Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.12% higher at 19,532, signalling that Dalal Street was headed for positive start on Wednesday.

Asian shares were trading higher as investors’ optimism was boosted by lower chances of more rate hikes by the Fed and interest rate cuts by China’s big banks. The Nikkei 225 index rose 0.94% and the Topix gained 0.77%. The Hang Seng jumped 0.91% and the CSI 300 index rose 0.32%.

The Indian rupee weakened 8 paise to close at Rs 82.71 against the US dollar on Tuesday.

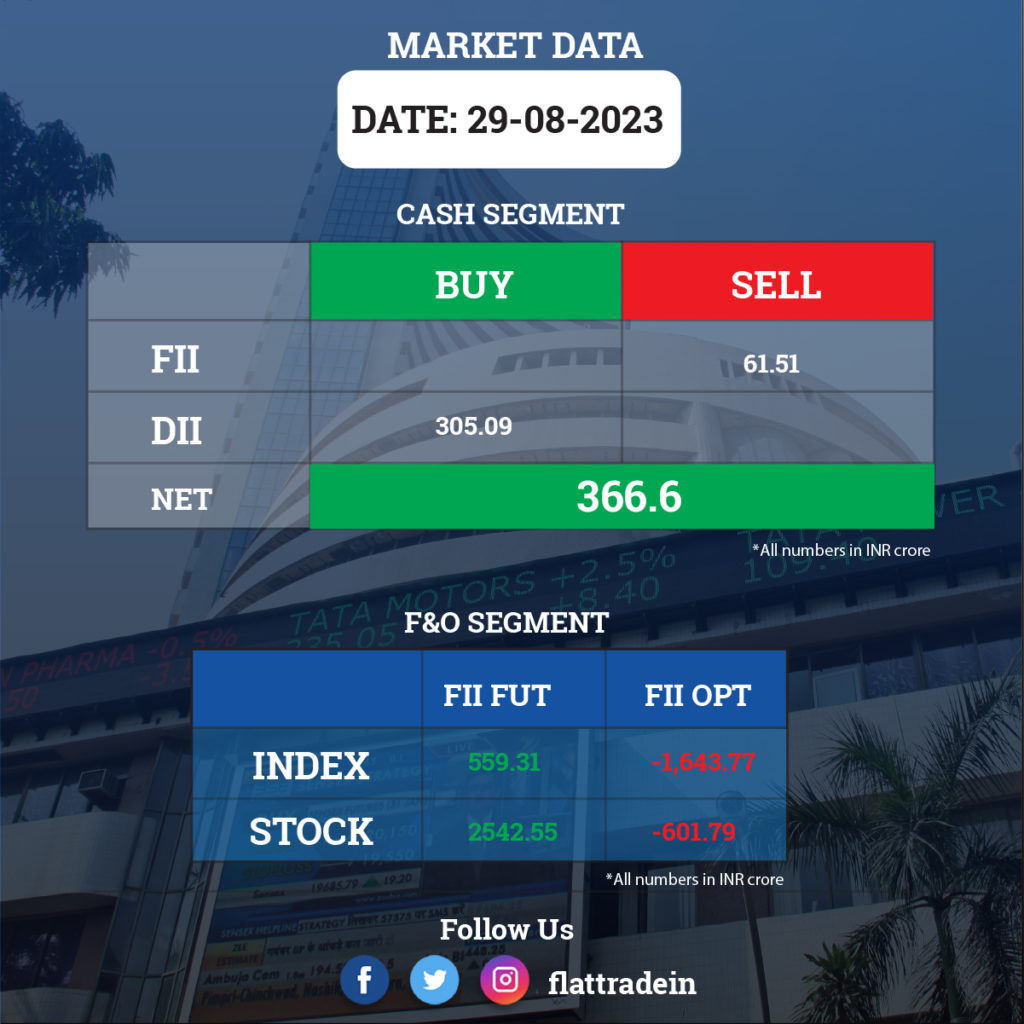

FII/DII Trading Data

Stocks in News Today

ONGC: The state-owned company will invest about Rs 2 lakh crore to achieve zero carbon emissions by 2038, its chairman Arun Kumar Singh said. It will invest Rs 1 lakh crore by 2030 in setting up 10 gigawatts of renewable energy capacity, offshore wind energy projects, and green ammonia plant, while the remaining funds would be used to achieve Scope-1 and Scope-2 net zero carbon emissions.

