Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.27% lower at 17,471.50, signalling that Dalal Street was headed for a negative start on Thursday.

Most Asian shares were trading lower as technology stocks declined amid investors keeping a keen eye on US inflation. The Nikkei 225 index slipped 0.09% and the broader Topix index fell 0.13%. The Hang Seng dropped 0.63% and the CSI 300 index rose 0.19%.

Indian rupee rose 16 paise to 82.50 against the US dollar on Wednesday.

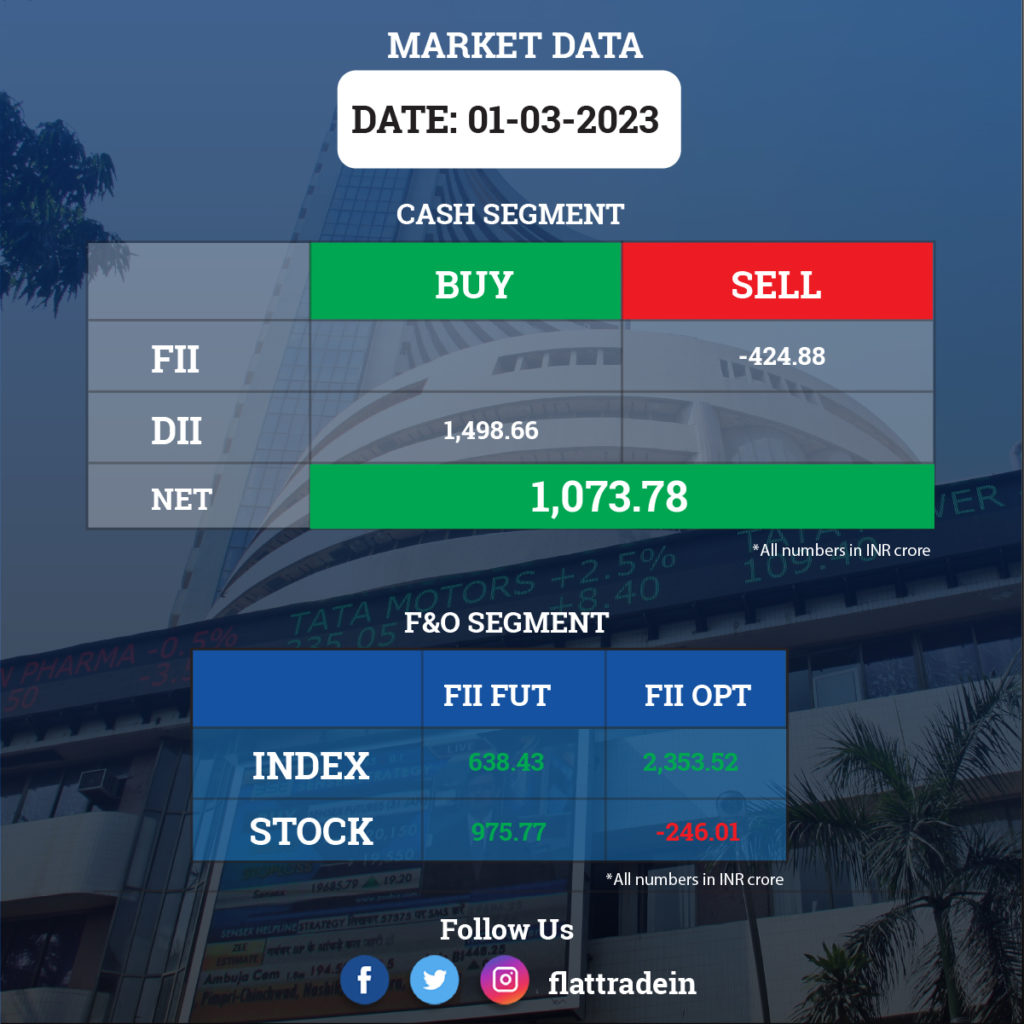

FII/DII Trading Data

Stocks in News Today

Adani Group: The group has denied a report by Reuters which claimed that the debt-ridden Indian conglomerate has secured a $3 billion loan from a sovereign wealth fund. Earlier, Reuters news agency reported that it has learnt from Adani group sources that a $3 billion loan has been secured by the company from a Middle East-based sovereign wealth fund. The BSE had also sought a clarification from the Adani group in response to the news report.

Hindustan Aeronautics (HAL): The Cabinet Committee on Security (CCS) chaired by Prime Minister Narendra Modi approved the procurement of 70 HTT-40 basic trainer aircraft from Hindustan Aeronautics Limited (HAL) for the Indian Air Force at a cost of Rs 6,828.36 crore. The aircraft will be supplied over a period of six years, the ministry of defence said. The procurement decision is expected to open new opportunities for hundreds of MSMEs (micro, small and medium enterprises) and create thousands of jobs.

Bajaj Finserv: The company has secured the final approval from the Securities and Exchange Board of India (SEBI) to foray into the mutual fund (MF) business. The final approval comes more than a year after getting Sebi’s in-principle approval to set up a fund house. Further, Bajaj Finserv Asset Management has also received approval to act as an asset management company for Bajaj Finserv Mutual Fund. In January 2022, Bajaj Finserv hired Canara Robeco MF’s equity head Nimesh Chandan to lead the investment team. The company also roped in Aniruddha Chaudhuri from ICICI Prudential AMC to head the sales team. The company has appointed Ganesh Mohan as the chief executive officer of the AMC

Indian Railway Catering and Tourism Corporation Ltd (IRCTC) and HDFC Bank: The two companies on Wednesday announced a partnership to launch a co-branded travel credit card. The co-branded credit card is in a single variant and will be available on NPCI’s Rupay network. This is the third tie-up of IRCTC after State Bank of India and Bank of Baroda. The card will provide exclusive benefits and maximum savings on bookings of train tickets booked through the IRCTC’s ticketing website and through IRCTC Rail Connect app. The cardholders will enjoy an attractive joining bonus, discounts on bookings and access to the several executive lounges at railway stations across the country.

