Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.38% lower at 17,372, signalling that Dalal Street was headed for negative start on Monday.

Asian markets were mixed on Monday as investors were concerned that the failure of California-based Silicon Valley Bank might have ripple effects around the world. Japan’s benchmark Nikkei 225 fell 1.56% and Topix plunged 2.02%. Meanwhile, CSI 300 index rose 0.64% and the Hang Seng index jumped 1.46%.

Indian rupee weakened by 6 paise to close at 82.04 against the US dollar on Friday (10 March 2023).

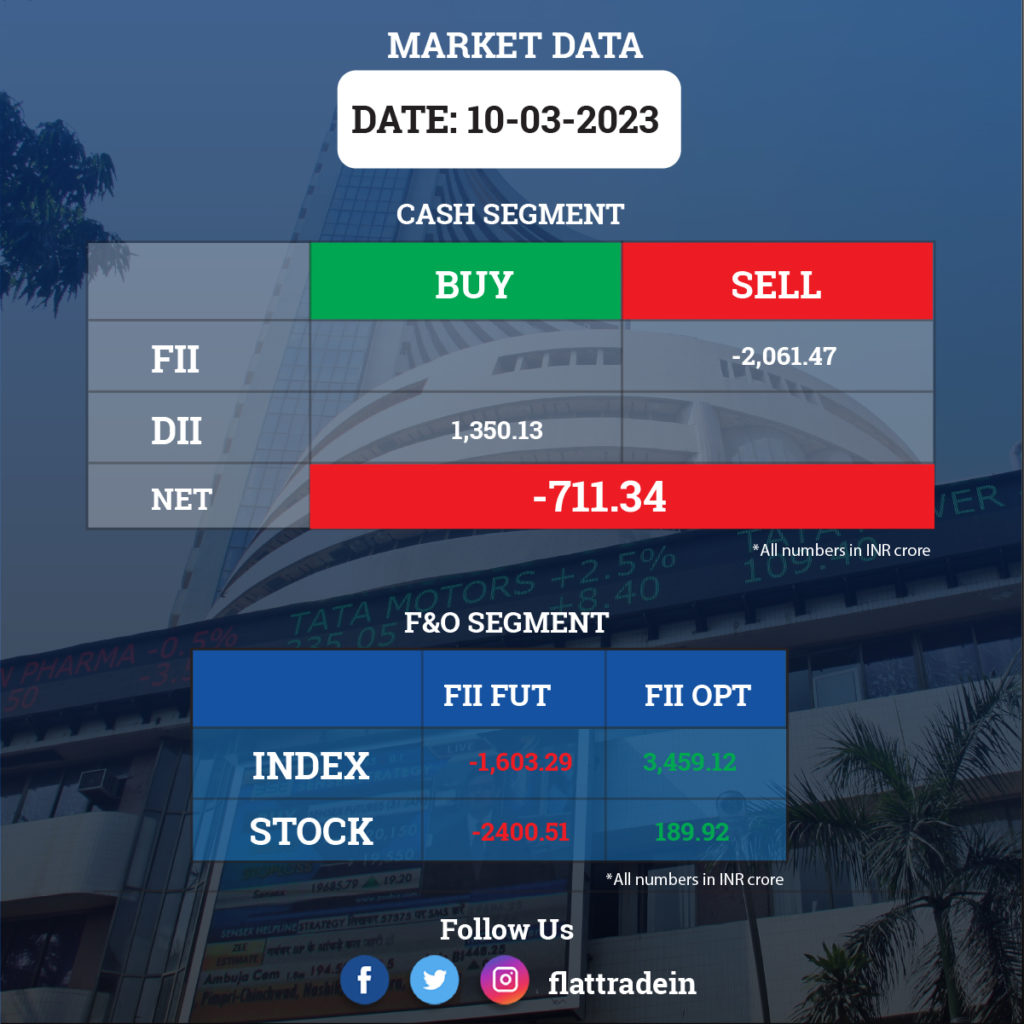

FII/DII Trading Data

Stocks in News Today

Adani Group: The group said that it has completed full prepayment of margin linked share-backed financing totalling $2.15 billion, before committed timeline of March 31, 2023. In addition to above, promoters have also prepaid $500 million facility taken for Ambuja acquisition financing. “This is in line with promoters’ commitment to increase equity contribution and promoters have now infused $2.6 billion out of total acquisition value of $6.6 billion for Ambuja and ACC,” the Gautam Adani-led conglomerate stated.

Meanwhile, Gautam Adani is seeking to sell a stake in Ambuja Cements worth about $450 million, as part of efforts to reduce debt and restore investor confidence in his conglomerate, a Financial Times report reported citing three company sources, who are privy to the development. Adani owns 63% stake in Ambuja Cements. The report said Adani issued a formal request to global lenders for selling 4% to 5% stake in the cement business.

