Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.21% higher at 17,453.50, signalling that Dalal Street was headed for positive start on Monday.

Most Asian shares were trading higher following global market rallies after data showed inflation slowing down in the eurozone and the US. The Nikkei 225 index rose 0.45%, Topix gained 0.53%. The Hang Seng slipped 0.02% and the CSI 300 index advaned 0.41%.

Meanwhile, oil prices surged on Monday after Saudi Arabia and other OPEC+ oil producers announced a surprise round of output cuts. The OPEC+ group has decided to reduce output by more than 1 million barrels a day.

Indian rupee appreciated by 17 paise to 82.17 against the US dollar on Friday.

Udayshivakumar Infra, a road construction company, will make its debut on the bourses on April 3. The final issue price has been fixed at Rs 35 a share.

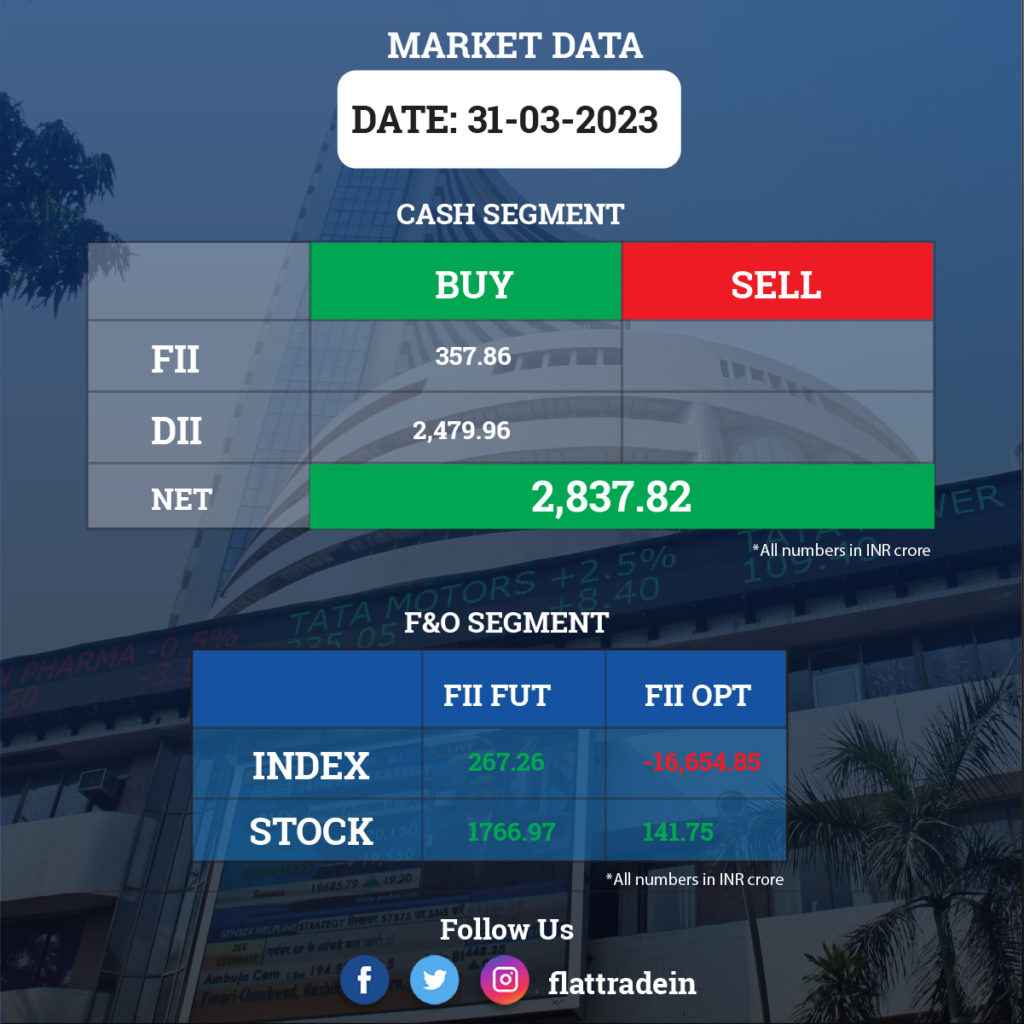

FII/DII Trading Data

Stocks in News Today

Hindustan Aeronautics (HAL): The state-owned company has registered its highest ever revenue from operations in a fiscal after a growth of 7.6% at Rs 26,500 crore during the year ended March 2023. The order book of the company stood at around Rs 82,000 crore at the end of March. The company’s cash flow improved substantially with payments of around Rs 25,000 crore from various defence customers during the period under review.

Maruti Suzuki: The country’s largest car maker sold 1.7 lakh units in March 2023, down 0.2% over the same month last year, with domestic sales contributing 82% to total sales and falling 2.7%, while exports rising 13.7% to 30,119 units.

ICICI Bank: The lender has acquired 9.5% stake in Propertypistol Realty through an investment of Rs 22.5 crore in the latter’s equity shares and compulsorily convertible preference shares.

