Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.09% higher at 19,873.5, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were trading lower as investors awaited for hints from global central banks with respect to their interest rate policies. The Nikkei 225 index fell 0.53% and the Topix was down 0.45%. The Hang Seng index fell 0.61% and the CSI 300 inched up 0.07%.

The Indian rupee stood at 83.37 against the US dollar.

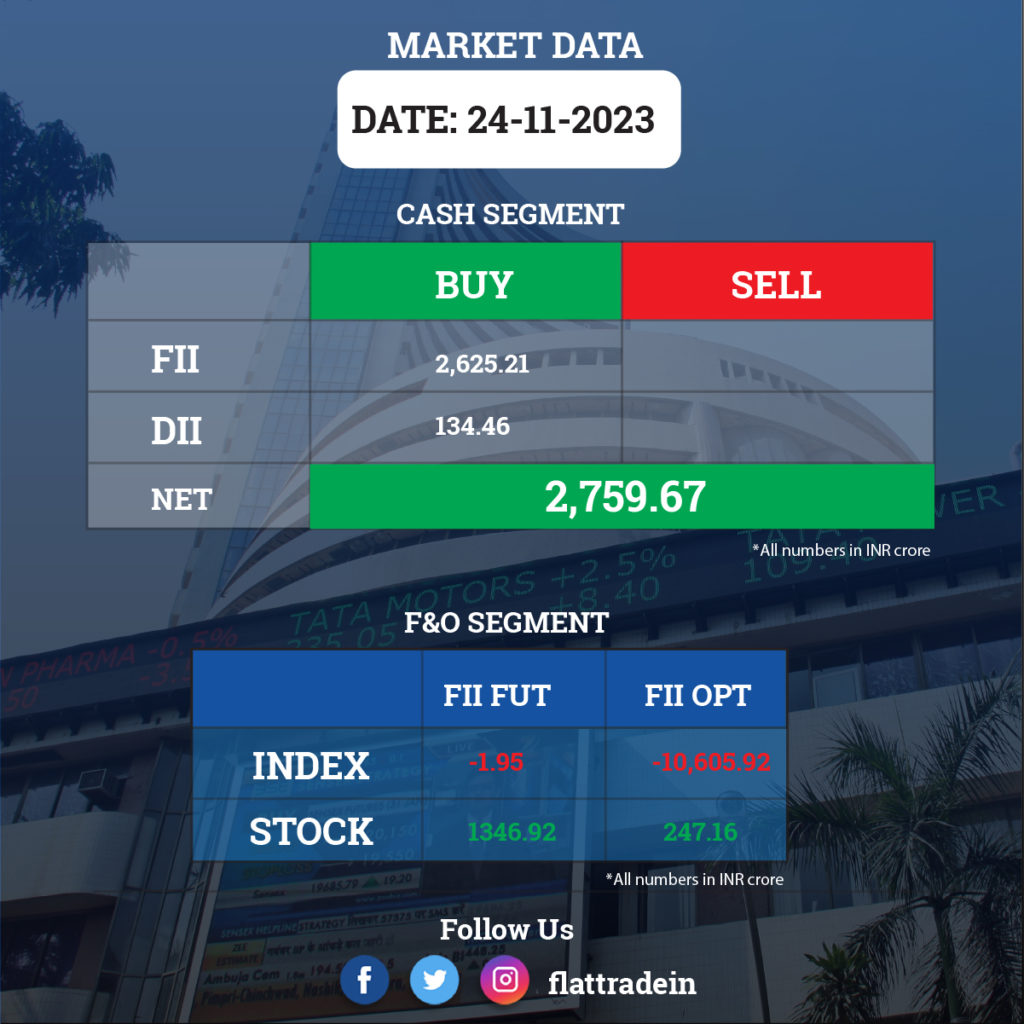

FII/DII Trading Data

Stocks in News Today

One 97 Communications (Paytm): BH International Holdings offloaded its stake in the company by selling its entire shareholding in the company through open market transactions. BH International Holdings sold 1.56 crore equity shares, which is equivalent to 2.46% of paid-up equity, at an average price of Rs 877.29 per share, amounting to Rs 1,370.6 crore. Meanwhile, foreign investors Copthall Mauritius Investment and Ghisallo Master Fund LP bought those shares sold by BH, buying 75.75 lakh shares and 42.75 lakh shares, respectively, at an average price of Rs 877.2 per share.

Maruti Suzuki India (MSI): The automaker has decided to increase the prices of its cars in January 2024 due to increased input costs driven by overall inflation and increased commodity prices. The company said it makes maximum efforts to reduce costs and offset the increase, but it may have to pass on some of the increase to the customers.

Tata Consultancy Services (TCS): The IT services company has launched its AWS generative AI practice to help customers harness the full potential of AI and AWS generative AI services to transform different parts of their value chain and achieve superior business outcomes.

