Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.45% lower at 18,376.50, signalling that Dalal Street was headed for negative start on Wednesday.

Asian stocks were trading lower as investor sentiments were dampened on uncertainty over US debt ceiling negotiations. The Nikkei 225 index was down 1.03%, while the Topix fell 0.53%. The Hang Seng index slumped 1.32% and the CSI 300 index dropped 0.91%.

Indian rupee strengthened by 3 paise to 82.80 against the US dollar on Tuesday.

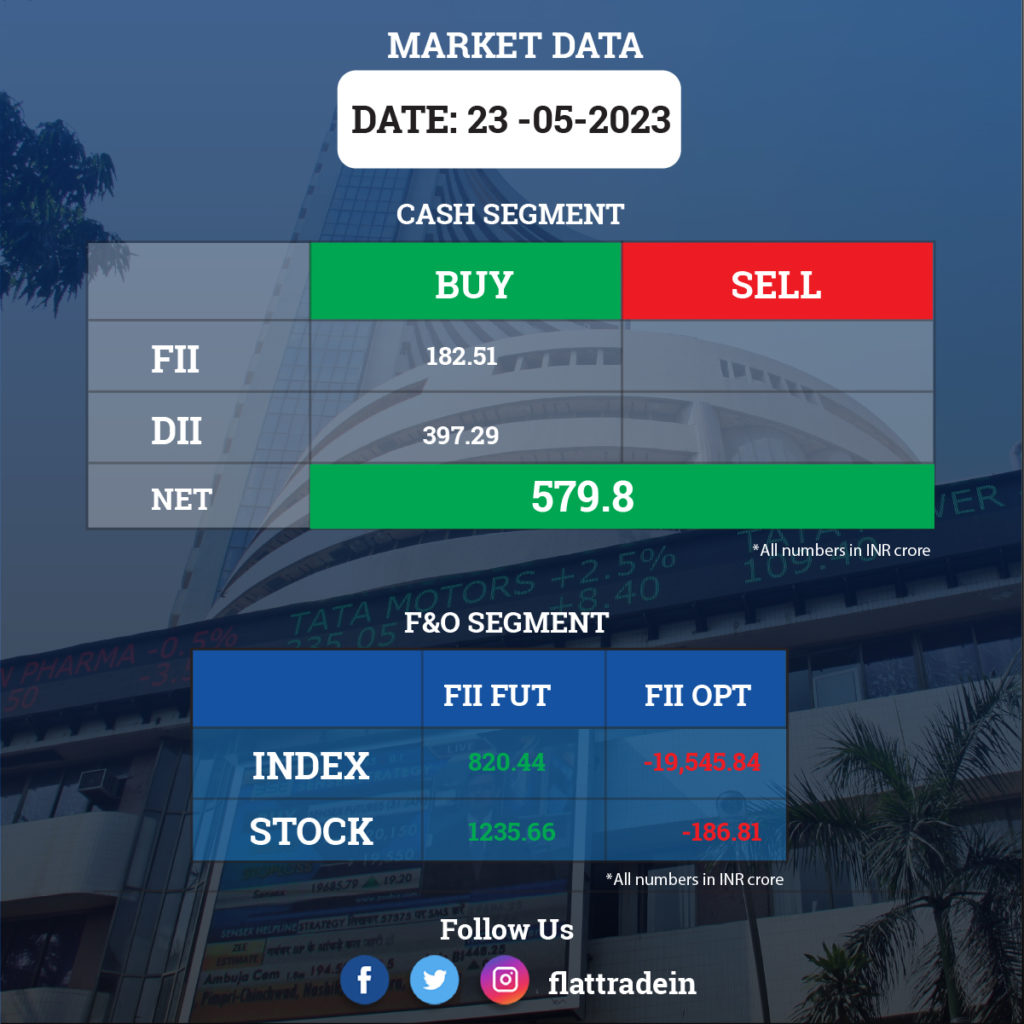

FII/DII Trading Data

Upcoming Results

Life Insurance Corporation of India, Hindalco Industries, National Aluminium Company, FSN E-Commerce Ventures, Oil India, 63 Moons Technologies, Ashoka Buildcon, Bayer Cropscience, Brigade Enterprises, Cummins India, Fine Organic Industries, Gujarat Pipavav Port, Garden Reach Shipbuilders & Engineers, ICRA, India Cements, IRCON International, JB Chemicals & Pharmaceuticals, Nava, The Phoenix Mills, Hitachi Energy India, Trident, Titagarh Wagons, Wonderla Holidays, Shyam Metalics and Energy, Piramal Pharma, Avanti Feeds, JB Chemicals & Pharmaceuticals, Pennar Industries, Caplin Point Laboratories, Aptech, Bannari Amman Sugars, Hawkins Cookers, Hindware Home Innovation, India Tourism Development Corporation, KCP, Kingfa Science & Technology (India), Lakshmi Machine Works, Moschip Technologies, Oil India, Rupa & Company, Tamil Nadu Newsprint & Papers, Venus Pipes & Tubes, Welspun Specialty Solutions, ZF Commercial Vehicle Control Systems India will report thei quarterly results.

Stocks in News Today

Ashok Leyland: The truck manufacturer said its standalone revenue rose 33% YoY to Rs 11,625.7 crore in Q4FY23. Ebitda rose 64% YoY to Rs 1,275.8 crore in Q4FY23. Standalone net profit fell 16.6% YoY to Rs 751.4 crore in Q4FY23. It reported an exceptional gain of Rs 56.43 crore in Q4FY23 against Rs 470.26 crore in Q4FY22. The board recommended a dividend of Rs 2.60 per share for the fiscal ended 2023.

Biocon: The company said its Q4FY23 consolidated revenue was up 57% YoY at Rs 3,773 crore. Ebitda was up 69% YoY to Rs 997 crore in Q4FY23. Consolidated net profit was up 31% YoY at Rs 313 crore in Q4FY23. The board declared a final dividend of Rs 1.50 per share for the fiscal ended 2023.

