Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.15% lower at 17,517, signalling that Dalal Street was headed for a negative start on Monday.

Asian shares were mixed as the Nikkei 225 index fell 0.18%, while Topix was up 0.09%. Meanwhile, China’s CSI 300 index was up marginally by 0.01%, while the Hang Seng index was up 0.13%.

Indian rupee fell 2 paise to 82.75 against the US dollar on Friday.

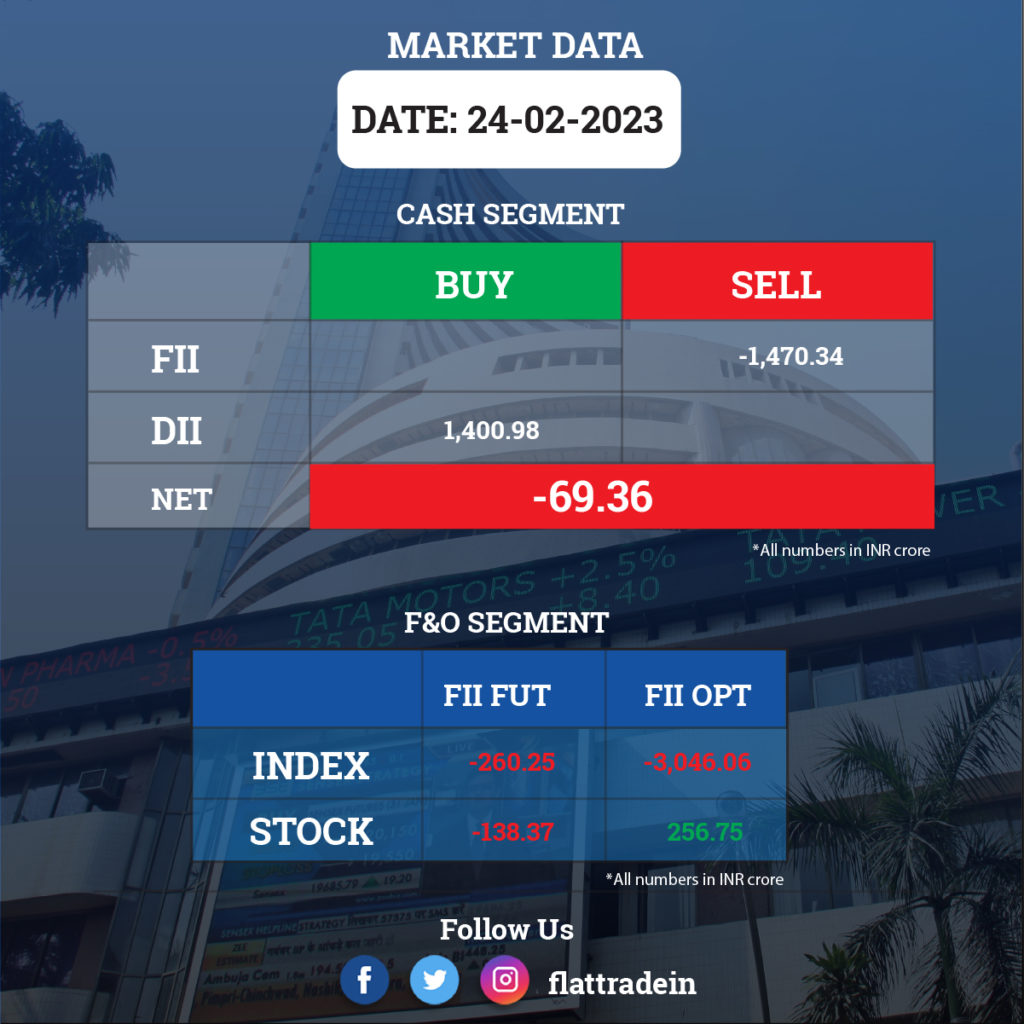

FII/DII Trading Data

Stocks in News Today

Indian Oil Corp (IOC): The oil company will set up green hydrogen plants at all its refineries as it pivots a Rs 2 lakh crore green transition plan to achieve net-zero emissions from its operations by 2046, its chairman Shrikant Madhav Vaidya said. IOC is remodelling business with an increased focus on petrochemicals to hedge volatility in the fuel business, while at the same time turning petrol pumps into energy outlets that offer EV charging points and battery swapping options besides conventional fuels as it looks to make itself future-ready, he added. The company plans to expand its refining capacity to 106.7 million tonnes per annum from 81.2 million tonnes as it sees India’s oil demand climbing from 5.1 million barrels per day to 7-7.2 million bpd by 2030 and 9 million bpd by 2040.

Tega Industries: The company will acquire McNally Sayaji Engineering as NCLT has approved Tega’s resolution plan for the acquisition of McNally Sayaji through CIRP process. The acquisition is in line with the company’s objective of widening its product portfolio to service global and Indian businesses better.

Power Grid Corporation of India: The Committee Of Directors on Investment of the company has approved four projects worth Rs 803.57 crore including implementation of western region expansion scheme-XXV, and north eastern region expansion scheme-XX.

