Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.2% lower at 19,644, signalling that Dalal Street was headed for negative start on Tuesday.

Japan’s markets were trading higher with the Nikkei 225 index rising 0.32% and the Topix gaining 0.31%. Chinese stock markets were trading mixed as investors were cautious ahead of trade and inflation data from China. The CSI 300 index rose 0.14%, the Hang Seng dropped 1.08% and the Shanghai Composite was flat.

The Indian rupee rose 10 paise to 82.75 against the US dollar on Monday.

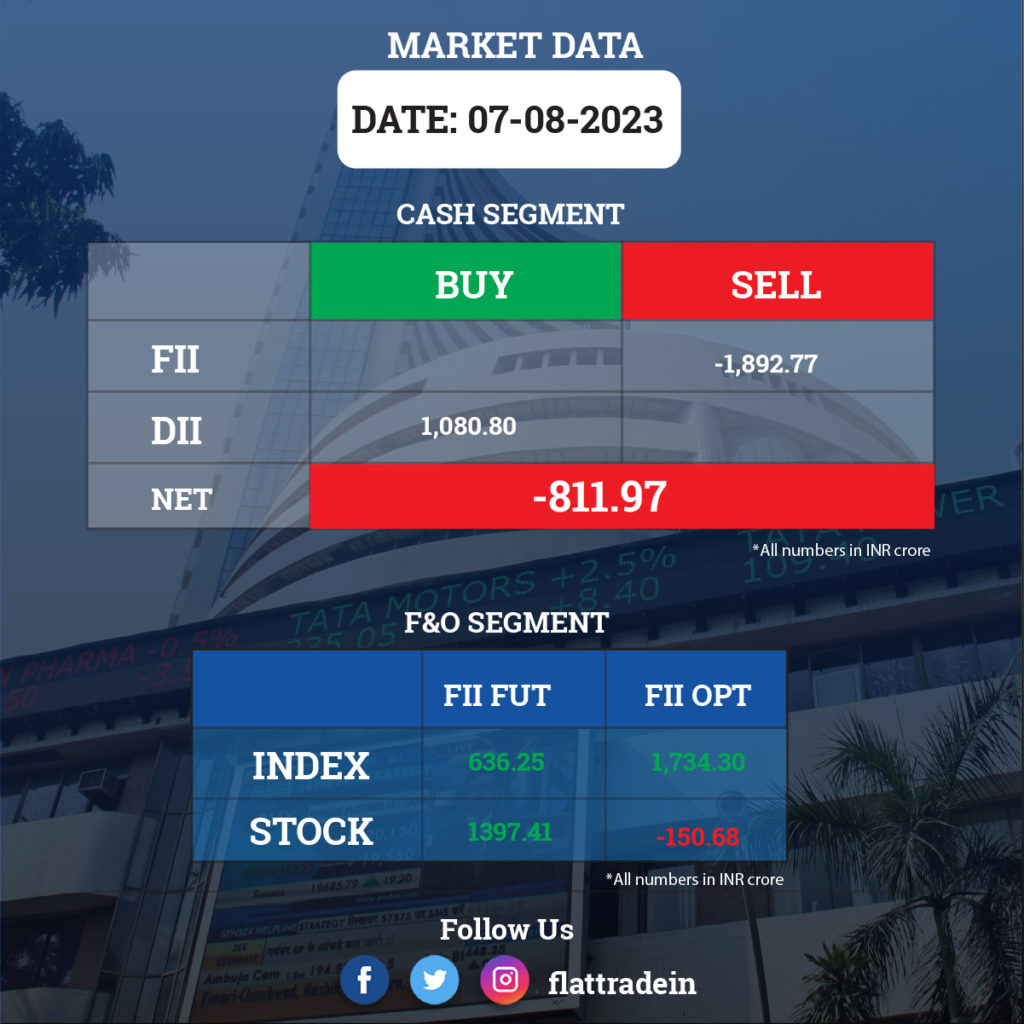

FII/DII Trading Data

Stocks in News Today

Adani Green Energy: Qatar Investment Authority bought a 2.7% stake in the company for about 39.2 billion rupees ($474 million) through a block deal on Monday, stock exchange data showed. INQ Holding, a unit of Qatar’s sovereign fund, bought more than 42.6 million shares at 920 rupees each. Infinite Trade and Investment sold 44.9 million shares Monday, BSE data showed.

Tata Chemicals: The company has registered a consolidated profit at Rs 523 crore for the quarter ended June FY24, down 11.8% compared to the corresponding period last fiscal. Revenue from operations grew by 5.6% year-on-year to Rs 4,218 crore in Q1FY24 from Rs 3,995 crore in the year-ago period. Ebitda was up 3% at Rs 1,043 crore in Q1FY24 as against Rs 1,015 crore in Q1FY23.

Godrej Consumer Products: The FMCG company has recorded a consolidated profit of Rs 318.8 crore for the quarter ended June FY24, falling 7.6% compared to the year-ago period due to an exceptional loss of Rs 81.78 crore related to the acquisition of Raymond Consumer Care Business and various restructuring costs. Revenue from operations grew by 10.4% YoY to Rs 3,449 crore compared to the year-ago period, and volume growth stood at 10% YoY.

Torrent Pharmaceuticals: The pharma company has reported a consolidated net profit at Rs 378 crore for June FY24 quarter, rising 6.8% over a year-ago period, driven by topline and operating numbers. Consolidated revenue from operations grew by 10.4% YoY to Rs 2,591 crore during the reported quarter from Rs 2,347 crore in the year-ago period. Its India business rose 15% YoY to Rs 1,426 crore, while the US business dropped 2% to Rs 293 crore during the same period.

