Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.12% lower at 17,778, signalling that Dalal Street was headed for a marginally lower opening.

Most Asian shares were trading higher amid investors weighing the consequence of faster rate hikes. The Nikkei 225 index was up 0.56% and the Topix gained 0.94%. The Hang Seng rose 0.12% and the CSI 300 index fell 0.21%.

Indian rupee fell 14 paise to 82.05 against the US dollar on Wednesday.

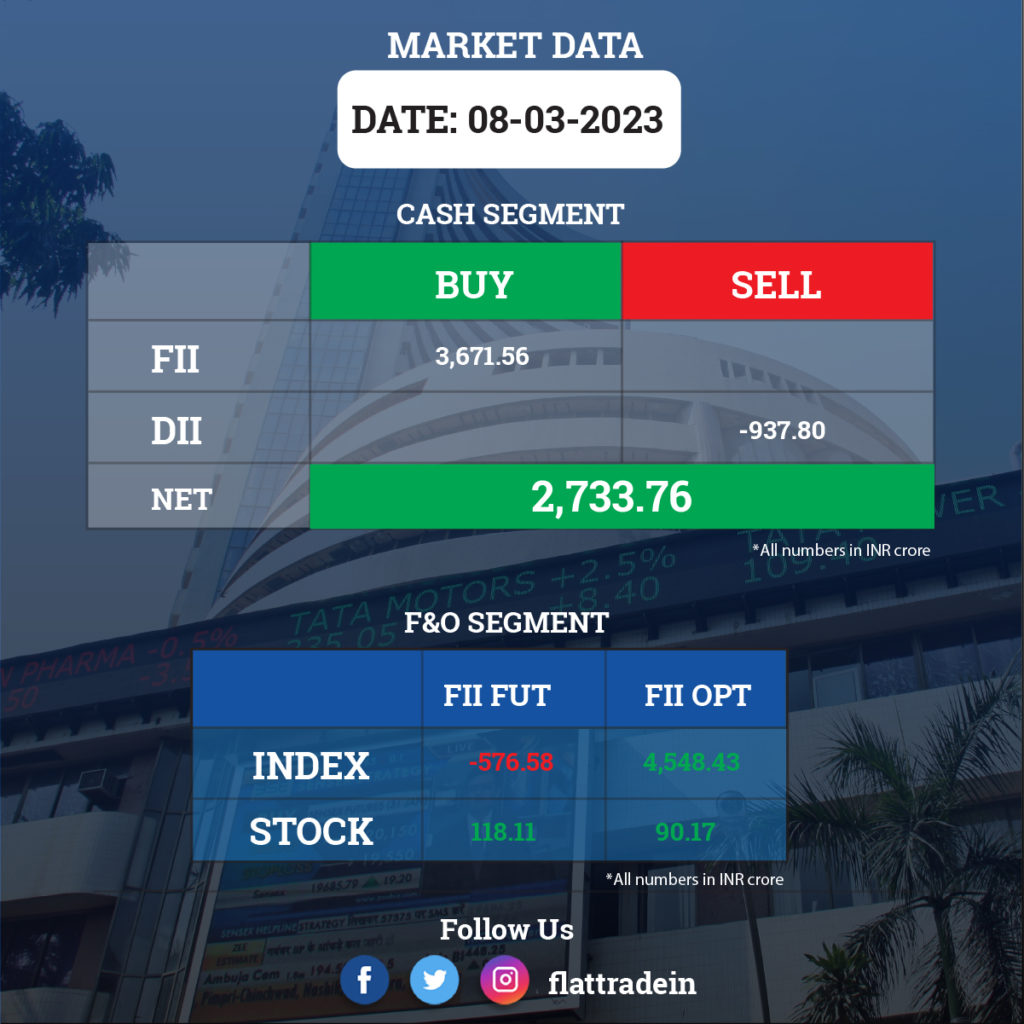

FII/DII Trading Data

Stocks in News Today

Adani Group: The Adani Group has repaid a $500 million bridge loan that was due on Thursday, Bloomberg reported citing people with knowledge of the matter, to restore confidence in its financial health after a scathing report by US-based short seller Hindenberg Research. In recent weeks, the group has pre-paid about $2 billion of share-backed loans, made bond repayments on time and won another $1.9 billion investment from star investor Rajiv Jain of GQG Partners.

