Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.19% lower at 18,294, signalling that Dalal Street was headed for negative start on Wednesday.

Japanese markets advanced after better-than-expected economic data boosted optimism. Meanwhile, Chinese markets were trading lower. The Nikkei 225 index rose 0.66% and the Topix gained 0.26%. The Hang Seng fell 0.21% and the CSI 300 index dropped 0.17%.

Indian rupee gained 9 paise to close at 82.21 against the US dollar on Tuesday.

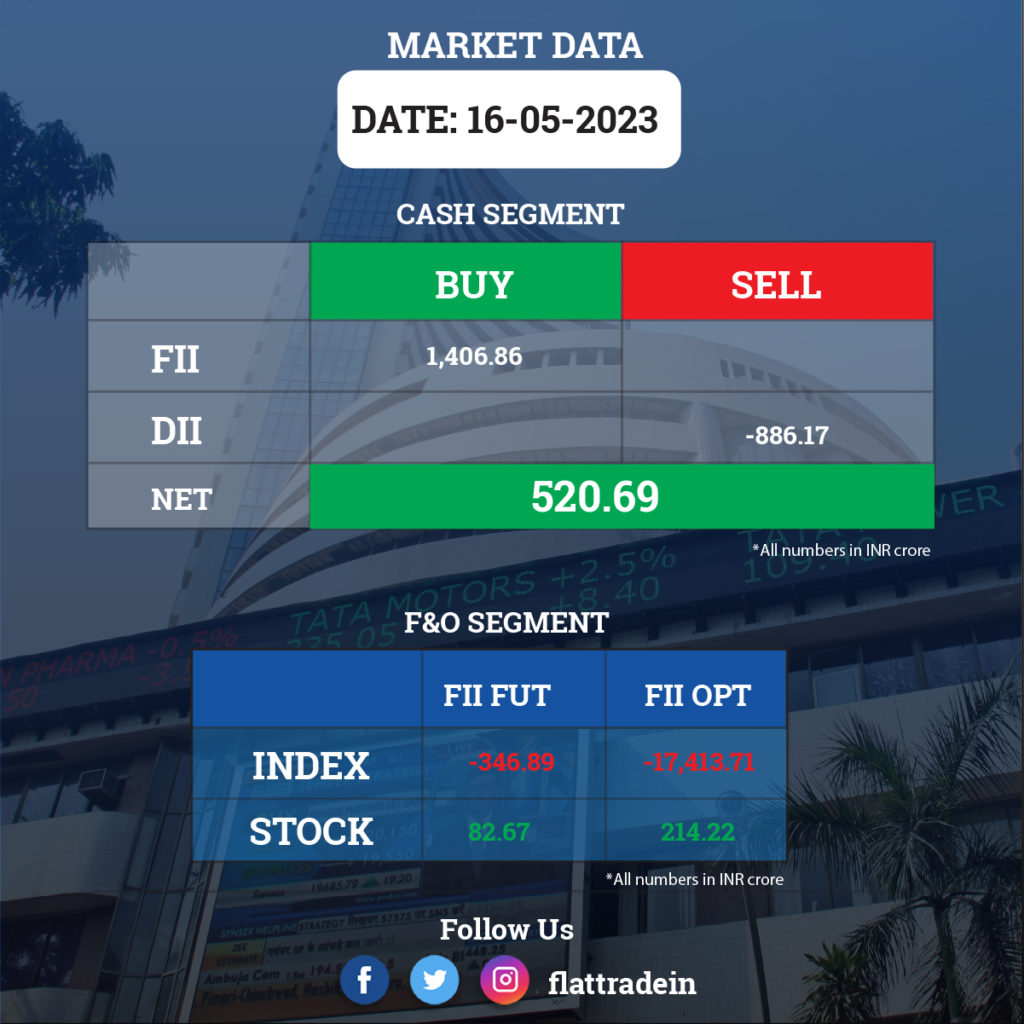

FII/DII Trading Data

Upcoming Results

Jindal Stainless, Jubilant Foodworks, Honeywell Automation India, Jindal Saw, JSW Ispat Special Products, Quess Corp, JK Tyre & Industries, Thermax, Deepak Fertilisers & Petrochemicals Corporation, Endurance Technologies, Teamlease Services, Sterlite Technologies, SKF India, Sheela Foam, Glaxosmithkline Pharmaceuticals, Timken India, Devyani International, Zydus Wellness, Railtel Corporation Of India, Restaurant Brands Asia, Eris Lifesciences, Sanghi Industries, MTAR Technologies, Anup Engineering, Electrosteel Castings, Hester Biosciences, Jyoti Resins & Adhesives, MM Forgings, Paradeep Phosphates, Permanent Magnets, REC, Sandur Manganese & Iron Ores, Shivalik Bimetal Controls, Thirumalai Chemicals, Vaibhav Global, Whirlpool Of India will report their quarterly earnings.