Hero MotoCorp: The world’s largest manufacturer of two-wheelers sold 3.94 lakh units in February 2023, a 10% growth from 3.58 lakh units sold in the same period last year. The domestic sales volumes increased by 15.3% YoY to 3.82 lakh units but exports fell 55% to 12,143 units in the same period.

Coal India Ltd (CIL): The company has reported a 14.3% growth in its production so far in FY23 at 619.7 million tonne. During the corresponding period (April-February) of FY22, the company produced 542.4 million tonne of the mineral. “Coal India’s (CIL) production of 619.7 million tonnes (MTs) till February in the current financial year posted a strong 14.3% growth over 542.4 MTs of the same period last year. This is 100% achievement against progressive target,” the company said in a statement.

NMDC: The company reported 4% growth in its iron ore production at 4.48 million tonnes (MT) in February 2023 compared to 4.31 MT, a year ago. Sales of iron ore, however, declined by 4.78 per cent to 3.78 MT in February 2023 compared to 3.97 MT in the same month of last year.

ONGC: The Indian government has named Pankaj Kumar as the director (production) of state-run energy major Oil and Natural Gas Corporation Ltd (ONGC). Kumar, who was so far the director (offshore) will take over the newly created post with immediate effect, ONGC said in a regulatory filing. The company also said in its filing that Anurag Sharma ceased to be the Director (Onshore) of the Company with effect from 1 March, on attaining the age of superannuation on 28 February 2023.

TVS Motor: The two- and three-wheeler maker witnessed a 1.97% decline in sales in February with sales of 2,76,150 units. The company had sold 2,81,714 units during the corresponding month of last year. Total two-wheeler sales in February 2023 marginally fell to 2,67,026 units from 2,67,625 units recorded in the same month of last year.

Rail Vikas Nigam: The state-owned railway company has emerged as the lowest bidder for manufacturing cum maintenance of Vande Bharat train sets including up-gradation of the government manufacturing units & trainset depots in a joint venture with three partners. The total quantity is 200 trainsets and the cost per set is Rs 120 crore.

Dreamfolks Services: The largest airport service aggregator platform has received board approval to acquire 60 percent equity shares of Vidsur Golf. Now, Vidsur will become a subsidiary of the company. The company will also incorporate a subsidiary in Singapore.

KNR Constructions: The construction engineering company has received a Letter of Acceptance for the development of six lanes from Marripudi to Somvarappadu of Bengaluru-Vijayawada economic corridor on HAM mode under Bharatmala Pariyojana Phase-1 in Andhra Pradesh. The cost of the project is Rs 665 crore and the completion period of the project is 24 months, while the operation period is 15 years from the commercial operational date.

Eicher Motors: Royal Enfield sold 71,544 motorcycles in February 2023, growing 21% over 59,160 motorcycles sold in the same period last year. Its international business recorded a 1 percent YoY growth by selling 7,108 motorcycles. The growth was largely driven by motorcycles with engine capacity up to 350cc that reported a 31% YoY rise at 64,180 units, but motorcycles with engine capacity over 350cc segment registered a 30 percent YoY decline at 6,734 units.

CreditAccess Grameen: The total income tax demand for AY19 at Rs 2,333 crore has now been reduced to Rs 122.63 crore under the fresh assessment order received from the assessment unit of the Income Tax Department.

Sunteck Realty: The company has leased out around 2 lakh square feet of the built-up area of its premium commercial building ‘Sunteck BKC51’ to Upgrad Education Private Limited for a lease term of 29 years. Suntech said that Upgrad will pay starting rentals of about Rs 300 per square foot per month on a carpet area basis. The total revenue generated from the project will amount close to ₹2,000 crore over the entire lease tenure.

Bharti Airtel: The company’s chairman, Sunil Bharti Mittal, confirmed plans to hike mobile phone call and data rates across all plans in 2023. Mittal said the return on capital in the telecom business is very low and a tariff hike is expected this year.

PVR: The multiplex operator expects a double-digit growth in its topline by FY24, after the merger with Inox Leisure. The management said that the merged entity has plans to add 200 screens per year and tap potential of smaller markets. Besides, some of the properties would have to be upgraded as well.

Marico: The FMCG company moved the National Company Law Tribunal (NCLT) seeking its intervention in admitting its claims as part of Future Retail’s corporate insolvency resolution process. Rishabh Jaisani, the counsel representing the resolution professional (RP), said Marico claimed Rs 22.08 crore, out of which Rs 18.11 crore have been admitted but for the remaining amount of Rs 3.97 crore, which the company claimed as interest, there are no supporting documents.

Lupin: The diagnostics arm of Lupin expanded presence in Southern India, with new regional referance laboratory in Hyderabad. The management expects to open over 200 collection centres in South India by March 2024.

KNR Constructions: The company received letter of acceptance for development of six lane access controlled Greenfield Highway from Marripudi to Somvarappadu Bengaluru-Vijayawada economic corridor on HAM mode.

Welspun Corporation: The company was awarded contract for export of LSAW pipes and bends to Middle East. The contract is for 83,000 MT bare pipes, with an option of coating exercisable by the project owner subsequently.