Bharat Forge: The leading forging company has announced its E-bike manufacturing facility at MIDC Chakan, Pune, through its wholly-owned subsidiary Kalyani Powertrain. The facility has a production capacity of 60,000 units per annum and scalable to 1 lakh units per annum, will undertake assembly of E-bikes for Tork Motors, wherein 64.29% owned by Kalyani Powertrain.

SeQuent Scientific: The company has terminated the share purchase agreement to acquire 100% shareholding in Tineta Pharma. Earlier, in November 2022, it had announced acquisition of Tineta Pharma, but now the said transaction has not materialised. Therefore, the company will not acquire Tineta and the Share Purchase Agreement entered by the company with Tineta and its promoters stands terminated.

Shoppers Stop: Singapore-based Shiseido Asia Pacific Pte Ltd has signed a strategic distribution partnership agreement with Global SS Beauty Brands, a subsidiary of Shoppers Stop, to expand its brand footprint in India. Through the partnership, Shiseido Group will launch its global make-up brand, NARS Cosmetics (headquartered in New York), in second half of 2023 in key cities in India.

Ramkrishna Forgings: The forging company has incorporated a wholly owned subsidiary, RKFL Engineering Industry, on March 6, to implement the resolution plan under Corporate Insolvency Resolution Process (CIRP) for acquisition of JMT Auto. RKFL Engineering is going to engage in the business of forging, pressing, stamping, and roll forming of metal and powder metallurgy.

ISMT: R Poornalingam has resigned as an independent director of the company, with effect from March 8. He resigned due to personal reasons.

Future Enterprises: The National Company Law Tribunal (NCLT) has ordered Insolvency Resolution Process against Future Enterprises, the company said in its exchange filing. The Mumbai bench of NCLT has also appointed Jitender Kothari as the interim resolution professional (IRP) in the case. The bench admitted the petition filed by Foresight Innovation, which has said that Future Enterprises has defaulted on payments worth Rs 1.58 crore. Operational creditor Retail Detailz India has filed another petition claiming a default of Rs 4.02 crore.

Jaypee Infratech: The company informed the exchange that National Company Law Tribunal (NCLT), Principal Bench New Delhi, on March 7, has approved the resolution plan under the Insolvency and Bankruptcy Code, 2016. The company further informed that as per Resolution Plan approved by NCLT under IBC, the existing equity shares of the corporate debtor shall stand cancelled and reduced to NIL without any further act and deed, from the effective date of the resolution plan and the equity shares of the company will be delisted. Trading in the securities of Jaypee Infratech have been suspended from March 8, NSE said in a statement.

K E C International: The company announced that KEC Global FZ LLC domiciled in the United Arab Emirates has been liquidated and de-registered with effect from March 8 from records of the local regulatory authority. The liquidation process of KEC Global Mauritius is still on and shall be intimated once completed.

Kirloskar Oil Engines: Ten investors have picked up 13.65% stake in the engineering and power generation company through open market transactions, at an average price of Rs 322 per share. the total value of the transaction is Rs 636 crore. Three promoters have offloaded 17.7% stake in the company.

Jindal Stainless: iShares Core MSCI Emerging Markets ETF has picked up 33.69 lakh equity shares (0.64% stake) in the stainless steel company through open market transactions at an average price of Rs 309.42 per share. The total value of the shares bought is Rs 104.3 crore.

Arunjyoti Bio Ventures: The company is planning to set up two beverages plants in Telangana and Andhra Pradesh.

Lotus Chocolate Company: The revised open offer schedule from Reliance Consumer Products Ltd (RCPL) and Reliance Retail Ventures Ltd (RRVL) to the shareholders of Lotus Chocolate to acquire 26% additional stake will begin on March 16 and end on March 31.