Stocks in News Today

Bharti Airtel: The telecom operator has registered 89.2% sequential growth in consolidated profit at Rs 3,005.6 crore for the quarter ended March FY23 due to lower tax cost. Profit in the previous quarter was impacted by an exceptional loss of Rs 669.8 crore. Revenue from operations for the quarter at Rs 36,009 crore grew by 0.5%% over the previous quarter. The company announced a final dividend of Rs 4 per share for the fiscal 2022-23.

Bharat Petroleum Corporation (BPCL): The state-owned oil marketing company has received board approval for the ethylene cracker project at Bina refinery including downstream petrochemical plants and expansion of refinery with capital expenditure of approximately Rs 49,000 crore. The company will also set up two 50 MW wind power plants for captive consumption one at Bina Refinery in Madhya Pradesh and another at Mumbai Refinery in Maharashtra, with a total project cost of Rs 978 crore. It will also build petroleum oil lubricants and lube oil base stock storage installations worth Rs 1,903 crore, with receipt pipelines at Rasayani in Maharashtra.

Reliance Industries (RIL): Jio-bp, joint venture between Reliance Industries and bp, has launched premium diesel fuel at a price below that charged by state-run oil companies.

MRF: The company has signed a purchase agreement with First Energy 4 for acquisition of 19.1% stake and purchasing solar power. The acquisition will be done for a cash consideration of Rs 1,3.09 crore.

Jindal Steel & Power: The company said its consolidated revenue was down 4.52% YoY at Rs 13,691.93 crore in Q4FY23. Ebitda also was down by 28.76% YoY at Rs 2,187.28 crore in Q4FY23. Consolidated net profit fell 78.9% YoY to Rs 465.66 crore in Q4FY23. The company declared a final dividend of Rs 2 for the fiscal 2023.

JK Paper: The paper & packaging board company has registered a 15% year-on-year decline in consolidated profit at Rs 283.52 crore for the quarter ended March FY23, dented by dismal operating numbers. Revenue from operations for the quarter grew by 4.6% to Rs 1,719.4 crore compared to the corresponding period last fiscal.

Oberoi Realty: The company’s consolidated revenue was up 16.75% YoY at Rs 961.43 crore in Q4FY23. Ebitda was up 4.81% on-year at Rs 368.70 crore in Q4FY23. Consolidated net profit was up 106.71% YoY at Rs 480.29 crore in Q4FY23. The board has approved a dividend of Rs 4 per share for the fiscal 2023 and also has approved the issue of non-convertible debentures worth Rs 1,500 crore on private placement basis.

Amber Enterprises India: The company’s consolidated revenue was up 55.04% YoY at Rs 3,002.62 crore in Q4FY23. Ebitda was up 62.43% YoY at Rs 203.51 crore in Q4FY23. Consolidated net profit soared 82.29% to Rs 108.10 crore in Q4FY23.

Aurobindo Pharma: The company received tentative approval from the USFDA for its Abacavir tablets, used in treatment of HIV infection.

KPI Green Energy: The company and its subsidiary KPIG Energia received commissioning certificates from Gujarat Energy Development Agency for solar power projects with a cumulative capacity of 10.18 MW, to be set up for five clients.

One 97 Communications (Paytm): The financial services company said that it has appointed Bhavesh Gupta as president and chief operating officer.

Redington: The company said its consolidated revenues was up 26.28% YoY at Rs 21,848.59 crore in Q4FY23. Ebitda rose 10.73% YoY to Rs 543.15 crore in Q4FY23. Consolidated net profit was down 7.64% YoY at Rs 328.39 crore in Q4FY23. The board has approved a dividend of Rs 7.20 per share for FY23.

Siyaram Silk Mills: The textile company said its consolidated revenue was up 10.69% YoY at Rs 695.43 crore in Q4FY23. Ebitda rose by 3.36% on-year to Rs 121.35 crore in Q4FY23. Consolidated net profit was up 7.27% YoY at Rs 88.14 crore in the quarter under review. The board has recommended a final dividend of Rs 4 per share for the fiscal 2023.

Metropolis Healthcare: The hospital chain said that consolidated revenue fell 8% YoY to Rs 283 crore in Q4FY23. Ebitda was down 6% YoY at Rs 70 crore in the reported quarter. Consolidated net profit fell 17% Yoy to Rs 33 crore in Q4FY23.

Creditaccess Grameen: The financial services company said that it net interest income was up 32.7% YoY at Rs 689.90 crore for the quarter ended March 2023. Net profit jumped 86.4% YoY to Rs 296.60 crore in Q4FY23. Gross non performing assets (NPA) ratio stood at 1.21% in Q4FY23 as against 1.71% Q3FY23. Net NPA ratio was at 0.42% in Q4FY23 as against 0.59% in Q3FY23.