Market Opening - An Overview

GIFT Nifty Futures on the NSE IX traded lower by 0.26% at 19,693, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were mixed as investors gauged the Fed’s longer hawkish monetary policy stance amid rising oil prices. The Nikkei 225 index rose 0.58% and the Topix gained 0.27%. Meanwhile the CSI 300 index fell 0.41% and the Hang Seng tanked 1.37%.

The Indian rupee rose by 18 paise to 82.93 against the US dollar on Friday.

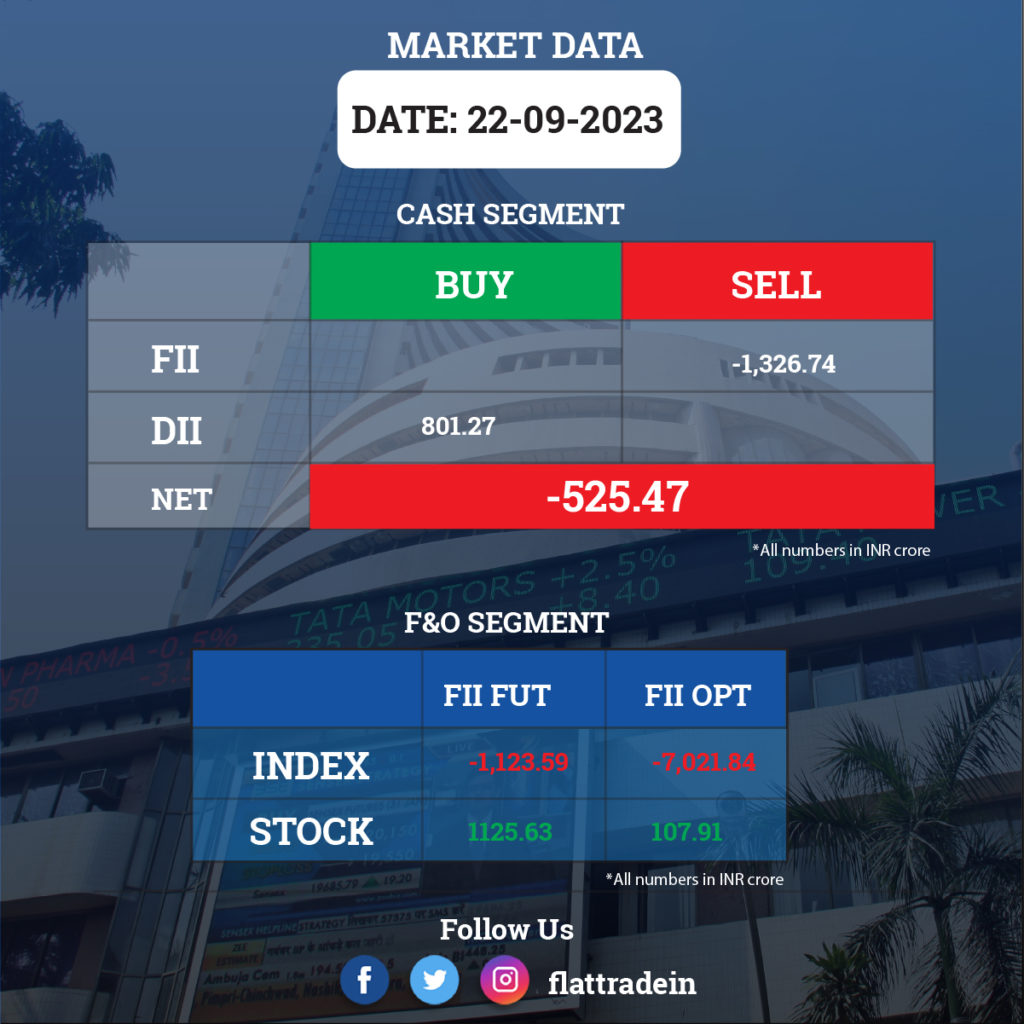

FII/DII Trading Data

Stocks in News Today

State Bank of India (SBI): The state-owned lender has raised Rs 10,000 crore at a coupon rate of 7.49% through its long-term infrastructure bond issuance. The investors were across provident funds, pension funds, insurance companies, mutual funds, corporates, etc. The proceeds of bonds will be utilised to enhance long-term resources for funding infrastructure and the affordable housing segment.

