Market Opening - An Overview

Nifty futures on the GIFT Exchange were trading 0.12% higher at 19,368, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were trading higher, tracking the US markets, and on signs of cooling inflation. The Nikkei 225 index rose 1.55% and the Topix gained 1.27%. China’s CSI 300 index advanced 0.81% and the Hang Seng jumped 1.37%

Indian rupee gained 3 paise to close at 82.03 against the US dollar on Friday.

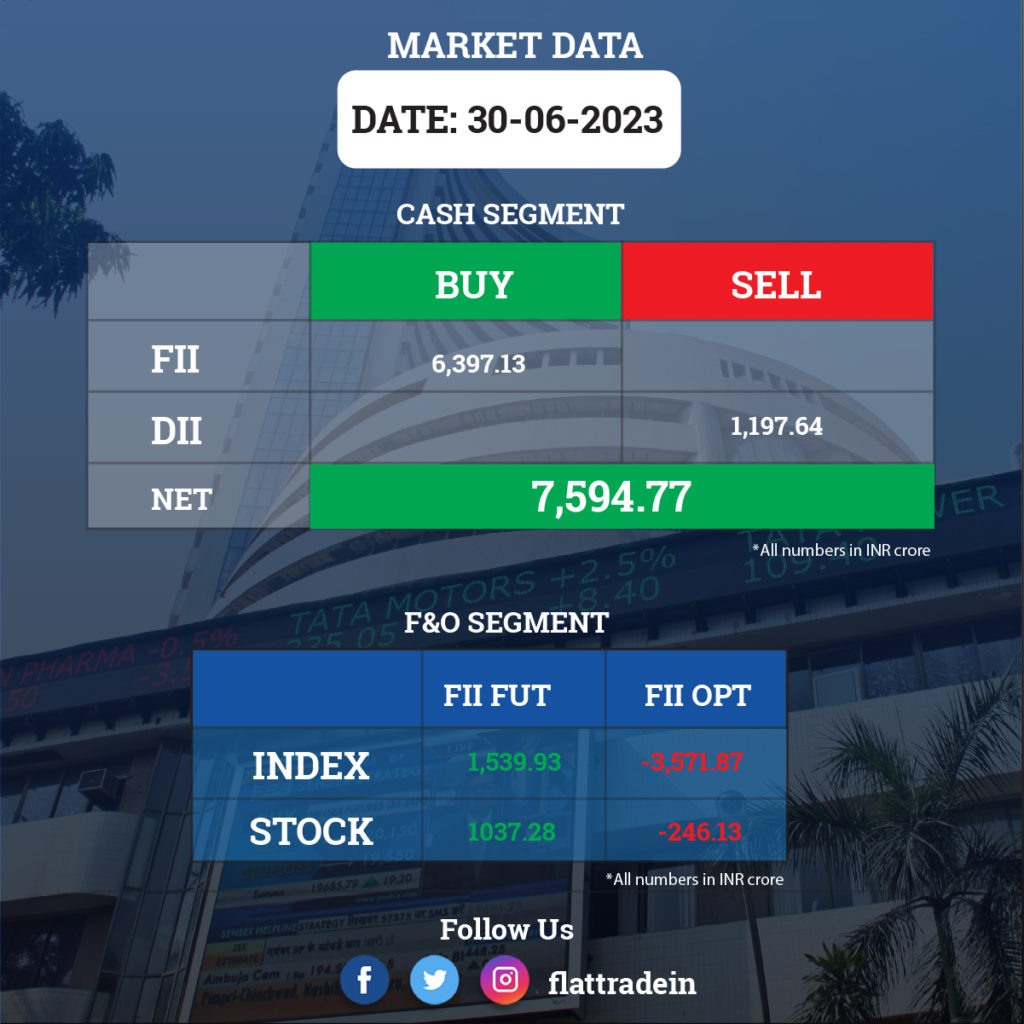

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): RIL and the UK-based bp p.l.c. have announced commencement of production from the MJ field. The MJ field represents the last of three major new deepwater developments the RIL-bp consortium have brought into production in block KG D6 off the east coast of India. Together, the three fields are expected to produce around 30 million standard cubic metres of gas a day (1 billion cubic feet a day) when MJ field reaches peak production.

Housing Development Finance Corporation (HDFC): The boards of mortgage lender Housing Development Finance Corporation (HDFC) and leading private sector lender HDFC Bank have approved July 1 as the effective date of merger, and July 13 as the record date. Post the deal, HDFC Bank will be 100% owned by public shareholders, and existing shareholders of HDFC will own 41% of the bank.

Adani Transmission: GQG Partners has bought 2.13 crore shares in Adani Transmission in two bulk deals. GQG Partners Emerging Markets Equity Fund bought 72.59 lakh shares at Rs 786.19 per share in a bulk deal. Goldman Sachs GQG Partners International Opportunities Fund has purchased 1.40 crore shares in Adani Transmission at Rs 786.19 apiece in a bulk deal. Fortitude Trade and Investment has sold 3.39 crore shares in Adani Transmission at Rs 786.17 per share.

