Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.36% higher at 17,696, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares were mixed as Japanese markets rose, while Chinese markets fell. The Nikkei 225 index jumped 1.19%, while the Topix gained 0.90%. The Hang Seng fell 0.14% and the CSI 300 index dropped 0.79%.

Indian rupee rose 63 paise to 81.97 against the US dollar on Friday.

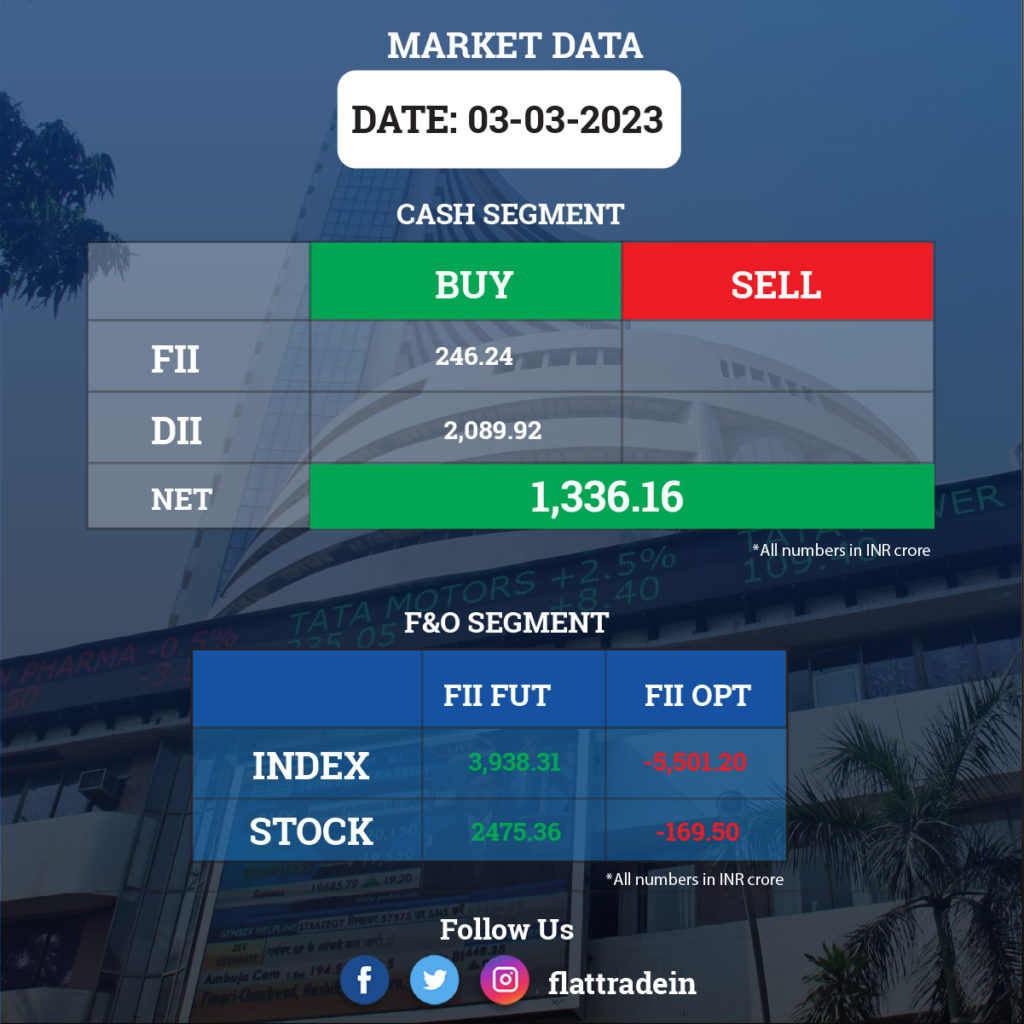

FII/DII Trading Data

Stocks in News Today

Reliance Industries Limited (RIL): The conglomerate and other companies such as US-based First Solar and Shirdi Sai have bid for end-to-end polysilicon wafer cells modules (PWCM) manufacturing for a total of 15.4 gigawatt (Gw) under the second tranche of the production linked incentive (PLI) scheme for solar equipment manufacturing. Under the PLI guidelines for the second phase, of the total corpus of Rs 19,000 crore, the highest tranche of Rs 12,000 crore has been allotted to end-to-end PWCM manufacturing (raw material to finished product). Unlike the first round, this phase of solar PLI has three schemes – PWCM and wafer-cells-modules, with allocation of Rs 4,500 crore and cells-modules with Rs 3,500 crore.

Mahanagar Gas: The company will acquire Unison Enviro, a city gas distribution company and a subsidiary of Ashoka Buildcon, for Rs 531 crore. The acquisition of shareholding in Unison is subject to PNGRB approval. Unison is authorised by PNGRB to implement the city gas distribution network in Ratnagiri, Latur & Osmanabad in Maharashtra and Chitradurga & Devengere in Karnataka. For the said sale transaction, Ashoka Buildcon along-with North Haven India Infrastructure Fund managed by Morgan Stanley Investment Management has entered into a Share Purchase Agreement with Mahanagar Gas.