ICICI Bank: The private sector lender has received approval from the Reserve Bank of India for extension of time till September 9, 2024 for divesting its shareholding in ICICI Lombard General Insurance Company to less than 30%. ICICI Bank holds 48.02% stake in ICICI Lombard General Insurance Company as of December 2022.

Godrej Industries: The company’s board has given its approval for issuance of one lakh non-convertible debentures with a face value of Rs 1 lakh each, amounting to Rs 1,000 crore on a private placement basis.

Mahindra & Mahindra (M&M): The auto major is likely to sell 4.6% stake in automotive component supplier Mahindra CIE Automotive at a floor price of Rs 355 per share, CNBC-TV 18 reported citing sources. The base size of the block deal is likely to be at Rs 615 crore with a 60-day lock up period on further sale of shares, the sources added. In September 2022, M&M had sold a 2.17% stake in Mahindra CIE for Rs 285 per share. Following the sale, the shareholding of the company in Mahindra CIE declined from 11.42% to 9.25% of its share capital.

Hindustan Aeronautics (HAL): The state-owned company has signed a Rs 667-crore contract to supply 6 Dornier-228 aircraft to the Indian Air Force.

IndusInd Bank: The Reserve Bank of India has approved the re-appointment of Sumant Kathpalia as Managing Director and CEO of the bank for two more years with effect from March 24, 2023.

Piramal Enterprises: The company has raised Rs 100 crore via non-convertible debentures as its board approved allotment of 10,000 non-convertible debentures with a face value of Rs 1 lakh each on a private placement basis. These NCDs are proposed to be listed on the Debt Segment and Capital Market Segment of National Stock Exchange of India, and BSE Limited.

Dynacons Systems & Solutions: The company has won order worth Rs 26.99 crore for supply of Apple iPad from Mumbai High Court. The scope includes the supply, installation & integration of Apple iPads at 2,400 Judicial officers all over Maharashtra.

JSW Steel: The company’s subsidiary JSW Steel Coated Products has completed the acquisition 31% stake in Ayena Innovation. In January, subsidiary has entered into a shareholders agreement and a share subscription agreement with Ayena Innovation for acquisition of 31% stake.

Elgi Equipments: Elgi Compressors USA Inc, a wholly-owned subsidiary of the company, has entered into an operating agreement for acquisition of 33.33% stake in CS Industrial Services LLC in US. CS Industrial which operates in capital goods industry is yet to commence business operations.

Lumax Auto Technologies: The auto ancillary company has completed the acquisition of 75% shareholding in IAC International Automotive India through its wholly-owned subsidiary Lumax Integrated Ventures. Accordingly, IAC India has become the step-down subsidiary of the company and subsidiary of Lumax Integrated Ventures with immediate effect.

Welspun Corp: The company’s subsidiary, Welspun Metallics, has received multiple export orders of 43 KMT for pig iron across South East Asia and Europe. These orders will be executed within next two months.

Lupin: The USFDA has completed a pre-approval and GMP inspection of Lupin’s API manufacturing facility in Visakhapatnam, India, with no observations. The inspection was conducted during March 6-10, 2023.

Lloyds Metals and Energy: The Indian Government has granted Environmental Clearance and Maharashtra Pollution Control Board has issued Consent to Operate, for the enhanced iron mining capacity of 10 million tonnes per annum, from 3 million tonnes per annum. Company remains confident of mining, handling, and selling the total quantity of 10 MMT iron ore in FY24. In addition, the company has also re-assessed its iron ore reserves in existing mines and preliminary reports suggested reserves of 180+ million tonnes.

Gateway Distriparks: HDFC Mutual Fund through its several schemes has bought additional 2.02% stake in the logistics company via open market transactions on March 8. With this, the fund house increased its stake to 7.1%, up from 5.09% earlier.

Vanta Bioscience: Vayam Research Solutions, an associate of Vanta Bioscience, has cleared the USFDA audit with zero 483s for its facility at Gandhi Nagar in Gujarat. The said approval will help Vayam to enhance customer service portfolio in various segments like pharmaceutical as well as nutraceutical clinical trial and BA/BE studies around the world.

Aster DM Healthcare: The company’s subsidiary, Aster Pharmacies Group LLC, has incorporated joint venture, Aster Arabia Trading Company LLC in Riyadh, KSA (Kingdom of Saudi Arabia). Aster Arabia Trading Company LLC will operate pharmacy chain across the Kingdom of Saudi Arabia to sell pharmaceutical and non-pharmaceutical products within each pharmacy under Aster Pharmacy brand. Aster Pharmacies Group LLC has acquired 48.995% stake in Aster Arabia Trading Company LLC.

Dishman Carbogen Amcis: The active pharmaceutical ingredients manufacturer has raised Rs 100 crore via non-convertible debentures, as it has approved issuance of up to 10,000 non-convertible debentures of face value of Rs 1 lakh each on a private placement basis.

Avantel: The company has received a work order worth Rs 10.48 crore from the Indian Navy and the order is going to be executed by March 9, 2024.