Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.36% higher at 18,984.50, signalling a positive start for Dalal Street.

Asian shares were trading higher following a sharp rally on Wall Street after Federal Reserve Chair Jerome Powell hinted at a slowdown in the pace of rate hikes. The Nikkei 225 index rose 1.11% and the Topix index gained 0.20%. The Hang Seng index jumped 1.70% and the CSI 300 index climbed 1.66%.

Indian rupee strengthened by 30 paise to 81.42 against the US dollar on Wednesday.

India’s gross domestic product (GDP) grew by 6.3 per cent in the second quarter of the current fiscal, official data released on Wednesday showed. The gross domestic product (GDP) had expanded by 8.4 per cent in the July-September quarter of 2021-22, according to data released by the National Statistical Office (NSO).

India’s core sector growth slowed down to 0.1 per cent in October 2023 against 8.7 per cent in the same month last year, according to the official data released on Wednesday. In September, the core sectors’ output growth stood at 7.8 per cent. The production growth of eight infrastructure sectors, coal, crude oil, natural gas, refinery products, fertiliser, steel, cement and electricity, was 8.2 per cent during April-October this fiscal, compared to 15.6 per cent a year ago.

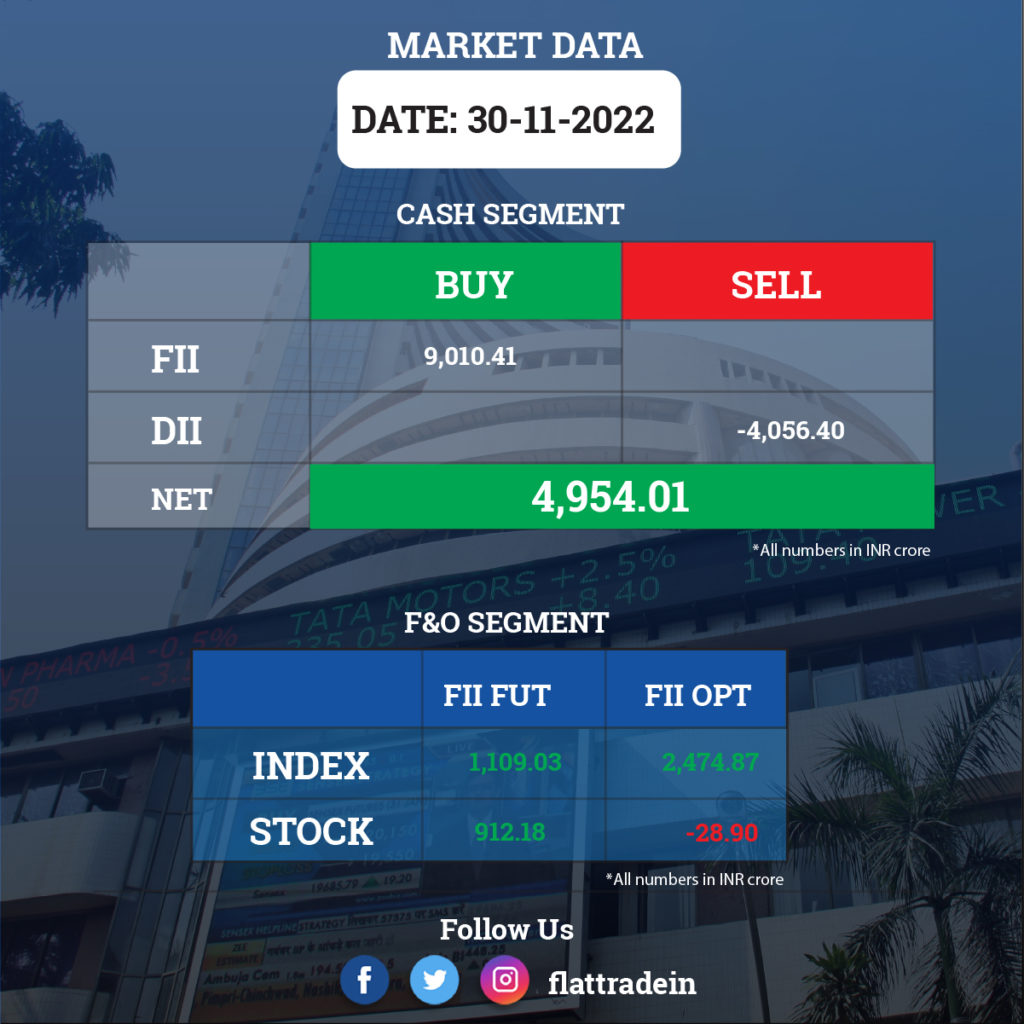

FII/DII Trading Data

Stocks in News Today

Tata Consultancy Services (TCS): The IT major said that it has bagged a deal from Rail Delivery Group (RDG) to design, develop, implement, and operate the UK’s Rail Data Marketplace. The contract between TCS and RDG is for six years including an extension term opportunity. “Built on TCS Dexam, the Rail Data Marketplace will provide data relating to the rail industry and also present adjacent data sources important to passengers and operators and help deliver an improved experience for users.

Apollo Hospitals Enterprises: The hospital chain operator has received board approval for fund raising up to Rs 105 crore via non-convertible debentures (NCDs). The company will issue 1,050 NCDs with a face value of Rs 10 lakh each.

Punjab National Bank (PNB): The public sector lender said that with effect from December 1, 2022, its MCLR (Marginal Cost of Funds Based Landing Rate) will increase by 5 bps. According to its stock exchange filing, the bank increased MCLR across all tenors by 5 bps. The overnight MCLR has been hiked from 7.40% to 7.45%, 1-month MCLR hiked from 7.45% to 7.50%, the three-month MCLR hiked from 7.55% to 7.60%, six-month MCLR hiked to 7.75% to 7.80%, 1-year MCLR goes up from 8.05% to 8.10% and 3-year MCLR goes up from 8.35% to 8.40%.

TVS Motor Company: Government of Singapore Investment Corporation Pte Ltd A/C C Account bought 24.69 lakh shares in the two-wheeler maker at an average price of Rs 1,047.81 apiece. Meanwhile, Integrated Core Strategies (Asia) Pte Ltd sold 39.77 lakh shares at an average price of Rs 1,046.69 per share.

Zomato: Foreign investor Alipay Singapore Holding has offloaded 26.28 crore shares in the food delivery giant at an average price of Rs 62.06 per share, which was worth Rs 1,631.4 crore. It held 6.7% stake or 55.89 crore shares in Zomato as of September 2022. Meanwhile, Camas Investments, the subsidiary of Singapore-based sovereign wealth fund Temasek, picked 9.8 crore shares in the company at an average price of Rs 62 apiece.

Tamilnad Mercantile Bank: The Reserve Bank of India (RBI) has authorised the bank to undertake government business on behalf of the central bank. The agreement has been signed by the bank with the RBI for appointing Tamilnad Mercantile Bank as an agency bank of the RBI for undertaking government agency business.

KPI Green Energy: The board has recommended to issue bonus shares in the ratio of one bonus equity share against one existing equity share. This is subject to the approval of the shareholders.

Wipro: The IT services company has launched Wipro Data Intelligence Suite running on Amazon Web Services (AWS). The Suite offers reliable and secure means to migrate from existing platforms and fragmented legacy systems to the cloud.