Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.13% at 19526.5, signalling that Dalal Street was headed for positive start on Thursday.

Asian markets were mixed as investors bet on the end of rate hike cycle. However, Chinese markets were down as the country slipped into deflation after consumer prices in China fell more than expected for October. The Nikkei 225 index rose 0.9% and the Topix advanced 0.5%. The Hang Seng fell 0.49% and the CSI 300 index dropped 0.21%.

The Indian rupee closed flat at 83.28 against the US dollar on Wednesday.

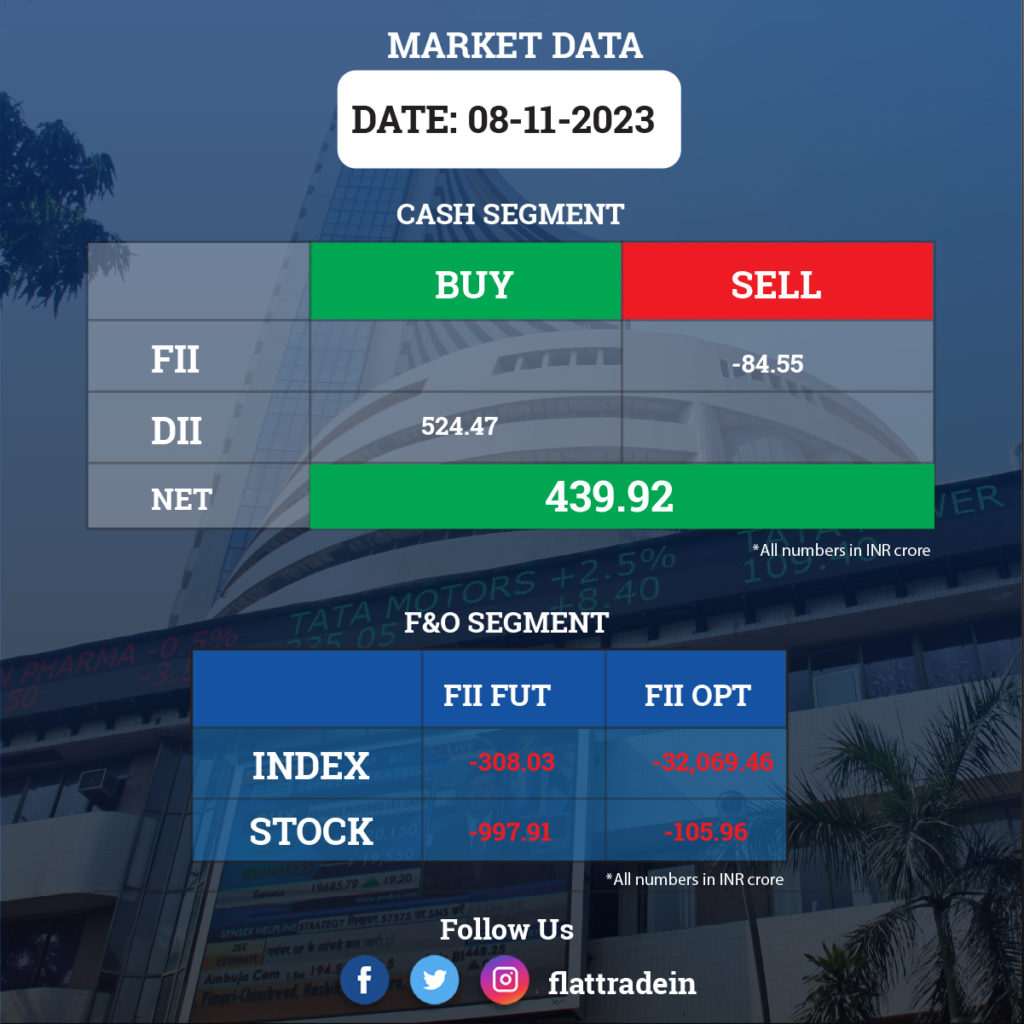

FII/DII Trading Data

Stocks in News Today

Tata Power: The company reported a 7% YoY increase in its consolidated net profit at Rs 876 crore for the quarter ended September 2023 as against Rs 819 crore in the same period last year. Its Ebitda stood at Rs 3,090 crore in Q2FY24, 76% YoY rise from Rs 1,759 in Q2FY23, while margins improved to 19.6% during the reported quarter. Revenue from operations jumped 12% to Rs 15,738 crore in Q2FY24 from Rs 14,031 crore in Q2FY23. The revenue growth was on the back of higher revenue from core businesses of generation, transmission and distribution.

United Spirits: The liquor manufacturer reported a consolidated net profit of Rs 339.3 crore in Q2FY24 as against a net profit of Rs 547.7 crore in Q2FY23. Its revenue from operations was Rs 6,736.5 crore in Q2FY24, as against Rs 8,282.7 crore reported in the same period of the previous fiscal. Its total expenses in the September 2023 quarter stood at Rs 6,361.3 crore. Its board has approved the payment of an interim dividend of Rs 4 per equity share of having a face value Rs 2 each for FY24.

Power Finance Corporation (PFC): The state-owned company posted a nearly 27% rise in its consolidated net profit at Rs 6,628.17 crore in Q2FY24 as against a consolidated net profit of Rs 5,229.33 crore in the year-ago period. Total income rose to Rs 22,403.69 crore in the quarter under review from Rs 19,344.39 crore in the same period a year ago. The company’s consolidated loan asset book stood at Rs 9,23,724 crore as of September 2023 quarter as against Rs 7,71,119 crores in the year-ago period, up 20%. Its Net NPA fell to 0.98% at the end of September 2023 from 1.27% at end of September 2022 quarter. The company’s board declared an interim dividend of Rs 4.50 per share.

