Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.49% lower at 17,980, signalling that Dalal Street was headed for a negative start on Friday.

Asian shares were trading lower as investor sentiments were dampened after Federal Reserve officials’ hawkish comments. The Nikkei 225 index fell 0.68% and the Topix was down 0.50%. The Hang Seng index was down 0.43% and the CSI 300 index slipped 0.05%.

Indian rupee was down by 8 paise to 82.71 against the US dollar on Thursday.

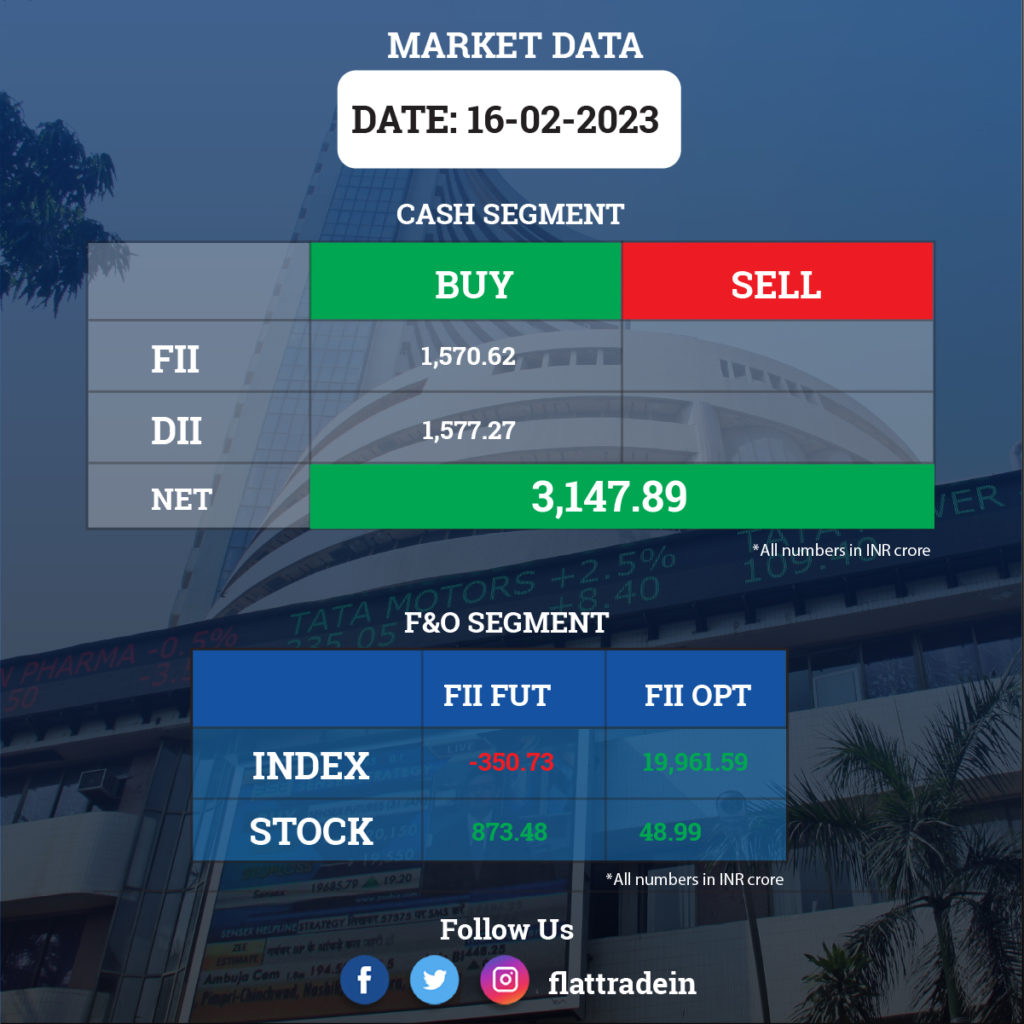

FII/DII Trading Data

Stocks in News Today

HDFC: The company concluded the sale of 10-year non-convertible debentures (NCDs) worth Rs 25,000 crore, marking the largest domestic rupee bond issuance by a corporate in India. The housing finance company said the bonds would carry an annualised coupon rate of 7.97%. The 10-year benchmark government bond yield closed at 7.35% in the secondary market.

NLC India: The company has received a power allocation order from the Ministry of Power for its projects in Uttar Pradesh and Odisha. NLC through its Joint Venture Company Neyveli Uttar Pradesh Power (NUPPL) is in the process of setting up of 1,980 MW coal-based thermal power project at Ghatampur in Uttar Pradesh for which the entire power has been tied up with UP and Assam after allocation order issued by Ministry of Power. Further, NLC has also planned to set up another coal-based pit head thermal power project of 2,400 MW at Talabira in Odisha.