Vedanta: The company has decided to initiate a strategic review of its steel and steel making raw materials businesses, according to its regulatory filing. The review will begin immediately and evaluate a broad range of options to maximize stakeholder value, including but not limited to a potential strategic sale of some or all of the steel businesses. The company has engaged advisors to assist in this review. Separately, SEBI has imposed a penalty of Rs 30 lakh on the company for violating disclosure norms. Vedanta made incorrect disclosures about its plan to enter the semiconductor business.

State Bank of India: The bank’s Chief Financial Officer, Charanjit Surinder Singh Attra, has resigned from the position. The resignation has been accepted and comes into effect after business hours on June 30.

Maruti Suzuki India: The largest car manufacturer in India has sold 1.59 lakh units in June 2023, up 2.3% fromm 1.55 lakh units sold in same month last year. Domestic sales increased by 5.77% to 1.39 lakh units, but exports dropped 17% to 19,770 units.

UltraTech Cement: The country’s largest cement maker announced India’s total sales volume in Q1FY24 grew by 20% YoY to 29.01 million tonnes and total consolidated sales volume jumped by 20% YoY to 29.96 million tonnes. The capacity utilisation was at approximately 90% in Q1FY24.

NMDC: The state-owned iron ore producer said its cumulative production and sales in Q1 of FY24 witnessed a 20% and 45% growth YoY respectively. During the quarter, the company produced 10.70 million tonnes and sold 11.15 million tonnes iron ore.

Tata Motors: The Tata Group company has announced sales at 81,673 units for June 2023, down 1.08% compared to 82,570 units sold in same month last year. Domestic sales fell 1 percent to 80,383 units.

Hero MotoCorp: The country’s largest two-wheeler maker sold 4.36 lakh units in June 2023, down 9.9% compared to 4.84 lakh units sold in same month last year. Domestic sales declined 8.7% to 4.2 lakh units, while exports were down by 34.3% to 14,236 units in the same period. The company also said it will make an upward revision in the ex-showroom prices of its motorcycles and scooters, effective from July 3, 2023. The price increase will be around 1.5 percent and the exact quantum of increase will vary by specific models and markets.

Aditya Birla Capital: The company has completed the fundraising of Rs 3,000 crore, through a qualified institutional placement (QIP) of equity shares worth Rs 1,750 crore and a preferential issuance of equity shares worth Rs 1,250 crore to its promoter and promoter group entity, Grasim Industries and Surya Kiran Investments Pte Ltd, respectively.

Eicher Motors: Eicher’s Royal Enfield announced sales at 77,109 units in June 2023, growing 26% over 61,407 units sold in corresponding month last year as domestic sales grew by 34% to 67,495 units, but exports fell 14% to 9,614 units. Its VECV sales grew by 6.5% YoY to 6,715 units in June 2023.

Escorts Kubota: The agri machinery business division in June 2023 sold 9,850 tractors, down 2% compared to 10,051 tractors sold in June 2022. Domestic sales grew by 0.1% to 9,270 tractors, but exports fell 26.2% to 580 tractors in the same period.

Granules India: Company’s unit-IV facility at Visakhapatnam in Andhra Pradesh has successfully completed the USFDA’s pre-approval inspection (PAI) and GMP audit with zero 483 observations. The USFDA conducted inspection of the said facility during June 26 and 30. Unit-IV facility manufactures active pharmaceutical ingredients (API).

Bank of Baroda (BoB): The state-owned lender plans to sell up to 49% stake in credit card business arm BOB Financial Solutions Ltd. Currently, the bank owns it is 100% stake in BoB Financial Solutions. The bank has floated a Request for Proposal for roping in a strategic investor, and the process is expected to complete in one year, a senior bank official said.

TVS Motor Company: The two-wheeler maker expects growth momentum to continue in the current fiscal, with the overall economy anticipated to grow at a robust pace and a continuous improvement in the road infrastructure. In its Annual Report for 2022-23, the company stated that it maintains a cautiously optimistic view regarding the current fiscal. The company said its premium bikes and scooter segment is likely to grow on the back of a rise in overseas shipments and higher penetration of electric two-wheelers this fiscal.

Mazagon Dock Shipbuilders: The company has signed a contract worth Rs 2,724.63 crore with the Indian Navy for medium-refit cum Life Certification of the second Shishumar class submarine INS Shankush.

Kansai Nerolac Paints: The board of the company approved the sale of its land in Thane and an additional area measuring 97,090 square metres for a total consideration of Rs 671 crore to Shoden Developers. Shoden Developers is a group company of the House of Hiranandani.

PVR Inox: The multiplex operator has opened a 10-screen multiplex in Delhi and a 5-screen multiplex in Ahmedabad. With this launch, the company now operates the largest multiplex network with 1697 screens at 360 properties in 114 cities, including India and Sri Lanka.

Easy Trip Planners: The company’s promoter Rikant Pittie has offloaded 10 crore equity shares or 5.75% stake in the travel agency company at an average price of Rs 40.05 per share, which amounted to Rs 400.5 crore. However, Societe Generale bought 1.5 crore shares in the company at average price of Rs 40 per share.

CSB Bank: The private sector lender has increased its base rate to 11.05% per annum, from 10.20% earlier, with effect from July 1. However, it has not made any changes in the marginal cost of funds based lending rates (MCLR).