JSW Energy: The company’s Q4FY23 consolidated revenue up 9.39% YoY at Rs 2,669.97 crore. Ebitda was down 34.14% at Rs 745.32 crore in Q4FY23. Consolidated net profit was down 67.86% YoY at Rs 282.03 crore in Q4FY23. The company will pay a dividend of Rs 2 per share for the fiscal 2023. It also approved reappointment of Sajjan Jindal as chairman and managing director for five years, effective Jan. 1, 2024.

Tata Chemicals: The company said the board of directors has reappointed R Mukundan as Managing Director and CEO for five years with effect from November 26, 2023. The reappointment is subject to the approval of the members at the forthcoming Annual General Meeting of the company.

Shriram Properties: The south-based real estate developer, through its wholly owned subsidiary Shrivision Elevations, has acquired 100% development rights in an ongoing project in Chennai. The remaining two phases having a saleable area of 1.9 million square feet are yet to be launched. The project has a revenue potential of around Rs 1,200 crore in the next five years.

Wipro: The IT services provider has expanded its partnership with Google Cloud to bring advanced generative artificial intelligence (AI) capabilities to clients across the globe. It will integrate generative AI into its entire suite of capabilities, accelerators, IP, and solutions.

NMDC: The state-owned company’s consolidated revenue was down 13.76% YoY at Rs 5,851.37 crore in Q4FY23. Ebitda fell 20.63% YoY to Rs 2,162.35 crore in Q4FY23. Its consolidated net profit up 21.7% at Rs 2,271.53 crore. The company reported exceptional income of Rs 1,237.27 crore during the period under review. The board approved Rs 2.85 per share for the fiscal 2023.

Adani Green Energy: The board meeting scheduled on May 24 to consider raising funds was cancelled due to non-availability of directors. The next date of meeting will be announced later.

Mahindra CIE Automotive: Promoter Mahindra & Mahindra is likely to sell 1.2 crore shares or 3.2% equity in Mahindra CIE Automotive via a block deal soon, CNBC-Awaaz reported citing sources. The block deal in Mahindra CIE is likely at a discount of 5-6% to the current market price.

