Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.23% higher at 17,184.50, signalling a positive start for Dalal Street on Wednesday.

Asian shares were trading higher as investors awaited Federal Reserve’s interest-rate decision later Wednesday. The Nikkei 225 index rose 1.82% and the Topix surged 1.75%. The Hang Seng soared 2.41% and the CSI 300 index gained 0.83%.

Indian rupee fell 2 paise to 82.65 against the US dollar on Tuesday.

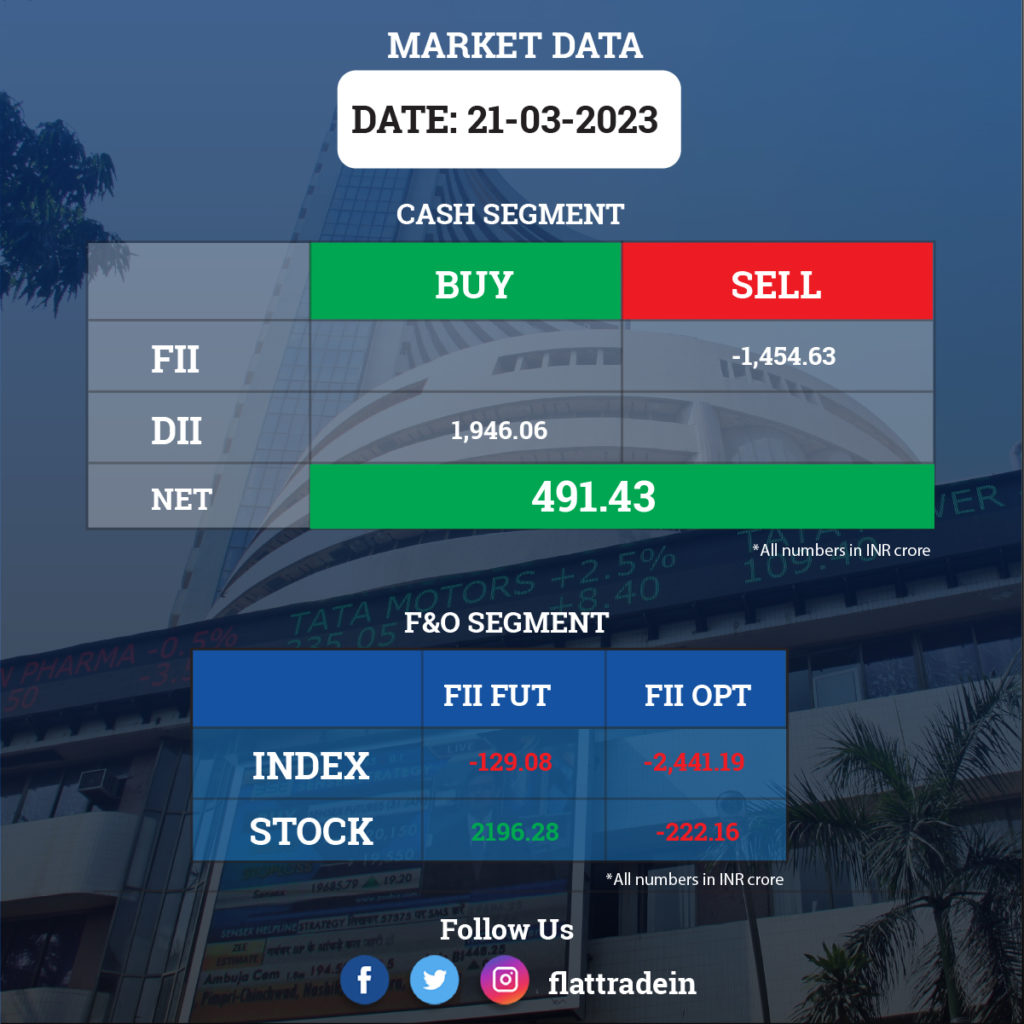

FII/DII Trading Data

Stocks in News Today

Tata Motors: The commercial vehicle manufacturer will increase the price of commercial vehicles by up to 5% starting from April 1, 2023. The decision to increase prices is a result of the company’s efforts to comply with more stringent BS6 phase II emission norms. The price increase will be applied across the entire range of commercial vehicles.

NTPC: NTPC Renewable Energy Ltd (NTPC REL), an arm of NTPC Ltd, has signed an agreement with the Indian Army for the implementation of green hydrogen projects in armed forces establishments. Under the MoU, a joint identification of potential sites would be undertaken for setting up of green hydrogen projects for supplying electricity, in a phased manner, NTPC said. The green hydrogen projects in its establishments will be on build, own and operate (BOO) model.

Hindustan Zinc (HZL): The company will pay dividends worth Rs 10,990 crore ($1.3 billion) to its shareholders. This will be the fourth time this year the company is paying dividends. The miner will pay an interim dividend of Rs 26 per share, which is 1,300% on the face value of Rs 2 per share, according to an exchange filing on Tuesday. The key beneficiaries will be Agarwal’s Vedanta, which owns about 65% in HZL, and the Indian government that holds about 30%.

Power Finance Corporation (PFC): The state-owned company said its board has approved raising up to Rs 80,000 crore through various financial instruments. An amount of Rs 40,000 crore will be raised through long-term domestic borrowings, and another Rs 20,000 crore by way of long-term foreign currency borrowing, according to its regulatory filing. Besides, proposals have been approved for raising up to Rs 20,000 crore through short-term borrowings and commercial paper. The proposals approved are for raising fund during the FY2023-24, the company said.

