Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading 0.09% lower at 19433, indicating that Dalal Street was headed for muted start on Wednesday.

Asian shares tanked, tracking losses on Wall Street, as investors were concerned that the Federal Reserve would keep the interest rates higher after upbeat US employment data. The Nikkei 225 index tanked 1.93% and the Topix plummeted 2.01%. The Hang Seng fell 0.79%, while markets in mainland China was closed and will be closed for the week due to 10-day holiday for the Mid-Autumn Festival and National Day.

The Indian Rupee fell 16 paise to 83.21 against the US dollar on Tuesday.

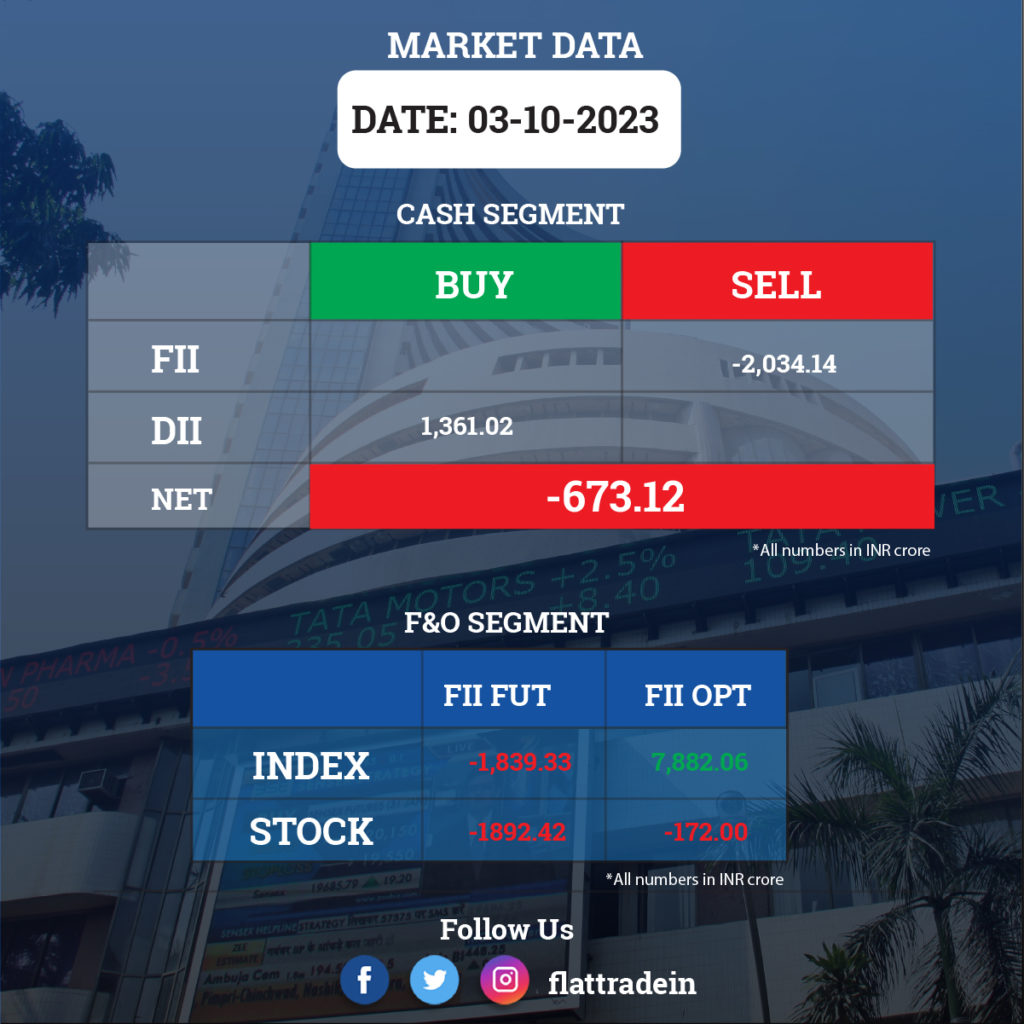

FII/DII Trading Data

Stocks in News Today

HDFC Bank: The bank announced about the management changes to its employees through a detailed memo, CNBC-TV18 reported. Arvind Kapil, the Group Head will head the bank’s mortgage business. and Arvind Vohra, the Group Head will move as Group Head of retail assets. Parag Rao, Group Head, will be also be responsible for marketing, and liability product group, while Smita Bhagat & Sampath Kumar will be the two new retail branch banking heads. Ramesh Lakshminarayanan, currently the CIO, would lead the IT & digital function.

Adani Enterprises: Abu Dhabi-based conglomerate International Holding Company (IHC) raised its stake in the company to 5.04% through open-market deals. IHC said it believes that the inherent strength of airports, data centres, green hydrogen and various other verticals being incubated under AEL is poised to uniquely capitalise on India’s robust growth journey.

Hero MotoCorp: The two-wheeler manufacturer is set to commence deliveries of its first co-developed premium motorcycle Harley-Davidson X440 on October 15. It has been organising test rides for pre-booked customers since September 1, and the new booking window will open on October 16.

Maruti Suzuki: The automaker has received a draft assessment order from the Income Tax Authority amounting to Rs 2,160 crore for FY2019–20. The company said it will file objections before the Dispute Resolution Panel.

Bajaj Finserv: The company said its unit Bajaj Allainz General Insurance has received a Rs 1,010 crore-show cause and demand notice from GST authorities for alleged non-payment of GST on co-insurance and re-insurance premiums.