Dixon Technologies: The contract electronics manufacturing company said its Q4FY23 consolidated revenue was up 3.82% YoY at Rs 3,065.45 crore. Ebitda was up 32.23% YoY at Rs 156.29 crore in Q4FY23. Consolidated net profit was up 27.7% YoY at Rs 80.62 crore in Q4FY23. The board has recommended a final dividend of Rs 3 per share.

Amara Raja Batteries: The company’s consolidated revenue revenue was up 11.39% YoY at Rs 2,429.44 crore in Q4FY23. Ebitda was up 7.79% YoY at Rs 237.34 crore in Q4FY23. Consolidated net profit was up 41.04% YoY at Rs 139.42 crore in Q4FY23. The company reported net exception loss of Rs 47.65 crore in the quarter on account of a fire at its Chittoor facility. The company’s board approved a dividend payout of of Rs 3.20 per share for FY23.

Thyrocare Technologies: The company’s consolidated revenue was up 4.07% YoY at Rs 135.88 crore in Q4FY23. Ebitda fell 34.32% YoY at Rs 24.69 crore in Q4FY23. Consolidated net profit was down 41.2% YoY at Rs 12.49 crore in Q4FY23.

Galaxy Surfactants: The company said its consolidated revenue was down 7.45% YoY at Rs 974.47 crore in Q4FY23. Ebitda was down 7.21% YoY at Rs 134.51 crore in Q4FY23. Consolidated net profit was down 7.99% YoY at Rs 90.53 crore in Q4FY23. The board recommended a final dividend of Rs 4 per share for fiscal 2023.

Polyplex Corporation: The company said its consolidated revenue was down 11.6% YoY at Rs 1,667.07 crore in Q4FY23. Ebitda was down 85.39% YoY at Rs 55.37 crore in Q4FY23. Consolidated net profit was down 93.34% YoY at Rs 20.27 crore in Q4FY23. The company will pay a final dividend of Rs 3 per share for fiscal 2023.

Metro Brands: The footwear retailer said its consolidated revenue jumped 34.97% YoY to Rs 544.13 crore in Q4FY23. Ebitda was up 10.57% YoY at Rs 143.56 crore in Q4FY23. Consolidated net profit was down 1.12% at Rs 68.74 crore in Q4FY23.

Bikaji Foods International: The company said its consolidated revenue was up 15.49% YoY at Rs 462.26 crore in Q4FY23. Ebitda was up 52.39% YoY at Rs 61.84 crore in Q4FY23. Consolidated net profit up 57.12% YoY at Rs 38.29 crore in Q4FY23. The board recommended a final dividend of Rs 0.75 per share.

Linde India: The company said its consolidated revenue was up 17.96% YoY at Rs 630.24 crore in Q4FY23. Ebitda was up 41.03% YoY at Rs 185.75 crore in Q4FY23. Consolidated net profit was up 50.42% YoY at Rs 99.25 crore in Q4FY23. The company announced a dividend of Rs 12 per share, including special dividend of Rs 7.5 per share, for 15 months ended March 2023.

Ipca Laboratories, Lyka Labs: Ipca Laboratories has increased its shareholding in Lyka Labs by 9.76% in two tranches. It bought 44 lakh shares at Rs 139.50 apiece on March 15 and April 18. Ipca now holds 1.20 crore share of Lyka, or 36.34% of latter’s overall shareholding.

Century Textiles: The company will raise Rs 400 crore via non-convertible debentures on private placement basis.

Punjab National Bank: The state-owned lender has appointed Amit Srivastava as its group chief risk officer.

Dish TV India: Anil Kumar Dua has resigned as Chief Executive Officer of the company effective from August 22, 2023. Hence, the board proposed the appointment of Manoj Dobhal as the Chief Executive Officer-designate and further advised the management to seek approval from the Ministry of Information and Broadcasting (MIB) for the appointment of Dobhal as the new CEO. Dobhal is the current Chief Operating Officer of the company.