Indian Oil Corporation: Indian Oil has received ‘in-principle’ approval from the board to carry out pre-project activities including the preparation of a detailed feasibility report for setting up the Paradip petrochemical complex at Paradip, Odisha at an estimated project cost of Rs 61,077 crore. The project will improve the Petrochemical Intensity Index of the company and de-risk its fossil fuel business.

Tata Power Company: The company’s subsidiary — Tata Power Renewable Energy — has received the ‘Letter of Award’ (LoA) from Maharashtra State Electricity Distribution Company (MSEDCL) to set up a 200 MW solar PV project in Solapur, Maharashtra. The project will be commissioned within 18 months from the PPA execution date.

Thomas Cook and LTIMindtree: Omnichannel travel services firm Thomas Cook India and its group company SOTC Travel on Tuesday partnered with LTIMindtree to launch ‘Green Carpet’, a global platform that will help companies to monitor and manage their business travel emissions. Markets regulator SEBI has mandated the top 1,000 listed companies in India by market capitalisations to make filings as per the Business Responsibility and Sustainability Reporting (BRSR) from FY24.

A SaaS-based platform, “Green Carpet” is designed to address specific concerns faced by organisations, helping them capture, monitor, analyse and reduce their carbon emissions from business travel. It offers real-time insights related to Scope 3 emissions and helps organisations to significantly reduce their ESG reporting costs.

Sonata Software: The company has secured a project worth about around Rs 1,322.8 crore from a US-based consumer retail company to manage end-to-end IT modernisation & transformation for the client.

Bandhan Bank: The lender has received binding bids of Rs.369.20 crore for a written-off portfolio worth Rs 2,614.03 crore and Rs. 370.62 crore for NPA originating from banking units worth Rs 2,316.32 crore on security receipt consideration basis for transferring loans to asset reconstruction company.

Samvardhana Motherson International: The company has acquired remaining 50% stake of Fritzmeier Motherson Cabin Engineering from F Holdings GmbH, Austria.

SBI Cards and Payment Services: The company has declared an interim dividend of Rs 2.5 per equity for the current financial year 2022-23. The company has fixed March 29 as the record date.

Devyani International: Franklin Templeton Fund has bought about 0.5% stake in Devyani International through a block deal on Tuesday. Franklin’s India Flexi Cap Fund has bought about 62 lakh shares in open market transaction for Rs 89 crore. The deal was executed at an average price of Rs 145 per share. Meanwhile, Singapore’s Temasek Holdings, through its subsidiary Dunearn Investment Mauritius, has sold 2.85% equity or 3.4 crore shares in the company for Rs 499 crore. Temasek has held 5.88% in the company, as of end of December quarter.

Lupin: The pharmaceuticals firm said it has received approval from the USFDA for its generic Brexpiprazole tablets used to treat the symptoms of schizophrenia and depression. These are generic equivalent of Rexulti tablets of Otsuka Pharmaceutical Company Ltd, it added. The tablets had an estimated annual sales of $1,575 million in the US, as per IQVIA MAT December 2022 data.

Ashiana Housing: The company has crossed its annual booking value guidance of Rs 1,100 crore for FY2022-23. The total booking value for FY23 (up to March 20) stood at Rs 1,278.84 crore with a booking area of 25.21 lakh square feet. Further, it has also received 351 expressions of interest (EOIs) in phase 2 of ‘Ashiana Amarah’ project at Gurugram (Haryana), which consists of 224 units with a saleable area of 3.77 lakh square feet and the tentative sale value stood at Rs 290 crore. The conversion of EOI into booking will commence in April 2023.

Cholamandalam Investment and Finance Company: The company’s board has appointed Ajay Bhatia as the Chief Risk Officer (CRO) of the company for three years effective April 1, 2023, in place of Shankar Subramanian, who will complete his term as CRO on March 31.

Emami: The board of directors will meet on March 24 to consider a proposal for buyback of equity shares of the company.

Zydus Lifesciences: Zydus has received final approval for Tofacitinib tablets, 5 mg and tentative approval for Tofacitinib tablets, 10 mg from the United States Food and Drug Administration (USFDA). Zydus was one of the first ANDA applicants to submit a substantially complete ANDA with a paragraph IV certification for Tofacitinib tablets, 5 mg and therefore is eligible for 180 days of shared generic drug exclusivity. Tofacitinib is indicated for the treatment of adult patients with moderately to severely active rheumatoid arthritis and for the treatment of adult patients with active psoriatic arthritis.

H G Infra Engineering: The company has been declared the lowest bidder by DYCE-C-CNB-Engineering/North Central Railway for the redevelopment of Kanpur Central railway station at Kanpur on engineering, procurement and construction mode in Uttar Pradesh. The project bid cost is Rs 677 crore and the construction period for said project is 36 months.

B L Kashyap and Sons: The civil engineering and construction company has secured a new order from domestic unrelated client ‘Railways Land Development Authority’ worth Rs 313 crore. The project includes the development of Bijwasan railway station, which is expected to be completed within 15 months from the date of award. The company’s total order book as on date stands at Rs 2,402 crore.