Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.55% lower at 17,773, signalling that Dalal Street was headed for negative start on Monday.

Most Asian shares were trading higher as investors were cautiously optimistic about the upcoming earnings season and China’s ecconomic recovery. The Nikkei 225 index fell 0.06%, the Topix rose 0.19%. The Hang Seng gained 0.27% and the CSI 300 index advanced 0.77%.

Indian rupee strengthened by 23 paise to 81.85 against the US dollar on Thursday.

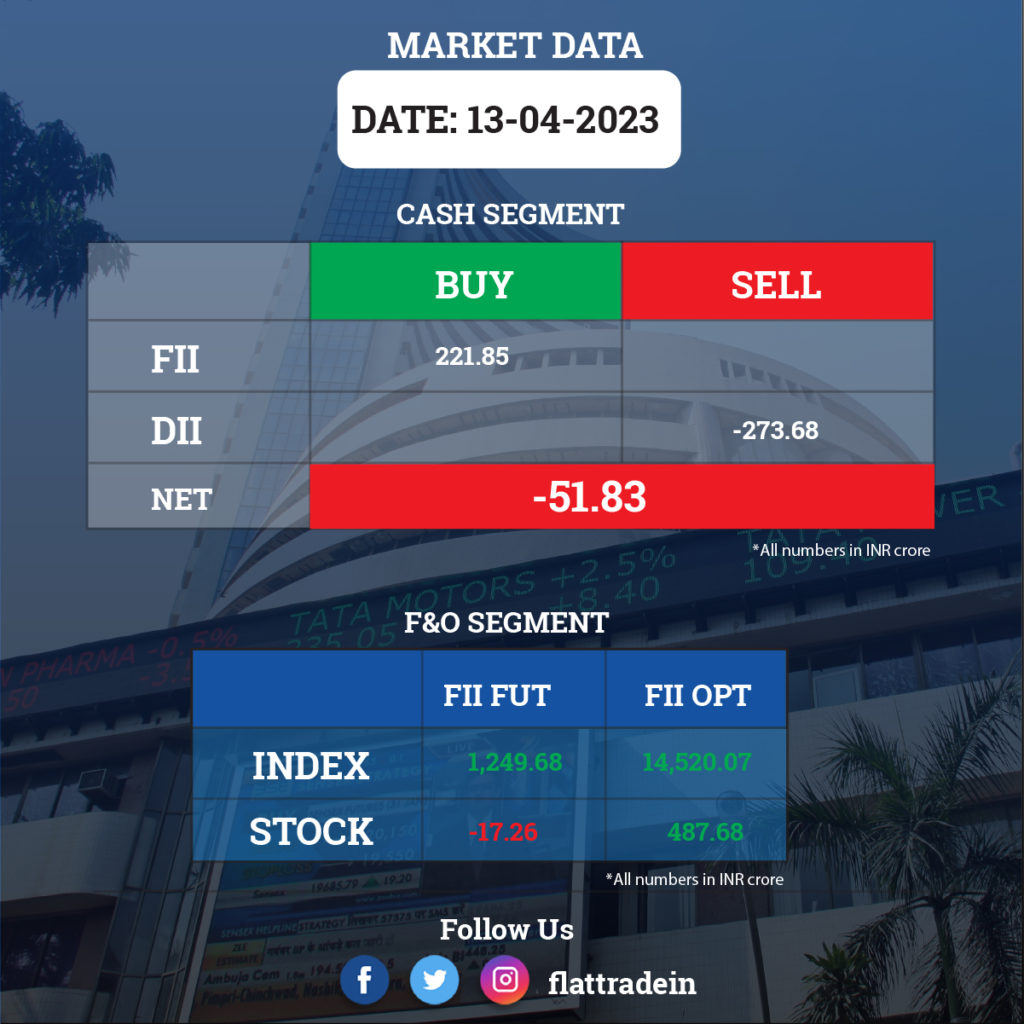

FII/DII Trading Data

Upcoming Results

Just Dial, Angel One, Hathway Cable and Datacom, Network 18 Media & Investments, TV18 Broadcast, Quick Heal Technologies, Jarigold Textiles, Justride Enterprises, and Morganite Crucible (India) will report their quarterly results.

Stocks in News Today

Infosys: The IT behemoth’s performance in the fourth quarter of FY23 was lower-than-expected as the company witnessed a decline in volumes due to unplanned project ramp downs and delays in decision-making among some of its clients. Consolidated net profit rose 7.8% year-on-year (YoY) to Rs 6,128 crore in the quarter ended March 31. This was against Rs 5,686 crore in the year-ago period. The profit declined 6.9% QoQ. Revenues from operations grew 16% to Rs 37,441 crore as against Rs 32,276 crore in Q4 FY22. Total revenues sequentially dropped 2.3%, down from Rs 38,318 crore in Q3 FY23.

