Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.18% at 20,182, signaling that Dalal Street was headed for positive start on Thursday.

Japanese shares were trading higher as investors were relieved that the US inflation was in line with consensus and the Fed may pause rate hikes. The Nikkei 225 index jumped 1.05% and the Topix gained 0.69%. Meanwhile, Chinese markets were down with the Hang Seng falling 0.41% and the CSI 300 index losing 0.23%.

The Indian rupee fell by 5 paise to 82.98 against the US dollar on Wednesday.

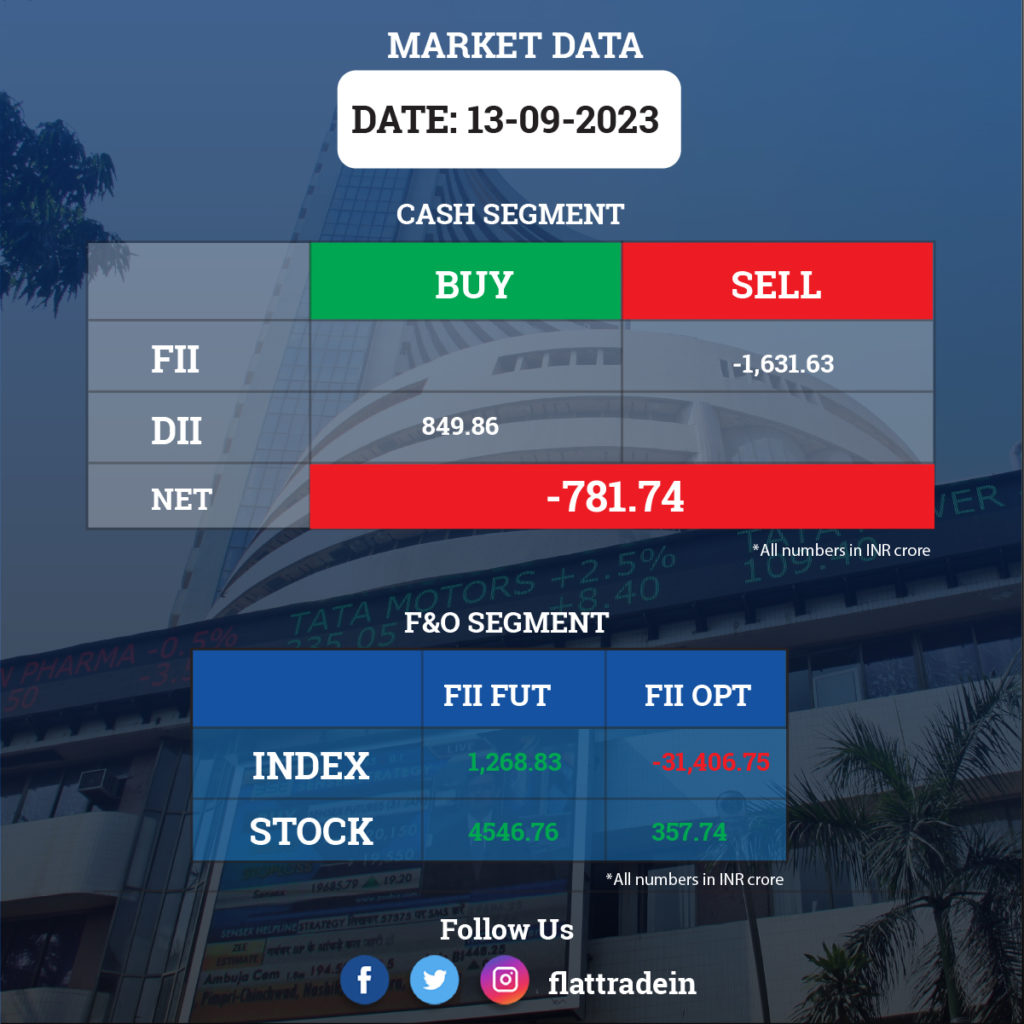

FII/DII Trading Data

Stocks in News Today

Wipro: The IT services company launched its Cyber Defense Center (CDC) in Dusseldorf, Germany. Wipro’s CDCs will use Microsoft’s portfolio of cybersecurity products to provide localised support and fulfil customers’ cybersecurity and compliance requirements.

Adani Enterprises: The company said Adani Wind’s 5.2 MW wind turbine generator, which is India’s largest turbine, has received type certification from WindGuard GmbH. The certification enables Adani Wind to start series production for global markets.

Bank of India: The public sector lender announced that it has raised Basel III compliant Tier II bonds of Rs 2,000 crore at 7.88% per annum. The lender said the funds will be used for regular business activities and it is not meant for financing any particular project.

Bombay Dyeing: The company has agreed to sell 22 acres in Mumbai’s Worli to Goisu Realty for Rs 5,200 crore in a bid to repay debt and fund future projects. Upon shareholders’ approval, the transaction will happen in two phases. Goisu Realty is a subsidiary of Japan-based developer Sumitomo Realty & Development Co.

Aditya Birla Fashion and Retail: The company’s premium fashion brand Louis Philippe announced its foray in the Middle East with the opening of a new outlet in the UAE. The company plans to increase its retail footprint by launching several additional outlets for its brands throughout the Middle East in the near future.

Suven Pharmaceuticals: The government has given approval up to Rs 9,589 crore in foreign investment in the drugmaker. The approval is for the acquisition of up to 76.1% of the company by Cyprus-based Berhyanda.

NBCC (India): The state-owned company has signed an MoU with the Central Government, Rashtriya Ispat Nigam (RINL) and National Land Monetization Corporation (NLMC) for monetization of the non-core assets of RINL at Vishakhapatnam. Under the MoU, NBCC would act as technical-cum-transaction advisor and assist the Ministry of Steel (MoS), RINL and NLMC in monetization of non-core assets of RINL available at Vishakhapatnam.

Lloyds Steels Industries: The company has signed a deal with Bhabha Atomic Research Centre for the transfer of technology for Multi Effect Distillation with Thermo Vapour Compression (MEDTVC) desalination. The licence will help the company to execute orders related to desalination and the license will be valid for five years.

KPI Green Energy: The company has commissioned a 7.80 MW wind-solar hybrid power project, which comprises 4.20 MW of wind and 3.60 MWdc solar capacity, through its wholly owned subsidiary KPIG Energia for Mono Steel India.

Bajaj Healthcare: The company has received the Establishment Inspection Report from the US drug regualtor for pre-approval inspection at its Vadodara plant with zero 483 observations.

IRCTC: The state-run company has signed a Memorandum of Understanding (MOU) with Maharashtra State Road Transport Corporation (MSTRC) to enable MSRTC’s online bus booking services through IRCTC’s website.

Venus Remedies: The company announced its recent registration with the Department of Scientific and Industrial Research (DSIR) that will help the company to avail customs duty exemptions.

Vinati Organics: The company has subscribed to the additional 1,11,60,000 fully paid-up equity shares of face value of Rs 10 each, amounting to Rs 11,16,00,000 via subscription towards the rights issue of Veeral Organics, a wholly owned subsidiary.