Wipro: The IT services company announced that it has helped Stockholm Exergi AB, Stockholm’s energy company, to build a new Information Technology (IT) infrastructure, helping it take a significant step toward achieving its, and Stockholm City’s, overall climate transformation targets.

IRB Infrastructure Developers: The company’s SPV, IRB Lalitpur Tollway Pvt., signed a concession agreement with NHAI for the Lalitpur Lakhnadon TOT Project in Madhya Pradesh. The project is for Tolling, Operation, Maintenance and Transfer of four lane Lalitpur-Sagar-Lakhnadon section in in the state of Uttar Pradesh and Madhya Pradesh. The SPV will pay an upfront concession fee of Rs 4,428 crore to NHAI for revenue linked concession period of 20 years

Fortis Healthcare: The company said that it has entered a business transfer agreement with MGM Healthcare Private Limited for the sale of its business operations pertaining to Fortis Malar Hospitals and related assets for an aggregate consideration of Rs 128 crore.

SJVN: The company’s first unit of 30 MW capacity for the 60 MW Naitwar Mori hydroelectric project in Uttarakhand has achieved the commercial operation date, and now its total generation capacity is 2,122 MW from 2,091.50 MW.

Eicher Motors: The company launched its new Himalayan at an introductory price of Rs 2.69 to 2.84 lakh, ex-showroom India, The motorcycle will be available at a starting price of £5,750 in the UK and €5900 across Europe. It also launched the Royal Enfield Shotgun 650, which will be available at an ex-showroom price of Rs 4,25,000.

Indian Overseas Bank: The Reserve Bank of India has imposed a monetary penalty of Rs 1 crore on the PSU for non-compliance with certain directions on loans and advances—statutory and other restrictions. The bank sanctioned term loans to three corporate entities without undertaking due diligence on the viability and bankability of the projects to ensure that revenue streams from the projects were sufficient to take care of the debt servicing obligations.

Bank of Baroda: The Reserve Bank of India (RBI) has imposed a monetary penalty of Rs 4.34 crore on the public sector lender for non-compliance with certain directions on the creation of a central repository of large common exposures across banks, loans and advances, statutory and other restrictions, and interest rates on deposits.

PNB Housing Finance: The housing finance company said the board of directors has approved the issuance of non-convertible debentures up to Rs 3,500 crore on a private placement basis in tranches over the next six months.

JK Cement: The company’s unit, JK Cement Works, Ujjain, has successfully commenced cement grinding unit which has a capacity of 1.5 million tonne per annum located in Ujjain, Madhya Pradesh.

KPI Green Energy: The company’s subsidiary, M/s. Sun Drops Energeia Pvt., got an order of 4.66 MW for solar projects from M/s GVM Woven and M/s Radhika Silk Mills.

Bharti Airtel: The Department of Telecommunications, Uttar Pradesh East, imposed a penalty of Rs 1,86,000 for an alleged violation of subscriber verification norms.

PB Fintech: The company has made an investment of Rs 350 crore in Policy Bazaar Insurance Brokers Pvt., a wholly owned subsidiary of the company.

Bandhan Bank: The lender’s board approved the re-appointment of Chandra Shekhar Ghosh as the Managing Director and Chief Executive Officer of the bank for a period of three years, with effect from July 10, 2024, subject to approval of the Reserve Bank of India.

Jindal Stainless: The company said that its board has approved the proposal to liquidate/disinvest their subsidiary, PT Jindal Stainless Indonesia (PTJSI). Further, the company said that PTJSI is not a material subsidiary of the company and therefore will not affect any business/accounting policies and will not have any material impact on the financials of the company.

Syrma SGS Technology: The company incorporated a wholly-owned subsidiary company named Syrma Semicon Pvt.

Welspun India: The company announced its participation in the United Nations Global Compact (UNGC) initiative, aligning its operations and strategies with the Ten Principles of UNGC.

Jay Bharat Maruti: The auto component manufacturer and Tier 1 supplier to Maruti Suzuki India Ltd. laid the foundation stone for its new plant in Kharkhoda, Sonipat, Haryana, last week on Thursday. The company is a strategic joint venture between JBM Group and Maruti Suzuki India Limited.

CMS Info Systems: The company’s Chief Technology Officer, Rohit Kilam, resigned from the position w.e.f. November 24, 2023.

Shivalik Bimetal Controls: The company signed a Memorandum of Understanding with Metalor Technologies International SA (Swiss Corporation) for setting up a joint venture in India to manufacture and sell electrical contacts.

Balkrishna Industries: The tyre manufacturing company said the board has approved the re-appointment of Rajiv Poddar as Joint Managing Director of the company for five years with effect from January 22, 2024.

Khadim India: The footwear retailer said its board has approved raising funds up to Rs 15 crore via the preferential issue of fully convertible equity share warrants on a private placement basis to one of the promoters and a few other identified non-promoter entities. The company will issue 4,08,768 fully convertible equity share warrants of Rs 10 each at an issue price of Rs 365 per share. The company will use the funds largely for the retail expansion and revamping of existing stores.