Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.17% lower at 17,795, signalling that Dalal Street was headed for negative start on Thursday.

Asian shares were mixed as investors were concerned over global economic growth. The Nikkei 225 index fell 0.235 and the Topix rose 0.05%. The Hang Seng slipped 0.01% and the CSI 300 index rose 0.23%.

Indian rupee rose 15 paise to 81.76 against the US dollar on Wednesday.

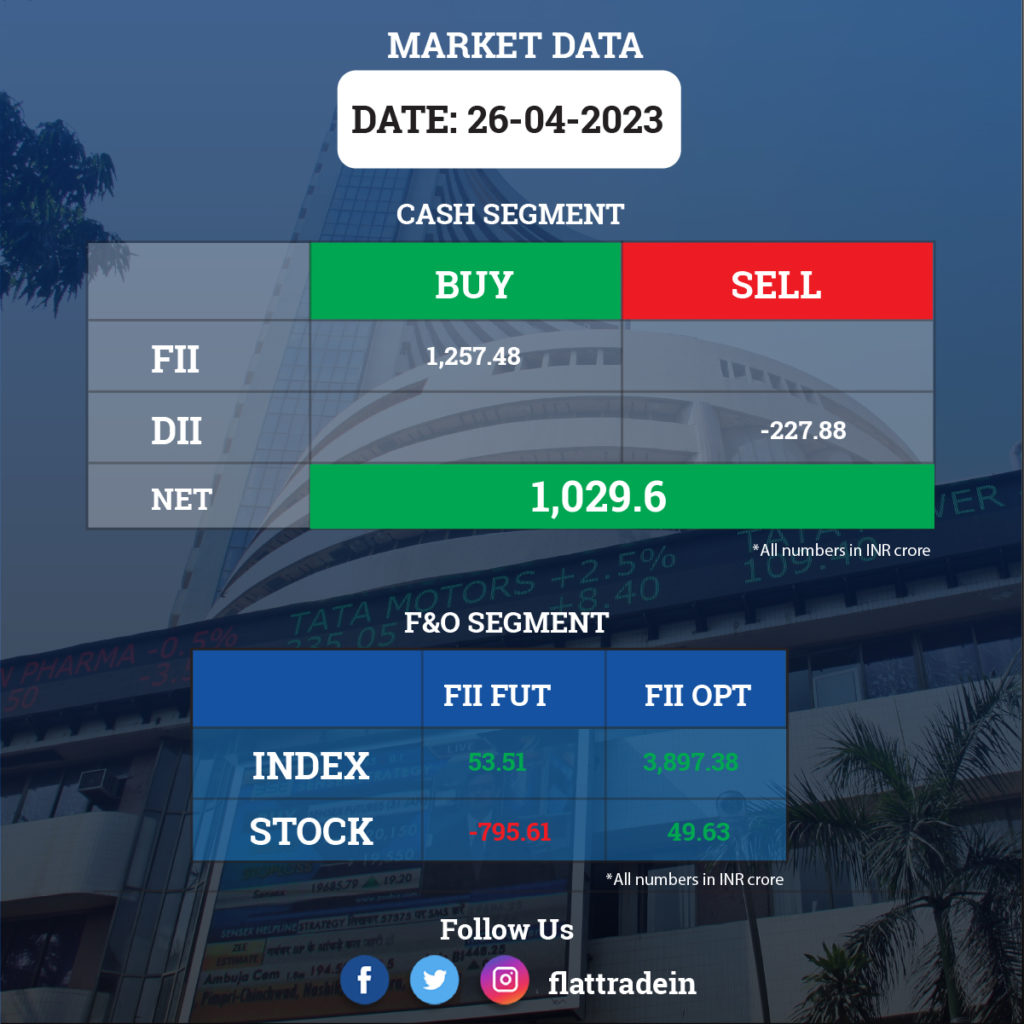

FII/DII Trading Data

Upcoming Results

Wipro, Bajaj Finserv, Axis Bank, Hindustan Unilever, Tech Mahindra, LTIMindtree, ACC, Mphasis, Surya Roshni, Coforge, Welspun India, Trent, Indian Hotels Co., Laurus Labs, Embassy Office Parks REIT, Dwarikesh Sugar Industries, Kirloskar Pneumatic Co., Gateway Distriparks, Aditya Birla Sun Life AMC, Swaraj Engines, Agro Tech Foods, Apcotex Industries, Bajaj Holdings & Investment, Chennai Petroleum

Stocks in News Today

Bajaj Finance: The NBFC has recorded a 30% year-on-year growth in consolidated net profit at Rs 3,158 crore for the quarter ended March FY23 despite 22.4% increase in loan losses and provisions in the same period. Net interest income for the quarter grew by 28% to Rs 7,771 crore compared to the year-ago period, with the number of new loans booked during Q4FY23 increasing by 20% to 7.56 million YoY. Its net NPA ratio stood at 0.34% in the reported quarter as against 0.41% in the third quarter of FY23. The company declared a dividend of Rs 30 per share for the financial year ended March 31, 2023.

HDFC Life Insurance Company: The life insurance company has reported a 0.3% year-on-year growth in standalone profit at Rs 358.66 crore for the March FY23 quarter. Net premium income for the quarter at Rs 19,426.6 crore increased by 36% over a year-ago period, and net commission jumped 79% to Rs 1,111.4 crore during the same period. For full year, VNB rose 37% YoY to Rs 3,674 crore in FY23.

