Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.13% lower at 19,359, signalling that Dalal Street was likely headed for a negative start on Wednesday.

Asian shares were mixed with the Japanese market trading higher and the Chinese market in the negative zone. The Nikkei 225 index rose 0.33% and the Topix gained 0.24%. China’s CSI 300 index fell 0.82%, the Hang Seng index slipped 0.04%, and the Shanghai Composite index dropped 0.66%.

The Indian rupee strengthened by 18 paise to 82.93 against the US dollar on Tuesday.

TVS Supply Chain Solutions will make its debut on the BSE and NSE on August 23. The issue price was fixed at Rs 197 per share.

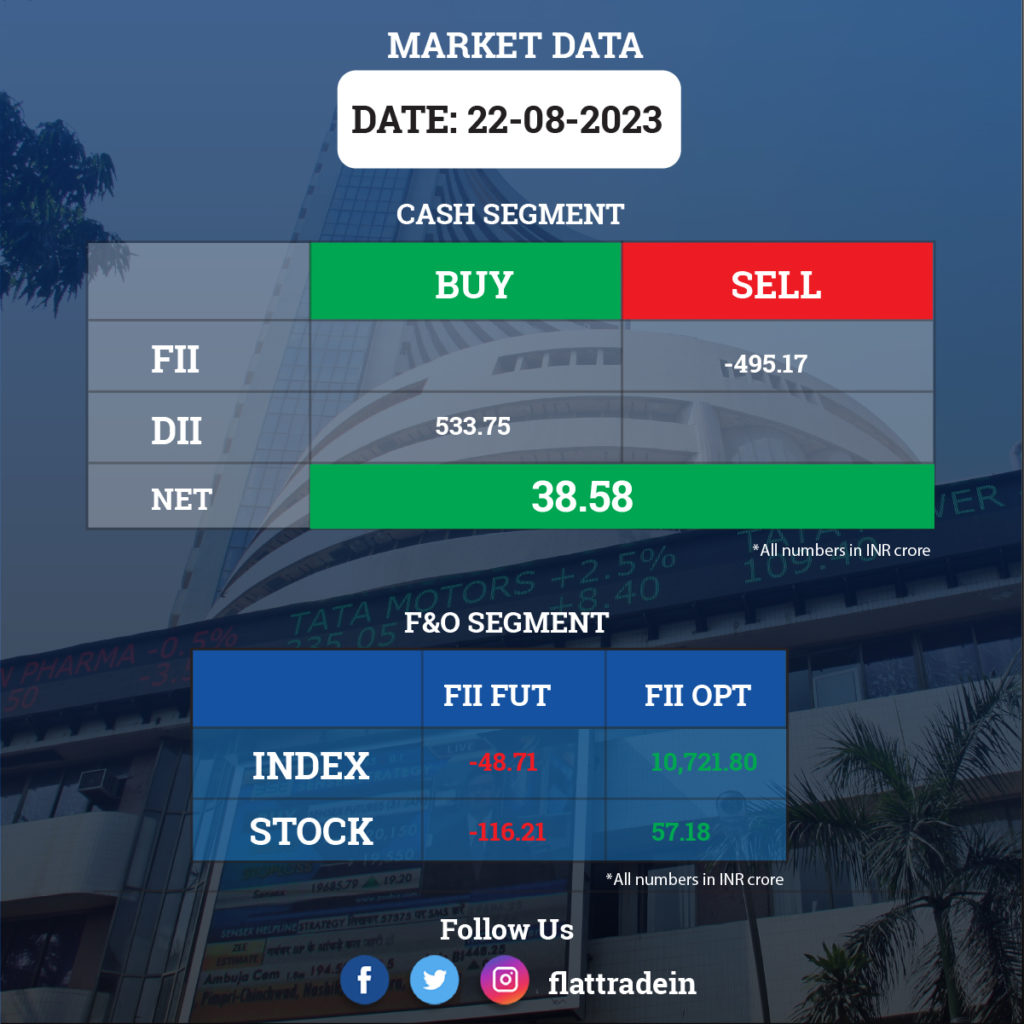

FII/DII Trading Data

Stocks in News Today

Adani Total Gas: The company’s subsidiary, Adani TotalEnergies E Mobility, has partnered with Prakriti E-Mobility to develop electric vehicle charging infrastructure in New Delhi with 200 EV charging point. The partnership will function on a revenue sharing model.