Reliance Industries (RIL): The company’s retail arm, Reliance Retail Ventures, has received the subscription amount of Rs 2,069.50 crore from Alyssum Asia Holdings II Pte Ltd (KKR) and allotted 1,71,58,752 equity shares to KKR.

Bajaj Finance: The NBFC major is planning to raise between $800 million to $1 billion via the QIP or/and preferential issue route with four investment banks shortlisted for the proposed deal, Moneycontrol reported citing multiple industry sources. “JM Financial, Citi, Morgan Stanley and BofA Securities have been mandated by Bajaj Finance,” said one of the sources.

JSW Steel: The company has executed the termination agreement with National Steel Holding (NSHL) for the termination of the joint venture agreement for establishing scrap shredding facilities in India. It will purchase NSHL’s 50% stake in NSL Green Recycling and NSL will become a wholly owned subsidiary of JSW Steel.

Power Finance Corp: The company has allotted 66 crore fully paid-up bonus equity shares of the face value of Rs 10 each in the ratio 1:4.

LIC: The insurer has received an order demanding GST along with interest and a penalty worth Rs 290.5 crore from Bihar’s Additional Commissioner of State Tax. The company said it will file an appeal before the GST Appellate Tribunal against the order.

Mahindra & Mahindra Financial Services: The NBFC has completed the acquisition of Mahindra Insurance Brokers (MIBL) for Rs 206 crore, at a price of Rs 1,001 per share. With this buyout, MIBL is now a wholly owned subsidiary of the company.

Inox Green Energy: The company has entered into a share subscription agreement to acquire a 51% stake in Resowi Energy, which is engaged in the business of operations and maintenance of Wind turbine generators (WTGs) and has capabilities to service 2 MW and higher rated WTGs of several OEMs operating in India & Sri Lanka. The acquisition will enhance Inox Green Energys’s expertise to offer its services to a wider customer base.

Shree Renuka Sugars: The company has received its board approval for acquiring Anamika Sugar Mills, a sugar manufacturing company in Uttar Pradesh, for Rs 235.5 crore. Further, it will also infuse up to Rs 110 crore in Anamika by way of subscription to equity shares of Anamika for the purpose of redemption of 100% of the outstanding cumulative redeemable preference shares (CRPS) issued by Anamika in favour of SICPA India Private Limited.

Ircon International: The company has a contract worth $14.89 million, or Rs 122 crore, with Sri Lanka Railways for the design, installation, and commissioning of signalling and telecommunication systems.

Zen Technologies: The company, in an exchange filing, has informed that the company has received an order worth of Rs. 227.65 crore including GST from Ministry of Defence, Government of India.

Karnataka Bank: The lender’s board has approved raising Rs 1,500 crore through the issue of equity shares. Of this, Rs 800 crore will be raised through a preferential issue of shares at Rs 239.52 apiece.

Edelweiss Financial Services: The equity shares of Nuvama Wealth Management will be listed on BSE and NSE on September. 26. Nuvama Wealth Management was formerly known as Edelweiss Securites which was earlier demerged from Edelweiss Financial Services.

Blue Star: The AC manufacturer said its board has approved the allocation of 1.29 crore equity shares at an issue price of Rs 770 apiece to 41 qualified institutional buyers. Norges Bank and SBI Large & Midcap Fund each secured over 12% of the issue.

Kirloskar Oil Engines: The company announced that Anurag Bhagania will resign as CFO of the company with effect from November 22.

Swan Energy: The company’s board has approved issuance of up to 2.9 crore equity shares of face value one rupee each at a price of Rs 495 each through preferential issue.

Borosil: The company informed that there has been a delay in receiving delivery of imported equipment and machinery from Europe required for setting up the furnace for the 25-tonne borosilicate glass factory in Jaipur, Rajasthan. Due to this delay, the project is likely to be commissioned by January 31, 2024.

Delta Corp: The company has received GST demand order of Rs 11,139 crore from Hyderabad’s Directorate General of GST Intelligence. The company said the tax liability amount claimed is based on the gross bet value of all games played at casinos rather than gross gaming revenue. It will pursue remedies to challenge the tax demand.

Vaibhav Global: The company’s subsidiary Shop TJC Ltd (UK) has successfully executed an Asset Sale Agreement to acquire assets of Ideal World, a teleshopping brand in the United Kingdom. Through this agreement, Shop TJC will acquire Ideal World’s IP rights, broadcasting rights, studio equipment along with other intangible assets. The transaction will be funded through internal accruals.