Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.41% higher at 18,277.50, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares were trading higher on Monday as global market sentiment improved on hopes of an economic reopening in China. Nikkei 225 index rose 1.21% and Topix advanced 1.02%. China’s CSI 300 index gained 0.17% and the Hang Seng jumped 1.64%.

The Indian rupee surged 44 paise to 82.44 against the US dollar on Friday.

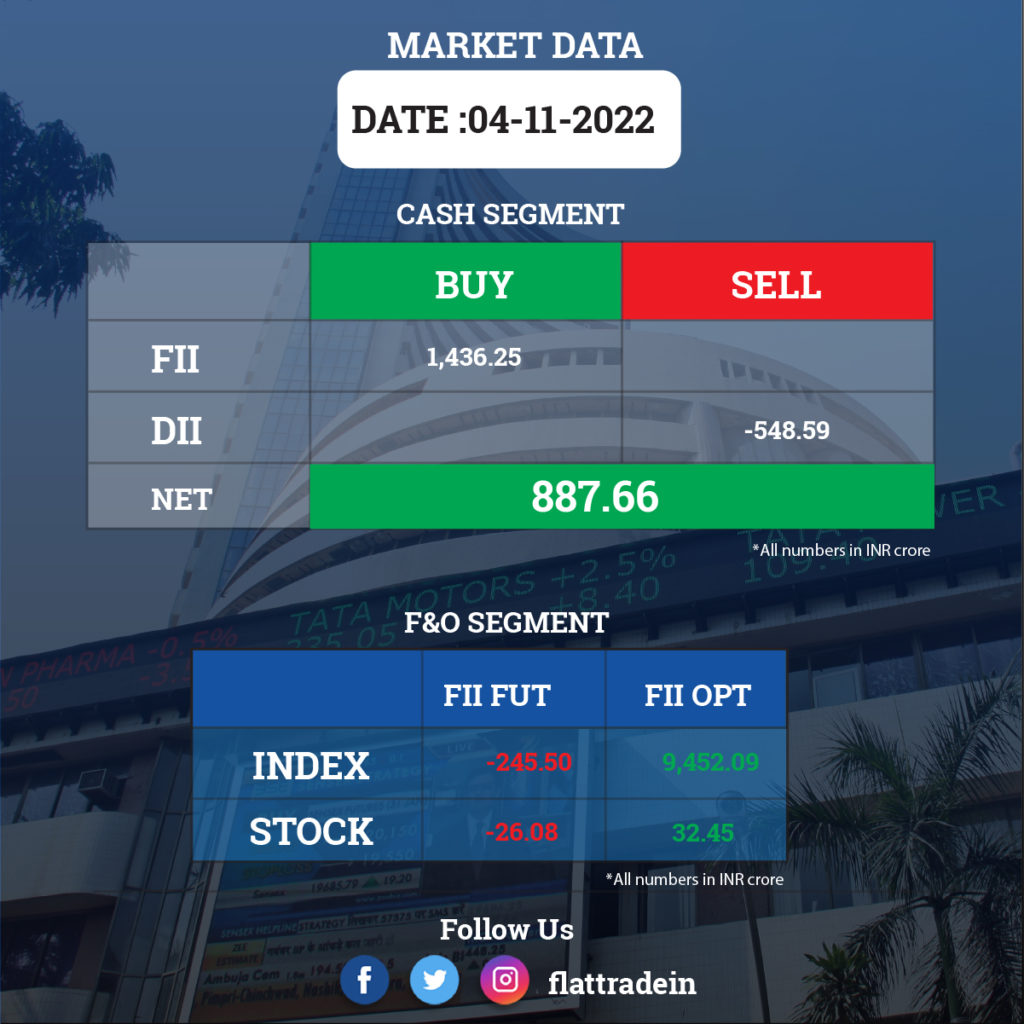

FII/DII Trading Data

Upcoming Results

Coal India, Bharat Petroleum Corporation, One 97 Communications (Paytm), Aditya Birla Capital, Divis Laboratories, PB Fintech (Policybazaar), Affle India, Ceat, Cera Sanitaryware, Endurance Technologies, Greenply Industries, India Cements, KEC International, RateGain Travel Technologies, Sun Pharma Advanced Research Company, Sundaram-Clayton, Tata Teleservices (Maharashtra), Ujjivan Small Finance Bank, and Vascon Engineers will report their quarterly earnings today.