Max Healthcare: The company’s consolidated revenue was up 17% at Rs 1,629 crore in Q1FY24 as against Rs 1,393 crore in Q1FY23. Net profit was up 27% at Rs 291 crore in Q1FY24 as against Rs 229 crore in Q1FY23. Ebitda rose 18% at Rs 436 crore in Q1FY24 as against Rs 370 crore in Q1FY23.

Sobha: The company’s consolidated net profit stood at Rs 12 crore in Q1FY24 as against Rs 4.5 crore in Q1FY23. Consolidated revenue was up 61% YoY at Rs 908 crore in Q1FY24 as against 564.6 crore in Q1FY23. Ebitda fell 10% YoY to Rs 65 crore in Q1FY24 as against Rs 72.6 crore in Q1FY23.

Bayer CropScience: The company’s revenue rose 4.33% at Rs 1739.6 crore in Q1FY24 from Rs 1667.4 crore in Q1FY23. Net profit rose 8.55% YoY to Rs 328.5 crore in Q1FY24 from Rs 302.6 crore in Q1FY23.

Emami: The FMCG company said its consolidated revenue grew 7% to Rs 825.66 crore in Q1FY24 from Rs 773.31 crore in Q1FY23. Consolidated net profit rose 88% to Rs 136.75 crore in Q1FY24 as against Rs 72.69 crore in Q1FY23. Ebitda climbed 10% to Rs 190.01 crore in Q1FY24 from Rs 173.32 crore in the year-ago period.

Medplus Health Services: The company posted a revenue of Rs 1,284.30 crore in Q1FY24, up 29.2% from Rs 993.65 crore in Q1FY23. Ebitda was up 35.5% to Rs 71.34 crore in Q1FY24 as against Rs 52.64 crore in Q1FY23. Consoldated net profit rose 2.3% to Rs 37.65 crore in Q1FY24 from Rs 36.79 crore in Q1FY23.

Gland Pharma: The pharmaceutical company reported a consolidated net profit of Rs 194.1 crore for the first quarter of FY24, down 15% YoY period due to weak operating margin. Revenue grew by 41% year-on-year to Rs 1,208.7 crore during the same period led by Europe and the Rest of the World businesses. Ebitda was up 9% to Rs 294 crore in the reported quarter from Rs 270 crore in the corresponding quarter of last fiscal.

RailTel Corporation of India: The state-owned railway company has received the work order from Pimpri Chinchwad Smart City (PCSCL) for providing end-to-end services for monetisation of PCSCL city network infrastructure on the revenue sharing model. The estimated annual revenue from the contract is Rs 70 crore and the total revenue for 10 years is Rs 700 crore.

PB Fintech: The Policybazaar operator has reported a loss of Rs 12 crore for the quarter ended June FY24, narrowing from a loss of Rs 204 crore in the same period last year on strong topline and operating performance. Revenue from operations at Rs 666 crore for the quarter increased by 32% over a year-ago period.

Indigo Paints: The company’s revenue was up 28.8% at Rs 288.42 crore in Q1FY24 from Rs 223.99 crore in Q1FY23. Ebitda was up 39.2% at Rs 49.11 crore in the reported quarter as against Rs 35.28 crore in the year-ago period. Consolidated net profit was up 58.3% at Rs 31.52 crore in Q1FY24 as against Rs 19.91 crore in Q1FY23.

Mangalore Chemicals & Fertilizers: The company recorded a consolidated net profit of Rs 49.29 crore in Q1FY24, up 116.2% from Rs 22.80 crore in Q1FY23. Consolidated revenue was down 6.2% at Rs 958.03 crore in Q1FY24 as against Rs 1,021.29 crore in Q1FY23. Ebitda rose 84.8% at Rs 116.31 crore in Q1FY24 from Rs 62.94 crore in Q1FY23.

Olectra Greentech: The company posted a consolidated revenue of Rs 216 crore in Q1FY24, down 23% from Rs 281 crore in Q1FY23. Consolidated net profit rose 8% to Rs 18.1 crore in Q1FY24 from Rs 16.7 crore in Q1FY23. Ebitda jumped 16% to Rs 42 crore in the quarter under review from Rs 36 crore in the corresponding quarter last fiscal.

BEML: The company secured a letter of acceptance from Bangalore Metro Rail Corporation for supply of rolling stock contract 5RS-DM valued at Rs 3,177 crore.

One 97 Communications: PWC India has resigned as auditor of Paytm Payments Services. The development comes after August 2 letter by One 97 Communications which cited change in auditor at holding company level.

Gravita India: The company announced that ‘pure lead’ of 99.98 % purity and above produced by the company from its Phagi, Jaipur plant has been empaneled as approved ‘Lead Brands’ deliverable against MCX lead futures contract.

Welspun Specialty Solutions: The company has received orders for Rs 37 crore for supply of stainless steel bars from a domestic customer and the said order is expected to be executed by the end of October 2023.

Gokaldas Exports: The board approved the re-appointment of Sivaramakrishnan Ganapathi as the vice chairman and managing director for a term of five years with effect from Oct. 3.

MMTC: SEBI has cancelled the registration of MMTC as a stockbroker for its involvement in an illegal “paired contract”. The case pertained to the defunct National Spot Exchange Limited.