Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading lower by 0.16% at 19,391.5, signalling that Dalal Street was headed for negative start on Friday.

Asian markets were trading lower after Jerome Powell said that the US Fed will not hesitate to tighten policy further if appropriate. The Nikkei 225 index fell 0.6% and the Topix was down 0.36%. The Hang Seng dropped 1.46% and the CSI 300 tumbled 0.7%.

The India rupee closed flat at 83.29 against the US dollar on Thursday.

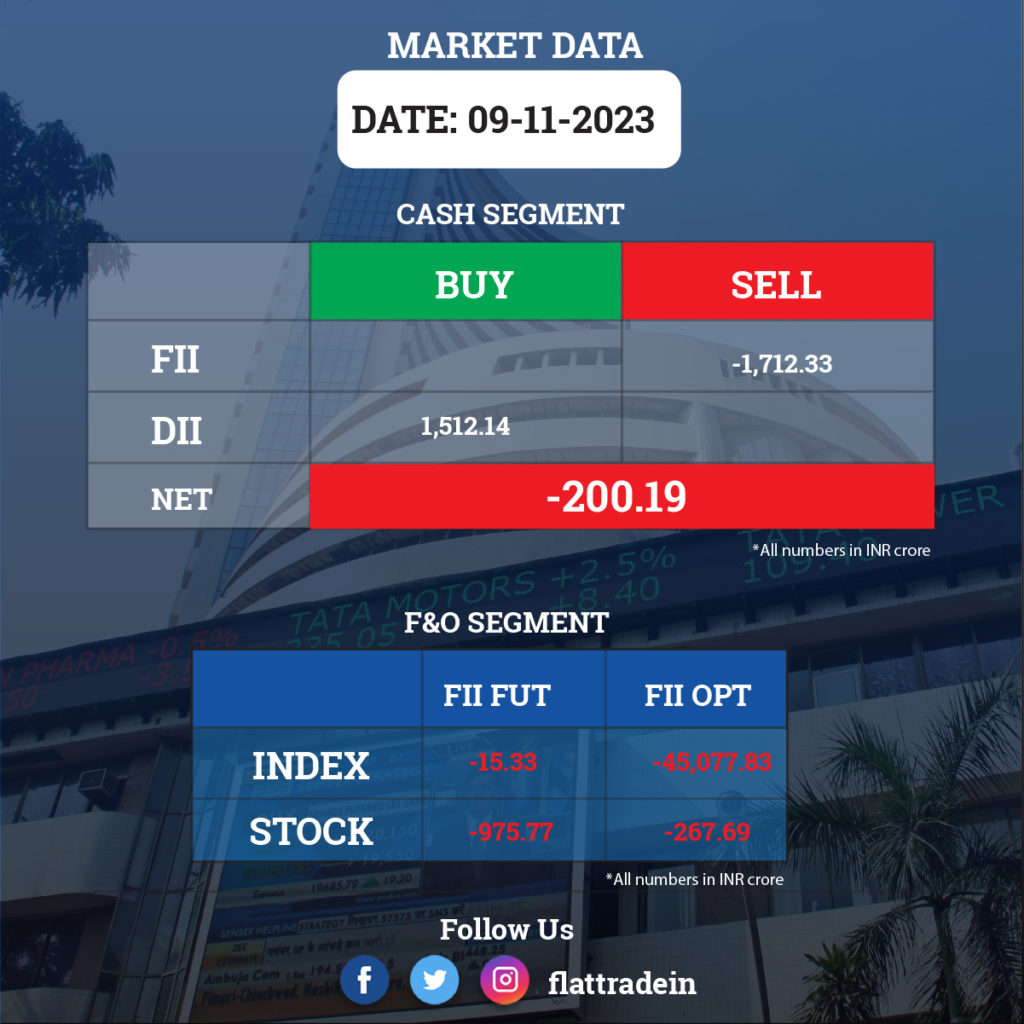

FII/DII Trading Data

Stocks in News Today

Ashok Leyland: The commercial vehicles manufacturer posted a 181% YoY surge in consolidated net profit at Rs 561 crore in Q2FY24 compared to a net profit of Rs 199 crore in the same period last fiscal year. Revenue from operations rose 16.6% to Rs 9,638 crore in the quarter under review from Rs 8,266 crore in corresponding period last fiscal. EBITDA for the quarter was Rs 1,080 crore in Q2FY24 as against Rs 537 crore in Q2FY23. Its domestic Medium and Heavy Commercial Vehicles MHCV volumes stood at 29,947 units, up 18% YoY.