Stocks in News Today

Reliance Industries: The conglomerate is set to acquire German retailer METRO AG’s Cash & Carry business in India for about 500 million euros (Rs 4,060 crore), PTI reported citing industry sources. The deal includes 31 wholesale distribution centres, land banks and other assets owned by METRO Cash & Carry here, sources said. This will help Reliance Retail to expand its presence in the B2B segment.

State Bank of India: The bank reported a quarterly net profit of Rs 13,265 crore, growing 74% YoY as provisions fell sharply by 25% during the same period. Its operating profit for Q2FY23 at Rs 21,120 crore increased 16.82% YoY and net interest income rose by 12.83% YoY to Rs 35,183 crore. Its loan book grew 20% and deposits rising 10% in the same period.

Power Grid Corporation of India: The state-owned company reported 8% year-on-year growth in consolidated profit at Rs 3,650 crore for the quarter ended September FY23, with EBITDA growing 3.4% YoY to Rs 9,426 crore in the same quarter. Revenue from operations at Rs 11,151 crore increased by 8.6% compared to year-ago period.

Britannia Industries: The biscuit manufacturer recorded a 28.5% year-on-year growth in consolidated profit at Rs 490.6 crore for the quarter ended September FY23, driven by strong operating performance. Its consolidated revenue from operations stood at Rs 4,379.6 crore for the quarter, a 21.4% rise, compared to year-ago period. EBITDA at Rs 711.7 crore for the quarter grew by 27.5% and margin expanded by 78 bps YoY to 16.25% in Q2FY23.

TVS Motor Company: The two- wheeler manufacturer reported a 59.3% year-on-year increase in consolidated profit at Rs 373.4 crore for the quarter ended September FY23 supported by strong operating as well top line performance. Revenue for the quarter stood at Rs 8,561 crore, an increase of 32% compared to same period last year. EBITDA rose 31% to Rs 737 crore during the same period.

InterGlobe Aviation: The IndiGo airline operator posted loss of Rs 1,583 crore for the quarter ended September FY23 (including foreign exchange loss of Rs 1,201.5 crore), widening from Rs 1,435.7 crore in same period last year, as EBITDAR fell 33% to Rs 229.2 crore during the same period on higher fuel prices, but revenue from operations increased by 122.8% YoY to Rs 12,497.6 crore during the quarter.

Bank of Baroda: The public sector undertaking recorded a 59% YoY growth in profit at Rs 3,313 crore for the quarter ended September FY23 as total provisions fell by 41% YoY to Rs 1,628 crore. The bank’s other income fell 18.4% to Rs 745 crore in the same period. Net interest income for the quarter jumped 34.5% YoY to Rs 10,174 crore.

DreamFolks Services: The company registered a massive 745% on-year growth in profit at Rs 14.78 crore for the quarter ended September FY23. Revenue from operations grew by 183% to Rs 171.24 crore during the quarter YoY, while EBITDA increased by 195% to Rs 21.1 crore and margin nearly doubled to 12.33% compared to same period last year on strong demand from passengers availing lounge access & other touchpoints.

Titan Company: The company recorded a 30.3% year-on-year growth in consolidated profit at Rs 835 crore for the quarter ended September FY23. Total income for the quarter grew by 22% YoY to Rs 9,224 crore with jewellery business growing 18%, and watches & wearables segment showing a 21% growth YoY.

Indian Overseas Bank: The lender has recorded a 33.2% jump in its net profit for the second quarter ending September 30, 2022 at Rs 501 crore. The bank had registered net profit at Rs 376 crore during the corresponding period last year. The total income during the quarter ending September 30, 2022 went up to Rs 5,852.45 crore from Rs 5,028 crore recorded as on June 30, 2022. The total business stood at Rs 4,34,441 crore as against Rs 4,23,589 crore. The net non-performing assets (NPA) ratio stood at 2.56 per cent as on September 30, 2022 when compared to 2.77 per cent registered as on September 30, 2021.