Rail Vikas Nigam (RVNL): The consortium of Tracks & Towers Infratech and Rail Vikas Nigam has received the letter of award from NHAI for construction of six-lane greenfield Varanasi-Ranchi-Kolkata highway for Rs 1,272 crore. The company received letter of award from NHAI for construction of six lane elevated Kona Expressway for Rs 720.67 crore. The company has also received letter of award from Ministry of Railways for manufacturing and maintenance of 120 Vande Bharat trainsets at a cost of Rs 120 crore per trainset.

Life Insurance Corporation of India (LIC): BC Patnaik has ceased to be the managing director of the corporation after close of office hours March 31, 2023, upon his superannuation.

Ashoka Buildcon: The company has received letter of acceptance from Ministry of Railways for all civil engineering works and supply of machine crushed stone ballast in between block section from Birpur to Seroni Road in connection with Gwalior-Sheopurkalan GC project of North Central Railway. The project cost is Rs 284.65 crore.

HG Infra Engineering: The company has received letter of award from NHAI for construction of six-lane greenfield Varanasi-Ranchi-Kolkata highway from Deoria to Donoreshan villages in Jharkhand at a project cost of Rs 998.36 crore.

EIH Associated Hotels: The company has acquired 40 acres of land on lease from Andhra Pradesh government for construction, development and operation of a five-star luxury hotel or resort in Visakhapatnam. The lease period for the land will be for 94 years, including four years of construction.

Punjab National Bank (PNB): The lender has changed its base rate from 9% to 9.5% with effect from April 1, 2023.

Bank of India: The bank has revised its marginal cost of fund-based lending rate (MCLR) in the range of 10-40 basis points with effect from April 1, 2023. The lender has also revised repo-based lending rate. For Bank’s Repo Based Lending rate (RBLR), ALCO has decided to reduce mark-up by 10 bps to 2.75%.

Westlife Foodworld: The company’s subsidiary will pay royalty fee at 4.5% to fast food restaurant chain McDonald’s for the fiscal ending March 2024.

Dixon Technologies (India): The electronics manufacturing company has incorporated wholly-owned subsidiary Dixtel Communications to undertake wholesale/trading of electronic equipment and other related parts.

CreditAccess Grameen: The company completed three direct assignment transactions aggregating to Rs 936.63 crore and a PTC transaction of Rs 98.77 crore during March. During the quarter ended March 2023, the company raised total funds of Rs 5,840.09 crore through term loans, NCDs, MLD, ECBs, direct assignments and PTC.

Orient Electric: The company has appointed Rajan Gupta has managing director and chief executive officer for a period of five years, effective April 4, 2023, after the resignation of Rakesh Khanna from the position.

Greenpanel Industries: The company has suspended manufacturing operations at the MDF plant in Rudrapur, Uttarakhand, for 20 days, with effect from April 1, 2023, due to routine maintenance.

Barbeque-Nation Hospitality: The company said it has suffered an IT incident and subsequently isolated its impacted IT assets. The core operations are unaffected, and all the company’s restaurants are fully operational, serving both dine-in and delivery.

Karnataka Bank: The bank saw CASA rise around 9% year-on-year to Rs 28,807.04 crore as on March 31, 2023. Meanwhile, gross advances increased 6% on-year to Rs 61,326.42 crore.

CSB Bank: The bank recorded 16% YoY rise in CASA at Rs 7,886.26 crore as on March 31, 2023, while term deposits increased 24% YoY to Rs 16,619.55 crore. Total deposits of the bank increased 21% YoY to Rs 24,505.81 crore. It recorded 30% YoY rise in gross advances at Rs 20,841.66 crore.

Karur Vysya Bank: The Tamil Nadu-based lender said that its total deposits increased 12% YoY to Rs 76,637 crore, as on March 31, 2023. The bank’s CASA increased 6.5% on-year to Rs 25,449 crore.

Piramal Pharma: The USFDA has conducted a Good Manufacturing Practices (GMP) inspection of Piramal Pharma’s Digwal facility during March 27-31. The inspection was completed successfully with zero Form 483 observations.

GR Infraprojects: The company has been awarded a Rs 847.87 crore four-lane access-controlled greenfield highway project in the Mahabubabed district of Telangana. The company also bagged a project worth Rs 1,248.37 crore to build a six-lane greenfield Varanasi-Ranchi-Kolkata Highway stretch in Bihar on hybrid annuity mode.

Engineers India: The company has secured orders worth Rs 48.82 crore for five assignments related to the energy sector.

Campus Activewear: The company announced that Raman Chawla has resigned as the chief financial officer (CFO). He demits the office on June 10, 2023, and the company is in the process of appointing a new CFO.

Eicher Motors: The company’s commercial vehicle sales volume in March increased by 35.2% to 11,906 units from the year-ago month, driven by domestic business but exports dropped 36.5% YoY to 414 units. Royal Enfield announced its sales for March 2023 at 72,235 motorcycles, up 7% YoY.

PNC Infratech: The company has received letters of award for three projects worth Rs 3,264.43 crore from the National Highways Authority of India (NHAI). All these projects are parts of the six-lane greenfield Varanasi- Ranchi-Kolkata highway stretch to be built in Bihar in hybrid annuity mode.

Cigniti Technologies: The digital engineering services company has appointed Srinivas Kandula as the executive director on the board. Kandula is a former chairman and CEO of Capgemini India..