Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.22%higher at 18,800, signalling that Dalal Street was headed for positive start on Friday.

Japanese shares werer trading lower as investors were cautious ahead of Bank of Japan’s monetary policy decision. The Nikkei 225 index was down 0.54% and the Topix fell 0.46%. Meanwhile, Chinese shares were trading higher with the CSI 30 index gaining 0.3% and the Hang Seng index up 0.47%.

Indian rupee fell 7 paise to 82.18 against the US dollar on Thursday.

IKIO Lighting will make its debut on the exchanges on June 16. The issue is trading with a premium of 32% in the grey market. The issue price was Rs 285 apiece. The LED maker’s maiden public issue was subscribed 66.30 times during June 6-8 with qualified institutional buyers’ reserved portion being booked 163.58 times, high networth individuals 63.35 times, and retail 13.86 times.

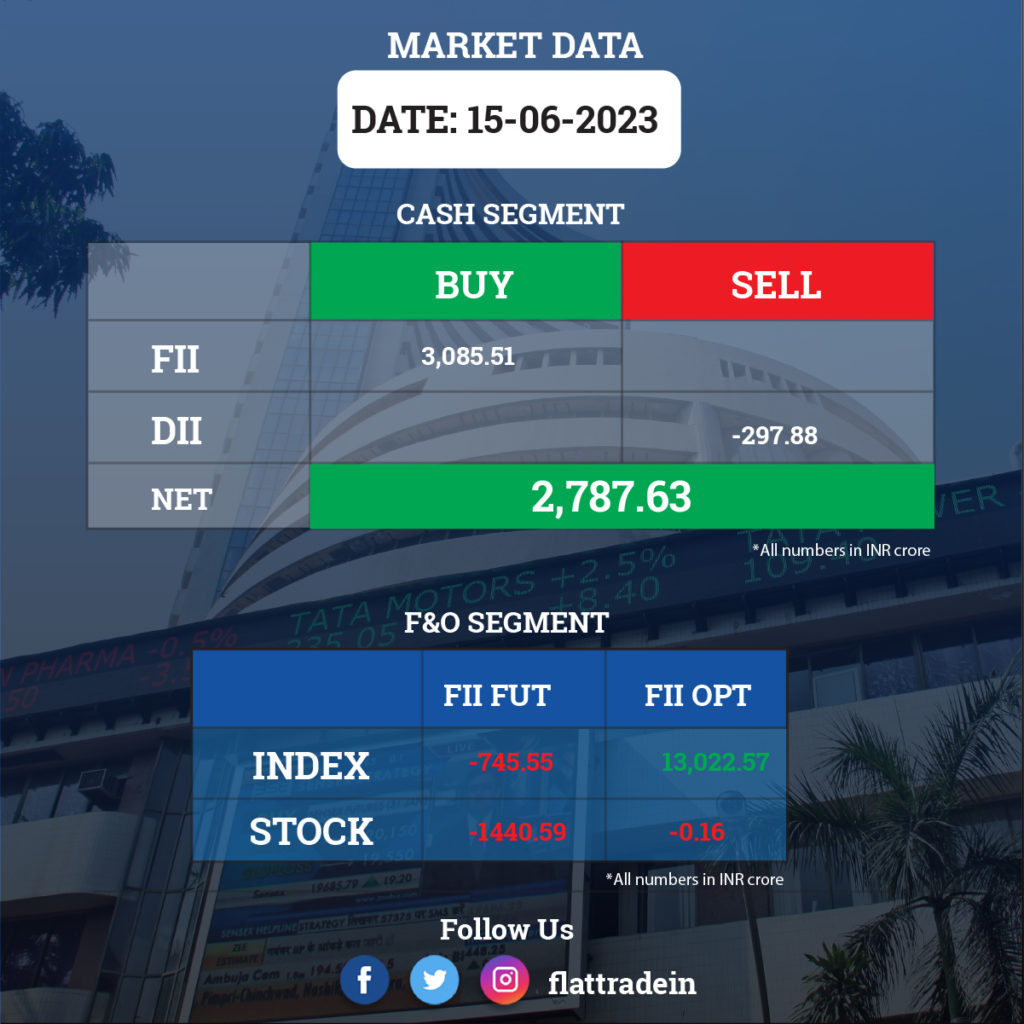

FII/DII Trading Data

Stocks in News Today

Reliance Industries Ltd. (RIL): The conglomerate is in talks with lenders for a foreign-currency loan of up to $2 billion to fuel its ongoing expansion of its oil-to-telecoms business, Bloomberg reported citing people familiar with the matter. The company plans to use India’s dedicated external commercial borrowing route to secure the loan, the report said. The facility may have a maturity period ranging between three to five years, and the proceeds will be used for capital expenditure as well as to refinance another loan that matures in September, Bloomberg reported.

TVS Motor: The company said it has sold its entire stake in Emerald Haven Realty for Rs 166.83 crore. The automaker held a 43.54% stake in Emerald Heaven Realty. The buyer is TVS Holdings Private Limited, a part of the promoter group.