Bata India: The footwear company recorded a decline of 38% in consolidated net profit at Rs 33.9 crore in Q2FY24, compared to Rs 54.8 crore in the corresponding period last fiscal. Its revenue from operations stood at Rs 819 crore in Q2FY24, a drop of 1.3% from Rs 829.7 crore in the year-ago period. Ebitda during the reported quarter stood at Rs 181.6 crore, a growth of 12.9% from Rs 160.9 crore in the year-ago period, while margin stood at 22.2% up 280 basis points (bps) year-on-year.

Patanjali Foods: The company’s net profit more than doubled year-on-year (YoY) to Rs 255 crore for the quarter ended September 2023. Revenue from operations declined 8% YoY to Rs 7,822 crore. The rise in the net profit driven by other income, which rose to Rs 24 crore from Rs 10.5 crore a year ago. Ebitda doubled year-on-year to Rs 395 crore in Q2FY24, while operating margin expanded by 276 basis points to 5.05%. Total expenses were Rs 7,511 crore in the quarter under, compared to Rs 8,371 crore a year ago. Raw material expenses dropped to Rs 5,145 crore during the quarter, from Rs 6,712 crore a year ago, and aided the expansion in the profitability.

Pidilite Industries: The adhesives manufacturer reported a 36% YoY rise in consolidated profit at Rs 458.5 crore for the quarter ended September FY24, driven by strong operating performance and decline in input cost. Revenue from operations increased by 2.2% YoY to Rs 3,076 crore for the quarter with domestic consumer volume growth at 8% during the quarter under review.

Oil India: The state-owned company said its consolidated revenue was up 37.6% to Rs 7,496 crore in Q2FY24 from Rs 6,209 crore in Q2FY23. Consolidated Ebitda jumped 54.7% to Rs 3,523 crore in Q2FY24 from Rs 2,277 crore in Q2FY23. The company’s net profit fell 54.3% at Rs 640 crore in Q2FY24 from Rs 1,399 crore in Q2FY23 as it incurred a one-time loss of Rs 2,366.84 crore in the reported quarter.