For the full year, Infosys reported revenues of about Rs 147 trillion, up 20.7 per cent. Net profit grew 9% at Rs 24,095 crore. Also, the IT major’s revenue growth guidance for FY24, in the range of 4-7 per cent, was lower than Street expectations, and much below the rise the company clocked in FY23. For FY23, the board has recommended a final dividend of Rs 17.50 per share. Together with the interim dividend of Rs 16.50 per share, which has been paid, the dividend per share for FY23 sums up to Rs 34.

Infosys shares listed on the NYSE in the US fell over 9% after the results were announced on Thursday.

HDFC Bank: The country’s largest private sector lender reported a 19.8% YoY growth in standalone profit at Rs 12,047.5 crore for quarter ended March FY23. Total income grew 31% on year to Rs 53,851 crore. Net interest income during the quarter at Rs 23,352 crore grew by 23.7% over a year-ago period. Provisions and contingencies fell 19% YoY to Rs 2,685.4 crore and the sequential decline in the same was 4.3%. The net non-performing assets ratio was 0.27% as of March end, compared to 0.33% a quarter ago, and 0.32% a year ago. The capital adequacy ratio improved significantly, as it came at 19.26% as of March 31, compared to 18.90% a year ago and 17.66% a quarter ago. The board has also approved a final dividend of Rs 19 a share.

Zee Entertainment Enterprises (ZEE): Invesco Oppenheimer Developing Markets Fund is likely to sell 5.65% stake in Zee Entertainment Enterprises via block deals, CNBC-TV18 reported citing sources. The offer price for offloading the shares by Oppenheimer is in the range of Rs 199.80-208.15 per share, taking the total offer size of Invesco’s stake sale to around Rs 1,130 crore.

Tata Motors: The automaker will marginally increase price of its passenger vehicles from May 1, 2023. The weighted average increase will be 0.6%, depending on the variant and model. It has been absorbing a significant portion of the increased costs on account of regulatory changes & rise in overall input costs and is hence compelled to pass on some proportion through this hike.

BPCL: The oil marketing company has received approval from the Madhya Pradesh government for the expansion of Bina Refinery and setting up of a petrochemical project.

Ugro Capital: The company has approved an issue price of Rs 152 per equity share with respect to Proposed Qualified Institutions Placement of equity shares.

PCBL: The company announced the commencement of commercial production of 63,000 MT greenfield carbon black manufacturing facility in Tamil Nadu

GTPL Hathway: The digital cable TV services provider posted a consolidated loss of Rs 11.7 crore for the quarter ended March FY23, against a profit of Rs 54.4 crore in same period last year. Consolidated revenue grew 12.2% YoY to Rs 692.4 crore in Q4FY23, with digital cable TV revenue rising 2% YoY to Rs 275.3 crore and broadband revenue increasing 14% to Rs 124.6 crore for the quarter.

Zydus Lifesciences: Zydus has received final approval from the United States Food and Drug Administration (USFDA) to manufacture and market Isoproterenol hydrochloride injection. This injection is indicated to improve hemodynamic status in patients in distributive shock and shock due to reduced cardiac output and for treatment of bronchospasm occurring during anaesthesia.

Max Healthcare Institute: The company has acquired additional 34% stake in Eqova Healthcare for Rs 68.86 crore. With this, the company now holds 60% equity stake in Eqova, which has exclusive rights to aid development of and provide medical, healthcare and allied services to the hospital being setup by Nirogi Charitable and Medical Research Trust.

KIOCL: The company received two mineral exploration projects in Karnataka for reconnaissance survey for polymetallic mineralisation in Nagavanda gold and base metal block in parts of Dhanvangere, Haveri and Shimoga districts at Rs 1.48 crore, and preliminary exploration for amalgamated Kalaburagi limestone blocks in Jevargi region at Rs 2.33 crore.

Brightcom Group: SEBI found that the company overstated profit after tax for fiscals 2019 and 2020 by more than Rs 1,280 crore. The regulator has ordered the company to publish correct shareholding pattern, and its managing director and directors not to sell their shares.

TV18 Broadcast: Viacom18, a subsidiary of the company, closed the merger of Reliance Storage with itself and also integrated JioCinema. Viacom18 allotted shares to RIL group entities and Bodhi Tree Systems as consideration for the scheme of merger.

Gujarat Gas: The company’s board has appointed Milind Torawane as Managing Director of the company with effect from April 13.

Tata Metaliks: The company, which was supposed to hold its board meeting to approve financial results, informed the exchanges that it will be rescheduled due to unavoidable circumstances. The revised date will be intimated in due course.

Torrent Power: Lalit Malik has stepped down as Chief Financial Officer and Whole Time Key Managerial Personnel of Torrent Power from April 13. The company has appointed Saurabh Mashruwala as new CFO with effect from April 14.

Muthoot Finance: The NBFC has completed the pre-payment of external commercial borrowings totalling $225 million on April 13.