Info Edge India: Redstart Labs (India), a wholly-owned subsidiary of the company, plans to invest about Rs 5.2 crore in Sploot, a community and content-led platform for pet parenting. Redstart will acquire 1,822-compulsorily convertible preference shares as primary acquisition of shares. The aggregate shareholding of the company through Redstart, post this investment, in Sploot would be 24.13% on fully converted & diluted basis.

HCL Technologies: The IT company expects to double semiconductor services business in 3-4 years following capabilities that it will develop around electronic chip plants to be set by its group firm. HCL Group is among the companies that have applied to set up electronic chip plants under the “Scheme for Compound Semiconductors” and HCL Technologies will assist HCL Corporate in end-to-end processing of chips.

Power Grid Corporation of India: The state-owned power transmission utility was declared as successful bidder to establish inter-state transmission system for two projects on build, own operate and transfer (BOOT) basis, in Chhattisgarh. The company has received letters of intent for two projects on March 2.

Britannia Industries: FMCG major aims to increase its women workforce to 50% from the present 41% by 2024, a senior company official said. Britannia currently has 41% women employees and would increase the strength to 50% by the end of 2024, Head of Manufacturing, Owned Factories, Indranil Gupta said. The company has 15 manufacturing plants and 35 contract and franchisee units across India having a workforce of over one lakh people.

Kansai Nerolac Paints: The paint company has acquired the remaining 40% stake in Nerofix from Polygel, for Rs 37 crore and the deal is expected to be completed by Mach 31. Now, Nerofix will become a wholly- owned subsidiary of Kansai. Nerofix was a joint venture between Polygel Industries and Kansai Nerolac Paints, which had acquired 60% stake of Nerofix in January 2020.

Hindustan Aeronautics (HAL): The state-owned aerospace company has received income tax refund order from Office of Joint Commissioner of IT for Assessment Year 2012-13, pursuant to the direction of ITAT, Bangalore. ITAT allowed R&D expenditure of Rs 725.98 crore as capital expenditure, resulting in refund of Rs 570.05 crore. This refund includes interest of Rs 163.68 crore.

Orchid Pharma: The company and its subsidiary Orchid Bio Pharma has entered into a Memorandum of Understanding (MoU) with an overseas technology provider for in-licensing 7ACA technology. In July 2022, Orchid-Bio Pharma got approval under the production linked incentive (PLI) Scheme for manufacturing of product ‘7 ACA’.

PNC Infratech: The road infrastructure company has received ‘provisional certificate’ for national highway project of National Highways Authority of India, implemented by its subsidiary PNC Triveni Sangam Highways, from Independent Engineer (SA Infrastructure Consultants). The project is of 6-laning of Chakeri to Allahabad section of NH-2 in Uttar Pradesh under NHPD Phase-V on Hybrid Annuity Mode (HAM) for completed length of 119.788 km out of total project length of 145.066 km. The appointed date for the project was January 12, 2019 with 910 days scheduled construction period and 15 years operation period, post completion. The Independent Engineer recommended the required extension of time for completion of the project.

Zydus Lifesciences: The company has received final approval from the United States Food and Drug Administration (USFDA) for Vigabatrin for oral solution. Vigabatrin for oral solution is indicated for the treatment of refractory complex partial seizures as adjunctive therapy in patients 2 years of age and older. The drug will be manufactured at formulation manufacturing facility in Moraiya, Ahmedabad. Vigabatrin had annual sales of $233.7 million in the United States as per IQVIA MAT data dated December 2022.

Ramkrishna Forgings: The company is planning a multi-crore investments to set up around 85 mega watt (MW) renewable energy capacity, company CFO Lalit Khetan has said. The company aims to execute the plan over the next 12 months, Khetan said. Out of the planned 85 MW green capacity, about 8 MW roof-top solar project will be set up at the company’s forging plants at Sariekella and Dugni, in Jamshedpur, he told PTI.

HFDC: The National Company Law Tribunal (NCLT) has given approval for the amalgamation of HDFC Property Ventures and HDFC Venture Capital with HDFC Capital Advisors, a subsidiary of HDFC.

Linde India: The company has invested a sum of Rs 7.69 crore in FPEL Surya Private Limited towards subscription of 26% stake. The purpose of the acquisition is to purchase renewable power under captive mechanism, which will result in a lower tariff and consequent cost savings.

Elgi Equipments: The company has formed a wholly-owned subsidiary company in the name “Elgi Compressors Vietnam LLC”, in Vietnam and has received the Enterprise Registration Certificate dated March 1, 2023 on March 3, 2023.

Satin Creditcare Network: The company has completed the merger of the wholly-owned subsidiaries in MSME and Business Correspondent Services The Business Correspondent subsidiary, Taraashna Financial Services Limited merges with MSME arm Satin Finserv.

Force Motors: The company has announced the production of 2,259 vehicles for February 2023, down 6.4% compared to 2,413 vehicles in January. Domestic sales grew 9% MoM to 2,236 vehicles, but exports fell 45% to 221 vehicles in the same period.