UltraTech Cement: The company announced commissioning of 1.30 MTPA brownfield cement capacity at Hirmi in Chhattisgarh, and 2.80 MTPA greenfield grinding capacity at Cuttack in Odisha. This is a part of the ongoing capacity expansion. With this, company’s total cement manufacturing capacity in India now stands at 126.95 MTPA.

Hero MotoCorp: The two-wheeler manufacturer will turn ex-dividend with effect from February 17. The firm has announced an interim dividend of Rs 65 per share for the financial year 2022-23.

Tata Steel: The company and Central Building Research Institute (CBRI), a constituent of the Council of Scientific and Industrial Research (CSIR), signed an MoU to collaborate on research, academic growth, and sustainable solutions in mining. Under the agreement, CBRI will provide scientific inputs to Tata Steel on slope stability analysis and control measures in mining areas and affordable and sustainable green housing technologies for the rehabilitation and resettlement of families in mining areas.

Vedanta: Diversified natural resources company Vedanta Resources-owned Vedanta is declared as the preferred bidder for nickel, chromium and associated platinum group elements block in Chhattisgarh. The preferred bidder is based on the highest final price offer of 4.15 percent submitted by the company.

Ambuja Cements: The company said it had been declared as the ‘preferred bidder’ for the Uskalvagu limestone block in Odisha. The company along with its subsidiary ACC has a capacity of 67.5 million tonne with 14 integrated cement manufacturing plants and 16 cement grinding units across the country. An e-auction was conducted by the Odisha government for the Uskalvagu limestone block, situated in Malkangiri district, and spread over an area of 547 hectares, the company said.

Hindustan Zinc: The company is planning to get in touch with the mines ministry to resolve the differences over the acquisition of overseas assets of holding company Vedanta Ltd, Hindustan Zinc CEO Arun Misra said. Valuation of the assets is among several concerns flagged by the government, which holds a 29.54% stake in Hindustan Zinc that was privatised more than two decades ago.

RPP Infra Projects: The company has won an order for the construction of integrated stormwater drain works in M1 & M2 components in the Kovalam basin in expanded areas in Greater Chennai Corporation Package 8 covering various streets of zone 14. The work order is worth Rs 59.92 crore and is expected to be completed within 24 months from the appointed date. The same set of contracts has been received by the company in Kovalam Basin in expanded areas in Greater Chennai Corporation Package 4 covering various streets of zone 12 & 14, which is worth Rs 70.50 crore.

Angel One: The company said Narayan Gangadhar has resigned from the post of Chief Executive Officer of the company with effect from May 16 this year due to personal reasons. With this, the day-to-day affairs of the company will be under Dinesh Thakkar as Chairman and Managing Director.

Bharat Forge: Bharat Forge, Hindustan Aeronautics’ foundry & forge division and Saarloha Advanced Materials have signed an MoU for collaboration in the development and production of aerospace-grade steel alloys. The MoU has been signed for the development, certification & proven out and application of new materials for use in the production of aircraft, engines, and accessories.

Schaeffler India: The industrial and automotive supplier has recorded a 21.2% year-on-year growth in profit at Rs 231 crore for the quarter ended December 2022 as revenue for the quarter increased by 17.8% YoY to Rs 1,795 crore. EBITDA grew by 20.2% YoY to Rs 345.22 crore with margin expansion of 38 bps for Q4CY22. For the year 2022, profit surged 40% to Rs 879.2 crore and revenue increased 23.5% to Rs 6,867.4 crore compared to the previous year. Its board recommended a dividend of Rs 24 per share for the year.

Minda Corporation: The company is likely to acquire upto 15.7% stake in Pricol via reverse book building for Rs 400 crore, CNBC-TV18 reported citing sources. The stake buy in Pricol is expected to take place at Rs 209 per share. Pricol shares closed at Rs 208.3 on the NSE on Thursday (February 16).

Alkem Laboratories: The share price of the pharmaceutical firm will start trading ex-dividend with effect from February 17. The company announced an interim dividend of Rs 15 per share and a special dividend of Rs 25 per share for FY23.

Zee Learn: The company said that Ritesh Handa has resigned from the statutory position of Whole-Time Director and Chief Executive Officer of the company with immediate effect from February 16. Handa resigned due to personal reason.

Piramal Pharma: The USFDA has issued an Establishment Inspection Report (EIR) for the company’s manufacturing facility located at Lexington and the inspection has now been successfully closed.

Srei Infra: The company said that the consolidated Committee of Creditors (CoC) took on record the result of e-voting on resolutions and the resolution plan submitted by National Asset Reconstruction Company Limited (NARCL) was approved by majority voting.