Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.38% lower at 18,658, signalling that Dalal Street was headed for negative start on Wednesday.

Asian stocks fell on Wednesday as investor sentiments were dampened after data showed subdued factory activity in China. The Nikkei 225 index fell 1.14% and the Topix was down 1%. The Hang Seng index plunged 1.95% and the CSI 300 index tanked 0.98%.

Indian rupee depreciated by 9 paise to close at 82.72 against the US dollar on Tuesday.

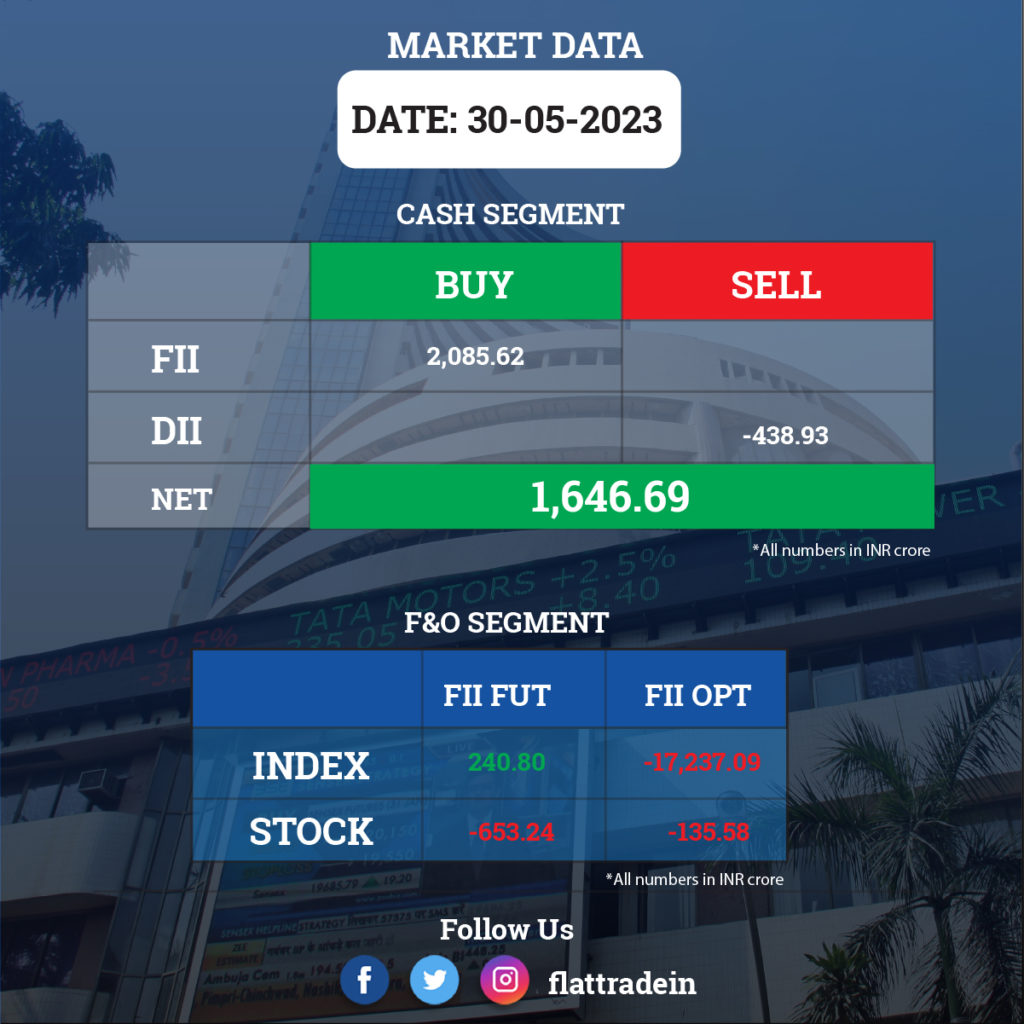

FII/DII Trading Data

Stocks in News Today

Coal India: The mining company said the board has approved the revision of non-coking coal prices with effect from May 31. The price increase is 8% over the existing notified prices for high-grade coal of grade G2 to G10, which will be applicable to all subsidiaries of Coal India. Due to this revision, the company will earn incremental revenue of Rs 2,703 crore for the balance period of financial year 2023-24.

Adani Ports and Special Economic Zone (APSEZ): The leading ports and logistics company has recorded a consolidated profit of Rs 1,159 crore in Q4FY23, up by 5% YoY. The company reported an impairment of Rs 1,273.38 crore during the March quarter on account of urgent sale of Myanmar assets, declared as exceptional items. Revenue from operations in Q4FY23 stood at Rs 5,797 crore, up 40% over the corresponding period last fiscal. The board has recommended a dividend of Rs 5 per share for FY23.

HDFC Life Insurance Company: Abrdn (Mauritius Holdings) 2006 Limited is likely to exit the life insurance company by selling the entire 1.66% equity via block deals, CNBC-TV18 reported quoting sources. The stake sale is likely to take place in the price range of Rs 563.20-585.15 per share.