Ramkrishna Forgings: The company along with TITAGARH RAIL SYSTEMS LIMITED (earlier known as Titagarh Wagons) have won Rs 12,226.5 crore contract to manufacture and supply 15,40,000 forged wheels over a span of 20 years for Indian railways. As per the contract, 40,000 forged wheels will be delivered during the first year, 60,000 wheels in the second year and 80,000 wheels every subsequent year thereafter.

Ashok Leyland: The truck manufacturer and Aidrivers, a specialist in AI-enabled autonomous solutions, will partner to produce autonomous electric terminal trucks to address the net zero emissions needs of the port industry. The two companies will combine their expertise to help sustainable autonomous transportation in the industry. The trucks will be produced at Ashok Leyland’s manufacturing facilities and orders can be placed now for delivery in 2024. The inaugural fleet of vehicles is anticipated to be ready for terminal operations early next year.

Titagarh Rail Systems Limited (TRSL) and Bharat Heavy Electricals Limited (BHEL): A consortium led by Bharat Heavy Electricals Limited (Bhel) and Titagarh Rail Systems Limited (TRSL) signed a contract for the manufacturing and supply of 80 fully assembled Vande Bharat sleeper train sets by 2029 and their maintenance for 35 years. The estimated value of the contract is Rs 24,000 crore (excluding GST).

Motherson: Samvardhana Motherson Automotive Systems Group BV, a step-down subsidiary of Samvardhana Motherson International Limited, through one of its European subsidiaries, has signed a binding undertaking to acquire a 100% stake in Cirma Entreprise from Vinci Energies France. The value of the deal is 7.2 million euros.

Tech Mahindra: The company has appointed Mohit Joshi as managing director and chief executive officer of the company with effect from December 20, 2023 to June 19,2028. Current MD and CEO CP Gurnani will retire on December 19, 2023.

Bharat Heavy Electricals, Eicher Motors: BHEL and Volvo Eicher Commercial Vehicles (an arm of Eicher Motors) have signed a memorandum of understanding to jointly develop and deploy Type-IV hydrogen, CNG cylinders in commercial vehicles segment.

InterGlobe Aviation (IndiGo): The airline registered its highest-ever domestic market share of 61.4% in May as it flew more than 8.1 million passenger, capitalising on Go First suspending flights. Data released by Directorate General of Civil Aviation showed domestic airlines flew over 13.2 million passengers in May, a sequential growth of over 3%. The total domestic traffic in May is more than 13.01 million passengers in December 2019.

Indian Oil (IOC): The company plans to set up an 80,000 tonnes sustainable aviation fuel plant with LanzaJet in Haryana, the refiner’s chairman said. The company is looking at an investment of about Rs 2,300 crore, S M Vaidya said on the sidelines of an industry event in New Delhi.

IDFCFirst Bank: Shares of the lender closed 2.93% higher on Thursday on the back of heavy volumes. It had hit a record high of Rs 83.40 in September 2016. In the past two months, the stock of the private sector lender has jumped 47% on positive outlook.

PNC Infratech: KKR’s roads platform Highways Infrastructure Trust is in talks to acquire a portfolio of 12 road projects from Agra-based construction firm PNC Infratech for an enterprise value of about Rs 9,000 crore (about $1.1 billion), Economic Times reported citing two people aware of the development. The portfolio on sale comprises 11 hybrid annuity model (HAM) roads and one build-operate-transfer (BOT) road. These projects are located across Uttar Pradesh, Madhya Pradesh and Rajasthan. Shares of the company rose over 8% in Thursday’s intraday trade.

ITC: Consumers spent more than Rs 29,000 crore to purchase ITC’s fast moving consumer goods (FMCG), excluding tobacco, in fiscal 2022-23, Economic Times reported citing the latest investor note from the company. ITC in the note said the Ebitda of the FMCG business for FY23 grew 34.9% to Rs 1,953.97 crore, while the Ebitda margin improved to 10.2% from 9.1% in FY22, despite high commodity and input prices. The margin expansion was driven by multi-pronged interventions such as premiumisation, supply chain agility, judicious pricing actions, digital initiatives, strategic cost management and fiscal incentives including production-linked incentives (PLI), it said.

Arihant Capital Markets: The company said its board has approved raising of funds through the issuance of secured unlisted non-convertible debentures (NCDs) up to Rs 100 crore in one or more tranches on a private placement basis.

Power Finance Corporation: PFC has incorporated a special purpose vehicle – Tirwa Transmission Limited – for the construction of Tirwa substation with associated lines. The SPV will be placed under PFC Consulting Limited, which is a wholly owned subsidiary of Power Finance Corporation.

Natco Pharma: The company has announced the successful closure of inspection and received Establishment Inspection Report (EIR) from the US Food and Drug Administration (USFDA) for its drug formulations manufacturing facility at Visakhapatnam for an inspection conducted during January 30 and February 3.

Torrent Pharma: The USFDA has issued an Establishment Inspection Report after inspecting the drugmaker’s oral-oncology manufacturing facility at Bileshwarpura in Gujarat.

NLC India: Company has incorporated wholly-owned subsidiary, NLC India Renewables, to take over the existing renewable assets of the company.

Balaji Telefilms: Abhishek Kumar has resigned as chief executive officer of the company with effect from June 16.