Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.21% lower at 17,820, signalling negative opening for Dalal Street on Wednesday.

Most Asian shares were trading lower, after Wall Street closed lower as shares of First Republic Bank tumbled, leading to fresh worries over the stabiltiy of the banking sector. The Nikkei 225 index fell 0.54%, the Topix dropped 0.7%. The Hang Seng inched up 0.03% and the CSI 300 index was down 0.68%.

Indian rupee closed at 81.91 against the US dollar on Tuesday.

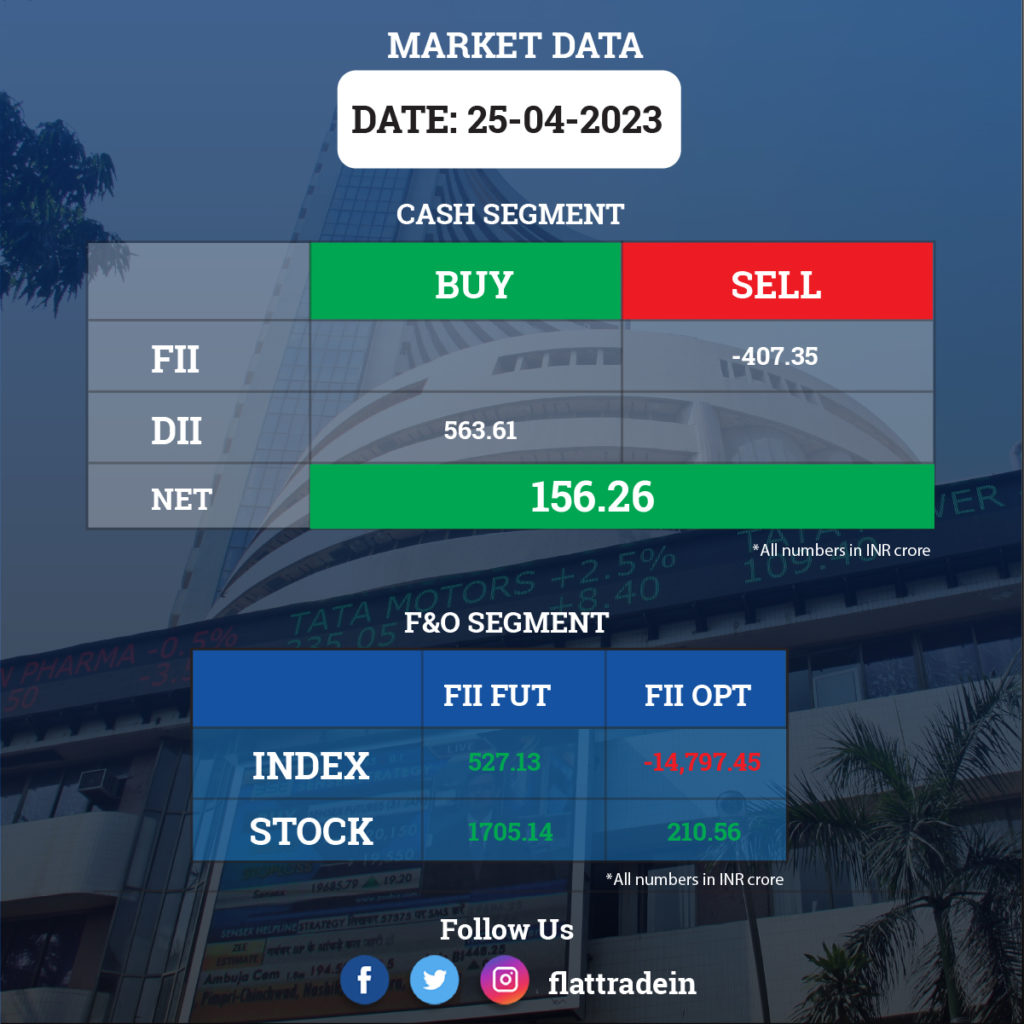

FII/DII Trading Data

Upcoming Results

Maruti Suzuki India, Bajaj Finance, HDFC Life Insurance Company, UTI Asset Management Company, Indus Towers, SBI Life Insurance Company, L&T Technology Services, KPIT Technologies, Can Fin Homes, IIFL Finance, Oracle Financial Services Software, Poonawalla Fincorp, Shoppers Stop, Supreme Petrochem, Syngene International, Tanla Platforms, and Voltas will report their quarterly earnings today.

Stocks in News Today

Bajaj Auto: The two-and-three-wheeler company has recorded a 2.5% year-on-year decline in standalone profit at Rs 1,433 crore for the quarter ended March FY23 despite a healthy topline and operating performance. Revenue for the quarter stood at Rs 8,905 crore, a growth of 11.66% over a year-ago period. Sales volumes declined 12.5% year-on-year. The company’s board approved a dividend of Rs 140 per share for the fiscal 2023. The board of the two-wheeler manufacturer approved the reappointment of Rakesh Sharma as whole-time director of the company for another five years, effective from January 1, 2024.