Lupin: The pharma firm announced a strategic collaboration with Enzene Biosciences to launch Cetuximab in India, the first biosimilar developed for Cetuximab. Cetuximab has received approval from the Drug Controller General of India for treating head and neck cancer, particularly Squamous Cell Carcinoma of the head and neck. Cetuximab is available as a 100mg vial.

Torrent Pharmaceuticals: The pharma company has reported a consolidated profit of Rs 287 crore for the quarter ended March FY23, as against a net loss of Rs 118 crore in the year-ago period. The loss of Rs 118 crore in Q4FY22 was due to a one-time loss of Rs 485 crore. Revenue from operations for the fourth quarter stood at Rs 2,491 crore, growing 17% over the corresponding period last fiscal. Ebitda was up 29.6% YoY at Rs 727 crore in Q4FY23. The board approved fundraising of Rs 5,000 crore via debt. The company will pay a final dividend of Rs 8 per share for the fiscal 2023.

Graphite India: The graphite electrodes manufacturer has posted consolidated profit at Rs 29 crore for the fourth quarter of FY23, falling 69.5% compared to the year-ago period. Revenue from operations for the January-March period stood at Rs 815 crore, declining 3.4% compared to the corresponding period last financial year. Ebitda was down 29.5% YoY at Rs 62 crore. The company has announced a dividend of Rs 8.50 per share.

Sona BLW Precision Forgings: Promoter entity Aureus Investment is likely to sell up to 3.25% equity worth Rs 950 crore at Rs 500 per share in Sona BLW Precision Forgings, reports CNBC-TV18 quoting sources. Aureus Investment held a 33% stake in Sona BLW at the end of the March 2023 quarter.

Aegis Logistics: The company’s consolidated revenue was up 2.42% YoY at Rs 2,154.47 crore in Q4FY23. Ebitda was up 41.6% YoY at Rs 202.6 crore in Q4FY23. Consolidated net profit was up 56% YoY at Rs 159.32 crore in Q4FY23. The board approved a final dividend of Rs 1.25 per share for the fiscal 2023.

Prestige Estate Projects: The company’s consolidated revenue was up 9.64% YoY at Rs 2,631.8 crore in Q4FY23. Ebitda was up 36.5% YoY at Rs 681.8 crore in Q4FY23. Consolidated net profit was down 46.5% YoY at Rs 505.4 crore in Q4FY23. The group recorded one-time gains of Rs 11.9 crore during the quarter under review, against Rs 807.9 crore exceptional gain in the year-ago period. The board approved a final dividend of Rs 1.50 per share for the fiscal 2023 and also approved raising Rs 2,000 crore via non-convertible debentures.

Welspun Corp: The company’s consolidated revenue jumped 102.4% to Rs 4,070.15 crore in Q4FY23. Ebitda soared 490.6% YoY to Rs 420.6 crore in Q4FY23. Consolidated net profit was down 8.91% YoY at Rs 240.1 crore in Q4FY23. The company reported 89% rise in total expenses at Rs 3,835.6 crore, with finance cost rising 216% to Rs 94.7 crore and depreciation growing 44% to Rs 91.2 crore.

Patanjali Foods: The company said its standalone revenue was up 18.1% YoY at Rs 7,872.92 crore in Q4FY23. Ebitda fell 19.6% YoY to Rs 326.3 crore in Q4FY23. Standalone net profit was up 12.4% YoY at Rs 263.71 crore in Q4FY23. The board announced a dividend of Rs 6 per share for the fiscal 2023.

Action Construction Equipment: The company’s consolidated revenue was up 20.2% YoY at Rs 613.8 crore in Q4FY23. Ebitda was up 55.2% YoY at Rs 73.3 crore in Q4FY23. Consolidated n et profit was up 33.1% YoY at Rs 47.2 crore in Q4FY23. The company will pay a dividend of Rs 1 per share

Greenply Industries: The company’s consolidated revenue was up 4.59% YoY at Rs 469.15 crore in Q4FY23. Ebitda rose 6.85% YoY to Rs 47.6 crore in Q4FY23. Consolidated net profit was down 61.8% YoY at Rs 11.1 crore in Q4FY23. The company reported a loss of Rs 16.6 crore due to disposal of assets by Greenply Industries (Myanmar). The board recommended a dividend of Rs 0.50 per share.

Lemon Tree Hotels: The company’s consolidated revenue jumped 111.4% YoY to Rs 252.7 crore in Q4FY23. Ebitda was up 385.9% YoY at Rs 141.9 crore in Q4FY23. Consolidated net profit stood at Rs 59 crore in Q4FY23 as against a net loss of Rs 39.16 crore in Q4FY22.

KRBL: The company’s consolidated revenue was up 29.6% YoY at Rs 1,279.7 crore in Q4FY23. Ebitda was down 11.5% YoY at Rs 143.9 crore in Q4FY23. Consolidated net profit was up 8.18% YoY at Rs 118 crore in Q4FY23.

Mankind Pharma: The company’s consolidated revenue rose 18.9% YoY to Rs 2,052.7 crore in Q4FY23. Ebitda was up 46.3% YoY at Rs 416.7 crore in Q4FY23. Consolidated net profit surged 52.4% to Rs 293.7 crore in Q4FY23.