The life insurer announced a final dividend of Rs 1.90 per share for the fiscal 2023. The company also appointed Niraj Shah as chief financial officer for a term of three years, and Bhaskar Ghosh as independent director for five years. The two appointments came into effect from April 26, 2023.

L&T Technology Services (LTTS): The IT services firm has recorded a 2% QoQ in profit at Rs 309.6 crore for quarter ended March 2023. Revenue grew by 2.3% QoQ to Rs 2,096.2 crore. The board recommended a final dividend of Rs 30 per share for the fiscal 2023.

Voltas: The home appliances company has posted a 21.2% year-on-year decline in consolidated profit at Rs 143.92 crore for the quarter ended March FY23 dented by weak operating performance. Revenue grew by 10.88% YoY to Rs 2,957 crore in Q4FY23 YoY, while EBITDA fell 16.4% YoY to Rs 218.2 crore with margin declining 240 bps at 7.4% for the quarter. The board recommended a dividend of Rs 4.25 per share for FY23.

HCL Technologies: Global pigment manufacturer Heubach Group has selected HCL Tech to drive its digital transformation agenda. HCL Tech will deliver an IT system for Heubach Group across 11 countries to include deployment of hybrid cloud, cybersecurity solutions, end-user services and secure networks.

Infosys: The IT bellwether has entered into a collaboration with Walmart Commerce Technologies to offer services to retailers that will help them leverage technology solutions to simplify customer and store employee experiences.

Rail Vikas Nigam: The finance minister has approved the upgradation of Rail Vikas Nigam to Navratna CPSE. RVNL will be the 13th Navratna amongst the CPSEs. RVNL is a Ministry of Railways CPSE with an annual turnover of Rs 19,381 crore and a net profit of Rs 1,087 crore for FY22.

Supreme Petrochem: The polystyrene polymer producer has recorded a massive 78.4% quarter-on-quarter growth in profit at Rs 159.8 crore for Q4FY23 driven by strong operating performance. Revenue from operations grew by 17.5% sequentially to Rs 1,387 crore, while EBITDA jumped 75.7% QoQ to Rs 208.9 crore with margin expansion of 500 bps to 15.06% for the quarter.

SBI Life insurance Company: The company said consolidated revenue was up 6% YoY to Rs 22,805 crore in Q4FY23. Consolidated net profit was up 16% YoY to Rs 777 crore in Q4FY23. For the full financial year, VNB jumped 37% YoY to Rs 5,070 crore in FY23 as against Rs 3,700 crore in FY22.

Syngene International: The company’s consolidated revenue was up 31% YoY at Rs 994 crore in Q4FY23. Its consolidated net profit rose 21% YoY to Rs 179 crore in Q4FY23. Ebitda rose 32% YoY to Rs 318 crore in Q4FY23. The board recommended a final dividend of Rs 1.25 per share, including a special dividend of Rs 0.75 per share to mark the 30th anniversary of the company. The record date for the dividend has been fixed as June 30, 2023.

IIFL Finance: The financial services company consolidated net interest income was up 20.1% YoY to Rs 1320.34 crore in Q4FY23. Consolidated net profit rose 28.61% YoY to Rs 412.74 crore in Q4FY23. Net NPA ratio stood at 1.08% in Q4FY23 as against 1.06% in Q3FY23.

Shoppers Stop: The retailer said its consolidated revenue was up 29.52% YoY to Rs 923.90 crore in Q4FY23. Consolidated net profit stood at Rs 14.26 crore in Q4FY23 as against a net loss of Rs 15.85 crore in the eyar-ago period. Ebitda jumped 102.95% YoY at Rs 154.73 crore in Q4FY23.

Indus Towers: The company said consolidated revenue fell 5.11% YoY to Rs 6,752.9 crore in Q4FY23. Consolidated net profit was down 23.48% YoY to Rs 1399.1 crore in Q4FY23. Ebitda was down 11.18% YoY to Rs 5,203.6 crore in the quarter under review.

Tata Motors: The Indian auto manufacturer signed a definitive agreement with Cummins to manufacture low- to zero-emissions technology products in India over the next few years.

HDFC and HDFC Bank: The BSE and National Stock Exchange accorded in-principle approval for transfer of non-convertible debentures issued by HDFC to HDFC Bank, subject to sanction of the composite scheme of amalgamation involving the two.

Jindal Saw: In accordance with the approved resolution plan, the company acquired entire shareholding of Sathavahana Ispat, making it a wholly owned subsidiary.

Goldiam International: The company received export orders worth Rs 50 crore from international clients for manufacturing diamond studded gold jewellery, including lab-grown diamonds jewellery worth Rs 17.5 crore.

Dr Reddy’s Laboratories: The company received tentative approval from US FDA for marketing Topiramate capsules in different strengths.

City Union Bank: The Reserve Bank of India has approved the reappointment of N Kamakodi as managing director and chief executive officer of the bank for another three years, effective May 1, 2023.

IDFC First Bank: The lender’s board will meet on April 29 to discuss raising funds via debt securities on private placement basis in one or more tranches.

CG Power and Industrial Solutions: The company completed the process of closure and de-registration of step-down subsidiary CG Middle East FZE, Dubai.