State Bank Of India (SBI): The country’s largest lender has received approval to set up a wholly-owned subsidiary, ‘SBI Funds Management,’ at IFSC Gift City, Gujarat.

HCLTech: The company announced an exclusive preferred professional services agreement with Cloud Software Group to help implement, upgrade, modernise, and provide services for all TIBCO products for enterprise customers across the globe.

Zomato: SoftBank Group’s affiliate SVF Growth Singapore is likely to sell a 1.17% stake in the company for at least Rs 940 crore. SVF Growth Singapore will sell 10 crore shares at a floor price of Rs 94 apiece, representing a 0.7% discount on Tuesday’s closing price.

Central Bank of India: The public sector lender has entered into a strategic co-lending partnership with IKF Home Finance to offer MSME and home loans. IKF Home Finance’s assets under management is Rs 696.10 crore through their operations across six states. Further, the bank has also entered into a strategic co-lending partnership with Samunnati Financial Intermediation & Services to offer agriculture and MSME loans. Samunnati is functioning across 22 states, with an AUM of Rs 1,150 crore.

MPS: The company’s subsidiary — MPS Interactive Systems — will acquire a 65% stake in Australia-based Liberate Group entities for AUD 9.32 million. The entities include Liberate Learning, Liberate eLearning, App-eLearn, and Liberate Learning (New Zealand). The remaining 35 percent shareholding of each of the entities of the Liberate Group will be acquired by MPSi in subsequent tranches.

Lupin: The pharma company’s subsidiary — Lupin Pharma Canada — has launched Propranolol LA (long-acting) capsules, with 60 mg, 80 mg, 120 mg and 160 mg strengths in Canada. Propranolol LA is a generic equivalent of Inderal LA, which is used to treat heart problems, anxiety, and migraines.

GR Infraprojects: The company’s two subsidiaries — GR Belgaum Raichur (Package-5) Highway Private Limited and GR Belgaum Raichur (package-6) Highway Private Limited — have executed an agreement for road projects worth Rs 1,457.24 crore with the National Highways Authority of India.

SBFC Finance: The non-banking finance company has recorded a standalone net profit of Rs 47 crore for the quarter ended June FY24, up 46.5% compared to Rs 32 crore profit in the year-ago period. Net interest income grew by 40.6% YoY to Rs 141 crore during the same quarter.

IndiaMART InteMESH : The company has submitted a Letter of Offer for the buyback of 12.5 lakh shares of face value Rs 10 each not exceeding Rs 500 crore by way of tender offer on a proportionate basis.

Unichem Laboratories: The company announced that it has received ANDA approval for its Prasugrel Tablets USP, 5 mg and 10 mg, from the USFDA to market a generic version of Effient (Prasugrel) Tablets, 5 mg and 10 mg, from Cosette Pharmaceuticals, Inc.

Jupiter Wagons: The company will consider fundraising through any means in a board meeting on September 5.

TVS Supply Chain Solutions: The company said that the present Executive Vice Chairman R Dinesh will take over as its Chairman with immediate effect after S Mahalingam steps down. Two additional independent directors, K. Ananth Krishnan and Narayan K. Seshadri, were inducted, taking the total strength of the independent directors on the board to five.

Dalmia Bharat: Puneet Dalmia will take over as its MD and CEO of Dalmia Cement (Bharat) after Mahendra Singhi’s decade-long tenure comes to an end on December 8.