Avenue Supermarts (D-Mart): The retail chain has reported a standalone revenue from operations at Rs 12,308 crore for the quarter ended September FY24, up 18.5% over Rs 10,385 crore in same period last year. The total number of stores as of September 2023 stood at 336.

Pidilite Industries: The company’s wholly owned subsidiary Pidilite MEA Chemicals LLC and Corporacion Empresarial Grupo Puma SL, Spain, have incorporated a joint venture company in UAE in the name of “PidilitePuma MEA Chemicals L.L.C.” (‘PidilitePuma’) to carry on the business of manufacture of construction chemicals. Pidilite MEA and Grupo Puma, Spain, shall hold 50% of the paid up capital in PidilitePuma.

Vedanta: The company’s chairman Anil Agarwal said the company is on course to repay the majority of its $6.4 billion debt in January and August next year. The remaining debt will be repaid via the strategic sale of steel and iron ore companies. Meanwhile, he said that Hindustan Zinc will be split into three entities: zinc, silver, and recycling.

IDFC First Bank: The lender is expected to raise up to Rs 3,000 crore via a qualified institutional placement (QIP) on October 3. The QIP price is likely to be around Rs 90-91 per share, which comes at a 3-4% discount to the closing price of Rs 94.25 on October 3.

Rail Vikas Nigam: The company bagged a Rs 444 crore order from the Himachal Pradesh government for the development of distribution infrastructure in the north zone under the the Revamped Reformsbased and Results-linked, Distribution Sector Scheme (loss reduction works). The project will be executed within 24 months.

Life Insurance Corporation of India (LIC): The life insurance behemoth said it has received an order from the Income Tax Authority, demanding a penalty of Rs 84.02 crore. The notice was for the assessment years 2012-13, 2018-19, and 2019-20.

UPL: The company said its unit in Mauritius unit UPL Corporation Limited has incorporated a subsidiary UPL Lanka Bio in Sri Lanka, with effect from October 2. UPL Lanka Bio is a wholly owned subsidiary of UPL Corporation, Mauritius, and a step-down subsidiary of UPL.

APL Apollo Tubes: The company has reported sales volume of 6,74,761 tonnes in Q2FY24, growing 12% YoY. Durign the April-September of FY24, the company reported sales volume of 13,36,262 tonnes, up 30% YoY.

Raymond: The company said the board members have approved to invest up to Rs 301 crore in one or more tranches in Ten X Realty, a step-down wholly owned subsidiary of the company. The company said it will invest up to Rs 125 crore in the form of redeemable preference shares, and the remaining amount of Rs 176 crore will be invested by providing an inter-corporate deposit (ICD) to Ten X Realty.

Zensar Technologies: The company said that Samir Gosavi – Senior Vice President, a Senior Managerial Personnel, has tendered his resignation to pursue opportunities outside the organisation. He is an employee of Zensar Technologies Inc. USA, subsidiary of the company. His last working day shall be October 20, 2023.

Titagarh Rail Systems: The company and Gujarat Metro Rail Corporation have signed a contract worth Rs 857 crore. Under the contract, the company will manufacture 72 numbers of standard gauge cars for the first phase of Surat Metro Rail. The execution of the contract is slated to commence 76 weeks after the signing of the contract and is expected to be completed within 132 weeks after teh commencement of work.

Strides Pharma Science: The company said that its step‐down wholly owned subsidiary, Strides Pharma Global Pte., Singapore received approval from the United States Food & Drug Administration (USFDA) for Icosapent Ethyl capsules. As per per IQVIA, the Icosapent Ethyl capsules have a market size of about $1.3billion. The product will be manufactured at the company’s facility in Bengaluru.

Polyplex Corp: The promoters of the company will sell a 24.3% stake to Dubai-based AGP Holdco Ltd. for Rs 1,188.93 crore. AGP Holdco will have right to appoint one director on the board of the company and such director will also be a member of identified board committees. AGP Holdco will have similar director appointment rights on the board of directors of an identified subsidiary of the Company

V-Mart: The company reported an 8% YoY jump in revenue from operations to Rs 549 for the quarter ended September 2023 as against Rs 506 in the year-ago quarter. The Company has opened eight new stores (6 under V-Mart and 2 under Unlimited) and closed two (2) stores during the quarter.

VST Tillers Tractors: The company said it has set up a joint venture VST ZETOR in association with HTC Investments. The JV company will initially launch three tractors in the 40-50 HP range.

Oracle Financial Services Software: The company’s board has approved the appointment of Makarand Padalkar as the Managing Director and Chief Executive Officer of the company. Avadhut Ketkar has been appointed as the Chief Financial Officer, and Gopala Ramanan Balasubramaniam as an Additional Director of the company, effective from October 5.

Yes Bank: The private sector lender has reported deposits growth of 17.2% YoY and 6.8% QoQ at Rs 2.34 lakh crore, while its advances increased by 9.5% YoY and 5.2% QoQ to Rs 2.10 lakh crore

South Indian Bank: The Kerala-based lender has reported gross advances at Rs 74,975 crore in September FY24, up 10.3% over a year-ago period. Its total deposits rose 9.8% YoY to Rs 97,146 crore during the same period, while CASA grew by 2.01% YoY to Rs 31,162 crore in Q2FY24.

Bank of Maharashtra: The public sector lender has announced deposit growth of 22.2% YoY at Rs 2.39 lakh crore for the quarter ended September FY24, while gross advance grew by 23.55% YoY to Rs 1.83 lakh crore during the second quarter of FY24.