Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.47% lower at 18,136, signalling that Dalal Street was headed for a negative start on Thursday.

Most Asian shares were trading lower on Thursday. The Nikkei 225 index was down by 0.91%, the Topix index down by 0.67%. The Hang Seng index was 0.38% lower, while the CSI 300 index fell 0.31%.

Indian rupee gains 44 paise to 81.25 against the US dollar on Wednesday.

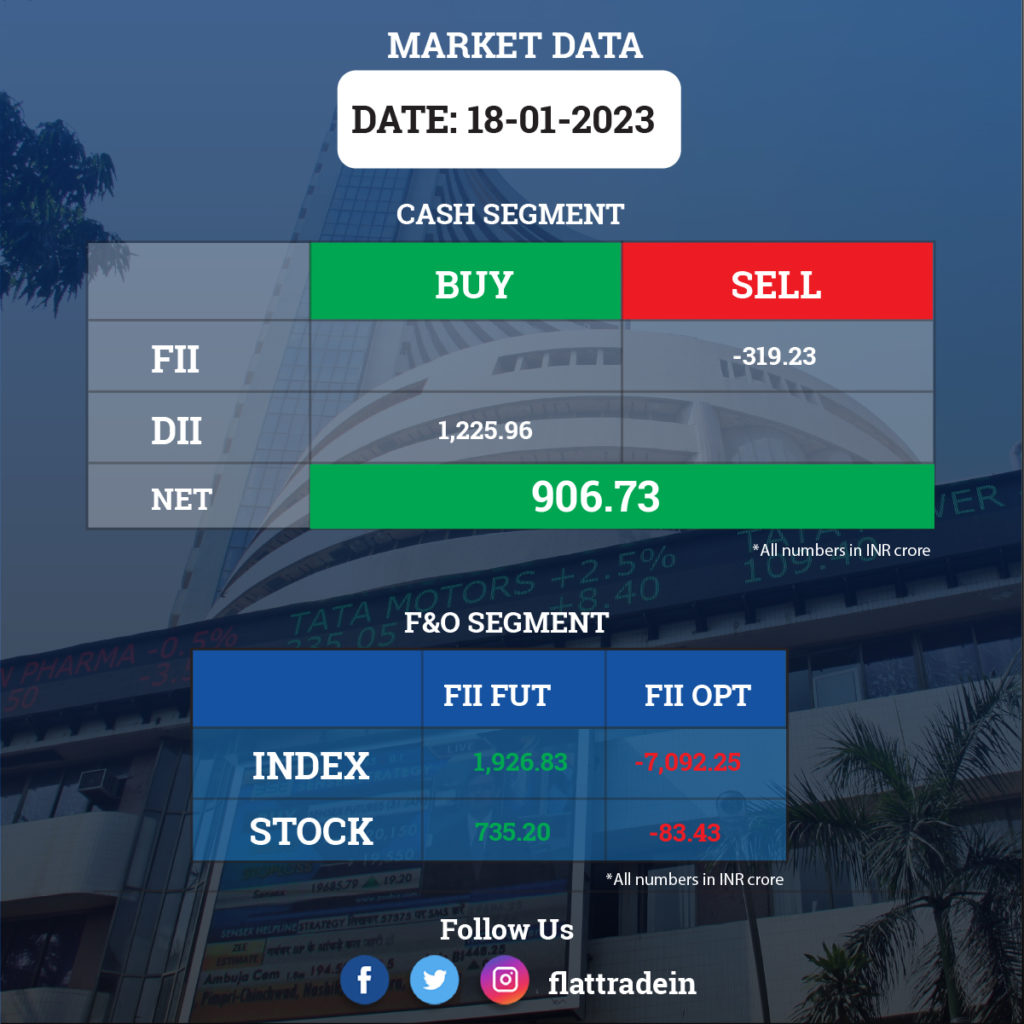

FII/DII Trading Data

Upcoming Results

Hindustan Unilever, Asian Paints, AU Small Finance Bank, Can Fin Homes, L&T Technology Services, Happiest Minds Technologies, Havells India, Hindustan Zinc, Anant Raj, IIFL Wealth Management, IndiaMART InterMESH, ICICI Securities, Mphasis, Polycab India, PVR, and Sterling and Wilson Renewable Energy.

Stocks in News Today

IndusInd Bank: The private sector lender has reported a massive 68.7% year-on-year jump in standalone profit at Rs 1,959 crore for the quarter ended December FY23, as provisions and contingencies fell 36% YoY to Rs 1,065 crore for the quarter. Net interest income grew by 18.5% YoY to Rs 4,495.3 crore for the quarter, meeting analysts expectations. Asset quality remained stable with gross non-performing assets improving by 5 bps QoQ to 2.06% and net NPA rising 1 bp to 0.62% for the quarter.

Vedanta: The company has been declared as the successful bidder for the acquisition of Meenakshi Energy under the Corporate Insolvency Resolution Process. After the same, the board of directors approved the said acquisition worth Rs 1,440 crore. Meenakshi Energy is a 1000 MW coal-based power plant in Nellore, Andhra Pradesh. The acquisition is estimated to be completed in FY 2024. Vedanta will make an upfront payment of Rs 312 crore and the balance of Rs 1,128 crore via NCDs issued by Meenakshi Energy.

Aurobindo Pharma: The United States Food and Drug Administration (US FDA) inspected the company’s wholly owned subsidiary, APL Health Care’s Unit I & III, at Jadcherla in Telangana, from January 9 to January 18, 2023. The US health regulator issued a ‘Form 483’ with 2 observations. The observations are procedural in nature.

State Bank of India: The country’s largest lender has raised Rs 9,718 crore through its second infrastructure bond issuance at a coupon rate of 7.70 percent. The proceeds of bonds will be utilized in enhancing long-term resources for funding infrastructure and the affordable housing segment. The tenor of these bonds is 15 years.

Persistent Systems: The IT services company has registered an 8.2% sequential growth in profit at Rs 238 crore for the quarter ended December FY23, with revenue growing 5.9% QoQ to Rs 2,169.4 crore and dollar revenue rising 3.4% to $264.35 million for the quarter. At the operating level, EBITDA increased by 9.1% QoQ to Rs 401.55 crore for the quarter. The company has announced an interim dividend of Rs 28 per share for FY23.

Mahindra Lifespaces: The company has won redevelopment projects in Mumbai. The project will offer the company a revenue potential of around Rs 500 crore.

Adani Enterprises: The company has received approval from board members for an FPO floor price of Rs 3,112 per share and a cap price for an FPO of Rs 3,276 per share. Retail investors will get FPO shares at a discount of Rs 64 per share. Investors can bid for a minimum of 4 FPO shares and in multiples of 4 FPO shares thereafter. The company plans to raise Rs 20,000 crore via FPO.

Oracle Financial Services Software: The company recorded a 10% sequential increase in consolidated profit at Rs 437.33 crore for the quarter that ended December FY23. Revenue from operations for the quarter at Rs 1,449.3 crore increased by 5.3% compared to the previous quarter. The company signed license fees of $27.5 million during this quarter with customers in 19 countries.

Goa Carbon: The company clocked a massive 57% year-on-year growth in profit at Rs 25.6 crore for the quarter that ended December FY23 despite higher input cost, driven by healthy topline and operating performance. Revenue from operations jumped 93% YoY to Rs 416.76 crore for the quarter.