Piramal Enterprises: The company said that its board has approved the public issuance of non-convertible debentures (NCDs) for up to Rs 3,000 crore. The public issuance of Rs 3,000 crore will take place in one or more tranches.

Vodafone Idea: The debt-ridden telecom operator plans to clear about Rs 2,400 crore of dues to the government by September, PTI reported citing sources. The company will clear dues for the June 2023 quarter and spectrum instalment with applicable interest by September, the source said. Vodafone Idea had to pay a licence fee of around Rs 770 crore by July and Rs 1,680 crore as the first instalment for the spectrum it won during the auction held last year.

IndiaMART InterMESH: The company has received shareholders’ approval for buyback of 12.5 lakh shares (2.04% stake) at a price of Rs 4,000 (26.9% premium) through a tender offer.

Bharat Forge: The validity period for the guarantee provided by the company to its wholly owned step-down subsidiary, Bharat Forge Aluminum USA, Inc, has been revised. The amount of $15.5 million issued in favour of JP Morgan Bank was earlier valid till November 27, 2023. The said guarantee is amended and the revised validity period is till July 31, 2026.

BEML: The state-owned entity has bagged an order from the Ministry of Defence for the supply of command post vehicles to the Indian Army. The order is worth Rs 101 crore.

RITES: The state-run railway company has emerged as the lowest bidder in the tender floated by Railway Board. The estimated order value is Rs 65.4 crore. The company will do service testing and inspection of rails as per IRS T-12 2009 for Indian Railways. The contract will be executed within five years, and extendable up to one year.

SJS Enterprises: The promoters of the company has divested 29.5% stake for nearly Rs 550 crore through open market transactions. Aditya Birla Sun Life Mutual Fund (MF), Quant MF, Sundaram MF, Morgan Stanley Asia Singapore Pte, Societe Generale, Alchemy Emerging Leaders of Tomorrow and Florida Retirement System Allspring Global Investments LLC EMSC, among others were the buyers of shares of SJS Enterprises.

NBCC: The company has signed an MoU with Delhi Metro to work together in the field of building and infrastructure development in overseas.

Axiscades Technologies: The company has completed the acquisition of GmbH, strengthening its position in the automotive vertical and enhancing its presence in Germany.

Zydus Lifesciences: The drug maker is expected to complete the acquisition of 6.5% stake in Mylab Discovery Solutions within the enxt one month.

Somany Ceramics: The company has entered into a joint venture to operate Cerapro Nepal and acquire a 30% stake in it. Cerapro Nepal will establish a tile manufacturing facility in Nepal.

Linde India: The company received an LoA from IOCL for setting-up of Air Separation Unit for production and supply of instrument air, plant air and cryogenic nitrogen to IOCL Panipat Refinery Expansion Project. On completion, it will operate and maintain the facility for a period of 20 years. The company will fund the capital expenditure by using internal accruals.

Brightcom Group: India’s capital market regulator, SEBI, has barred Chairman and Chief Executive Officer Suresh Kumar Reddy and its Chief Financial Officer Narayan Raju from company boards for fraud and allegedly misrepresenting financial statements of the company. They are also barred from disposing off shares of the company until further notice, according to an interim order.

Mphasis: Life Insurance Corporation of India increased its shareholding in the IT company from 4.99% to 5.05% through open market purchases. The acquisition of shares done on August 21 at an average price of Rs 2,343.58 apiece.