Biocon: The company’s subsidiary, Biocon Biologics, has entered into a definitive agreement with Eris Lifesciences for the divesture of its dermatology and nephrology branded formulations business units in India, on a slump sale basis for a consideration of Rs 366 crore.

Lupin: The drugmaker reported a consolidated revenue from operations of Rs 5038.6 crore in Q2FY24, up 21.54% from Rs 4,145.5 crore in Q2FY23. Its Ebitda was up 102.51% at Rs 917.8 crore in Q2FY24 from Rs 453.2 crore in Q2FY23. Its consolidated net profit jumped 277.56% to Rs 489.7 crore in Q2FY24 from Rs 129.7 crore in Q2FY23.

Welspun: The company recorded a consolidated revenue from operations of Rs 4,059.5 crore in Q2FY24 as against Rs 1,963.8 crore in Q2FY23. Its Ebitda stood at Rs 399.6 crore in Q2FY24 as against Ebitda loss of Rs 131.2 crore in Q2FY23. Its net profit stood at Rs 386.6 crore in Q2FY24 as against a net loss of Rs 63.2 crore in Q2FY23.

Ashoka Buildcon: The infrastructure company said its consolidated revenue grew 19.2% to Rs 2,154.3 crore in Q2FY24 from Rs 1,807.7 crore in Q2FY23. Its Ebitda was up 27.1% at Rs 545.9 crore in Q2FY24 as against Rs 429.5 crore in Q2FY23. Consolidated net profit jumped 81.12% to Rs 119 crore in Q2FY24 from Rs 65.7 crore in Q2FY23.

BHEL: The company said that its revenue from operation fell 1.5% to Rs 5,125.3 crore in Q2FY24 from Rs 5,202.6 crore in Q2FY23. Its Ebitda loss stood at Rs 387.7 crore in Q2FY24 as against Ebitda loss of Rs 243.9 crore in Q2FY23. Its net loss was at Rs 238.12 crore in Q2FY24 as against a net profit of Rs 12.1 crore in Q2FY23.

PI Industries: The company reported a 43.5% YoY rise in net profit at RS 480.5 crore in Q2FY24 as against a net profit of Rs 335 crore in Q2FY23. The company’s revenue from operations increased 19.6% to Rs 2,117 crore from Rs 1,770 crore in the corresponding period of the preceding fiscal. Ebitda jumped 27.7% to Rs 551.5 crore in Q2FY24 from Rs 431.9 crore in Q2FY23. Ebitda margin stood at 26.1% in the quarter under review as against 24.4% in the year-ago period. PI Industries reported 22% growth in agro-chemical exports driven by volume growth of 21% during the reported quarter.

Mazagon Dock Shipbuilders: The state-owned shipbuilding company has registered 55.6% YoY growth in consolidated net profit at Rs 333 crore in Q2FY24, driven by other income and strong operating numbers. Consolidated revenue from operations increased by 7.4% YoY to Rs 1,827.7 crore in Q2FY24.

Birla Corporation: The company said its revenue from operations rose 14% to Rs 2,286 crore in Q2FY24 from Rs 2,000 crore in Q2FY23. Its Ebitda jumped to Rs 288 crore in Q2FY24 from Rs 94 crore in Q2FY23. The company’s consolidated net profit stood at Rs 58.4 crore in Q2FY24 as against a net loss of Rs 56.5 crore in Q2FY23.

CAMS: The company reported a 17.1% rise in net profit to Rs 84.51 crore in Q2FY24 as against Rs 72.14 crore in the year-ago period. Its revenues from operation during July-September 2023 rose 13.5% to Rs 275.08 crore in Q2FY24, from Rs 242.37 crore in the year-ago period. The company’s overall assets under service touched a life-time high of Rs 32.6 lakh crore and its market share was at 68.5%. The company’s board of directors has recommended an interim dividend of Rs 10 per equity share.