Market Opening - An Overview

Nifty futures on the Singapore Exchange traded 0.49% lower at 18,390, signalling that Dalal Street was headed for a negative start on Thursday.

Asian shares were mixed as investors gauged the US central bank’s monetary policy outlook. Japan’s Nikkei 225 index fell 0.40%, while TOpix was up 0.145. The Hang Seng tanked 2.72% and the CSI 300 index was down 1.26%.

Indian rupee fell 20 paise to 81.30 against the US dollar on Wednesday.

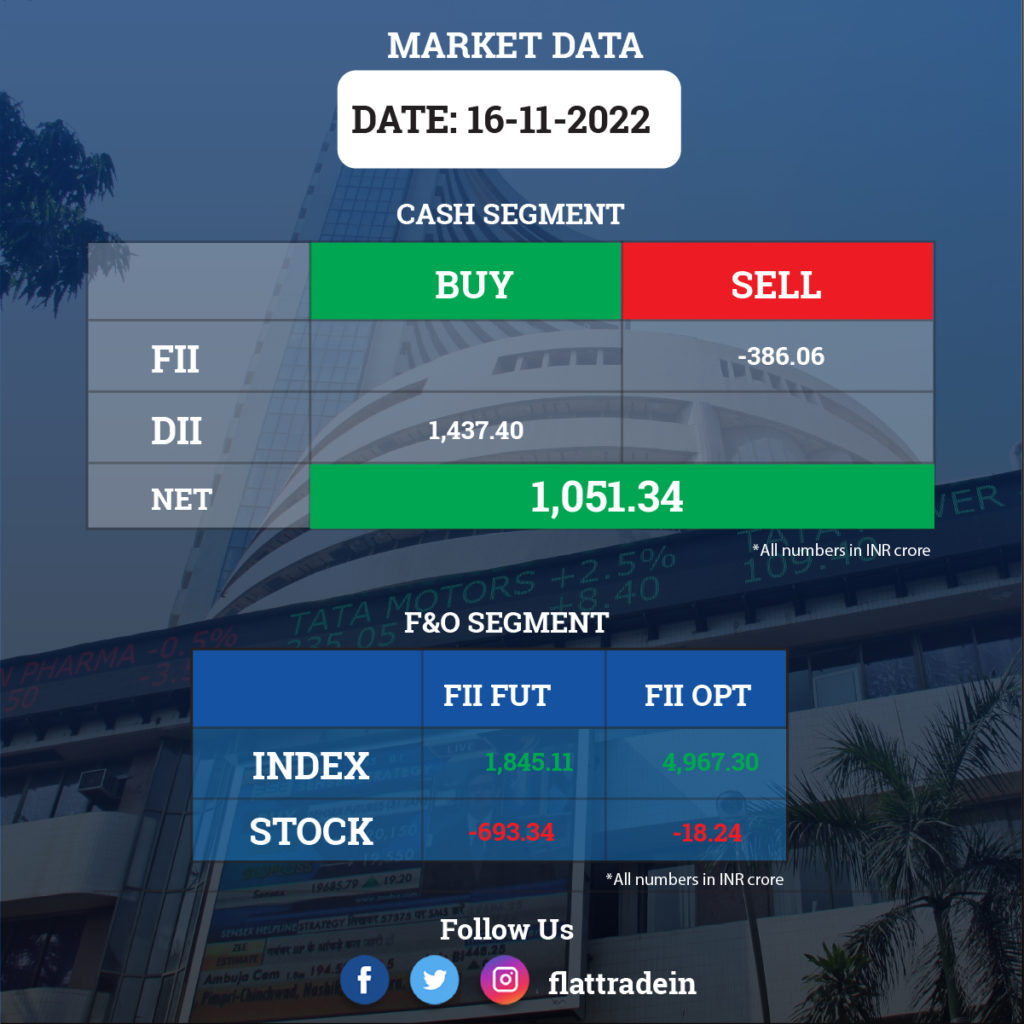

FII/DII Trading Data

Stocks in News Today

One 97 Communications (Paytm): Japan-based SoftBank is planning to offload $215 million worth shares in Paytm as lock-in for pre-IPO investors ends later this week, Bloomberg reported. Softbank is planning to sell 29 million shares in the company at Rs 555 to Rs 601.45 apiece, at a discount of up to 7.72% to the current market price.

Hindustan Zinc: The company said its Board of Directors has approved second interim dividend of Rs 15.50 per share i.e. 775 percent on face value of Rs 2/- per share for FY23 amounting to Rs 6,549.24 crore.

Page Industries: The clothing manufacturer said it will invest Rs 290 crore to set up two facilities in Telangana. The new units will provide a total employment to 7,000 local youngsters. It will manufacture garments which include sportswear and athleisure wear.

Wipro: The IT services major has reached an agreement with employee representatives on setting up a European Works Council (EWC). Wipro’s EWC is the first to be established by an India-headquartered company.

FSN E-Commerce Ventures (Nykaa): Lighthouse India Fund III has offloaded about 3 crore shares of Nykaa’s parent company at an average price of Rs 175.13 apiece, worth Rs 525.39 crore through open market transactions, according to the bulk deal data available with the BSE.

Aurobindo Pharma: The company has received Establishment Inspection Report from USFDA for unit XI, an API non-antibiotic manufacturing facility at Pydibhimavaram, Andhra Pradesh. The unit was inspected by USFDA during July 25 – August 2 and issued a Form 483 with 3 observations.

Balrampur Chini Mills: The sugar manufacturer has commenced commercial production of industrial alcohol in its new distillery at Maizapur unit, with a capacity of 320 kilo litre per day. With the said addition, the total distillation capacity of the company now stands at 880 kilo litre per day.

Spandana Sphoorty Financial: The microfinance lender will raise up to Rs 300 crore by issuing bonds next week The board of directors has approved to issue market-linked rated non-convertible debentures with a base issue size of Rs 200 crore and green shoe option of Rs 100 crore.

Agarwal Industrial Corporation: The petrochemical company reported a 178% rise in the net profit to Rs 7.18 crore in the September 2022 quarter. The company had reported a net profit of Rs 2.59 crore in the year-ago period. It registered a total revenue from operations at Rs 163.44 crore in the Q2FY23.

Ircon International: The company has emerged as the lowest bidder (L1) for construction of balance work of Bahuti canal project on turnkey basis including completion of earth work of main canal system from RD 18 to 74 km & other ancillary activities. The project was floated by Madhya Pradesh government and value of project is Rs 392.52 crore.

Timken India: The company will be setting up new manufacturing facility at Bharuch, Gujarat to manufacture spherical roller bearings and cylindrical roller bearings and components thereof. It already has manufacturing plant at Bharuch, wherein primarily tapered roller bearings and its components are manufactured.

Waaree Technologies: Promoter Waaree ESS bought 4.64 percent stake in the company via open market transactions on November 15. With this, it increased stake in the company to 60.42 percent, from 55.78 percent earlier.

Tera Software: The company has received work orders worth Rs 46.7 crore from Bharat Electronics, for scanning & digitizations – E Mahabhoomi Polygons in 14 districts of Maharashtra. The period for completion of work will be 19 months.

Cholamandalam Financial Holdings: ICICI Prudential Mutual Fund under its various schemes bought 3.04 lakh shares in the company via open market transactions on November 14. As a result, the shareholding of the fund increased by 2.04 percent to 7.11 percent, from 5.07 percent earlier.