Tata Consumer Products: The FMCG company said its consolidated net profit during the quarter ended March 2023 grew by 21% YoY to Rs 289.6 crore. Consolidated revenue from operations increased by 14% YoY to Rs 3,618.7 crore. The company said the revenue increase was mainly driven by underlying growth of 15% in India business, 6% in international business and 9% in non-branded business. Ebitda was up 15% YoY to Rs 511.67 crore in the quarter under review. The board has recommended a final dividend of Rs 8.45 per equity share for FY23.

AU Small Finance Bank (AU SFB): The small finance bank has recorded a 23% year-on-year growth in profit at Rs 424.63 crore for quarter ended March FY23, with provisions and contingencies falling 56% YoY. Net interest income grew by 29.5 percent YoY to Rs 1,213 crore for the quarter. Asset quality improved for Q4FY23 with gross non-performing assets (NPA) as a percentage of gross advances falling 15 bps QoQ to 1.66% and net NPA falling 9 bps QoQ to 0.42 percent. The bank’s board recommended a dividend of Rs 1 per share, subject to shareholders’ approval.

Mahindra Lifespace Developers: The real estate developer has recorded a consolidated profit of Rs 0.54 crore for the quarter ended March FY23, compared with Rs 137.7 crore in the same period last year. The company reported an exceptional gain of Rs 96.8 crore in Q4FY22. Consolidated revenue from operations stood at Rs 255.4 crore for the reported quarter, a 57.8% rise over the year-ago period. Ebitda loss stood at Rs 27.37 crore as against an Ebitda loss of Rs 35.68 crore in the eyar-ago period. The board recommended a dividend of Rs 2.30 per share for the fiscal ended March 2023.

Mahindra CIE Automotive: The auto ancillary company has recorded a 73% year-on-year growth in profit at Rs 279.1 crore for the March FY23 quarter. Revenue from operations grew by 18.4% YoY to Rs 2,440.2 crore in Q1CY24. Ebitda was up 35.74% YoY at Rs 380.65 crore in the reported quarter. The board of directors approved a final dividend of Rs 2 per share.

Cipla: Madison Pharmaceuticals Inc, a wholly owned step-down subsidiary of Cipla, in Delaware, USA, will be dissolved with effect from April 28, 2023. Madison is a dormant entity, and this dissolution will not affect the performance or revenue of the company.

Dalmia Bharat: The company has reported a massive 121.4% year-on-year growth in Q4FY23 consolidated profit at Rs 589 crore despite a lower margin. The rise in profit was attributed to profit from joint ventures of Rs 529 crore in Q4FY23 as against nil in the same period last year. Consolidated revenue from operations increased by 15.7% YoY to Rs 3,912 crore in Q4FY23. Ebitda was up 3.51% YoY at Rs 707 crore in the reported quarter. The company announced a final dividend Rs 5 per share for the fiscal ended March 2023.

Anant Raj: Consolidated revenue rose 29.75% YoY to Rs 280.15 crore in Q4FY23. Consolidated net profit rose 118% YoY to Rs 49.4 crore in Q4FY23. Ebitda surged 195% YoY to Rs 73.67 crore in Q4FY23. The company declared a final dividend of Rs 0.50 per share for the previous fiscal.

Lloyds Metal and Energy: Consolidated revenue was up 163% YoY at Rs 876.25 crore in Q4FY23. Consolidated net profit rose 118% YoY at Rs 269.04 crore. Ebitda jumped 46.74% YoY to Rs 164.55 crore in the reported quarter. Ebitda margin stood at 18.78% in Q4FY23 as against 33.65% in the eyar-ago period.

KPI Green Energy: The company commissioned a 26.1 MW wind-solar hybrid power project at Bhungar site in Bhavnagar under Gujarat Wind-Solar Hybrid Power Policy, 2018

UCO Bank: The state-owned lender siad its board will convene on May 2 to consider raising equity capital via follow-on public offer, qualified institutions placement, preferential issue, etc. for the fiscal 2024. The board will also consider the financial results for the quarter and year ended March 2023, as well as dividend for the fiscal 2023.

Bata India: The company appointed Anil Ramesh Somani as chief financial officer of the company for five years with immediate effect. The board also approved appointment of Ravindra Dhariwal as non-executive non-independent director for two years, starting May 27, 2023.

JSW Holdings: The company denied reports claiming that it is in talks to acquire stock in auto companies BYD India and MG Motor India.

Thermax: The company liquidated its wholly owned subsidiary, Thermax Sustainable Energy Solutions, as per the order by Mumbai bench of National Company Law Tribunal. The voluntary liquidation will not have any impact on the financial, the company said.