29.8 crore for March FY23 quarter. Revenue from operations for the quarter stood at Rs 523.5 crore, up by 26.4% over a year-ago period.

Ratnamani Metals and Tubes: The company has recorded a massive 71.6% year-on-year growth in profit at Rs 191.5 crore, while revenue from operations grew by 54% to Rs 1,449 crore compared to year-ago period. The company also announced a dividend of Rs 12.00 per share for FY23 and also approved the re-appointment of Prakash M Sanghvi as the Managing Director and Jayanti M Sanghvi as the Joint Managing Director for a period of 5 years with effect from November 1, 2023.

Sagar Cements: The company has posted a consolidated profit of Rs 100.5 crore for the quarter ended March FY23, against a loss of Rs 115.1 crore in the same period last year, supported by higher other income. Revenue grew by 24% to Rs 621.5 crore compared to the year-ago.