Aurobindo Pharma: The company reported 84% YoY rise in net profit to Rs 752 crore in Q2FY24, led by strong sales from the US market. The company has recorded a net profit of Rs 409 crore in the corresponding quarter of the previous year. Revenue from operations increased 25.8% YoY to Rs 7219 crore in Q2FY24. EBITDA rose 68% to Rs 1403 crore, while EBITDA margin for the quarter was up 480 basis points YoY to 19.4%. US formulations revenue that accounts for 47% of the revenue increased 35.7% YoY to Rs 3385 crore. Europe formulation revenue which contributes for 25% of its revenue stood at Rs 1,769 crore, up 16.7% YoY.

ICICI Bank: The private sector lender has received the approval from Reserve Bank of India for making ICICI Securities a wholly owned subsidiary, subject to certain conditions. The bank has proposed to delist equity shares of ICICI Securities, pursuant to a scheme of arrangement.

Aditya Birla Fashion and Retail (ABFRL): The company registered a consolidated net loss of Rs 200.34 crore for the second quarter ended September 2023 as against a net profit of Rs 29.42 crore during the July-September quarter of the previous fiscal. Its revenue from operations was at Rs 3,226.44 crore crore during the second quarter of this fiscal compared with Rs 3,074.61 crore in the year-ago period. ABFRL’s total expenses were at Rs 3,500.27 crore in the September quarter. Its revenue from the ‘Madura Fashion & Lifestyle’ segment was at Rs 2,275.94 crore and Rs 1,021.50 crore from Pantaloons

GlaxoSmithKline Pharmaceuticals (GSK India): The company reported a 11% YoY jump in its net profit for the quarter ended September 2023 at Rs 216 crore. Revenue from operations rose 5% YoY to Rs 953 crore. Its EBITDA margins stood at 30.1% in during the quarter under review.

SJVN: The state-owned company reported a marginal decline in its consolidated net profit at Rs 439.64 crore compared to a consolidated net profit of Rs 445.44 crore in the same quarter last fiscal. Total expenses in the quarter rose to Rs 398.22 crore in Q2FY24 from Rs 387.75 crore in the year-ago period. Total income also increased to Rs 951.62 crore in Q2FY24 from Rs 916.25 crore in Q2FY23.

Zee Entertainment Enterprises Limited (ZEEL): The media company posted a 9% YoY increase in its consolidated net profit to Rs 123 crore. The company’s operating revenue stood at Rs 2437.8 crore compared to Rs 2023.9 crore a year ago. Domestic ad revenues was up 4.4% QoQ to Rs 941.1 crore, but was down by 2.1% YoY. Subscription revenues rose 8% YoY, driven by a pick-up in linear subscription revenue post-NTO 3.0 (new tariff order) and ZEE5.

Global Health (Medanta): The company reported a 46% YoY increase in net profit at Rs 125 in Q2FY24 on a revenue rise of 24.5% YoY at Rs 865 crore. EBITDA rose 35.7% YoY to Rs 234 crore, while EBITDA margins expanded 220 basis points YoY to 27%. Average occupied bed days climbed by 17.8% YoY , representing an occupancy of 64.9% in Q2FY24. Average revenue per occupied bed (ARPOB) grew by 4.8% YoY to Rs 61,003.

Piramal Enterprises (PEL): The NBFC reported a net profit of Rs 48 crore in the quarter ended September 2023 as against a net loss of Rs 1,536 crore in the year-ago period. Retail assets under management grew 55% YoY to Rs 38,604 crore. Retail loans now constitute 58% of the company’s loan book up from 39% a year ago. Total loans sold to ARCs stood at ₹4,800 crore in the September quarter from ₹1,000 crore a year earlier. Provisions made by the NBFC fell 94% YoY to Rs 198 crore during the quarter.

Muthoot Finance: The NBFC has posted a standalone profit at Rs 991 crore for July-September period of FY24, up 14.3% over the corresponding period last fiscal. Net interest income for the quarter under review was Rs 1,858.4 crore, a rise of 18.2% YoY.

AstraZeneca Pharma: The pharma company has registered a 60.8% YoY rise in profit at Rs 52.4 crore in Q2FY24, driven by higher sales. Revenue from operations increased by 31.7% YoY to Rs 311 crore in Q2FY24.

G R Infraprojects: The company has emerged as lowest bidder for the tender invited by RITES on behalf of Shri Mata Vaishno Devi Shrine Board, Katra (J&K) for design, engineering, construction, development, finance, operation & maintenance of passenger ropeway between Tarakote & Sanjichhat, on BOOT basis. The cost of the project is estimated to be Rs 200 crore.