Titan: Zoya, the luxury jewellery brand from Titan, is looking to more than double its revenue as well as the store count over the next three years from what it has done all through its 14-year history. Since its launch in 2009, Zoya has become a Rs 200-crore sub-brand in the Titan stable which grosses over Rs 40,000 crore annually, with seven showrooms. On the investment side, each store will command at least Rs 40 crore, which means, they will invest over Rs 320 crore over the next three years.

Tube Investments of India: The company’s subsidiary, TI Clean Mobility (TICMPL), has signed definitive agreements with Tube Investments, Multiples Private Equity Fund III, State Bank of India along with other co-investors to raise capital up to Rs 1,950 crore in form of equity and CCPS. The total investment by Multiples, SBI and other co-investors would be Rs 1,200 crore. Tube Investments’ total investment would be Rs 750 crore, of which Tube Investments has already invested Rs 639 crore by way of equity and ICD. Further, TICMPL plans to raise additional funding of Rs 1,050 crore by end of March 2024, thereby taking the total fund raise to Rs 3,000 crore.

Paytm: Indian telecommunications tycoon Sunil Mittal is seeking a stake in Paytm by merging his financial services unit into the fintech giant’s payments bank, Bloomberg reported. In other news, Ant Group is considering to sell some of its shares in Paytm to keep its holding within a required threshold.

Vodafone Idea: The telecom company’s shareholders approved a Rs 1,600-crore preferential issue of optionally convertible debentures (OCDs) to American Tower Corp (ATC), a move that will allow the cash-strapped telco to pay off most of the US tower company’s dues.

Zee Learn: The company’s Board has approved the appointment of Manish Rastogi as the Chief Executive Officer (CEO) of the company with effect from February 24.

Edelweiss Financial Services: The company has received the shareholders’ approval for the proposed demerger of its wealth management business, paving the way for the listing of Nuvama Wealth Management (NWML). NWML will allot 1.05 crore equity shares to shareholders of Edelweiss Financial Services on proportionate basis as a consideration for demerger.

Piramal Enterprises: The company will consider the issue of secured, rated, listed, redeemable, non-convertible debentures up to Rs 100 crore along with an option to retain oversubscription up to Rs 500 crore, the total size aggregating up to Rs 600 crore, on a private placement basis.

Easy Trip Planners: The online travel solutions company has entered into an advertisement agreement with Capri Global Holdings for 5 years starting from the first season of the Women’s Premier League T20 tournament.

IRB Infrastructure Developers: The road developer has received Letter of Award from National Highways Authority of India (NHAI) for the project of ‘upgradation to six lane with paved shoulder of NH-27 from Samakhiyali to Santalpur section in Gujarat on BOT (Toll) mode.

IndiGo: More than 50 planes of IndiGo and Go First are on the ground due to Pratt & Whitney engine woes amid persisting supply chain headwinds, forcing airlines to explore wet leasing of aircraft and other options to minimise disruptions, according to officials. IndiGo is looking at various options, including slowing down redeliveries through lease extensions, exploring the re-induction of aircraft into the fleet, and evaluating the wet lease options within the regulatory guidelines.

Kalpataru Power Transmission: The company has successfully completed the sale and transfer of an additional 25 percent stake in Kohima-Mariani Transmission, to Apraava Energy. Post the transaction, the company has now transferred an aggregate of 48 percent stake in KMTL, with an agreement to sell balance 26 percent to Apraava, after obtaining requisite regulatory and other approvals. The company had held 74 percent equity stake in Kohima-Mariani Transmission, and the remaining 26 percent held by Techno Electric and Engineering Company.

Pfizer Ltd: The pharma company has completed selling its Thane business to Vidhi Research and Development LLP after receiving all requisite approvals from the concerned authorities. The company has transferred its business undertaking at Thane including land, plant & machinery and all the workmen employed at the said undertaking.

Indiabulls Housing Finance: The Securities Issuance Committee of the company has approved the public issue of secured redeemable non-convertible debentures of Rs 100 crore, with an option to retain oversubscription up to Rs 800 crore, aggregating up to Rs 900 crore. This is within the shelf limit of Rs 1,400 crore. The said Tranche V Issue will open for subscription during March 3 and March 17, 2023.

The Phoenix Mills: The company’s subsidiary, Palladium Construction (PCPL), has completed acquisition of a prime land parcel approximately 5.5 acres, in Alipore, Kolkata, for Rs 414.31 crore. This acquisition provides the company to build a residential development of more than 1 million square feet of saleable area.

SpiceJet: The board of directors of the airline will meet again on February 27 to consider issuance of equity shares on preferential basis consequent upon conversion of outstanding liabilities into equity shares, and raising fresh capital through issue of eligible securities to qualified institutional buyers.

Inox Green Energy Services: The company has acquired a majority stake of 51% equity shares in I-Fox Windtechnik India, an Independent O&M wind service provider. Accordingly, I-Fox has become a subsidiary of the company.